What Are The Types Of Insurance

Insurance is an integral part of modern life, providing financial protection and peace of mind to individuals and businesses alike. With a wide range of insurance policies available, it can be overwhelming to navigate the insurance landscape. This comprehensive guide aims to demystify the world of insurance by exploring the diverse types of coverage and their specific applications.

Understanding the Basics: A Brief Overview of Insurance

Insurance is a contractual agreement between an individual or entity (the insured) and an insurance company (the insurer). In exchange for regular payments, known as premiums, the insurer agrees to compensate the insured for specific losses, damages, or liabilities outlined in the insurance policy.

The primary purpose of insurance is to mitigate financial risks associated with unforeseen events, such as accidents, illnesses, natural disasters, or lawsuits. By spreading the risk across a large pool of policyholders, insurance companies can provide financial protection and security to those facing uncertain circumstances.

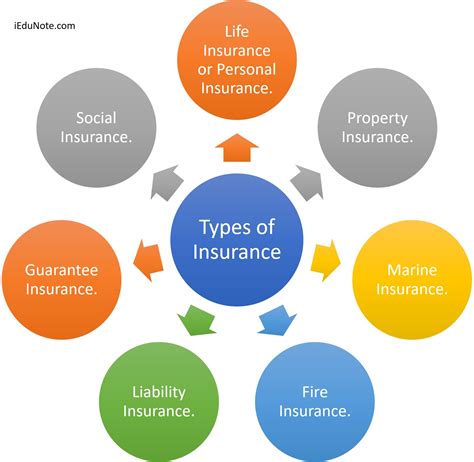

The Diverse World of Insurance Types

Insurance policies are tailored to cover a vast array of risks and needs, catering to individuals, families, businesses, and various industries. Here, we delve into the primary types of insurance, exploring their unique features and applications.

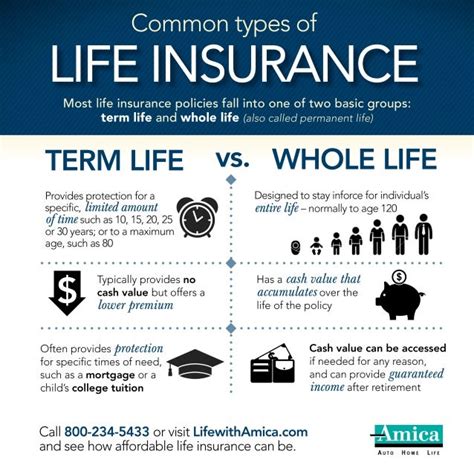

Life Insurance: Securing Your Legacy

Life insurance is a fundamental type of coverage designed to provide financial support to loved ones in the event of the policyholder’s death. It offers a sense of security and ensures that beneficiaries can maintain their standard of living and meet financial obligations even after the insured’s passing.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically 10 to 30 years, while permanent life insurance, including whole life and universal life policies, provides lifelong coverage.

Key benefits of life insurance include:

- Death benefit: A tax-free sum paid to beneficiaries upon the insured's death.

- Financial security: Ensures loved ones can cover funeral expenses, pay off debts, and maintain their lifestyle.

- Income replacement: Helps replace lost income, ensuring dependents' financial stability.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, often renewable. Ideal for covering short-term needs like mortgages or education expenses. |

| Whole Life Insurance | Provides lifelong coverage with a fixed premium and a cash value component that grows over time. Offers permanent protection and can be used for estate planning. |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits. Allows policyholders to customize their coverage and invest a portion of their premiums. |

Health Insurance: Protecting Your Well-being

Health insurance is vital for covering medical expenses, ensuring access to quality healthcare, and protecting individuals from the financial burden of illness or injury. With rising healthcare costs, health insurance has become a necessity for maintaining physical and financial well-being.

Health insurance policies typically cover a range of medical services, including:

- Doctor visits

- Hospital stays

- Prescription medications

- Diagnostic tests

- Specialized treatments

Key types of health insurance include:

- Individual health insurance: Coverage for individuals and their families, often purchased directly from insurance providers or through government-sponsored programs.

- Group health insurance: Offered by employers or organizations, providing coverage to employees or members and often featuring lower premiums due to the large pool of insured individuals.

| Health Insurance Type | Key Features |

|---|---|

| HMO (Health Maintenance Organization) | Provides comprehensive healthcare through a network of approved providers. Requires a primary care physician (PCP) for referrals to specialists. |

| PPO (Preferred Provider Organization) | Offers flexibility by allowing policyholders to choose any healthcare provider, both in and out of network, with varying levels of coverage and cost-sharing. |

| POS (Point of Service) | Combines features of HMO and PPO, requiring a PCP for referrals but offering more flexibility in choosing providers and covering a portion of out-of-network expenses. |

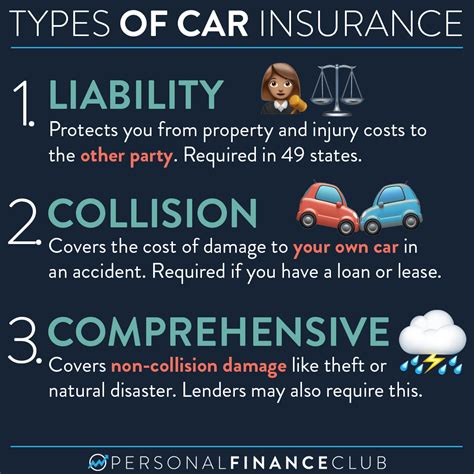

Auto Insurance: Protecting Your Vehicle and More

Auto insurance is mandatory in most countries and provides financial protection in the event of accidents, theft, or other vehicle-related incidents. It covers not only the insured vehicle but also the driver, passengers, and third parties involved in an accident.

Key components of auto insurance include:

- Liability coverage: Covers bodily injury and property damage caused to others in an accident for which the insured is at fault.

- Collision coverage: Pays for repairs or replacement of the insured vehicle after an accident, regardless of fault.

- Comprehensive coverage: Covers non-collision incidents like theft, vandalism, weather-related damage, or collisions with animals.

- Uninsured/underinsured motorist coverage: Protects the insured if involved in an accident with a driver who has insufficient or no insurance.

When choosing auto insurance, factors such as the make and model of the vehicle, driving history, and geographic location play a significant role in determining premiums.

Homeowners Insurance: Safeguarding Your Residence

Homeowners insurance is essential for protecting one’s residence and personal belongings. It covers a wide range of risks, including damage caused by natural disasters, theft, and liability claims arising from accidents on the insured property.

Key components of homeowners insurance include:

- Dwelling coverage: Protects the structure of the home and attached structures like garages or sheds.

- Personal property coverage: Covers the contents of the home, including furniture, appliances, and personal belongings.

- Liability coverage: Provides protection against lawsuits arising from accidents on the insured property, such as a guest slipping and falling.

- Additional living expenses: Covers temporary living expenses if the home becomes uninhabitable due to a covered incident.

| Homeowners Insurance Coverage | Description |

|---|---|

| HO-1 | Basic coverage, typically including fire, lightning, windstorm, and hail damage. |

| HO-2 | Broad form coverage, offering more extensive protection, including damage from falling objects and weight of ice, snow, or sleet. |

| HO-3 | Standard homeowners insurance, covering dwelling and personal property against named perils, including theft and vandalism. |

| HO-4 | Renters insurance, covering personal property and providing liability protection for renters. |

| HO-5 | Comprehensive coverage, offering the highest level of protection with open perils coverage for dwelling and personal property. |

Business Insurance: Shielding Your Enterprise

Business insurance is crucial for protecting businesses of all sizes and industries. It covers a wide range of risks, from property damage and liability claims to business interruption and employee-related issues.

Key types of business insurance include:

- General liability insurance: Protects against third-party claims arising from bodily injury, property damage, or personal and advertising injury.

- Property insurance: Covers physical assets like buildings, equipment, and inventory against damage or loss from fires, storms, or vandalism.

- Professional liability insurance (E&O): Covers lawsuits arising from professional services, such as negligence, errors, or omissions.

- Workers' compensation insurance: Provides coverage for employees injured on the job, including medical expenses and lost wages.

The specific needs of a business will dictate the types and levels of coverage required, with factors such as industry, location, and number of employees influencing insurance costs and requirements.

Travel Insurance: Peace of Mind on the Go

Travel insurance is a specialized form of coverage designed to protect travelers against unforeseen events and expenses during their trips. It offers financial protection for canceled or interrupted trips, medical emergencies, lost luggage, and more.

Key components of travel insurance include:

- Trip cancellation or interruption: Covers non-refundable trip expenses if the trip is canceled or interrupted due to covered reasons, such as illness or natural disasters.

- Medical and dental coverage: Provides coverage for medical and dental emergencies during travel, including transportation to the nearest medical facility.

- Baggage and personal effects coverage: Reimburses for lost, stolen, or damaged luggage and personal items.

- Emergency evacuation coverage: Covers the cost of medical evacuation in the event of a serious injury or illness.

Pet Insurance: Caring for Your Furry Friends

Pet insurance is a growing industry, offering coverage for veterinary expenses and providing peace of mind to pet owners. With the rising costs of veterinary care, pet insurance has become an essential tool for managing unexpected medical bills and ensuring pets receive the best possible care.

Key features of pet insurance include:

- Accident and illness coverage: Covers unexpected injuries and illnesses, including emergency care, surgery, and ongoing treatment.

- Routine care coverage: Some policies offer coverage for preventive care, such as vaccinations, check-ups, and spaying/neutering.

- Chronic condition coverage: Provides coverage for ongoing conditions, such as diabetes or arthritis, ensuring pets receive the necessary long-term treatment.

When choosing pet insurance, factors such as the pet's breed, age, and pre-existing conditions will influence the cost and coverage options available.

The Importance of Tailored Insurance Solutions

As we’ve explored, the world of insurance is vast and diverse, with policies tailored to meet the unique needs of individuals, families, and businesses. Understanding the different types of insurance and their specific applications is crucial for making informed decisions and ensuring adequate coverage.

By selecting the right insurance policies, individuals and businesses can mitigate financial risks, protect their assets, and provide a safety net for themselves and their loved ones. It is essential to work with reputable insurance providers and seek expert advice to ensure coverage aligns with personal or business goals and needs.

Frequently Asked Questions

What is the difference between term and permanent life insurance?

+

Term life insurance offers coverage for a specified period, typically 10 to 30 years, and is often more affordable. Permanent life insurance, such as whole life or universal life, provides lifelong coverage with additional benefits like cash value accumulation. The choice depends on your specific needs and financial goals.

How does health insurance work, and what are the different types available?

+

Health insurance covers medical expenses, ensuring access to healthcare. Common types include HMO (requiring a primary care physician for referrals), PPO (offering flexibility in choosing providers), and POS (combining features of HMO and PPO). Individual and group health insurance plans are also available.

What factors determine auto insurance premiums?

+

Auto insurance premiums are influenced by factors such as the make and model of the vehicle, driving history, geographic location, and the level of coverage chosen. It’s essential to compare quotes from multiple insurers to find the best coverage and pricing for your specific circumstances.