What Does Liability Insurance On A Car Cover

Liability insurance is an essential component of any comprehensive car insurance policy. It plays a crucial role in protecting individuals from the financial consequences of accidents they may cause while driving. In this article, we will delve into the specifics of what liability insurance on a car covers, exploring its scope, benefits, and the potential scenarios it can help mitigate.

Understanding Liability Insurance

Liability insurance, often referred to as third-party insurance, is designed to cover the costs associated with property damage and bodily injuries caused by the policyholder to others in an automobile accident. It serves as a financial safety net, ensuring that the insured individual can meet their legal obligations and responsibilities resulting from an at-fault accident.

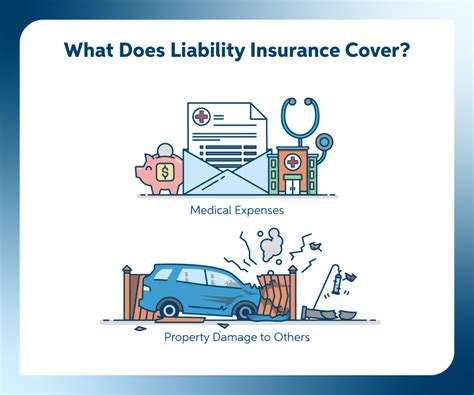

Coverage Provided by Liability Insurance

Liability insurance on a car typically offers two primary types of coverage: property damage liability and bodily injury liability. Let’s explore each of these coverage types in detail.

Property Damage Liability

Property damage liability coverage is an essential component of liability insurance. It provides protection against the costs of repairing or replacing another person’s property that has been damaged as a result of an accident caused by the policyholder. This coverage extends beyond just vehicle damage; it also covers damage to structures such as buildings, fences, and even personal belongings within the damaged property.

For instance, if you accidentally collide with a parked car or knock over a mailbox, property damage liability coverage would step in to cover the costs of repairing or replacing these items. This coverage is particularly valuable as it helps mitigate the financial burden that can arise from causing property damage to others.

| Scenario | Property Damage Covered |

|---|---|

| Colliding with a parked car | Repair or replacement of the damaged vehicle |

| Knocking over a fence | Cost of repairing or rebuilding the fence |

| Hitting a building | Necessary repairs to the building's structure |

Bodily Injury Liability

Bodily injury liability coverage is another critical aspect of liability insurance. It is designed to cover the medical expenses and other costs associated with injuries sustained by individuals involved in an accident caused by the policyholder. This coverage can include not only the treatment costs but also compensation for pain and suffering, lost wages, and legal fees, should the injured party pursue a lawsuit.

For example, if you are at fault in an accident that results in injuries to the other driver or their passengers, bodily injury liability coverage would step in to provide financial assistance for their medical bills, rehabilitation costs, and any other related expenses. This coverage is essential to ensure that the injured individuals receive the necessary care and support they deserve.

| Scenario | Bodily Injury Covered |

|---|---|

| Accident resulting in broken bones | Medical treatment, rehabilitation, and compensation for pain and suffering |

| Whiplash injuries | Treatment costs, including physical therapy |

| Loss of income due to injuries | Compensation for lost wages or salary |

Limitations and Considerations

While liability insurance provides valuable protection, it’s important to understand its limitations. Liability coverage typically has set limits, which are the maximum amounts the insurance company will pay for property damage and bodily injury claims. These limits are chosen by the policyholder during the policy purchase process and can vary based on individual preferences and budget constraints.

Additionally, liability insurance does not cover damage to the policyholder’s own vehicle or personal injuries sustained by the policyholder or their passengers. For these types of coverage, one would need to consider purchasing collision and comprehensive insurance, respectively.

Importance of Adequate Liability Coverage

Ensuring that you have adequate liability insurance coverage is crucial for several reasons. Firstly, it protects your financial well-being in the event of an at-fault accident. Medical costs and property damage repairs can quickly accumulate, and without sufficient liability coverage, you may be left with substantial out-of-pocket expenses.

Secondly, liability insurance is often a legal requirement in many jurisdictions. Failure to carry adequate liability coverage can result in legal consequences, including fines, license suspension, or even criminal charges. It is essential to understand and comply with the specific liability insurance requirements in your area to avoid any legal issues.

Choosing the Right Liability Limits

When selecting liability insurance coverage limits, it’s important to consider your unique circumstances and potential risks. Factors such as the value of your assets, your financial stability, and the frequency of your driving can influence the level of coverage you choose.

Consulting with an insurance professional can be invaluable in determining the appropriate liability limits for your situation. They can provide expert advice and help you understand the potential costs associated with different coverage levels, ensuring you have adequate protection without overspending.

Conclusion

Liability insurance on a car is a vital component of any comprehensive insurance policy. It offers protection against the financial consequences of causing property damage and bodily injuries to others in an automobile accident. By understanding the scope and benefits of liability insurance, you can make informed decisions to safeguard your financial well-being and fulfill your legal obligations as a responsible driver.

Can liability insurance cover my own vehicle’s damage in an accident?

+No, liability insurance only covers the damage you cause to others’ property and injuries you cause to others. To cover your own vehicle’s damage, you’ll need to purchase collision insurance.

Are there different liability coverage limits available?

+Yes, liability insurance coverage limits vary based on your chosen policy. Higher limits provide greater financial protection but may result in a higher premium. It’s important to find the right balance for your needs.

Is liability insurance mandatory in all states?

+While liability insurance is required in most states, the specific coverage amounts and requirements can vary. It’s crucial to check the laws in your state to ensure compliance and avoid any legal consequences.