What Is A Sr22 Insurance

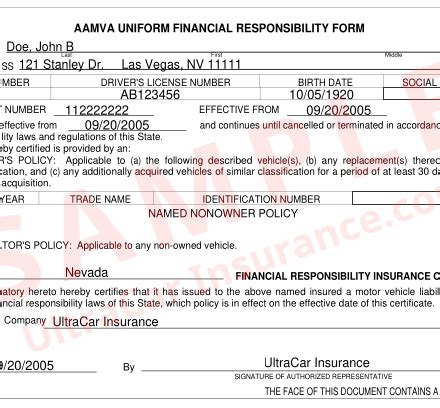

SR-22 insurance, also known as a Certificate of Financial Responsibility, is a specific type of insurance document required by law in the United States. It serves as proof to state authorities that an individual has obtained the minimum liability insurance coverage mandated by their state's regulations.

This requirement typically arises after a motorist has been involved in certain legal or insurance-related issues, such as driving under the influence (DUI), driving without insurance, or accumulating a significant number of traffic violations. The SR-22 acts as a guarantee to the state that the driver has the necessary insurance coverage to operate a vehicle and provides assurance to other road users.

The Purpose and Functionality of SR-22 Insurance

The primary purpose of SR-22 insurance is to ensure that drivers who have demonstrated high-risk behaviors or have had their licenses suspended or revoked can regain their driving privileges. It is a form of financial protection for both the driver and the general public.

When a driver is required to file an SR-22, their insurance provider issues this certificate, which is then sent to the state's Department of Motor Vehicles (DMV). The SR-22 confirms that the driver has purchased liability insurance coverage that meets or exceeds the state's minimum requirements. This coverage includes bodily injury liability, property damage liability, and, in some states, uninsured/underinsured motorist coverage.

The SR-22 is a temporary measure, typically valid for a set period, such as three years. During this time, the driver must maintain continuous insurance coverage, and any lapse in coverage will result in the SR-22 being canceled. This can lead to further legal consequences, including the reinstatement of the driver's license suspension.

Who Needs SR-22 Insurance?

SR-22 insurance is mandated for individuals who have committed certain traffic offenses or have had their driving privileges suspended or revoked. The specific offenses that trigger the requirement vary by state, but common reasons include:

- Driving Under the Influence (DUI) or Driving While Intoxicated (DWI)

- Driving without insurance (in states with mandatory insurance laws)

- Multiple serious traffic violations, such as reckless driving, speeding, or hit-and-run accidents

- Failing to pay traffic fines or court-ordered judgments

- Accumulating too many points on one's driving record

Once an individual falls into one of these categories, the court or the DMV will notify them of the requirement to file an SR-22. Failure to comply can result in the continued suspension of their driving privileges.

The Cost and Availability of SR-22 Insurance

SR-22 insurance is often more expensive than standard auto insurance policies, as it caters to high-risk drivers. The cost can vary significantly depending on the individual’s driving record, the state they reside in, and the specific requirements set by their state’s DMV.

Not all insurance providers offer SR-22 insurance, so it may be necessary to shop around to find a suitable policy. Additionally, some providers may require a larger down payment or set higher premiums for SR-22 policies.

| State | Minimum Liability Coverage |

|---|---|

| Alabama | 25/50/25 |

| California | 15/30/5 |

| Texas | 30/60/25 |

In the table above, we've included the minimum liability coverage requirements for a few states. These requirements represent the minimum amount of coverage an SR-22 policy must provide to comply with state laws.

The Process of Obtaining SR-22 Insurance

Obtaining SR-22 insurance involves several steps, and it’s important to understand the process to ensure compliance with the state’s requirements.

- Check State Requirements: Begin by researching your state's specific SR-22 requirements. This includes understanding the duration of the requirement, the minimum liability coverage needed, and any additional provisions.

- Contact Insurance Providers: Reach out to insurance providers that offer SR-22 insurance. Provide them with your driving record and inquire about their policies and rates.

- Purchase the Policy: Once you've found a suitable provider, purchase the SR-22 insurance policy. The provider will then file the SR-22 certificate with the state's DMV on your behalf.

- Maintain Continuous Coverage: Ensure that you keep your SR-22 insurance policy active for the entire duration of the requirement. Any lapse in coverage could result in severe penalties, including the loss of your driving privileges.

- Monitor Your Driving Record: Regularly check your driving record to ensure that all violations and points are accurately reflected. This helps prevent any surprises during the SR-22 period.

Tips for Managing SR-22 Insurance

- Stay informed about your state’s SR-22 requirements and any changes to those regulations.

- Consider using a reputable insurance broker who specializes in high-risk insurance to find the best rates.

- Maintain a clean driving record during the SR-22 period to avoid further complications.

- If you plan to travel to another state, ensure that your SR-22 insurance is valid and accepted in that state.

The Future of SR-22 Insurance

As the insurance industry evolves, there are ongoing discussions and initiatives to make SR-22 insurance more accessible and less punitive. Some states are exploring alternatives to the SR-22, such as the use of electronic verification systems, which could simplify the process and reduce administrative burdens.

Additionally, advancements in technology, such as telematics and usage-based insurance, may provide opportunities for high-risk drivers to demonstrate their improved driving behavior and potentially reduce their insurance costs over time.

However, the future of SR-22 insurance is largely dependent on individual state regulations, and drivers should stay informed about any changes that may impact their requirements.

Conclusion

SR-22 insurance is a critical component of the US automotive insurance system, providing a vital safety net for drivers who have made mistakes or faced legal consequences. While it can be a challenging and costly process to obtain SR-22 insurance, understanding the requirements and staying compliant is essential for regaining and maintaining driving privileges.

How long does an SR-22 stay on my record?

+The duration of an SR-22 requirement varies by state but typically ranges from 3 to 5 years. During this time, you must maintain continuous insurance coverage.

Can I get SR-22 insurance if I don’t own a car?

+Yes, SR-22 insurance is not limited to car owners. Even if you don’t own a vehicle, you can obtain SR-22 insurance as a non-owner policy to comply with state requirements.

What happens if I don’t file an SR-22 when required?

+Failing to file an SR-22 when mandated can result in the continued suspension of your driving privileges. It may also lead to additional legal consequences and fees.