What Does An Insurance Card Look Like

An insurance card is a vital document that serves as proof of insurance coverage for individuals or entities. It contains crucial information related to insurance policies, providing verification and details about the insured party and the policy itself. In this comprehensive article, we will delve into the various aspects of an insurance card, exploring its design, content, purpose, and significance.

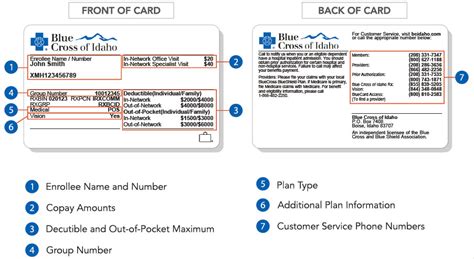

The Insurance Card: A Visual Guide

The design and appearance of insurance cards can vary depending on the insurance company and the type of coverage. However, there are several common elements that are typically found on most insurance cards. These elements provide essential information and ensure the card serves its purpose effectively.

Key Features of an Insurance Card

Here is a breakdown of the key components you can expect to find on an insurance card:

- Insurance Company Logo and Name: The insurance card prominently displays the logo and name of the insurance provider. This identifies the company and establishes trust and recognition.

- Policy Number: A unique policy number is assigned to each insurance policy. This number is crucial for identification and is used for various administrative purposes, such as claims processing and policy updates.

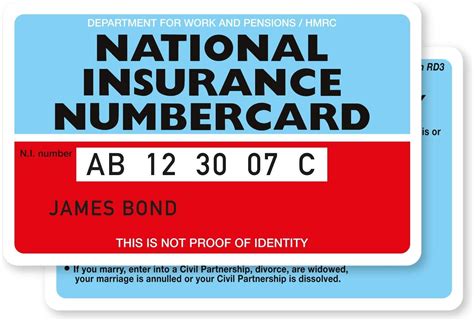

- Insured Information: The insurance card provides the name and relevant details of the insured individual or entity. This may include the full name, date of birth, and other identifying information.

- Coverage Details: The card outlines the type of insurance coverage, such as auto, health, or home insurance. It specifies the coverage limits, deductibles, and any additional endorsements or riders.

- Effective Dates: Insurance policies have specific start and end dates. The insurance card indicates the effective dates of coverage, ensuring that the insured party knows the period during which they are covered.

- Contact Information: The card often includes contact details for the insurance company, such as a customer service phone number, website address, or email. This allows insured individuals to reach out for assistance or inquire about their policy.

- Additional Notes : Some insurance cards may feature additional notes or instructions, such as important reminders, policy exclusions, or contact information for emergency services.

Insurance cards are typically designed to be compact and easily portable, making them convenient for carrying in wallets or vehicle glove compartments. The layout and presentation of information aim to make the card user-friendly and easily readable, ensuring quick access to crucial details in case of emergencies or when making claims.

Variations in Insurance Card Design

While the basic structure of insurance cards remains consistent, there can be variations in design and presentation. Insurance companies may incorporate different colors, layouts, or graphics to make their cards more visually appealing and distinctive. Some cards may also include QR codes or barcodes for easy scanning and verification.

| Design Element | Description |

|---|---|

| Color Scheme | Insurance cards often use a combination of colors to represent the company's brand and create a visually appealing design. |

| Layout | The arrangement of information on the card can vary, with some cards featuring a vertical layout and others opting for a horizontal design. |

| Graphics and Icons | Insurance companies may include simple graphics or icons to represent different types of coverage, such as a car icon for auto insurance. |

It's important to note that the specific design and content of an insurance card may also depend on the regulations and requirements of the region or country where the policy is issued.

The Purpose and Significance of Insurance Cards

Insurance cards serve multiple crucial purposes and play a significant role in the insurance industry and for policyholders. Understanding their importance can help individuals appreciate the value of these small but essential documents.

Key Purposes of Insurance Cards

- Proof of Insurance: The primary purpose of an insurance card is to provide proof of insurance coverage. In various situations, such as traffic stops, accidents, or when seeking medical treatment, presenting an insurance card is often required to verify that the insured party has valid coverage.

- Claims Process: Insurance cards play a vital role in the claims process. They contain the necessary information for insurance companies to process claims efficiently. The policy number, insured details, and coverage specifics are crucial for accurate claim assessments.

- Policy Verification: Insurance cards act as a quick reference for insured individuals to verify their coverage details. By referring to the card, policyholders can easily access important information, such as policy limits, deductibles, and coverage periods.

- Regulatory Compliance: In many regions, having an insurance card is a legal requirement. It ensures that individuals comply with insurance regulations and carry the necessary proof of coverage when operating vehicles or engaging in certain activities.

- Convenience and Accessibility: Insurance cards are designed to be easily accessible and portable. Their compact size allows individuals to carry them in their wallets or vehicles, ensuring quick access to important insurance information whenever needed.

Real-World Examples of Insurance Card Usage

To illustrate the practical applications of insurance cards, let's explore a few real-world scenarios:

- Traffic Incident: During a routine traffic stop, a police officer may ask for proof of insurance. The driver presents their insurance card, which verifies their coverage and avoids potential fines or penalties.

- Accident Reporting: In the event of a car accident, both parties involved can exchange insurance information, including their insurance cards. This facilitates the claims process and helps insurance companies assess liability and damages.

- Medical Treatment: When seeking medical care, insurance cards are often required to verify coverage and process claims. This ensures that individuals receive the necessary treatment and that insurance companies cover the associated costs.

- Rental Agreements: When renting a vehicle or equipment, insurance cards are commonly requested to confirm that the renter has valid coverage. This protects the rental company and ensures the renter's liability is covered.

In these scenarios and many more, insurance cards serve as a crucial link between policyholders, insurance companies, and various stakeholders, facilitating smooth operations and ensuring compliance with regulations.

The Future of Insurance Cards

As technology continues to advance, the insurance industry is exploring new ways to enhance the functionality and accessibility of insurance cards. Here are some potential future developments:

Digital Insurance Cards

Insurance companies are increasingly embracing digital solutions, and the concept of digital insurance cards is gaining traction. Digital insurance cards can be accessed through mobile apps or online portals, providing insured individuals with convenient and instant access to their insurance information.

Digital cards offer several advantages, including real-time updates, the ability to share insurance details electronically, and the elimination of physical card storage concerns. Additionally, digital cards can incorporate advanced security features, such as encryption and biometric authentication, to ensure data protection.

Enhanced Security Features

To combat fraud and ensure the integrity of insurance cards, insurance companies may incorporate advanced security measures. This could include holographic images, microprinting, or even RFID (Radio Frequency Identification) technology to verify the authenticity of the card.

Integration with IoT Devices

With the rise of the Internet of Things (IoT), insurance cards may evolve to integrate with connected devices. For example, smart home systems or connected vehicles could automatically retrieve insurance information from digital insurance cards, streamlining the process of verifying coverage and providing real-time updates.

Personalized Insurance Cards

Insurance companies may explore personalized insurance cards that cater to individual preferences and needs. These cards could feature customizable designs, allowing policyholders to choose colors, layouts, or even add their own photos. Personalized cards can enhance brand loyalty and provide a unique experience for insured individuals.

Conclusion

Insurance cards are more than just pieces of paper; they are essential tools that provide proof of insurance coverage, facilitate the claims process, and ensure compliance with regulations. With their compact design, crucial information, and user-friendly layout, insurance cards serve as a convenient and reliable way to verify insurance details.

As the insurance industry continues to evolve, insurance cards will likely undergo transformations to meet the changing needs of policyholders and stakeholders. The future holds exciting possibilities for enhanced security, digital accessibility, and personalized experiences, all while maintaining the core purpose of providing reliable proof of insurance.

Can I obtain a replacement insurance card if I lose mine?

+Yes, if you lose your insurance card, you can typically request a replacement from your insurance provider. Most insurance companies offer online or phone-based options to order a new card. Keep in mind that there may be a small fee associated with the replacement process.

Are insurance cards valid for all types of insurance coverage?

+Insurance cards are commonly associated with auto insurance, health insurance, and home insurance. However, insurance providers may issue cards for various other types of coverage, such as life insurance, travel insurance, or business insurance. The specific details and validity of the card will depend on the type of insurance and the policy terms.

How often should I update my insurance card?

+Insurance cards typically reflect the current policy period. If you renew your insurance policy or make significant changes to your coverage, you should receive an updated insurance card. It’s essential to keep your insurance card up to date to ensure accurate and valid proof of insurance.