Wc Insurance Companies

Welcome to an in-depth exploration of the world of WC Insurance Companies, an integral part of the insurance industry focused on providing Workers' Compensation insurance. This article aims to delve into the intricacies of this specialized field, offering a comprehensive guide for businesses, employers, and those interested in understanding the role and impact of WC insurance providers.

Understanding WC Insurance Companies

WC insurance companies, also known as Workers’ Compensation insurers, are specialized entities that offer insurance coverage for workplace injuries and illnesses. This form of insurance is a critical component of any business’s risk management strategy, ensuring that employees who suffer work-related injuries or illnesses receive the medical treatment and compensation they deserve.

The history of WC insurance traces back to the early 20th century when the need for such coverage became evident due to the rise in industrial accidents. The first WC laws were enacted in the United States to provide a social insurance program, ensuring a measure of economic protection for workers and their families in the event of work-related injuries or illnesses.

Today, WC insurance is a highly regulated industry, with specific laws and regulations governing its operation in each state. These regulations ensure that insurers provide adequate coverage and that employees receive the benefits they are entitled to.

Key Functions and Responsibilities

WC insurance companies play a vital role in the overall workers’ compensation system. Their primary functions include:

- Risk Assessment and Underwriting: Insurers assess the risk profile of each business they insure, considering factors such as industry, size, and safety record. This assessment helps determine the premium and coverage offered.

- Claims Management: When an employee suffers a work-related injury or illness, the insurer is responsible for managing the claims process. This includes verifying the claim, arranging medical treatment, and ensuring the employee receives appropriate compensation.

- Loss Prevention and Safety Promotion: WC insurers often work with businesses to promote workplace safety and prevent losses. They may provide safety training, recommend safety measures, and offer incentives for businesses with good safety records.

- Regulatory Compliance: Insurers must adhere to the specific WC laws and regulations of the state they operate in. This includes timely reporting of claims and maintaining adequate reserves to cover potential liabilities.

WC insurance companies are typically regulated by state insurance departments, which ensure that insurers maintain adequate financial reserves, operate ethically, and comply with all relevant laws and regulations.

The WC Insurance Market

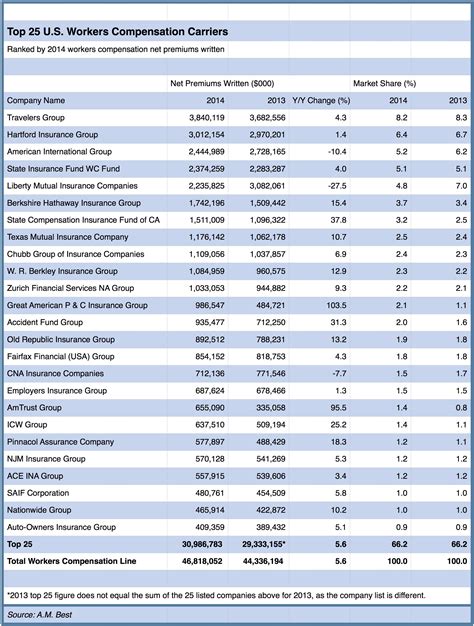

The WC insurance market is a highly competitive landscape, with numerous insurers offering specialized coverage to meet the unique needs of different industries and businesses.

Market Size and Growth

The WC insurance market is substantial, with an estimated global market size of $[Global Market Size in USD] as of [Latest Year]. This market has experienced steady growth over the years, driven by increasing awareness of workplace safety and the importance of adequate insurance coverage.

In the United States, the WC insurance market is dominated by a few large insurers, with [Top Insurer] being the leading provider, accounting for [Percentage] of the market share. However, there are also numerous smaller, specialized insurers catering to specific industries and niches.

Industry Trends

The WC insurance industry is constantly evolving, driven by technological advancements, changing workplace dynamics, and shifting regulatory landscapes. Some key trends shaping the industry include:

- Digital Transformation: Insurers are increasingly adopting digital technologies to streamline processes, improve efficiency, and enhance the customer experience. This includes the use of artificial intelligence, machine learning, and digital platforms for claims management and policy administration.

- Focus on Prevention: There is a growing emphasis on loss prevention and safety promotion. Insurers are partnering with businesses to implement proactive safety measures, reduce workplace injuries, and ultimately lower insurance costs.

- Specialization: The industry is seeing a trend towards specialization, with insurers developing expertise in specific industries or niches. This allows them to offer more tailored coverage and risk management solutions.

- Regulatory Changes: WC insurance is heavily regulated, and changes in state laws and regulations can significantly impact the industry. Insurers must stay abreast of these changes to ensure compliance and adjust their offerings accordingly.

The Role of Brokers and Agents

WC insurance brokers and agents play a crucial role in connecting businesses with the right insurance providers. They act as intermediaries, offering expert advice, comparing coverage options, and negotiating the best terms and rates for their clients.

Brokers and agents bring a wealth of industry knowledge and experience, helping businesses navigate the complex world of WC insurance. They can assist with policy selection, claims management, and risk mitigation strategies, ensuring businesses have the coverage they need to protect their employees and their operations.

Choosing the Right WC Insurance Company

Selecting the appropriate WC insurance company is a critical decision for any business. The right insurer can provide comprehensive coverage, efficient claims management, and valuable risk management support.

Factors to Consider

When choosing a WC insurance provider, businesses should consider several key factors, including:

- Financial Stability: It is essential to choose an insurer with a strong financial foundation. This ensures that the insurer will have the resources to pay claims promptly and provide ongoing coverage.

- Industry Expertise: Select an insurer with experience and knowledge in your specific industry. They will understand the unique risks and challenges your business faces and can offer tailored coverage solutions.

- Claims Handling: The insurer's claims management process should be efficient, fair, and transparent. Look for insurers with a good track record of timely claims processing and positive customer experiences.

- Risk Management Support: Choose an insurer that provides valuable risk management resources and support. This may include safety training, loss prevention programs, and other resources to help your business reduce workplace injuries and insurance costs.

- Communication and Customer Service: Effective communication and responsive customer service are essential. Ensure the insurer has a dedicated customer service team and provides multiple channels for communication, such as online portals, phone support, and email.

Comparative Analysis

To make an informed decision, businesses should conduct a comparative analysis of several WC insurance providers. This analysis should consider the factors mentioned above and also include a review of policy terms, coverage limits, and premium costs.

Businesses can seek recommendations from industry peers, consult with insurance brokers or agents, and review online ratings and reviews to gain insights into different insurers' strengths and weaknesses.

Case Study: [Company Name] and Their WC Insurance Journey

To illustrate the impact and importance of WC insurance, let’s explore the real-world example of [Company Name], a leading manufacturer in the [Industry] sector.

[Company Name] has been operating for over [Number of Years] and employs a workforce of [Number of Employees]. As a manufacturer, they face unique workplace risks, including heavy machinery, chemical exposure, and physical labor.

The Challenge

[Company Name] recognized the need for robust WC insurance coverage to protect their employees and their business. However, they faced several challenges, including:

- A high volume of workplace injuries, resulting in increased insurance costs.

- Difficulties in managing claims efficiently, leading to delays in employee compensation and increased administrative burdens.

- A lack of specialized risk management support, making it challenging to implement effective safety measures.

The Solution

[Company Name] decided to partner with [WC Insurance Company Name], a leading insurer with extensive experience in the manufacturing industry. [WC Insurance Company Name] offered:

- Tailored Coverage: A customized insurance policy that addressed the unique risks of [Company Name]'s operations.

- Efficient Claims Management: A streamlined claims process, ensuring prompt medical treatment and compensation for injured employees.

- Risk Management Support: Expert guidance and resources to implement safety programs, reduce workplace injuries, and lower insurance costs.

The Results

By partnering with [WC Insurance Company Name], [Company Name] experienced significant improvements, including:

- A [Percentage] reduction in workplace injuries over a [Time Period], resulting in lower insurance premiums.

- Improved employee morale and satisfaction due to the insurer's efficient claims handling and timely compensation.

- Enhanced workplace safety culture, with employees actively participating in safety initiatives.

- Reduced administrative burden for [Company Name]'s HR and risk management teams.

[Company Name]'s journey showcases the value of partnering with the right WC insurance company. By choosing an insurer with industry expertise, efficient claims management, and valuable risk management support, businesses can effectively protect their employees and their operations.

Future Outlook and Industry Innovations

The WC insurance industry is poised for continued growth and innovation, driven by technological advancements, changing workplace dynamics, and a heightened focus on workplace safety.

Emerging Technologies

Technology is playing an increasingly important role in the WC insurance industry. Insurers are leveraging innovative technologies to enhance their operations, including:

- Artificial Intelligence (AI): AI-powered systems are being used for automated claims processing, risk assessment, and fraud detection.

- Internet of Things (IoT): IoT devices are being deployed in workplaces to monitor safety conditions, track employee health and wellness, and provide real-time alerts for potential hazards.

- Telemedicine: The integration of telemedicine services allows for remote medical consultations, expediting the claims process and improving access to medical care for injured workers.

Workplace Safety Innovations

The focus on workplace safety is driving the development of innovative safety technologies and practices. Some notable innovations include:

- Wearable Technology: Wearable devices, such as smart helmets and vests, are being used to monitor worker safety, detect hazards, and provide real-time alerts.

- Advanced Robotics: Robotics are being employed in hazardous work environments to reduce human exposure to risks, improve productivity, and enhance workplace safety.

- Safety Training and Education: Insurers are investing in digital safety training platforms to provide employees with accessible and engaging safety education, helping to prevent workplace injuries.

Collaborative Risk Management

There is a growing trend towards collaborative risk management, where insurers, businesses, and employees work together to create safer workplaces. This collaborative approach involves:

- Employee Engagement: Encouraging employee participation in safety initiatives and providing incentives for proactive safety behaviors.

- Data-Driven Insights: Utilizing data analytics to identify patterns and trends in workplace injuries, allowing for targeted risk mitigation strategies.

- Partnerships: Collaborating with industry associations, safety organizations, and other stakeholders to develop best practices and share knowledge.

Regulatory and Legal Developments

The WC insurance industry is also influenced by regulatory and legal developments, which can impact insurer operations and policy offerings. Some key areas of focus include:

- Telecommuting and Remote Work: With the rise of remote work, insurers are adapting their policies to cover employees working from home or in non-traditional work environments.

- Mental Health Coverage: There is an increasing emphasis on providing mental health support for workers, and insurers are developing policies that cover mental health-related injuries and illnesses.

- Occupational Disease Coverage: Insurers are expanding coverage to include a wider range of occupational diseases, recognizing the long-term health impacts of certain workplace exposures.

As the WC insurance industry continues to evolve, insurers will need to adapt their strategies, leverage innovative technologies, and collaborate with stakeholders to deliver comprehensive coverage and effective risk management solutions.

Conclusion

WC insurance companies play a vital role in protecting workers and businesses, providing essential coverage for workplace injuries and illnesses. As we’ve explored, the WC insurance market is dynamic, driven by technological advancements, changing workplace dynamics, and a growing focus on workplace safety.

Businesses seeking WC insurance coverage should carefully evaluate their options, considering factors such as financial stability, industry expertise, claims handling, and risk management support. By partnering with the right WC insurance company, businesses can effectively manage their workplace risks, protect their employees, and ensure the long-term success and sustainability of their operations.

The WC insurance industry is poised for continued growth and innovation, and insurers who embrace these changes and adapt their strategies will be well-positioned to meet the evolving needs of their clients.

FAQ

What is the difference between WC insurance and general liability insurance?

+

WC insurance specifically covers workplace injuries and illnesses, while general liability insurance provides coverage for a wide range of liabilities, including property damage, personal injury, and advertising injuries. WC insurance is a mandatory requirement in most states, while general liability insurance is often optional but highly recommended for businesses.

How do WC insurance premiums vary between industries?

+

WC insurance premiums can vary significantly between industries due to the differing levels of risk. Industries with higher injury rates, such as construction and manufacturing, typically have higher premiums. On the other hand, industries with lower injury risks, like office-based businesses, may have lower premiums.

What are some common challenges faced by WC insurance companies?

+

WC insurance companies face various challenges, including rising healthcare costs, fraud, and an increasingly competitive market. They must also navigate complex state regulations and adapt to changing workplace dynamics to provide effective coverage and risk management solutions.