What Does Full Coverage Car Insurance Consist Of

Full coverage car insurance is a comprehensive insurance policy that provides extensive protection for vehicle owners. It is designed to offer financial coverage for a wide range of situations, ensuring that drivers are adequately protected against various risks and liabilities associated with owning and operating a motor vehicle. This type of insurance is an essential aspect of responsible vehicle ownership, as it helps mitigate the financial impact of accidents, theft, and other unforeseen events.

While the exact components of full coverage car insurance can vary depending on the provider and the specific policy, there are several key elements that are typically included. Understanding these components is crucial for vehicle owners to make informed decisions about their insurance coverage and ensure they have the necessary protection.

Comprehensive Coverage

One of the cornerstone features of full coverage car insurance is comprehensive coverage. This aspect of the policy provides protection for damages caused by events other than collisions, such as theft, vandalism, natural disasters, falling objects, and even damage caused by animals. For instance, if a tree branch falls on your car during a storm, comprehensive coverage would typically cover the repair costs. This coverage ensures that vehicle owners are protected against a wide range of unexpected incidents that could result in costly repairs.

It's worth noting that comprehensive coverage often comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the insurance provider, so it's important to review the terms carefully to understand the financial obligations associated with this aspect of full coverage.

Examples of Comprehensive Coverage Scenarios

- Theft: If your vehicle is stolen, comprehensive coverage would help cover the cost of replacing it or repairing any damage caused during the theft.

- Vandalism: In the event that your car is vandalized, for instance, if someone keys your paintwork, comprehensive coverage can assist with the repair or repainting expenses.

- Natural Disasters: If a hurricane or tornado damages your vehicle, comprehensive coverage can provide financial assistance for repairs or replacements.

Collision Coverage

Collision coverage is another critical component of full coverage car insurance. This aspect of the policy provides protection for damages sustained when your vehicle collides with another vehicle or object, regardless of who is at fault. In essence, collision coverage helps cover the cost of repairs or replacements for your vehicle in the event of a crash.

Similar to comprehensive coverage, collision coverage often comes with a deductible. Policyholders are responsible for paying this deductible amount before the insurance coverage takes effect. The specific amount of the deductible can vary based on the policy and the insurance provider, so it's important to review the terms of your policy to understand your financial obligations in the event of a collision.

Scenario: Collision Coverage in Action

Imagine you’re driving and accidentally collide with a median barrier. In this scenario, collision coverage would step in to help cover the costs of repairing your vehicle, ensuring you’re not left with a hefty bill for the necessary repairs.

Liability Coverage

Liability coverage is an essential aspect of full coverage car insurance, as it provides protection for the policyholder in the event they are found legally responsible for an accident that causes injuries or property damage to others. This coverage is designed to safeguard the policyholder from potentially devastating financial consequences that could arise from such incidents.

Liability coverage typically consists of two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the policyholder. Property damage liability, on the other hand, covers the cost of repairing or replacing the other party's vehicle or any other property damaged in the accident.

Understanding Liability Coverage Limits

Liability coverage limits are set amounts that determine the maximum financial protection provided by the insurance policy. These limits are usually expressed in three numbers, such as 100/300/100. In this example, the first number (100) represents the maximum amount of coverage per person for bodily injury, the second number (300) represents the maximum amount of coverage per accident for bodily injury, and the third number (100) represents the maximum amount of coverage for property damage.

It's important to carefully review and understand the liability coverage limits included in your full coverage car insurance policy. These limits can significantly impact your financial protection in the event of an accident, so it's crucial to ensure they align with your specific needs and potential risks.

| Liability Coverage Component | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the policyholder. |

| Property Damage Liability | Covers the cost of repairing or replacing the other party's vehicle or any other property damaged in the accident. |

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an important addition to full coverage car insurance, as it provides protection for the policyholder when involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages caused. This coverage ensures that the policyholder is not left financially vulnerable in such situations.

Uninsured motorist coverage covers the policyholder's medical expenses, lost wages, and other related costs when involved in an accident with an uninsured driver. Underinsured motorist coverage, on the other hand, comes into play when the at-fault driver's insurance coverage is insufficient to cover the policyholder's damages. In both cases, this coverage helps ensure the policyholder receives the necessary financial support to cover their losses.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, is a vital component of full coverage car insurance, as it provides medical coverage for the policyholder and their passengers, regardless of who is at fault in an accident. This coverage ensures that individuals involved in an accident receive the necessary medical treatment promptly, without having to wait for liability issues to be resolved.

PIP coverage typically includes payment for medical expenses, lost wages, and other related costs, such as rehabilitation and funeral expenses. This coverage is especially valuable in no-fault states, where it provides a streamlined process for accident victims to receive the medical care they need without the complexities of determining fault.

Understanding PIP Limits

Similar to other aspects of full coverage car insurance, PIP coverage comes with specific limits that determine the maximum amount of financial protection provided. These limits can vary based on the policy and the insurance provider, so it’s important to review the terms of your policy to understand the specific coverage limits for PIP.

Additional Coverages and Benefits

Full coverage car insurance policies often include a range of additional coverages and benefits that can enhance the overall protection and peace of mind for policyholders. These additional features can vary depending on the provider and the specific policy, but some common examples include:

- Rental Car Reimbursement: This coverage helps cover the cost of renting a vehicle while your insured car is being repaired or replaced after an accident.

- Towing and Labor Coverage: This aspect of the policy provides assistance with towing and labor costs when your vehicle breaks down or is involved in an accident.

- Glass Coverage: Glass coverage helps cover the cost of repairing or replacing damaged windshields or other glass components of your vehicle.

- Emergency Roadside Assistance: This benefit provides assistance in various situations, such as flat tires, dead batteries, or running out of gas.

It's important to carefully review the full coverage car insurance policy to understand the specific additional coverages and benefits included, as these can vary significantly between providers and policies.

Conclusion: The Value of Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance solution that offers a wide range of protections for vehicle owners. From comprehensive and collision coverage to liability protection and additional benefits, this type of insurance policy provides the necessary financial support to mitigate the impact of accidents, theft, and other unexpected events. By understanding the various components of full coverage car insurance, vehicle owners can make informed decisions about their insurance coverage and ensure they have the protection they need.

It's important to note that the specific terms and conditions of full coverage car insurance policies can vary significantly, so it's crucial to carefully review the policy details and consult with insurance professionals to ensure the chosen coverage aligns with individual needs and circumstances. With the right full coverage car insurance policy, vehicle owners can drive with confidence, knowing they are adequately protected on the road.

What is the difference between full coverage and liability-only car insurance?

+Full coverage car insurance offers comprehensive protection, including collision, comprehensive, and liability coverage. Liability-only insurance, on the other hand, provides coverage only for damages caused to others, not for your own vehicle. Full coverage is more extensive and provides protection for a wider range of situations.

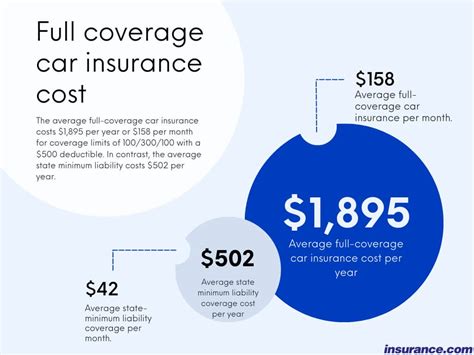

Is full coverage car insurance more expensive than other types of insurance?

+Yes, full coverage car insurance is generally more expensive than liability-only insurance due to the broader range of protections it offers. The cost can vary based on factors such as the make and model of your vehicle, your driving record, and the specific coverage limits you choose.

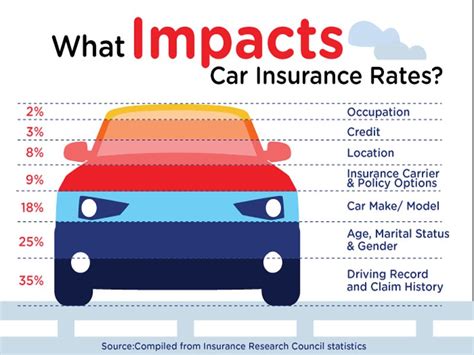

What are some factors that influence the cost of full coverage car insurance?

+Several factors can influence the cost of full coverage car insurance, including your age, gender, driving record, the make and model of your vehicle, the coverage limits you choose, and the location where you reside or primarily drive. These factors are considered by insurance providers when calculating premiums.