What Are Deductibles In Insurance

Insurance is a vital tool for managing risks and financial uncertainties, and understanding its intricacies is essential for anyone looking to protect their assets and future. Among the various terms and concepts, deductibles play a crucial role in determining the cost and coverage of an insurance policy. This article aims to delve deep into the world of insurance deductibles, exploring their meaning, how they work, and their impact on policyholders.

Unraveling the Concept of Deductibles

A deductible in insurance is a predetermined amount that the policyholder must pay out of pocket before the insurance company covers the remaining expenses. It is essentially the financial responsibility that falls on the insured individual before the insurance coverage kicks in. Deductibles are a common feature in various types of insurance policies, including health, auto, home, and life insurance.

The purpose of deductibles is twofold. Firstly, they help reduce the frequency of small claims, as policyholders are incentivized to bear the cost of minor incidents themselves. This, in turn, lowers administrative costs for insurance companies and helps keep insurance premiums affordable for everyone. Secondly, deductibles encourage policyholders to take a more active role in risk management, as they have a financial stake in preventing losses and accidents.

How Deductibles Work in Practice

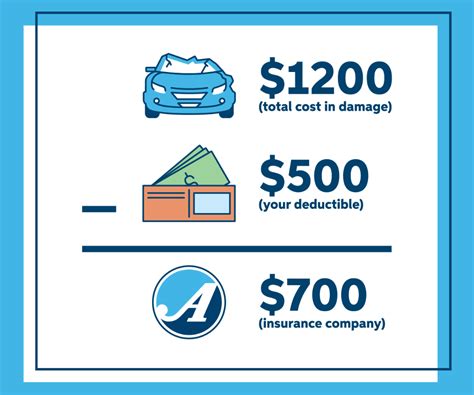

To understand how deductibles operate, let’s consider an example. Imagine you have a car insurance policy with a 500 deductible</strong>. If you get into a minor accident and the repairs cost 1,200, you will be responsible for paying the first 500 out of your own pocket. The insurance company will then cover the remaining 700. If, however, the repairs cost less than $500, it may not be worth filing a claim, as the insurance company’s involvement would not provide any financial benefit.

The choice of deductible amount can significantly impact the cost of insurance premiums. Typically, higher deductibles lead to lower premiums, as the policyholder assumes more financial risk. Conversely, lower deductibles result in higher premiums, as the insurance company takes on more financial responsibility. It is a delicate balance, and policyholders must carefully consider their financial situation and risk tolerance when selecting a deductible.

Types of Deductibles

Deductibles can vary in their structure and application. Here are some common types:

- Per-Policy Deductible: This is a single deductible amount applicable to all covered losses under the policy during a specific period, often a year.

- Per-Claim Deductible: This type of deductible applies separately to each claim made under the policy. It resets for each new claim.

- Per-Occurrence Deductible: Similar to a per-claim deductible, but it applies specifically to each distinct incident or occurrence, regardless of the number of claims resulting from it.

- Percentage Deductible: Instead of a fixed amount, the deductible is calculated as a percentage of the total loss or claim amount. This type is more common in commercial insurance policies.

The Impact of Deductibles on Policyholders

Deductibles can have both advantages and challenges for policyholders. On the positive side, they can lead to significant cost savings, especially for those with high deductibles who rarely make claims. Additionally, policyholders with high deductibles often receive discounts on their premiums, further reducing their overall insurance costs.

However, deductibles can also present challenges. In the event of a large loss or multiple claims, policyholders with high deductibles may find themselves facing substantial out-of-pocket expenses. This can be particularly burdensome for those with limited financial resources or unexpected, catastrophic events. It is crucial for policyholders to carefully assess their financial situation and choose a deductible that aligns with their ability to absorb potential losses.

Strategies for Managing Deductibles

Policyholders can employ various strategies to effectively manage their deductibles and insurance coverage:

- Understand Your Coverage: Familiarize yourself with the terms and conditions of your insurance policy, including the type and amount of your deductible. Know when and how it applies to different types of claims.

- Assess Your Risk Tolerance: Evaluate your financial situation and risk tolerance. Consider whether you can afford a higher deductible and potential out-of-pocket expenses in exchange for lower premiums.

- Review Your Deductible Regularly: Insurance needs and financial circumstances can change over time. Regularly review your insurance policy and deductible to ensure it still aligns with your current situation.

- Consider a Higher Deductible with an Emergency Fund: If you opt for a higher deductible to save on premiums, consider setting aside funds in an emergency savings account specifically for potential insurance-related expenses. This way, you have the necessary financial cushion when needed.

The Future of Deductibles

As the insurance industry evolves, deductibles are likely to play an increasingly important role in risk management and cost control. Insurance companies are continually refining their policies and strategies to adapt to changing market conditions and consumer needs. Here are some potential future implications and trends related to deductibles:

Customized Deductibles

Insurance providers may offer more personalized and flexible deductible options to cater to the diverse needs of their customers. This could involve allowing policyholders to choose their deductible amount within a certain range, or even offering customizable deductibles based on specific risk factors or claim history.

Incentivizing Risk Management

Insurance companies may further incentivize policyholders to take proactive measures to prevent losses and manage risks. This could involve offering lower deductibles or premium discounts to those who participate in safety programs, install preventive measures (such as security systems or smoke detectors), or demonstrate a history of responsible behavior.

Integrating Technology

Advancements in technology, particularly in data analytics and artificial intelligence, could enable insurance companies to more accurately assess and price risk. This could lead to more precise deductible structures, tailored to the individual policyholder’s risk profile and claim history. Additionally, technology could facilitate easier claim processes and provide policyholders with more transparency and control over their deductibles.

Collaborative Risk Sharing

In the future, insurance companies may explore more collaborative models of risk sharing with their policyholders. This could involve innovative structures where policyholders contribute to a shared risk pool, with the potential for rebates or reduced deductibles if the pool performs well. Such models could encourage greater engagement and shared responsibility between insurers and policyholders.

Frequently Asked Questions

Can I change my deductible after purchasing an insurance policy?

+

In most cases, you can adjust your deductible by contacting your insurance provider and requesting a change. However, altering your deductible may impact your premium, as higher deductibles typically result in lower premiums and vice versa. It’s important to carefully consider your financial situation and risk tolerance before making any changes.

Are there any situations where the deductible does not apply?

+

Some insurance policies may have specific exemptions or waivers for deductibles in certain situations. For example, certain types of natural disasters or catastrophic events may trigger a waiver of the deductible. It’s essential to review your policy’s terms and conditions to understand any exceptions or exclusions.

How do deductibles impact my insurance premium?

+

Generally, higher deductibles result in lower insurance premiums, as the policyholder assumes more financial risk. Conversely, lower deductibles lead to higher premiums, as the insurance company takes on more responsibility. When choosing a deductible, it’s crucial to find a balance that aligns with your financial capabilities and risk tolerance.

Can I negotiate my deductible with the insurance company?

+

Negotiating deductibles can be challenging, as insurance companies often have standardized policies and rates. However, if you have a strong claim history or other mitigating factors, it may be worth discussing with your insurance provider to see if they can offer any flexibility or discounts.

What happens if I cannot afford to pay my deductible after a claim?

+

If you find yourself in a situation where you cannot afford to pay your deductible, it’s essential to communicate with your insurance provider. They may offer payment plans or work with you to find a solution. Additionally, having an emergency fund specifically for insurance-related expenses can be beneficial in such situations.