What Is A Marketplace Health Insurance Plan

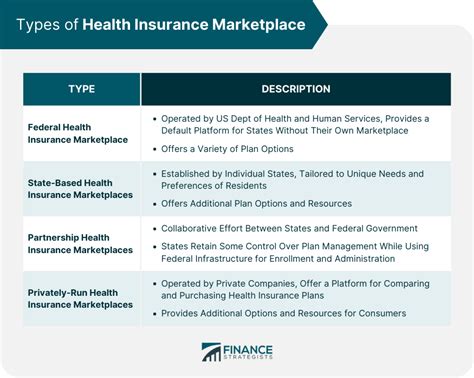

In the realm of healthcare, Marketplace Health Insurance Plans, also known as Qualified Health Plans (QHPs), play a crucial role in providing accessible and affordable healthcare coverage to individuals and families. These plans are a result of the Affordable Care Act (ACA), which aimed to revolutionize the healthcare industry and ensure that more Americans could obtain comprehensive medical insurance.

Marketplace Health Insurance Plans are designed to offer a range of coverage options, catering to diverse needs and budgets. They are primarily available through the Health Insurance Marketplace, an online platform created by the ACA to facilitate the enrollment process and make it more transparent and accessible.

This article aims to delve into the intricacies of Marketplace Health Insurance Plans, exploring their definition, significance, and key features. By the end, readers will have a comprehensive understanding of these plans and their impact on the healthcare landscape.

Understanding Marketplace Health Insurance Plans

Marketplace Health Insurance Plans are a product of the Affordable Care Act's reforms, which aimed to address the shortcomings of the traditional healthcare system. These plans are offered by private insurance companies and are regulated by the federal or state government to ensure they meet certain standards.

The primary goal of Marketplace Health Insurance Plans is to provide individuals and small businesses with a range of affordable healthcare options. These plans must cover a set of essential health benefits, which include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care.

Eligibility and Enrollment

Eligibility for Marketplace Health Insurance Plans is open to individuals and families who are not eligible for other forms of coverage, such as employer-sponsored insurance or government-funded programs like Medicaid or Medicare. The enrollment period typically runs from November 1st to December 15th each year, allowing individuals to select a plan for the upcoming year.

During the enrollment process, individuals can compare different plans based on their coverage, cost, and provider networks. The Marketplace provides tools to help consumers make informed choices, ensuring they select a plan that best suits their needs and budget.

Cost and Financial Assistance

One of the key advantages of Marketplace Health Insurance Plans is the availability of financial assistance. Individuals and families with moderate incomes may be eligible for premium tax credits, which can significantly reduce the cost of their monthly premiums. Additionally, those with lower incomes may qualify for cost-sharing reductions, which lower their out-of-pocket expenses for deductibles, copayments, and coinsurance.

The cost of Marketplace Health Insurance Plans can vary based on factors such as age, location, tobacco use, and the chosen level of coverage. Plans are categorized into metal tiers (Bronze, Silver, Gold, and Platinum), with each tier offering a different balance of premiums and out-of-pocket costs.

| Metal Tier | Premium Cost | Out-of-Pocket Costs |

|---|---|---|

| Bronze | Lower | Higher |

| Silver | Moderate | Moderate |

| Gold | Higher | Lower |

| Platinum | Highest | Lowest |

It's important to note that the actual cost of a plan may vary based on individual circumstances and the specific insurance company offering the plan.

Network and Provider Coverage

Marketplace Health Insurance Plans typically have a network of healthcare providers, including doctors, hospitals, and specialists, with whom they have negotiated rates. Enrollees can access these providers within the network at a discounted rate. However, it's crucial to check the plan's provider directory to ensure that one's preferred doctors and facilities are included.

Some Marketplace plans also offer out-of-network coverage, although this may come with higher costs. It's essential to review the plan's out-of-network policy to understand the financial implications.

The Benefits of Marketplace Health Insurance Plans

Marketplace Health Insurance Plans offer several advantages that contribute to their popularity and significance in the healthcare industry.

Affordable Coverage

One of the primary benefits of Marketplace Health Insurance Plans is their affordability. With the availability of premium tax credits and cost-sharing reductions, individuals and families can access comprehensive healthcare coverage at a reduced cost. This is particularly beneficial for those who are self-employed, work for small businesses that don't offer insurance, or have incomes that make them ineligible for government-funded programs.

Comprehensive Benefits

Marketplace Health Insurance Plans are required to cover a range of essential health benefits, ensuring that enrollees receive comprehensive coverage. This includes not only medical services but also preventive care, mental health services, and prescription drug coverage. By having access to these benefits, individuals can take a proactive approach to their health and well-being.

Transparency and Consumer Empowerment

The Health Insurance Marketplace provides a transparent platform for consumers to compare and select plans. This transparency empowers individuals to make informed choices based on their specific needs and preferences. The Marketplace also offers educational resources and tools to help consumers understand their options and the potential financial implications of their choices.

No Discrimination

Marketplace Health Insurance Plans cannot discriminate against individuals based on pre-existing conditions. This means that regardless of one's health status, they can obtain coverage and access the care they need. This is a significant shift from the pre-ACA era, where insurance companies could deny coverage or charge higher premiums to individuals with pre-existing conditions.

Marketplace Health Insurance Plans and the Future of Healthcare

The introduction of Marketplace Health Insurance Plans has had a profound impact on the healthcare industry, and its influence is expected to continue shaping the future of healthcare in the United States.

Expanding Access to Healthcare

Marketplace Health Insurance Plans have played a crucial role in expanding access to healthcare for millions of Americans. By offering affordable coverage options and ensuring coverage for pre-existing conditions, these plans have enabled individuals and families to obtain the medical care they need without facing financial hardship.

Innovations in Healthcare Delivery

The ACA and Marketplace Health Insurance Plans have also encouraged innovations in healthcare delivery. Insurance companies and healthcare providers are exploring new models of care, such as value-based care and telemedicine, to improve patient outcomes and reduce costs. These innovations are expected to continue shaping the future of healthcare, making it more efficient and patient-centric.

Addressing Healthcare Disparities

Marketplace Health Insurance Plans have the potential to address healthcare disparities by providing coverage to underserved populations. By making healthcare more accessible and affordable, these plans can help reduce health inequities and improve overall population health.

Frequently Asked Questions

Can I enroll in a Marketplace Health Insurance Plan at any time during the year?

+

The general open enrollment period for Marketplace Health Insurance Plans is from November 1st to December 15th each year. However, there are certain circumstances, such as losing other coverage or experiencing a significant life event, that may qualify you for a Special Enrollment Period, allowing you to enroll outside of the open enrollment window.

What happens if I miss the open enrollment period and don’t have a qualifying event for a Special Enrollment Period?

+

If you miss the open enrollment period and don’t qualify for a Special Enrollment Period, you may have to wait until the next open enrollment period to enroll in a Marketplace Health Insurance Plan. However, you may still be eligible for other forms of coverage, such as Medicaid or Medicare, depending on your income and circumstances.

How do I know if I’m eligible for premium tax credits or cost-sharing reductions?

+

Eligibility for premium tax credits and cost-sharing reductions is based on your household income. You can use the Health Insurance Marketplace’s Eligibility Calculator to determine if you qualify. It’s important to note that these benefits are only available to those who enroll in a Marketplace Health Insurance Plan.