Website To Compare Car Insurance

Car Insurance Comparison Made Easy: Discover the Best Coverage for Your Needs

When it comes to finding the right car insurance policy, making an informed decision is crucial. With numerous insurance providers offering a wide range of coverage options, it can be challenging to navigate the market and choose the policy that suits your specific needs. This is where dedicated car insurance comparison websites step in, providing a convenient and efficient solution to help you make an educated choice.

In this comprehensive guide, we will delve into the world of car insurance comparison websites, exploring their features, benefits, and how they can empower you to secure the best coverage for your vehicle. By the end of this article, you'll have a clear understanding of why these platforms are invaluable tools for any car owner and how they can simplify the process of finding the ideal insurance policy.

Understanding Car Insurance Comparison Websites

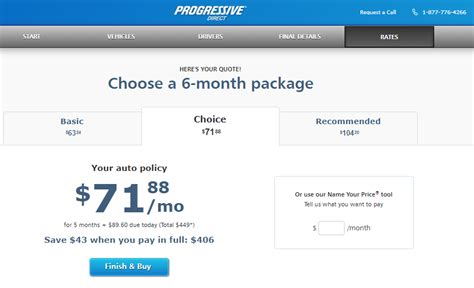

Car insurance comparison websites are online platforms designed to streamline the process of researching and comparing various insurance policies. These websites serve as centralized hubs, aggregating information from multiple insurance providers and presenting it in a user-friendly format. By inputting your vehicle details and personal information, these websites generate personalized quotes from different insurers, allowing you to easily compare prices, coverage options, and additional benefits.

These comparison platforms have become an essential tool for car owners due to their ability to save time and effort. Instead of contacting each insurance provider individually or visiting multiple websites, you can access a wealth of information in one place. This not only simplifies the comparison process but also ensures that you have access to a comprehensive range of options, helping you make an informed decision.

Key Features and Benefits of Comparison Websites

Quick and Easy Quotes

One of the standout features of car insurance comparison websites is their ability to provide quick and accurate quotes. By leveraging advanced algorithms and partnerships with insurance providers, these platforms can generate personalized quotes within minutes. All you need to do is enter your vehicle's make, model, and year, along with your personal details, and the website will present you with a list of quotes from multiple insurers.

| Insurer | Quote (Annual) |

|---|---|

| Company A | $890 |

| Company B | $950 |

| Company C | $780 |

This feature is particularly beneficial for those with busy schedules or limited time to research insurance options. By obtaining multiple quotes in a matter of minutes, you can quickly assess the market and identify the most competitive prices.

Comprehensive Comparison

Comparison websites go beyond just providing quotes; they offer a comprehensive overview of the available insurance policies. These platforms present detailed information about each policy, including coverage limits, deductibles, additional benefits, and any exclusions. This allows you to evaluate the fine print and understand the full scope of what each policy offers.

For example, some policies may include rental car coverage or roadside assistance, while others may have unique features like gap insurance or accident forgiveness. By comparing these aspects, you can choose a policy that aligns with your specific needs and preferences.

User-Friendly Interface

Car insurance comparison websites are designed with user experience in mind. They feature intuitive interfaces that guide you through the comparison process step by step. Clear navigation, straightforward forms, and easy-to-understand language ensure that even those unfamiliar with insurance terminology can easily interact with the platform.

Additionally, many comparison websites offer helpful tools and resources to further assist users. These may include insurance calculators, claim simulators, and articles or guides that provide valuable insights into the insurance landscape. These resources can empower you to make more informed decisions and better understand the implications of your choices.

How to Get the Most Out of Comparison Websites

While car insurance comparison websites are powerful tools, getting the most value from them requires a strategic approach. Here are some tips to ensure you make the most of your comparison journey:

- Be Thorough: Take the time to input accurate and complete information about your vehicle and driving history. Inaccurate or incomplete data can lead to misleading quotes.

- Compare Multiple Quotes: Don't settle for the first quote you see. Compare quotes from at least three to five insurers to get a good understanding of the market.

- Read the Fine Print: While comparison websites provide valuable overviews, it's crucial to review the policy documents thoroughly before making a decision. Pay attention to coverage limits, exclusions, and any specific terms that may impact your coverage.

- Consider Additional Benefits: Besides price, evaluate the additional benefits offered by each policy. These benefits can add significant value to your coverage and provide peace of mind in various situations.

- Use Advanced Filters: Many comparison websites offer advanced filtering options to narrow down your search. Utilize these filters to refine your results based on your specific needs, such as coverage limits, deductibles, or specific add-ons.

The Future of Car Insurance Comparison

As technology continues to advance, the future of car insurance comparison looks promising. Comparison websites are expected to become even more sophisticated, leveraging artificial intelligence and machine learning to provide personalized recommendations and tailored quotes. Additionally, the integration of telematics and usage-based insurance is likely to play a more significant role, offering dynamic pricing based on individual driving behavior.

Furthermore, with the rise of electric vehicles and autonomous driving technologies, comparison websites may adapt to include specialized coverage options for these emerging segments of the automotive industry. This evolution will ensure that car owners can continue to access relevant and up-to-date insurance options as the automotive landscape evolves.

Conclusion

Car insurance comparison websites have revolutionized the way we shop for insurance, making it easier and more efficient to find the best coverage for our vehicles. By leveraging their features and benefits, car owners can save time, money, and effort while securing a policy that aligns with their unique needs. As the industry continues to innovate, these platforms will remain essential tools for anyone looking to navigate the complex world of car insurance.

How accurate are the quotes provided by comparison websites?

+

The quotes generated by comparison websites are typically accurate, as they are based on the information you provide and the data shared by insurance providers. However, it’s important to note that these quotes are estimates and may not reflect the final policy price. To get an exact quote, you’ll need to complete an application with the chosen insurer.

Can I trust the insurance providers listed on comparison websites?

+

Comparison websites typically partner with reputable insurance providers, ensuring that the quotes and policies offered are legitimate. However, it’s always advisable to conduct your own research and verify the insurer’s credibility and financial stability before making a final decision.

Are there any additional fees associated with using comparison websites?

+

Comparison websites are generally free to use, as they are funded by the insurance providers they feature. However, it’s essential to review the terms and conditions to ensure there are no hidden fees or charges associated with the quote or policy procurement process.