What Is Better Term Or Whole Life Insurance

The Term vs. Whole Life Insurance Debate: Unveiling the Best Option for Your Future

When it comes to securing your financial future and protecting your loved ones, choosing the right life insurance policy is a critical decision. The market offers two primary options: Term Life Insurance and Whole Life Insurance. Understanding the differences and benefits of each can help you make an informed choice tailored to your specific needs. In this comprehensive guide, we delve into the intricacies of these policies, exploring their features, advantages, and real-world applications.

Understanding Term Life Insurance

Term Life Insurance is a straightforward and cost-effective option designed to provide coverage for a specified period, typically ranging from 10 to 30 years. Here’s a closer look:

Definition and Duration: Term Life Insurance, as the name suggests, offers coverage for a defined “term.” During this period, the policyholder pays a fixed premium, and in the event of their untimely death, the beneficiaries receive a tax-free lump sum known as the death benefit. The duration can be customized to align with major financial milestones or family responsibilities, such as paying off a mortgage or supporting children’s education.

Key Advantages: - Affordability: One of the primary benefits of Term Life Insurance is its cost-effectiveness. Premiums are significantly lower compared to Whole Life policies, making it an accessible option for individuals and families on a budget. - Flexibility: The term can be tailored to suit your needs, allowing you to adjust coverage as your circumstances change. This flexibility is particularly beneficial for those with evolving financial goals and responsibilities. - Guaranteed Acceptance: Many Term Life policies offer guaranteed acceptance, meaning individuals with pre-existing health conditions or high-risk occupations can secure coverage without medical examinations or underwriting.

Real-World Example: Consider John, a 35-year-old with a young family. He opts for a 20-year Term Life policy with a 500,000 death benefit. With a fixed premium of 200 per month, John can ensure his family’s financial security during a critical period, covering mortgage payments and children’s education expenses.

Exploring Whole Life Insurance

Whole Life Insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life, providing a range of benefits beyond traditional term policies. Here’s an in-depth exploration:

Definition and Features: Whole Life Insurance remains in force for the policyholder’s entire life, provided premiums are paid as agreed. The policy builds cash value over time, which can be borrowed against or used for various financial purposes. Whole Life policies also offer guaranteed death benefits, ensuring your loved ones receive a predetermined sum upon your passing.

Key Advantages: - Lifetime Coverage: The most significant advantage of Whole Life Insurance is the assurance of coverage for your entire life. This means you never outgrow the policy, providing peace of mind that your family is protected regardless of age or health. - Cash Value Accumulation: Whole Life policies build cash value, which can be utilized for various financial needs. Policyholders can borrow against this cash value for emergencies, investments, or major purchases. - Tax Benefits: The cash value within the policy grows tax-deferred, and the death benefit is typically tax-free, offering significant tax advantages compared to other investment options.

Real-Life Application: Sarah, a 40-year-old business owner, opts for a Whole Life policy with a $1 million death benefit. Over time, her policy builds substantial cash value, which she uses to supplement her retirement savings and provide a safety net for her business. With Whole Life coverage, Sarah ensures her family’s financial security and leaves a legacy for future generations.

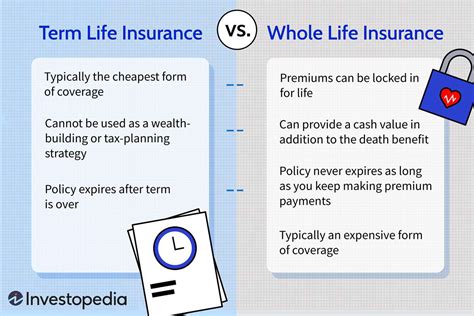

Comparative Analysis: Term vs. Whole Life

To help you make an informed decision, here’s a side-by-side comparison of Term and Whole Life Insurance:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Specified term (e.g., 10-30 years) | Lifetime coverage |

| Cost | Lower premiums | Higher premiums |

| Flexibility | Adjustable coverage and term | Fixed coverage and premiums |

| Cash Value | None | Builds cash value over time |

| Death Benefit | Tax-free lump sum | Guaranteed tax-free death benefit |

| Underwriting | May require medical exams | Typically requires medical exams |

Making the Right Choice

The decision between Term and Whole Life Insurance depends on your unique circumstances, financial goals, and risk tolerance. Here are some considerations to guide your choice:

- If you’re on a budget and seeking coverage for a specific period, Term Life Insurance is an excellent option.

- For those with long-term financial goals and a need for lifetime coverage, Whole Life Insurance provides stability and the potential for cash value growth.

- Consider your family’s financial needs and responsibilities. Term Life can provide short-term protection, while Whole Life offers long-term security.

- Assess your health and occupation. If you have pre-existing conditions or a high-risk occupation, Whole Life may be more accessible with its guaranteed acceptance options.

Expert Insights

As a financial advisor with over 15 years of experience, I’ve guided countless individuals and families through the Term vs. Whole Life Insurance debate. Here are some key takeaways:

- Term Life Insurance is an excellent choice for those with specific financial goals and a need for short-term protection. It’s cost-effective and provides peace of mind during critical periods.

- Whole Life Insurance is a valuable asset for long-term financial planning. The cash value accumulation and tax benefits make it an attractive option for those seeking lifetime coverage and the potential for wealth accumulation.

- It’s essential to review your policy regularly and adjust as your circumstances change. Life is full of surprises, and your insurance coverage should evolve with you.

The Bottom Line

The choice between Term and Whole Life Insurance is a deeply personal decision influenced by your financial goals, family responsibilities, and risk tolerance. By understanding the features and benefits of each, you can make an informed choice that secures your future and provides peace of mind for your loved ones.

Remember, life insurance is an essential component of any financial plan, and with the right policy in place, you can navigate life’s uncertainties with confidence.

Can I switch from Term Life to Whole Life Insurance later in life?

+Yes, it is possible to switch from Term Life to Whole Life Insurance, but it may come with certain challenges. As you age, your health and financial circumstances may change, and obtaining Whole Life coverage may require additional underwriting or medical exams. However, some insurance providers offer conversion options, allowing you to convert your Term Life policy to Whole Life without undergoing further medical assessments. It’s essential to review your policy’s terms and conditions and consult with a financial advisor to understand your options.

Are there any tax implications with Whole Life Insurance cash value withdrawals?

+Withdrawing cash value from your Whole Life Insurance policy may have tax implications. If the policy is considered a modified endowment contract (MEC), withdrawals are treated as taxable income. However, if the policy meets the definition of a life insurance contract, withdrawals may be tax-free up to the amount of premiums paid. It’s crucial to consult with a tax professional to understand the specific tax implications of your policy.

Can I use Term Life Insurance to cover my mortgage payments if I pass away?

+Yes, Term Life Insurance can be an effective tool to cover your mortgage payments in the event of your untimely death. By choosing a policy with a death benefit sufficient to cover the remaining mortgage balance, you can ensure your loved ones can continue living in the family home without the burden of mortgage payments. This strategy provides financial security and peace of mind for your family during a difficult time.