What Is Comprehensive Insurance

Comprehensive insurance, often referred to as "full coverage" in the insurance industry, is a type of insurance policy that provides a broad range of coverage for various types of risks and losses. It is designed to offer extensive protection and financial security to individuals and businesses, covering a wide spectrum of potential perils and liabilities.

The Scope of Comprehensive Insurance

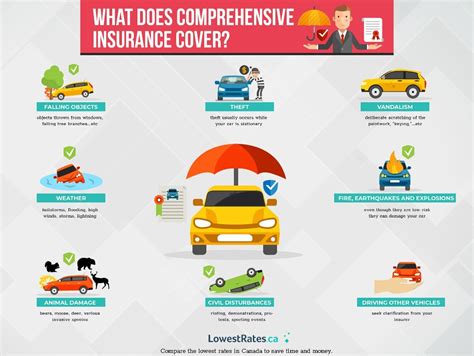

Comprehensive insurance policies are renowned for their all-encompassing nature, providing protection against a multitude of unforeseen events and circumstances. Unlike basic insurance plans that often cover only specific risks, comprehensive insurance offers a more holistic approach to risk management.

Coverage for Physical Damage

One of the key features of comprehensive insurance is its coverage for physical damage to the insured property or asset. This includes damage from a wide array of sources, such as:

- Fire and explosion.

- Natural disasters like hurricanes, tornadoes, earthquakes, and floods.

- Vandalism and malicious acts.

- Theft and burglary.

- Collision with animals (e.g., hitting a deer while driving).

- Falling objects, such as tree branches during a storm.

In most cases, comprehensive insurance will cover the repair or replacement costs of the damaged property, up to the policy’s specified limits and subject to the terms and conditions outlined in the insurance contract.

Liability Protection

Comprehensive insurance policies often extend beyond just physical damage coverage. They frequently include liability protection, which safeguards the insured against legal claims and financial liabilities arising from accidents or injuries caused to others. This can include:

- Bodily injury to third parties.

- Property damage to others.

- Legal defense costs in the event of a lawsuit.

- Medical payments for injuries sustained by others.

Liability coverage is a critical component of comprehensive insurance, offering peace of mind and financial protection in the event of accidents or incidents where the insured is held responsible.

Additional Benefits and Coverages

Comprehensive insurance policies may also include a range of additional benefits and coverages that further enhance the protection offered. These can vary depending on the insurer and the specific policy, but some common examples include:

- Medical Payments Coverage: This provides coverage for medical expenses incurred by the insured and their passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects the insured against financial loss if they are involved in an accident with a driver who has no insurance or insufficient insurance coverage.

- Rental Car Reimbursement: Offers coverage for rental car expenses while the insured’s vehicle is being repaired or replaced after an insured loss.

- Personal Property Coverage: Provides protection for personal belongings in the event of theft, damage, or loss.

- Roadside Assistance: Includes benefits such as towing, flat tire changes, and fuel delivery in case of emergencies.

Real-World Examples of Comprehensive Insurance

To better understand the practical application of comprehensive insurance, let’s explore a few real-world scenarios where comprehensive coverage has proven invaluable:

Case Study: Natural Disaster Coverage

Imagine a homeowner in a flood-prone area who has purchased a comprehensive home insurance policy. During a severe storm, their home is flooded, causing extensive damage to the structure and its contents. Thanks to their comprehensive insurance, the homeowner is able to file a claim and receive financial assistance to repair or rebuild their home and replace damaged possessions.

Case Study: Auto Insurance Coverage

Consider a driver who purchases a comprehensive auto insurance policy. One day, while driving through a rural area, they hit a deer, causing significant damage to their vehicle. With comprehensive coverage, the driver can file a claim to have their vehicle repaired or replaced, even though the accident was not caused by another driver.

Case Study: Business Insurance Coverage

A small business owner purchases a comprehensive business insurance policy that includes property, liability, and business interruption coverage. Unfortunately, a fire breaks out in their office building, causing significant damage. The business owner is able to rely on their comprehensive insurance to cover the cost of repairing the building, replacing damaged equipment, and even providing financial support during the period when the business is unable to operate.

Performance Analysis and Benefits

Comprehensive insurance policies offer a host of benefits that make them an attractive choice for many individuals and businesses:

- Peace of Mind: By providing coverage for a wide range of risks, comprehensive insurance offers peace of mind, knowing that you are financially protected against unforeseen events.

- Financial Security: In the event of a covered loss, comprehensive insurance can provide the necessary funds to repair or replace damaged property, cover medical expenses, and handle legal liabilities, ensuring financial stability.

- Customizable Coverage: Many comprehensive insurance policies allow for customization, enabling policyholders to tailor their coverage to their specific needs and risks.

- Cost-Effectiveness: While comprehensive insurance policies may have higher premiums compared to basic coverage, they often provide better value for money due to the extensive protection they offer.

Future Implications and Industry Trends

The insurance industry is continuously evolving, and comprehensive insurance is no exception. As risks and consumer needs change, insurers are adapting their policies to meet these new demands. Here are some key trends and future implications to consider:

- Technology Integration: Insurers are increasingly leveraging technology to enhance the efficiency and accuracy of their services. This includes the use of telematics in auto insurance, where driving behavior data is collected to offer more personalized and dynamic coverage.

- Risk Assessment and Mitigation: With advancements in data analytics and risk modeling, insurers are better equipped to assess and manage risks. This allows for more precise pricing and coverage options, benefiting both insurers and policyholders.

- Personalized Coverage: As consumer preferences shift towards more tailored insurance solutions, insurers are developing products that offer greater flexibility and customization. This enables policyholders to select the specific coverages they need, ensuring a more cost-effective and relevant insurance package.

- Sustainable and Green Initiatives: With growing environmental concerns, insurers are exploring ways to support sustainable practices and reduce their environmental impact. This includes offering incentives for policyholders who adopt eco-friendly measures and encouraging the use of green technologies.

Conclusion

Comprehensive insurance is a vital tool for managing risks and protecting one’s financial well-being. By offering a broad range of coverage options, it provides a comprehensive safety net against a multitude of unforeseen events. Whether it’s safeguarding your home, vehicle, or business, comprehensive insurance offers peace of mind and financial security in an uncertain world.

What is the difference between comprehensive insurance and collision insurance?

+Comprehensive insurance covers a wide range of risks, including physical damage and liability. It provides protection against various events like natural disasters, theft, and vandalism. Collision insurance, on the other hand, is a more specific coverage that solely covers damages to your vehicle resulting from a collision with another vehicle or object.

Is comprehensive insurance always more expensive than basic coverage?

+Yes, comprehensive insurance typically comes at a higher cost compared to basic coverage. This is because it offers a much broader range of protections, covering a wider variety of risks and providing more extensive coverage limits. However, the additional cost may be well worth it for those who want comprehensive financial protection.

Can I customize my comprehensive insurance policy to fit my specific needs?

+Absolutely! One of the significant advantages of comprehensive insurance is its flexibility. Many insurers offer customizable policies, allowing you to select the specific coverages and limits that best suit your needs and budget. This ensures that you only pay for the protection you require.