What Is A Typical Monthy Car Insurance Price

Understanding the typical monthly cost of car insurance is crucial for any vehicle owner, as it can significantly impact their financial planning and overall budget. The price of car insurance is a multifaceted topic, influenced by a myriad of factors that can vary greatly between individuals and regions. This comprehensive analysis will delve into the various aspects that contribute to the cost of car insurance, providing an in-depth understanding of what to expect when budgeting for this essential coverage.

Unveiling the Factors Behind Car Insurance Costs

The cost of car insurance is a highly personalized expense, influenced by an array of variables unique to each driver and their circumstances. From the make and model of the car to the driver’s age, location, and driving history, a multitude of factors come into play when insurance providers calculate premiums.

Vehicle-Related Factors

The type of car you drive is a significant determinant of your insurance costs. Insurance providers consider factors such as the car’s make, model, and year of manufacture. Vehicles that are more expensive to repair or replace, or those that are frequently targeted by thieves, will generally attract higher insurance premiums. For instance, sports cars or luxury vehicles often come with a higher price tag for insurance due to their higher repair costs and greater appeal to thieves.

Additionally, the safety features of a vehicle can also impact insurance costs. Cars equipped with advanced safety technologies like lane departure warning systems, automatic emergency braking, and adaptive cruise control may be eligible for insurance discounts. These features not only enhance driver and passenger safety but can also reduce the likelihood and severity of accidents, leading to potential savings on insurance.

Driver-Related Factors

Your personal characteristics and driving history play a pivotal role in determining your insurance premium. Younger drivers, especially those under the age of 25, often face higher insurance costs due to their perceived higher risk of accidents. Similarly, drivers with a history of accidents, traffic violations, or claims are typically viewed as higher-risk and may pay more for insurance.

On the other hand, drivers with a long, clean driving record and a history of safe driving are often rewarded with lower insurance premiums. Insurance providers see these drivers as lower-risk and less likely to make claims, which can lead to significant savings over time. Furthermore, the number of years you've held a driver's license can also impact your insurance costs, with longer-term drivers often benefiting from lower premiums.

Geographical Factors

The region where you live and drive can significantly influence your insurance costs. Insurance providers consider the number of claims made in your area, the prevalence of accidents and traffic violations, and even the likelihood of natural disasters. Areas with a higher incidence of claims, accidents, or crimes may see higher insurance premiums.

For instance, regions with a high rate of car theft or areas prone to natural disasters like hurricanes or floods may have higher insurance costs. On the other hand, rural areas with lower population densities and a reduced risk of accidents and theft may offer lower insurance premiums. Your specific address, including your zip code, can thus have a significant impact on your insurance costs.

Usage-Based Insurance

Usage-based insurance, or pay-as-you-drive insurance, is a relatively new concept that is gaining traction. With this type of insurance, your premium is based on your actual driving behavior and habits, as measured by a device installed in your car or through an app on your smartphone. This can include factors such as the number of miles driven, driving speed, and even the time of day you drive.

For drivers who do not drive frequently or who have a history of safe driving, usage-based insurance can offer significant savings. However, for those who drive frequently or have a more aggressive driving style, this type of insurance may result in higher premiums. It is a highly personalized approach to insurance that rewards safe and responsible driving.

Average Monthly Car Insurance Costs

Given the multitude of factors that influence car insurance costs, it is challenging to provide a single, definitive figure for the average monthly car insurance premium. However, according to various industry sources and surveys, the average monthly cost of car insurance in the United States ranges from approximately 100 to 200. This figure can vary significantly based on the factors discussed above.

| Factor | Average Monthly Premium |

|---|---|

| Age | $150 - $250 (for young drivers under 25) |

| Clean Driving Record | $100 - $150 |

| Urban Areas | $120 - $220 |

| Rural Areas | $80 - $180 |

It's important to note that these averages are just a guide and that your actual insurance costs could be significantly higher or lower based on your individual circumstances. The best way to determine your personal insurance costs is to obtain quotes from multiple insurance providers, taking into account the specific factors that influence your premium.

Tips for Lowering Your Car Insurance Costs

While the cost of car insurance is largely influenced by factors beyond your control, there are still several strategies you can employ to potentially reduce your insurance premiums.

- Shop Around: Compare quotes from multiple insurance providers. Prices can vary significantly between companies, even for the same coverage.

- Bundle Policies: If you have multiple insurance needs (e.g., car, home, life), consider bundling your policies with one provider. Many insurers offer discounts for multiple policies.

- Safe Driving: Maintain a clean driving record. Avoid accidents, traffic violations, and claims, as these can significantly increase your insurance costs.

- Safety Features: When choosing a car, consider models with advanced safety features. These can lead to insurance discounts and potentially lower your premiums.

- Usage-Based Insurance: If you are a safe, low-mileage driver, consider usage-based insurance. This can offer significant savings, especially if you drive infrequently.

- Ask for Discounts: Many insurers offer discounts for various reasons, such as good grades (for young drivers), loyalty, or even for taking a defensive driving course. Don't hesitate to ask your insurer about available discounts.

By understanding the factors that influence car insurance costs and implementing strategies to reduce your premiums, you can make car insurance a more manageable expense in your overall budget.

Future Trends in Car Insurance Costs

The car insurance industry is continuously evolving, influenced by technological advancements, changing consumer behaviors, and shifts in regulatory environments. These factors can significantly impact the cost of car insurance in the future.

Technological Advancements

The rapid advancement of technology, particularly in the automotive sector, is expected to have a profound impact on car insurance costs. The increasing adoption of autonomous and semi-autonomous vehicle technologies, for instance, could lead to a significant reduction in accidents, potentially lowering insurance costs for many drivers. Similarly, the widespread use of telematics and usage-based insurance is likely to continue, offering more personalized insurance plans and potentially reducing costs for safe drivers.

Regulatory Changes

Changes in insurance regulations can also significantly impact insurance costs. For instance, if regulations are relaxed or tightened regarding mandatory insurance coverages or minimum liability limits, this could lead to changes in insurance premiums. Additionally, changes in tax laws or insurance-related fees can also influence the overall cost of insurance.

Consumer Behavior

The way consumers interact with their vehicles and insurance providers is also evolving. The increasing popularity of ride-sharing services and the potential shift towards electric vehicles could impact insurance needs and costs. Furthermore, the growing preference for online insurance purchasing and the rise of digital-only insurance providers could lead to more competitive pricing and a more efficient insurance market.

In conclusion, while it is challenging to predict the exact direction of car insurance costs in the future, it is clear that the industry is undergoing significant changes. By staying informed about these trends and adapting to changing circumstances, consumers can better navigate the evolving insurance landscape and potentially reduce their insurance costs.

How often should I review my car insurance policy and costs?

+

It is generally recommended to review your car insurance policy and costs at least once a year, or whenever your policy renews. This allows you to stay up-to-date with any changes in your circumstances (e.g., a new car, a clean driving record), which could impact your insurance costs. Additionally, reviewing your policy annually provides an opportunity to compare quotes from other insurers, ensuring you are still getting the best deal.

Can I negotiate my car insurance premium?

+

While insurance premiums are largely based on calculated risks and fixed rates, you can still negotiate with your insurer to potentially reduce your costs. For instance, you can ask about available discounts, or request a review of your policy if your circumstances have changed (e.g., you’ve moved to a lower-risk area, or your driving record has improved). It’s worth noting that some insurers may be more open to negotiation than others.

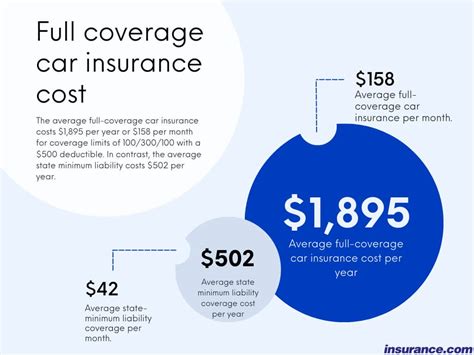

What is the difference between liability-only insurance and full coverage insurance?

+

Liability-only insurance, also known as basic or minimum coverage, provides protection for the other party in an accident you cause. It covers their medical bills, vehicle repairs, and any other damages you’re legally responsible for. On the other hand, full coverage insurance, also known as comprehensive insurance, provides more extensive coverage. It includes liability coverage, but also covers your own vehicle’s repairs, regardless of who is at fault, as well as additional protections like collision, comprehensive, and personal injury protection.