What Does Uninsured Motorist Insurance Cover

Understanding Uninsured Motorist Insurance: Coverage and Benefits

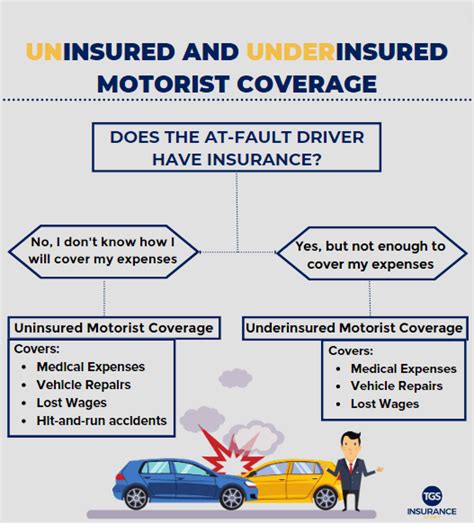

Uninsured motorist insurance is an essential component of your auto insurance policy, offering protection in the event of an accident involving an at-fault driver who lacks adequate insurance coverage. This coverage safeguards you from the financial burdens that can arise from such incidents, ensuring you're not left to bear the costs alone.

In this comprehensive guide, we'll delve into the intricacies of uninsured motorist insurance, exploring its coverage, benefits, and how it can provide vital financial security. By understanding this coverage, you can make informed decisions to protect yourself and your finances on the road.

The Significance of Uninsured Motorist Insurance

Uninsured motorist insurance plays a critical role in ensuring your financial well-being after an accident. While we hope to never find ourselves in such a situation, the reality is that not all drivers carry adequate insurance. In the United States, the Insurance Information Institute reports that approximately 1 in 8 drivers are uninsured, a figure that varies by state. This statistic highlights the importance of having uninsured motorist coverage as a safety net.

This coverage is designed to step in when the at-fault driver's insurance falls short, covering a range of expenses and losses that can arise from the accident. By understanding what this insurance covers, you can ensure you're adequately protected and prepared for any unforeseen circumstances.

What Does Uninsured Motorist Insurance Cover?

Uninsured motorist insurance provides coverage for a variety of damages and losses that may occur in an accident involving an uninsured or underinsured driver. Here's a detailed breakdown of the key areas it covers:

Bodily Injury

One of the primary functions of uninsured motorist coverage is to provide compensation for bodily injuries sustained in an accident caused by an uninsured or underinsured driver. This coverage ensures that your medical expenses, including hospital stays, surgeries, rehabilitation, and ongoing medical care, are covered. It also extends to lost wages and other out-of-pocket expenses related to your recovery.

For instance, if you're involved in a collision with an uninsured driver and require extensive medical treatment, this coverage will step in to cover those costs, ensuring you're not personally burdened with these expenses.

Property Damage

Uninsured motorist insurance also covers damage to your vehicle or other property resulting from an accident with an uninsured driver. This can include repairs to your car, replacement of damaged parts, or even the cost of a rental car while your vehicle is being fixed. It provides financial support to get your life back on track after the accident.

| Property Damage Scenario | Uninsured Motorist Insurance Coverage |

|---|---|

| Vehicle Repairs | Covers costs for repairs or replacement of damaged parts. |

| Rental Car Expenses | Offers support for rental car costs during repairs. |

| Damage to Personal Property | Compensates for damage to items in your vehicle, like laptops or phones. |

Pain and Suffering

In addition to physical injuries, uninsured motorist coverage can also provide compensation for the non-economic damages you may suffer. This includes pain and suffering, emotional distress, and loss of enjoyment of life. These damages are more difficult to quantify but can have a significant impact on your overall well-being.

For example, if you experience ongoing pain and limited mobility due to an accident with an uninsured driver, this coverage can provide financial compensation for these intangible losses.

Legal Fees and Court Costs

If you need to pursue legal action against an uninsured or underinsured driver, uninsured motorist insurance can cover the associated costs. This includes attorney fees, court fees, and other legal expenses. Having this coverage ensures you're not deterred from seeking justice due to financial concerns.

By covering these legal expenses, uninsured motorist insurance empowers you to take the necessary legal steps to hold the at-fault driver accountable.

Accidental Death and Dismemberment

In the unfortunate event of a fatal accident involving an uninsured driver, this coverage provides benefits to the surviving family members. It can cover funeral and burial expenses, as well as provide financial support to the deceased's dependents. This aspect of uninsured motorist coverage offers vital financial protection in the face of unimaginable loss.

Real-Life Example: Uninsured Motorist Insurance in Action

Let's consider a scenario to illustrate the practical benefits of uninsured motorist insurance. Imagine you're involved in a collision with an uninsured driver. You sustain injuries that require extensive medical treatment, including surgery and physical therapy. Your vehicle also suffers significant damage and needs extensive repairs.

Without uninsured motorist coverage, you would be responsible for covering all these expenses out of pocket. However, with this insurance in place, your policy can step in to cover your medical bills, reimburse you for lost wages, and pay for the repairs to your vehicle. It ensures you're not left financially devastated by the accident.

Additionally, if you decide to pursue legal action against the uninsured driver, your policy can provide the necessary funds to cover legal fees and court costs. This coverage not only provides financial protection but also offers peace of mind, knowing you have the support you need to navigate the aftermath of the accident.

Choosing the Right Uninsured Motorist Insurance Coverage

When selecting your uninsured motorist insurance coverage, it's essential to consider your specific needs and the potential risks on the road. Here are some factors to keep in mind:

- Review your state's minimum requirements for uninsured motorist coverage. While these minimums provide a baseline, you may want to opt for higher limits to ensure more comprehensive protection.

- Consider your personal assets and financial situation. If you have significant assets, higher uninsured motorist coverage limits can provide an extra layer of protection against potential lawsuits.

- Evaluate your driving habits and the risk of uninsured drivers in your area. If you frequently drive in areas with a higher rate of uninsured drivers, it may be wise to increase your coverage limits.

- Discuss your options with an insurance agent or broker. They can provide expert advice tailored to your circumstances and help you choose the right coverage for your needs.

Future Implications and Ongoing Protection

Having uninsured motorist insurance is not just about protecting yourself in the immediate aftermath of an accident. It's also about long-term financial stability and peace of mind. By choosing adequate coverage, you ensure that you're not left vulnerable to the financial burdens that can arise from accidents with uninsured drivers.

As you navigate the roads, it's important to stay informed about your insurance coverage and make adjustments as your needs evolve. Regularly reviewing and updating your policy can help ensure you're always protected, no matter what unexpected situations may arise.

Conclusion: A Vital Component of Your Auto Insurance

Uninsured motorist insurance is an indispensable part of your auto insurance portfolio, offering a vital safety net when accidents involving uninsured or underinsured drivers occur. By understanding the coverage it provides and making informed choices about your policy, you can drive with confidence, knowing you're protected from the financial fallout of such incidents.

Remember, accidents can happen, and being prepared with the right insurance coverage is key to ensuring your financial well-being. Stay informed, stay protected, and drive safely.

What happens if I’m hit by an uninsured driver, and I don’t have uninsured motorist coverage?

+

If you’re involved in an accident with an uninsured driver and don’t have uninsured motorist coverage, you may be responsible for covering all associated costs out of pocket. This includes medical expenses, vehicle repairs, and any other damages. It’s crucial to have this coverage to protect yourself financially.

Can I stack my uninsured motorist coverage with other insurance policies I have?

+

Stacking uninsured motorist coverage allows you to combine the limits of multiple policies you hold, providing additional financial protection. Not all states allow stacking, so it’s important to check your state’s regulations and discuss options with your insurance provider.

What should I do if I’m involved in an accident with an uninsured driver?

+

If you’re involved in an accident with an uninsured driver, the first step is to ensure your safety and that of any passengers. Then, gather as much information as possible, including the driver’s details, witness statements, and photos of the accident scene. Contact your insurance provider to report the accident and initiate a claim under your uninsured motorist coverage.