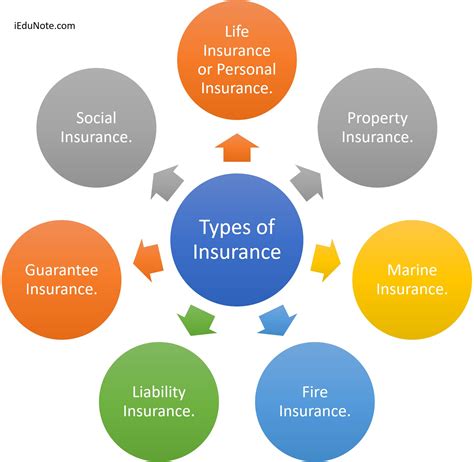

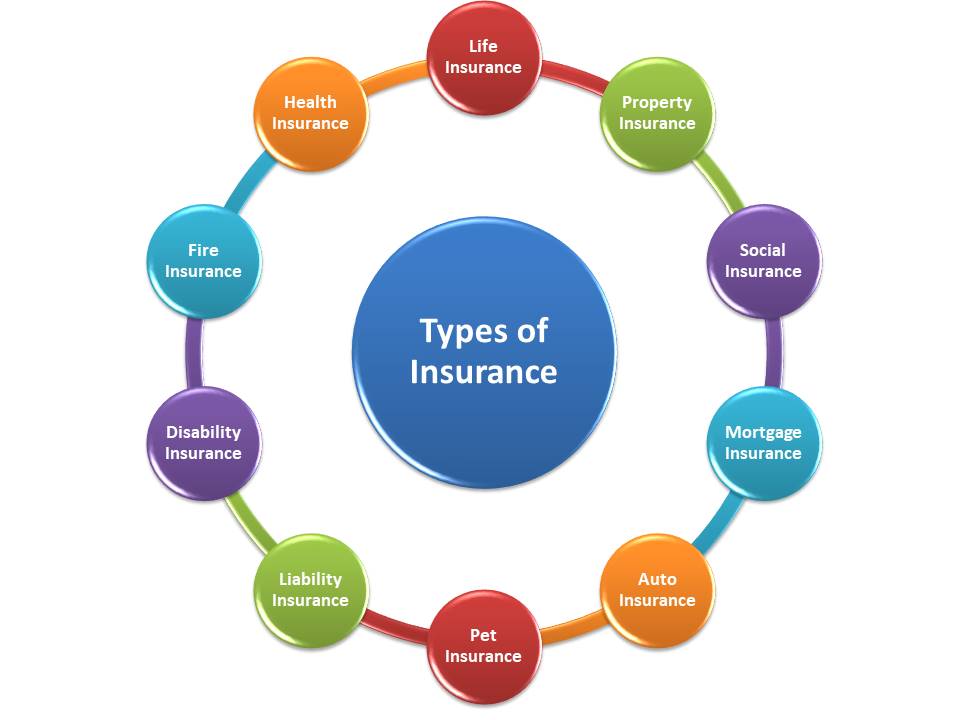

What Is Difernt Type Of Insurance

Insurance is an essential financial tool that provides protection and peace of mind against various uncertainties and risks in life. With a wide range of insurance types available, it's crucial to understand the specific needs and coverage options to make informed decisions. In this comprehensive guide, we will explore the different types of insurance, their unique features, and how they can benefit individuals and businesses.

Life Insurance: A Safety Net for Your Loved Ones

Life insurance is one of the most common types of insurance, offering financial security to your family or dependents in the event of your untimely death. It acts as a safety net, ensuring that your loved ones can maintain their standard of living and meet their financial obligations even in your absence.

There are two primary types of life insurance:

- Term Life Insurance: This type of insurance provides coverage for a specific term, typically ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away during the policy term. Term life insurance is often more affordable compared to permanent life insurance, making it an attractive option for individuals with limited budgets.

- Permanent Life Insurance: Unlike term life insurance, permanent life insurance offers lifelong coverage. It includes whole life insurance, universal life insurance, and variable life insurance. These policies not only provide a death benefit but also accumulate cash value over time, which can be accessed through loans or withdrawals. Permanent life insurance is ideal for long-term financial planning and estate planning.

Key Features of Life Insurance

Life insurance policies typically offer a range of features and benefits, including:

- Death Benefit: A lump-sum payment made to your beneficiaries upon your death, providing them with financial support.

- Level Premiums: Most life insurance policies offer fixed premiums that remain constant throughout the policy term, making it easier to budget.

- Riders and Add-ons: These are optional features that can be added to your policy to enhance coverage, such as waiver of premium, accelerated benefit rider, or spousal coverage.

- Tax Benefits: In many countries, life insurance proceeds are tax-free, making it an attractive financial planning tool.

Health Insurance: Protecting Your Well-being

Health insurance is designed to safeguard your financial well-being in the event of unexpected medical expenses. It covers a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and preventive care.

Health insurance can be obtained through various channels, including:

- Employer-Sponsored Health Insurance: Many employers offer health insurance plans as part of their employee benefits package. These plans often provide comprehensive coverage at a discounted rate.

- Individual Health Insurance Plans: Individuals can purchase health insurance plans directly from insurance companies or through government-sponsored marketplaces. These plans offer flexibility and can be tailored to individual needs.

- Government-Sponsored Health Insurance: In some countries, the government provides health insurance coverage to its citizens, ensuring access to healthcare for all.

Understanding Health Insurance Coverage

Health insurance policies vary in their coverage and benefits. Here are some key aspects to consider:

- Premiums: The amount you pay for your health insurance policy, typically on a monthly or annual basis.

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Co-payments (Co-pays): A fixed amount you pay for certain medical services, such as doctor visits or prescriptions, even after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you will have to pay out of pocket in a year for covered services. After reaching this limit, your insurance plan covers 100% of eligible expenses.

- Network Providers: Health insurance plans often have networks of preferred providers. Using in-network providers can result in lower out-of-pocket costs.

Auto Insurance: Safeguarding Your Vehicle and Liability

Auto insurance is a legal requirement in most countries and provides financial protection in the event of an accident or other vehicle-related incidents. It covers a wide range of risks, including collision, comprehensive, liability, and personal injury protection.

Auto insurance policies typically consist of several components, including:

- Liability Coverage: This covers the costs associated with injuries or damages you cause to others in an accident. It includes both bodily injury liability and property damage liability.

- Collision Coverage: Pays for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-accident-related damages, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): Provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has little or no insurance.

Factors Affecting Auto Insurance Premiums

Auto insurance premiums can vary based on several factors, such as:

- The make and model of your vehicle

- Your driving history and record

- The location where you reside and drive

- Your age and gender

- The coverage limits and deductibles you choose

Homeowners Insurance: Protecting Your Residence

Homeowners insurance is essential for anyone who owns a home, providing coverage for your property and its contents. It offers protection against various perils, including fire, theft, vandalism, and natural disasters.

Homeowners insurance typically includes the following coverage types:

- Dwelling Coverage: Covers the structure of your home, including walls, roofs, and foundations.

- Personal Property Coverage: Protects your personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you are held responsible for an accident that occurs off your premises.

- Additional Living Expenses (ALE): Covers temporary living expenses if your home becomes uninhabitable due to a covered loss.

Special Considerations for Homeowners Insurance

When purchasing homeowners insurance, it’s important to consider the following:

- The replacement cost of your home: Ensure your policy covers the cost of rebuilding your home, not just its market value.

- Valuable items: Some policies have limits on coverage for high-value items like jewelry or artwork. Consider purchasing separate riders for adequate coverage.

- Flood and earthquake coverage: Standard homeowners insurance typically excludes flood and earthquake damage. Consider purchasing separate policies if you live in an area prone to these natural disasters.

Business Insurance: Safeguarding Your Enterprise

Business insurance is crucial for protecting your business assets, employees, and customers. It provides coverage for a wide range of risks, including property damage, liability claims, and business interruption.

Some common types of business insurance include:

- General Liability Insurance: Covers bodily injury, property damage, and personal and advertising injury claims that occur on your business premises or as a result of your operations.

- Professional Liability Insurance (Errors and Omissions): Protects against claims of negligence or inadequate work by your business or its employees.

- Product Liability Insurance: Provides coverage if your product causes harm to a consumer.

- Business Interruption Insurance: Offers financial support if your business is forced to shut down temporarily due to a covered loss, such as a fire or natural disaster.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

Key Factors for Business Insurance

When selecting business insurance, consider the following factors:

- The nature and size of your business

- The industry you operate in and its associated risks

- The number of employees you have and their job roles

- The value of your business assets and inventory

- Any specific regulations or requirements for your industry

Travel Insurance: Peace of Mind for Your Adventures

Travel insurance is designed to protect you and your travel plans against unexpected events, such as trip cancellations, medical emergencies, or lost luggage. It provides coverage for a wide range of travel-related risks, ensuring you can enjoy your journey with peace of mind.

Travel insurance policies typically include coverage for:

- Trip Cancellation and Interruption: Reimburses non-refundable expenses if your trip is canceled or interrupted due to covered reasons, such as illness, natural disasters, or severe weather.

- Medical and Dental Expenses: Covers emergency medical and dental treatment while traveling, including evacuation and repatriation if necessary.

- Baggage and Personal Effects: Provides compensation for lost, stolen, or damaged luggage and personal items.

- Emergency Assistance: Offers 24⁄7 assistance for medical emergencies, legal issues, or other urgent situations while traveling.

- Travel Delay: Covers additional expenses incurred due to delays in your travel plans, such as accommodation and meals.

Choosing the Right Travel Insurance

When selecting travel insurance, consider the following factors:

- The duration and destination of your trip

- Your age and any pre-existing medical conditions

- The value of your trip and any non-refundable expenses

- The level of coverage you require for medical emergencies and evacuation

- Any specific activities or adventures you plan to undertake during your trip

Conclusion: The Power of Insurance

Insurance is an invaluable tool that empowers individuals and businesses to protect themselves against unforeseen circumstances and financial risks. By understanding the different types of insurance and their unique features, you can make informed decisions to secure your future and the well-being of those around you.

What is the difference between term life insurance and permanent life insurance?

+

Term life insurance provides coverage for a specific term, typically ranging from 10 to 30 years, offering a death benefit if you pass away during that period. On the other hand, permanent life insurance offers lifelong coverage and includes whole life, universal life, and variable life insurance. Permanent life insurance also accumulates cash value over time, making it suitable for long-term financial planning.

How does health insurance coverage work?

+

Health insurance coverage typically involves paying premiums, deductibles, and co-payments. Premiums are the regular payments you make to maintain your insurance coverage. Deductibles are the amounts you pay out of pocket before your insurance kicks in. Co-payments are fixed amounts you pay for certain services even after meeting your deductible. Understanding these components helps you manage your healthcare expenses effectively.

What factors influence auto insurance premiums?

+

Auto insurance premiums can vary based on several factors, including the make and model of your vehicle, your driving history and record, your location, age, and gender, as well as the coverage limits and deductibles you choose. These factors influence the level of risk associated with insuring your vehicle, impacting the premium you pay.