Virginia Insurance Marketplace

Welcome to a comprehensive guide to the Virginia Insurance Marketplace, an essential resource for residents seeking insurance coverage in the state of Virginia. This marketplace serves as a crucial platform, connecting individuals and businesses with a wide range of insurance options tailored to their unique needs. From auto and health insurance to property and life coverage, the Virginia Insurance Marketplace plays a vital role in ensuring financial security and peace of mind for Virginians.

In this expert-reviewed article, we delve into the intricacies of the Virginia Insurance Marketplace, offering an in-depth analysis of its workings, the various insurance products available, and the benefits it provides to policyholders. By exploring real-world examples and industry insights, we aim to provide a clear understanding of how this marketplace operates and why it is a trusted source for insurance solutions.

Understanding the Virginia Insurance Marketplace

The Virginia Insurance Marketplace, officially known as the Virginia Health Benefit Exchange, is a state-based online platform designed to simplify the process of purchasing health insurance for individuals, families, and small businesses. Established in 2013 as part of the Affordable Care Act (ACA), the marketplace has since expanded to offer a broader range of insurance products beyond health coverage.

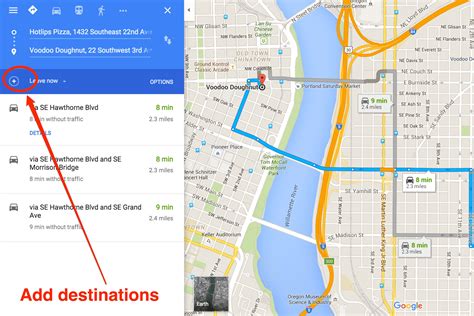

One of the key advantages of the Virginia Insurance Marketplace is its user-friendly interface, making it accessible to individuals with varying levels of insurance knowledge. The platform provides a centralized hub where users can compare different insurance plans, obtain quotes, and apply for coverage, all within a secure and efficient online environment.

Furthermore, the marketplace ensures that Virginians have access to a diverse range of insurance providers, fostering competition and promoting affordable rates. By aggregating insurance offerings from multiple carriers, the marketplace empowers consumers to make informed decisions, comparing coverage options, deductibles, and premium costs to find the best fit for their specific circumstances.

Key Features and Benefits of the Virginia Insurance Marketplace

- Transparency and Comparison Tools: The marketplace provides detailed information on each insurance plan, allowing users to compare policies side by side. This transparency ensures that consumers can make informed choices based on their unique needs and budget constraints.

- Cost Assistance: Virginia residents who qualify based on their income may be eligible for premium tax credits, reducing the cost of their monthly premiums. The marketplace helps users determine their eligibility and applies these credits directly to their insurance plan, making coverage more affordable.

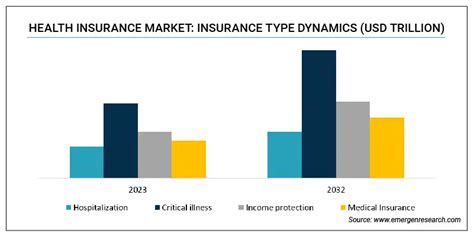

- Broad Range of Insurance Products: Beyond health insurance, the Virginia Insurance Marketplace offers a comprehensive selection of coverage options, including auto, homeowners, renters, life, and business insurance. This diversification allows users to address multiple insurance needs through a single, trusted platform.

Exploring Insurance Options on the Virginia Marketplace

The Virginia Insurance Marketplace provides a robust selection of insurance products to cater to the diverse needs of its users. Whether you’re seeking coverage for your vehicle, home, or life, the marketplace offers a wide array of options to choose from, ensuring that you can find the right policy to protect what matters most.

Auto Insurance

Auto insurance is a crucial aspect of financial protection for vehicle owners in Virginia. The marketplace offers a variety of auto insurance plans, including comprehensive, collision, liability, and personal injury protection (PIP) coverage. Users can compare different policies based on factors such as coverage limits, deductibles, and premium costs, ensuring they find the most suitable option for their driving needs and budget.

Additionally, the marketplace provides resources and guidance on understanding the complexities of auto insurance, such as explaining the differences between collision and comprehensive coverage and highlighting the importance of maintaining adequate liability limits to protect against potential lawsuits.

Homeowners and Renters Insurance

The Virginia Insurance Marketplace understands the importance of safeguarding your home and belongings. For homeowners, the marketplace offers a range of policies that provide coverage for structural damage, personal property, liability, and additional living expenses in the event of a covered loss. Users can customize their coverage limits and deductibles to align with the specific needs and value of their home.

For renters, the marketplace provides affordable insurance options that protect personal belongings and offer liability coverage in case of accidents or injuries that occur within the rental unit. Renters can rest assured that their possessions are protected, even if they're not the property owner.

| Insurance Type | Key Coverage |

|---|---|

| Homeowners Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses |

| Renters Insurance | Personal Property, Liability, Loss of Use |

Life Insurance

Life insurance is an essential aspect of financial planning, providing peace of mind and ensuring your loved ones are taken care of in the event of your untimely demise. The Virginia Insurance Marketplace offers a variety of life insurance policies, including term life, whole life, and universal life insurance.

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and is ideal for individuals seeking affordable protection for a defined timeframe. Whole life insurance, on the other hand, offers permanent coverage and builds cash value over time, making it a popular choice for long-term financial planning and wealth accumulation.

The marketplace provides tools and resources to help users determine their life insurance needs, compare different policy options, and select the most suitable coverage based on their age, health, and financial goals.

Performance and Impact Analysis

The Virginia Insurance Marketplace has had a significant impact on the state’s insurance landscape, providing numerous benefits to both policyholders and insurance carriers. By facilitating a competitive environment and offering a wide range of insurance options, the marketplace has contributed to improved access to coverage and more affordable rates for Virginians.

Increased Enrollment and Coverage

Since its inception, the Virginia Insurance Marketplace has experienced steady growth in enrollment, with thousands of individuals and families gaining access to health insurance coverage each year. This increase in enrollment has not only improved overall health outcomes but has also helped reduce the state’s uninsured rate, ensuring that more Virginians have the financial protection they need to access necessary medical care.

Affordable Premiums and Cost Assistance

One of the key advantages of the marketplace is its ability to negotiate competitive rates with insurance carriers, resulting in more affordable premiums for policyholders. Additionally, the marketplace offers cost-assistance programs, such as premium tax credits and reduced cost-sharing, to make insurance coverage more accessible for individuals and families with lower incomes.

These cost-assistance programs have played a crucial role in ensuring that insurance remains within reach for those who need it most, promoting financial stability and security for vulnerable populations in Virginia.

Enhanced Consumer Protection and Education

The Virginia Insurance Marketplace prioritizes consumer protection and education, ensuring that policyholders have the necessary tools and resources to make informed decisions about their insurance coverage. The marketplace provides comprehensive information on different insurance products, helping consumers understand their options and choose policies that align with their unique needs.

Furthermore, the marketplace actively addresses consumer concerns and provides assistance in resolving insurance-related issues, fostering a positive and supportive environment for Virginians seeking insurance coverage.

Conclusion: Empowering Virginians with Insurance Solutions

The Virginia Insurance Marketplace stands as a testament to the state’s commitment to providing accessible and affordable insurance options to its residents. By offering a user-friendly platform, a diverse range of insurance products, and valuable resources for policyholders, the marketplace has become an essential tool for Virginians seeking financial protection and peace of mind.

As the marketplace continues to evolve and adapt to the changing needs of its users, it remains a vital resource, ensuring that Virginians can navigate the complexities of insurance with confidence and make informed decisions to safeguard their futures.

Frequently Asked Questions

What types of insurance are available on the Virginia Insurance Marketplace?

+The Virginia Insurance Marketplace offers a comprehensive range of insurance products, including health insurance, auto insurance, homeowners insurance, renters insurance, life insurance, and business insurance. This diverse selection ensures that Virginians can find coverage for various aspects of their lives.

How can I determine my eligibility for premium tax credits on the marketplace?

+To determine your eligibility for premium tax credits, you can use the eligibility calculator available on the Virginia Insurance Marketplace website. This tool considers factors such as your income, family size, and other household information to assess whether you qualify for cost assistance.

Are there any resources available to help me understand different insurance policies on the marketplace?

+Absolutely! The Virginia Insurance Marketplace provides a wealth of resources and educational materials to help users navigate the insurance landscape. These resources include articles, guides, and videos that explain different insurance terms, coverage options, and how to choose the right policy for your specific needs.