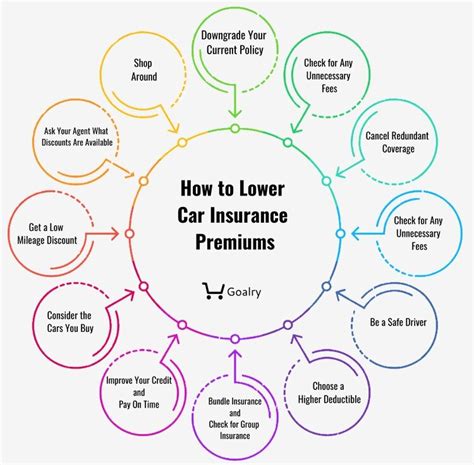

Ways To Lower Car Insurance

Lowering car insurance premiums is a common goal for many vehicle owners, and it's not just about finding the cheapest policy. Understanding the factors that influence your insurance rates and taking proactive measures can lead to significant savings over time. This comprehensive guide will delve into the strategies and insights you need to navigate the world of car insurance with confidence.

Understanding Car Insurance Premiums

Car insurance premiums are influenced by a multitude of factors, including personal details, driving history, and the type of vehicle you own. By grasping these variables, you can make informed decisions to reduce your insurance costs.

Factors Affecting Insurance Rates

Insurance providers assess various aspects of your life to determine your premium. These include your age, gender, marital status, and even your credit score. Additionally, the make and model of your vehicle, its safety features, and the number of miles you drive annually all play a role. Understanding these factors is the first step towards optimizing your insurance plan.

| Factor | Impact on Premium |

|---|---|

| Age and Gender | Younger drivers and males tend to face higher premiums due to statistical risk profiles. |

| Marital Status | Married individuals often enjoy lower rates, as they are statistically less likely to be involved in accidents. |

| Credit Score | A higher credit score can lead to reduced premiums, as it indicates financial responsibility. |

| Vehicle Type | Sports cars and luxury vehicles generally attract higher premiums due to their performance and cost of repairs. |

| Annual Mileage | The more you drive, the higher the risk, which can result in increased premiums. |

Shopping Around for the Best Deal

Finding the right car insurance provider is crucial to getting the best value for your money. With numerous options available, it’s essential to compare policies and quotes to identify the most cost-effective plan for your needs.

Comparing Insurance Policies

When comparing insurance policies, pay attention to more than just the premium. Consider the coverage limits, deductibles, and any additional benefits or discounts offered. A policy with a slightly higher premium but better coverage might be a more prudent choice in the long run.

- Coverage Limits: Ensure the policy covers the full value of your vehicle and provides adequate liability protection.

- Deductibles: Higher deductibles can lower your premium, but make sure you can afford the out-of-pocket expense if needed.

- Discounts: Look for providers offering discounts for safe driving, multiple policies, or loyalty.

- Additional Benefits: Some policies include roadside assistance or rental car coverage, which can be valuable in certain situations.

Online vs. Traditional Insurance Providers

The rise of online insurance providers has introduced new competition, often resulting in more affordable rates. These companies typically offer a streamlined, digital experience, making it easier and quicker to obtain quotes and manage your policy.

| Online Insurance | Traditional Insurance |

|---|---|

| Often cheaper due to lower overhead costs. | May offer more personalized service and local expertise. |

| Quick and easy to get quotes and manage policies online. | Can provide more complex or tailored coverage options. |

| Limited physical presence, which might be a drawback for some. | Typically offer a wider range of additional services. |

Optimizing Your Insurance Policy

Once you’ve selected an insurance provider, there are still strategies you can employ to further reduce your premiums and optimize your coverage.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. This not only saves you money but also simplifies your insurance management.

Increasing Deductibles

Opting for a higher deductible can lead to reduced premiums. However, it’s important to ensure you can afford the higher out-of-pocket expense if you need to make a claim. This strategy works best for responsible drivers who are confident in their driving abilities.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts to attract and retain customers. These can include safe driving discounts, loyalty discounts, and discounts for completing defensive driving courses. Stay informed about the discounts available and take steps to qualify for them.

Maintaining a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid speeding tickets, avoid driving under the influence, and practice safe driving habits. Insurance companies reward responsible drivers with lower premiums.

Choosing the Right Coverage

Assess your needs and choose the coverage that suits you best. If you own an older vehicle, you might consider dropping collision or comprehensive coverage to save money. On the other hand, if you have a newer or more expensive vehicle, these coverages are essential.

Regularly Review and Adjust Your Policy

Your insurance needs can change over time. Regularly review your policy to ensure it still aligns with your current circumstances. Life events like getting married, buying a new home, or changing jobs can impact your insurance requirements. Adjust your policy accordingly to optimize your coverage and costs.

FAQs

How often should I review my car insurance policy?

+

It’s a good practice to review your policy annually, especially when your policy is up for renewal. This allows you to stay informed about any changes in your coverage and premiums.

Can I negotiate my car insurance premium?

+

While insurance premiums are largely determined by standard rates, you can negotiate certain aspects. For instance, you can discuss the value of your vehicle, the coverage limits, or the deductibles to see if there’s room for adjustment.

What factors can cause my car insurance premium to increase suddenly?

+

Sudden premium increases can be triggered by a range of factors, including an at-fault accident, a speeding ticket, or a change in your credit score. It’s important to keep your driving record clean and monitor your credit to avoid unexpected increases.

Are there any ways to lower my insurance premium without affecting my coverage?

+

Yes, you can often lower your premium by adjusting your deductibles or taking advantage of available discounts. Additionally, some insurance companies offer pay-as-you-drive policies, which can reduce your premium if you drive less than average.

How do insurance companies determine my credit-based insurance score?

+

Insurance companies use credit-based insurance scores to assess your financial responsibility. These scores are based on factors such as your payment history, the length of your credit history, and the types of credit you use. Maintaining a good credit score can positively impact your insurance premium.