What Is Actual Cash Value Insurance

Understanding the nuances of insurance policies is crucial for anyone seeking to protect their assets effectively. One such policy type that often sparks curiosity and confusion is Actual Cash Value (ACV) insurance. This concept forms the foundation of many insurance plans, particularly those covering personal property and business assets. In this comprehensive article, we will delve into the intricacies of ACV insurance, exploring its definition, how it works, its key advantages and disadvantages, and its real-world applications.

Actual Cash Value Insurance: A Definition

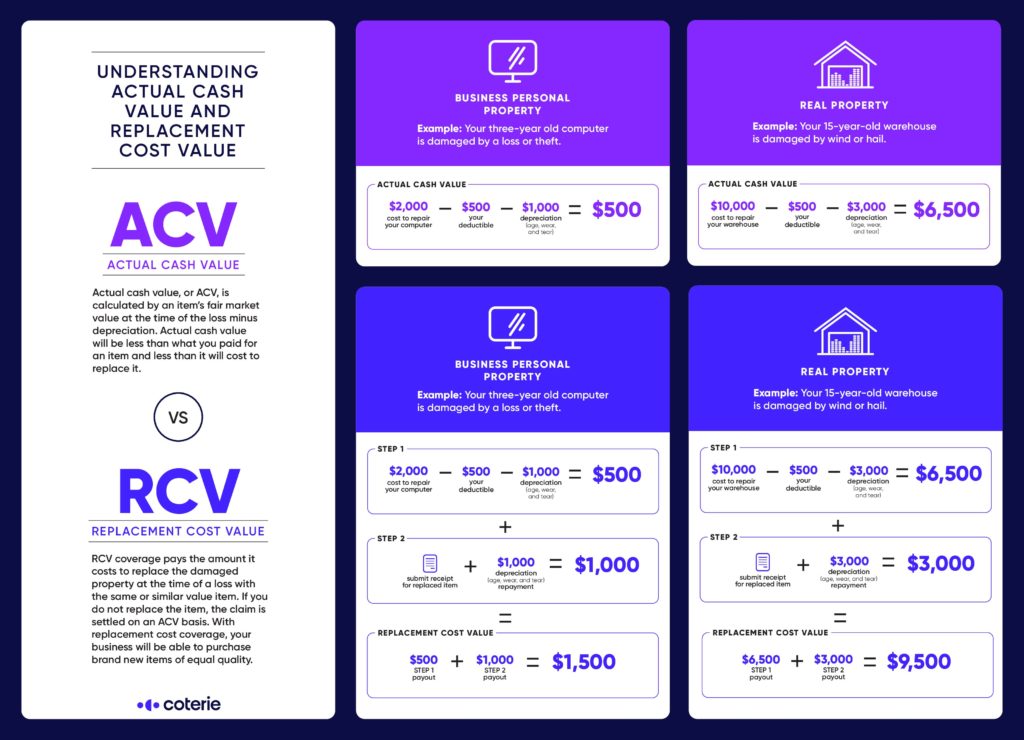

Actual Cash Value insurance is a type of coverage that considers the current value of an asset at the time of a claim, taking into account its age, condition, and depreciation. Unlike other insurance policies, such as replacement cost or agreed value, ACV policies do not reimburse the full cost of replacing the asset. Instead, they provide compensation based on the asset’s fair market value at the time of loss or damage.

For instance, imagine you have a 5-year-old laptop that you insured with an ACV policy. If it were to be stolen or damaged beyond repair, the insurance company would assess its current value, considering factors like its age, technological advancements, and any pre-existing conditions. This value, known as the actual cash value, would then be the basis for your reimbursement.

How Does Actual Cash Value Insurance Work?

ACV insurance operates on the principle of indemnification, which means that the insured party is restored to the financial position they were in before the loss occurred. Here’s a step-by-step breakdown of how ACV insurance works:

- Policy Selection: Policyholders opt for ACV insurance when purchasing a policy, typically for personal property or business assets. This choice is often influenced by factors like the asset's value, the level of protection desired, and the policyholder's budget.

- Determining ACV: When a claim is filed, the insurance company assesses the asset's actual cash value. This evaluation considers factors like the asset's purchase price, its age, condition, and any enhancements or modifications made. Depreciation, or the decrease in value over time, is a key factor in this calculation.

- Depreciation and Reimbursement: The insurance company applies depreciation to determine the asset's current value. This value, less any applicable deductibles, is the amount reimbursed to the policyholder. For instance, if your 2-year-old smartphone, originally valued at $1000, is stolen, the insurance company might calculate its ACV at $800, considering depreciation.

- Claim Settlement: Once the ACV is determined, the insurance company settles the claim by providing the policyholder with the calculated reimbursement amount. This process may involve various steps, including inspections, estimates, and negotiations, to ensure a fair settlement.

Advantages of Actual Cash Value Insurance

ACV insurance offers several benefits to policyholders, making it a popular choice for various insurance needs:

- Affordability: One of the primary advantages of ACV insurance is its cost-effectiveness. ACV policies typically come with lower premiums compared to other types of insurance, making them an attractive option for those on a budget.

- Wider Availability: ACV insurance is widely available for various assets, from personal belongings like electronics and jewelry to business equipment and inventory. This accessibility ensures that a broad range of individuals and businesses can obtain the protection they need.

- Flexibility: ACV insurance provides flexibility in terms of coverage. Policyholders can choose the level of coverage they require, balancing their budget with the desired level of protection. This flexibility allows for customization based on individual needs.

- Quick Claims Settlement: ACV insurance often results in faster claim settlements. Since the calculation of ACV is based on the asset's current value, the insurance company can assess and reimburse the policyholder promptly, reducing the time and complexity involved in the claims process.

- Suitable for Short-Term Assets: ACV insurance is particularly beneficial for assets with a relatively short lifespan, such as technology, vehicles, or perishable goods. For these assets, replacement cost or agreed value policies might not be practical due to rapid depreciation.

Disadvantages of Actual Cash Value Insurance

While ACV insurance offers several advantages, it also comes with certain limitations and considerations:

- Limited Coverage: ACV insurance provides compensation based on the asset's depreciated value, which may not cover the full cost of replacing the asset. This can be a disadvantage for policyholders who wish to ensure their assets are fully protected and replaced in the event of a loss.

- Depreciation Risk: The depreciation factor in ACV insurance can pose a risk, especially for assets that experience rapid depreciation. In such cases, the reimbursement amount may be significantly lower than the original purchase price, leaving the policyholder to bear the difference.

- Lack of Full Protection: ACV insurance does not guarantee full protection for assets. Policyholders may need to consider additional coverage options or riders to ensure their assets are adequately protected, especially for high-value or specialized items.

- Potential for Disputes: Determining the ACV of an asset can sometimes lead to disputes between the policyholder and the insurance company. Differences in opinion regarding the asset's value, condition, or depreciation rate may arise, potentially leading to lengthy negotiations or legal battles.

Real-World Applications of Actual Cash Value Insurance

ACV insurance finds practical applications in various scenarios, offering tailored protection for different assets and situations:

Personal Property Insurance

ACV insurance is commonly used for personal property coverage, such as homeowners’ or renters’ insurance policies. These policies typically cover a wide range of belongings, including furniture, electronics, jewelry, and clothing. In the event of a loss, ACV insurance ensures that policyholders are reimbursed for the current value of their belongings, taking into account depreciation.

Business Insurance

Businesses often opt for ACV insurance to protect their assets, including office equipment, inventory, and machinery. ACV coverage ensures that businesses can recover financially after a loss, considering the depreciation of their assets. This type of insurance is particularly beneficial for small businesses with limited budgets, as it provides essential protection at an affordable cost.

Vehicle Insurance

ACV insurance is widely used in the automotive industry, particularly for comprehensive and collision coverage. When a vehicle is damaged or totaled, ACV insurance calculates the vehicle’s current value, factoring in its age, mileage, and condition. This reimbursement amount helps policyholders cover the cost of repairs or replacement, ensuring they are not left with a financial burden.

Specialty Insurance

ACV insurance is also applicable to specialty assets, such as collectibles, fine art, and musical instruments. These items often experience unique depreciation patterns, and ACV insurance allows for a more accurate assessment of their value. Policyholders can ensure they receive adequate compensation for their specialty items, even if they are not readily replaceable.

Rental Property Insurance

Landlords and property owners often opt for ACV insurance to protect their rental properties. This type of insurance covers the building and its contents, ensuring that owners can recover financially in the event of damage or loss. ACV insurance takes into account the depreciation of the property and its contents, providing a cost-effective solution for property owners.

Actual Cash Value vs. Other Insurance Types

To better understand the place of ACV insurance in the insurance landscape, let’s compare it with other common insurance types:

Replacement Cost Insurance

Replacement cost insurance, unlike ACV insurance, provides reimbursement based on the cost of replacing the asset with a new one of similar quality and functionality. This type of insurance offers full protection, ensuring that policyholders can replace their assets without incurring additional costs. However, replacement cost insurance typically comes with higher premiums, making it a less budget-friendly option.

Agreed Value Insurance

Agreed value insurance is a type of coverage where the policyholder and the insurance company agree on the asset’s value at the time the policy is purchased. This agreed value is the basis for reimbursement in the event of a claim. Agreed value insurance provides a guaranteed payout, ensuring that policyholders receive the full agreed amount. However, this type of insurance is often more expensive and may not be suitable for all assets.

Actual Cash Value vs. Market Value

It’s important to note the distinction between ACV and market value. While ACV takes into account depreciation, market value is determined by the current demand and supply in the market. Market value can fluctuate based on various factors, including economic conditions and consumer preferences. ACV insurance provides a more stable and predictable valuation, making it a reliable choice for many policyholders.

Expert Insights and Recommendations

As an industry expert, I recommend carefully considering your insurance needs and budget when choosing between ACV and other insurance types. ACV insurance is an excellent option for those seeking affordable coverage, especially for assets that experience rapid depreciation. However, for high-value or specialized items, policyholders may benefit from exploring additional coverage options to ensure their assets are fully protected.

It's crucial to understand the terms and conditions of your ACV insurance policy. Familiarize yourself with the factors that influence the determination of ACV, such as depreciation schedules and the insurance company's methodology. This knowledge will help you make informed decisions and ensure you receive fair compensation in the event of a claim.

Additionally, consider the potential impact of depreciation on your assets. For assets with significant depreciation, such as technology or vehicles, ACV insurance may not provide sufficient coverage. In such cases, exploring alternatives like replacement cost or agreed value insurance may be more suitable to ensure your assets are adequately protected.

Lastly, don't hesitate to consult with insurance professionals to tailor your insurance coverage to your specific needs. Insurance brokers and agents can provide valuable guidance, helping you navigate the complexities of insurance policies and find the best fit for your assets and budget.

What is the difference between ACV and replacement cost insurance?

+ACV insurance reimburses the asset’s current value, considering depreciation, while replacement cost insurance covers the cost of replacing the asset with a new one.

How is depreciation calculated in ACV insurance?

+Depreciation is determined based on factors like the asset’s age, condition, and any enhancements. Insurance companies use depreciation schedules and methodologies to calculate the asset’s current value.

Can I upgrade my ACV insurance to a higher coverage level?

+Yes, many insurance companies offer options to upgrade your ACV insurance to a higher coverage level, such as replacement cost or agreed value, for an additional premium.