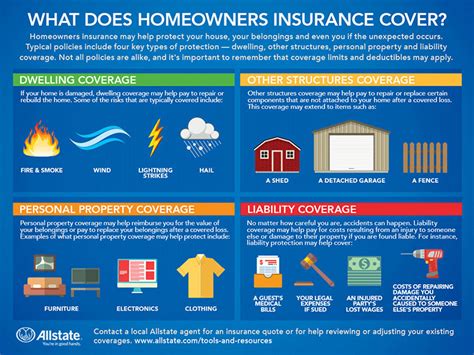

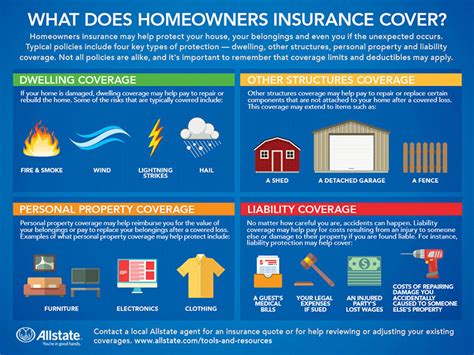

What Does Homeowner Insurance Cover

Homeowner insurance, also known as home insurance or house insurance, is a vital protection measure for homeowners to safeguard their financial interests and assets. It offers coverage for a wide range of potential risks and damages that homeowners may face, providing peace of mind and financial security. Understanding what homeowner insurance covers is essential to ensure adequate protection for your home and belongings.

Understanding Homeowner Insurance Coverage

Homeowner insurance policies are designed to provide comprehensive coverage for various aspects of a homeowner’s life. These policies typically include coverage for the structure of the home, personal belongings, liability, and additional living expenses. However, the exact coverage can vary depending on the specific policy and the provider.

It's important to note that homeowner insurance is not a one-size-fits-all solution. Different policies offer varying levels of coverage, and it's crucial to carefully review and understand the terms and conditions of your policy. By doing so, homeowners can ensure they have the necessary protection for their unique circumstances.

Structure and Dwelling Coverage

One of the primary components of homeowner insurance is structure or dwelling coverage. This coverage protects the physical structure of the home, including the walls, roof, foundation, and any attached structures like garages or sheds. In the event of damage caused by covered perils, such as fire, storms, or vandalism, this coverage helps with the repair or rebuilding of the home.

| Peril Type | Coverage Details |

|---|---|

| Fire | Covers damage caused by fire, including smoke damage. |

| Storms | Protects against damage from storms, including wind, hail, and lightning. |

| Vandalism | Provides coverage for intentional damage to the home. |

| Water Damage | Covers water damage from sources like burst pipes or roof leaks. |

Personal Property Coverage

Homeowner insurance also extends protection to the personal belongings within the home. This coverage, known as personal property coverage, safeguards items such as furniture, electronics, clothing, and other valuables. In the event of theft, damage, or loss, this coverage helps replace or repair these items.

It's important to note that personal property coverage usually has specific limits and exclusions. High-value items like jewelry, art, or collectibles may require additional coverage or separate endorsements to ensure adequate protection.

Liability Coverage

Liability coverage is a critical aspect of homeowner insurance, providing protection against claims of bodily injury or property damage caused by the policyholder or a family member. This coverage ensures financial support if someone is injured on your property or if you or a family member accidentally causes damage to someone else’s property.

Liability coverage can be particularly important in cases of accidents or injuries that occur on your property, as it helps cover medical expenses, legal fees, and any settlements or judgments that may arise from such incidents.

Additional Living Expenses Coverage

In the unfortunate event that your home becomes uninhabitable due to a covered peril, additional living expenses coverage steps in to provide financial support. This coverage helps cover the costs of temporary housing, meals, and other necessary expenses until your home is repaired or rebuilt.

It's crucial to review the limits and conditions of this coverage, as it can vary depending on the policy. Some policies may provide a set daily or monthly amount, while others may cover a percentage of the dwelling coverage limit.

Understanding Exclusions and Limitations

While homeowner insurance provides comprehensive coverage, it’s essential to be aware of the exclusions and limitations that may apply to your policy. These can vary depending on the provider and the specific policy.

Common Exclusions

- Flood damage: Homeowner insurance typically does not cover damage caused by flooding. A separate flood insurance policy is often required for areas prone to flooding.

- Earthquake damage: Similar to flood damage, homeowner insurance generally does not cover earthquake-related damage. Additional coverage or a separate policy is necessary for earthquake protection.

- Water backup: Damage caused by water backing up through sewers or drains is often excluded from standard homeowner insurance policies.

- Neglect or intentional damage: If damage is caused by neglect or intentional actions, homeowner insurance may not provide coverage.

- Wear and tear: Normal wear and tear or gradual deterioration of the home and its systems are typically not covered.

Limitations and Deductibles

Homeowner insurance policies often come with limitations and deductibles. Limitations refer to the maximum amount the insurance company will pay for a covered loss, while deductibles are the amount you, as the policyholder, must pay out of pocket before the insurance coverage kicks in.

It's important to choose an appropriate deductible that aligns with your financial situation. A higher deductible can result in lower premiums, but it means you'll be responsible for a larger portion of the costs in the event of a claim. Understanding these limitations and deductibles is crucial for effective financial planning.

Tailoring Your Homeowner Insurance

To ensure your homeowner insurance provides the right level of protection, it’s essential to tailor your policy to your specific needs and circumstances. This involves assessing the value of your home, the cost of rebuilding, and the value of your personal belongings.

Assessing Your Needs

Start by evaluating the replacement cost of your home. This is the estimated cost to rebuild your home if it were completely destroyed. Consider factors such as the size of your home, the quality of materials used, and any unique features or customizations. Accurately assessing the replacement cost ensures you have adequate coverage.

Next, take an inventory of your personal belongings. Make a detailed list of your furniture, electronics, clothing, and other valuables. Assign a value to each item and consider the overall value of your possessions. This information will help determine the appropriate amount of personal property coverage you require.

Adding Endorsements and Riders

Endorsements and riders are additional coverage options that can be added to your homeowner insurance policy to provide protection for specific items or situations. These endorsements often come at an additional cost but can be essential for valuable possessions or high-risk scenarios.

For example, if you own high-value jewelry, art, or collectibles, you may need to add a personal property endorsement to ensure adequate coverage. Similarly, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may want to consider adding coverage specifically for those perils.

Frequently Asked Questions

What is the difference between actual cash value and replacement cost coverage for personal property?

+Actual cash value coverage considers the depreciation of your belongings, paying the current value of the item at the time of loss. Replacement cost coverage, on the other hand, provides the full cost to replace the item, regardless of its age or depreciation.

How often should I review and update my homeowner insurance policy?

+It’s recommended to review your policy annually to ensure it aligns with your current needs and circumstances. Life changes, such as home renovations, purchasing new valuables, or moving to a new location, may require policy adjustments.

Can I customize my homeowner insurance policy to fit my specific needs?

+Absolutely! Homeowner insurance policies are highly customizable. You can choose different levels of coverage for your dwelling, personal property, and liability, and add endorsements for specific items or situations.

What should I do if I experience a loss or damage covered by my homeowner insurance policy?

+In the event of a covered loss, contact your insurance provider promptly. They will guide you through the claims process, which typically involves providing documentation, estimates, and proof of ownership for damaged items. It’s important to take photos and gather evidence to support your claim.

Homeowner insurance is a crucial tool for protecting your financial well-being and assets. By understanding the coverage it provides, including structure, personal property, liability, and additional living expenses, you can make informed decisions to tailor your policy to your specific needs. Remember to regularly review and update your policy to ensure it remains adequate as your circumstances change.