What Is Coinsurance In Insurance

Coinsurance is a fundamental concept in the insurance industry, playing a critical role in how policies are structured and how claims are paid out. This mechanism ensures a shared responsibility between the insured and the insurance provider, fostering a balanced relationship. Understanding coinsurance is crucial for policyholders, as it directly impacts their financial obligations and the overall cost of insurance coverage.

Understanding Coinsurance: Definition and Functionality

Coinsurance is a term used in insurance policies, particularly in health, property, and casualty insurance, to describe the sharing of risk between the policyholder and the insurance company. In essence, it’s a mechanism that ensures the insured party bears a portion of the financial burden in the event of a covered loss or claim. This shared responsibility is designed to discourage policyholders from making unnecessary or excessive claims, as well as to ensure the sustainability of the insurance fund.

When an insured event occurs, such as a health emergency or property damage, the coinsurance clause in the policy comes into effect. This clause specifies the percentage of the loss that the policyholder is responsible for covering. For instance, if a policy has an 80/20 coinsurance ratio, the insurance company will pay 80% of the claim, while the policyholder is liable for the remaining 20%.

Coinsurance is a critical aspect of insurance policies, especially in health insurance, where it can significantly impact the out-of-pocket expenses of the insured. In property insurance, coinsurance ensures that policyholders maintain their properties adequately, thus reducing the risk of large-scale losses.

Health Insurance Coinsurance: Navigating Medical Expenses

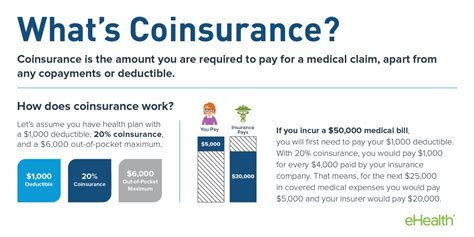

In the realm of health insurance, coinsurance is a vital component that determines the cost-sharing arrangement between the insured and the insurer. After the deductible, which is the initial out-of-pocket expense the insured pays before the insurance coverage kicks in, coinsurance comes into play. For instance, if your health insurance policy has an 80⁄20 coinsurance ratio and you’ve met your deductible, the insurance company will pay 80% of the approved medical expenses, leaving you responsible for the remaining 20%.

The impact of coinsurance on health insurance policies can be significant. It directly affects the overall cost of healthcare for the insured, especially for those who require frequent medical treatments or have chronic conditions. Higher coinsurance ratios generally mean that policyholders will pay a larger portion of their medical expenses, potentially leading to substantial out-of-pocket costs.

Coinsurance in health insurance often varies based on the type of medical service. For instance, a policy might have different coinsurance rates for primary care visits, specialist consultations, and hospital stays. Understanding these variations is crucial for policyholders to effectively manage their healthcare expenses and make informed decisions about their medical care.

Example: Coinsurance in Action

Let’s illustrate this with an example. Assume you have a health insurance policy with an 80⁄20 coinsurance ratio and a 1,500 deductible. You incur medical expenses totaling 5,000 after meeting your deductible. Here’s how the coinsurance would work:

| Expense | Coinsurance Ratio | Insurance Payout | Your Expense |

|---|---|---|---|

| $5,000 | 80/20 | $4,000 | $1,000 |

Property Insurance Coinsurance: Protecting Your Assets

Coinsurance in property insurance is slightly different from its health insurance counterpart. Here, coinsurance is often expressed as a percentage of the property’s actual cash value or replacement cost. This percentage, known as the coinsurance percentage, is specified in the policy and is critical in determining the adequacy of the insurance coverage.

If a property is insured for less than its actual value, the coinsurance clause comes into play. In the event of a claim, the insurance company will pay the claim amount, but only up to the policy limit. The policyholder is then responsible for covering the remaining difference, which can be substantial if the property is significantly undervalued.

For instance, if a property is insured for $800,000 but its actual replacement cost is $1,000,000, and the policy has an 80% coinsurance requirement, the insured will only receive 80% of the policy limit ($640,000) in the event of a total loss. This leaves a substantial gap, known as the coinsurance penalty, which the policyholder must cover out of pocket.

Example: Property Insurance and Coinsurance

Consider the following example to better understand coinsurance in property insurance:

You own a house insured for $500,000, but its actual replacement cost is $750,000. Your policy has an 80% coinsurance requirement. If your house is damaged in a fire and the repairs cost $600,000, here's how the coinsurance would work:

| Replacement Cost | Coinsurance Percentage | Policy Limit | Insurance Payout | Coinsurance Penalty |

|---|---|---|---|---|

| $750,000 | 80% | $500,000 | $480,000 | $120,000 |

In this scenario, the insurance company would pay out $480,000, leaving you, the policyholder, responsible for the coinsurance penalty of $120,000.

Key Considerations and Expert Insights

Coinsurance is a critical component of insurance policies, and understanding its implications is essential for policyholders. Here are some key considerations and expert insights to keep in mind:

- Coinsurance and Policy Selection: When choosing an insurance policy, consider the coinsurance ratio. A higher coinsurance ratio might result in lower premiums but can lead to higher out-of-pocket expenses in the event of a claim.

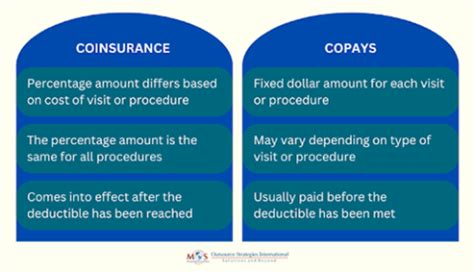

- Coinsurance and Deductibles: Deductibles and coinsurance are two distinct cost-sharing mechanisms. While deductibles are a fixed amount paid upfront before insurance coverage kicks in, coinsurance is a percentage of the claim amount paid by the policyholder after the deductible.

- Managing Coinsurance Costs: To manage coinsurance expenses, consider setting aside funds in a dedicated account for potential out-of-pocket costs. Additionally, regular reviews of your insurance policy can help ensure it aligns with your current needs and financial situation.

- Coinsurance and Policy Adequacy: In property insurance, ensuring that your property is adequately insured is crucial to avoid coinsurance penalties. Regularly review and update your policy limits to reflect changes in the property's value.

Conclusion: Navigating the World of Coinsurance

Coinsurance is a vital aspect of insurance policies, influencing the financial relationship between the insured and the insurer. Whether in health or property insurance, understanding coinsurance is key to making informed decisions about your coverage and managing potential financial risks. By staying informed and proactive, policyholders can navigate the complexities of coinsurance and ensure they are adequately protected while maintaining financial stability.

How does coinsurance differ from a deductible in insurance policies?

+A deductible is a fixed amount the policyholder must pay upfront before the insurance coverage kicks in. Coinsurance, on the other hand, is a percentage of the claim amount that the policyholder is responsible for paying after the deductible has been met. Deductibles and coinsurance are distinct mechanisms for cost-sharing in insurance policies.

Can coinsurance percentages change over time in a policy?

+Yes, in some cases, coinsurance percentages can change over the life of a policy. This is more common in certain types of insurance, such as health insurance, where the coinsurance ratio might adjust annually based on factors like the policyholder’s age or the overall cost of healthcare.

What happens if I don’t meet the coinsurance requirement in property insurance?

+If your property is insured for less than its actual value and a claim occurs, you may face a coinsurance penalty. This means the insurance company will pay the claim amount up to the policy limit, but you’ll be responsible for the difference between the policy limit and the actual cost of the loss.