What Is Difference Between Whole Life And Term Life Insurance

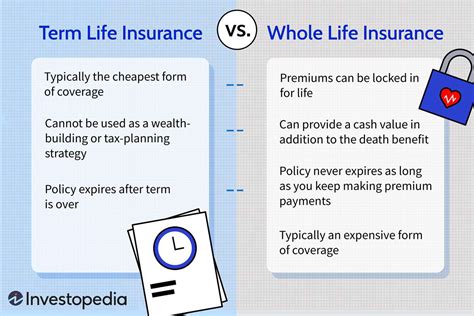

When it comes to securing your financial future and protecting your loved ones, understanding the differences between whole life and term life insurance is crucial. These two types of life insurance policies offer distinct advantages and cater to different needs, so let's delve into the specifics to help you make an informed decision.

Whole Life Insurance: A Comprehensive Overview

Whole life insurance, often referred to as permanent life insurance, is a long-term financial solution designed to provide coverage throughout your entire life. Here’s a breakdown of its key features and benefits:

Coverage Period

Whole life insurance offers lifetime coverage, meaning it remains active as long as you continue to pay the premiums. This provides peace of mind, knowing that your beneficiaries will receive the death benefit no matter when you pass away.

Fixed Premiums

One of the standout features of whole life insurance is its fixed premium structure. You pay the same premium amount every month or year, regardless of any changes in your health or age. This predictability makes financial planning easier and ensures that your insurance costs remain stable.

Cash Value Accumulation

Whole life policies accumulate cash value over time. A portion of your premium goes towards building this cash value, which acts as a savings component. You can borrow against this cash value during your lifetime for various purposes, such as funding retirement, paying for education, or covering unexpected expenses.

| Whole Life Insurance Benefits |

|---|

| Guaranteed Lifetime Coverage |

| Fixed and Predictable Premiums |

| Cash Value Accumulation for Financial Flexibility |

| Potential Tax Benefits on Cash Withdrawals |

Term Life Insurance: A Focused Protection Plan

Term life insurance, on the other hand, provides coverage for a specified period of time, typically ranging from 10 to 30 years. It is designed to meet the protection needs of individuals during specific life stages or when they have financial dependents.

Coverage Period and Premiums

Term life insurance offers coverage for a defined term, after which the policy expires. Premiums are generally lower compared to whole life insurance, especially for younger individuals. However, premiums can increase significantly as you age and renew the policy.

Renewability and Convertibility

Most term life policies allow you to renew your coverage at the end of the term, often at a higher premium rate. Additionally, many policies offer the option to convert your term life insurance into a whole life or permanent policy, providing you with the flexibility to adapt your coverage as your needs change.

Affordability and Flexibility

Term life insurance is highly affordable for those seeking temporary coverage. It is an excellent choice for young families, mortgage holders, or anyone who needs protection for a specific period, such as until their children become independent or their debts are paid off.

| Term Life Insurance Benefits |

|---|

| Lower Premiums for Short-Term Coverage |

| Renewability Option for Extended Coverage |

| Flexibility to Convert to Permanent Life Insurance |

| Ideal for Specific Life Stages and Financial Goals |

Key Differences and Considerations

The choice between whole life and term life insurance depends on your unique financial situation and goals. Here are some key considerations to help you decide:

- Financial Stability: Whole life insurance provides long-term financial stability and predictability, making it suitable for those seeking a comprehensive and consistent insurance plan.

- Coverage Needs: Term life insurance is ideal for those with temporary financial obligations, such as young families or those with significant debt. It offers adequate coverage for a defined period.

- Cash Value Accumulation: Whole life insurance allows you to build cash value over time, providing financial flexibility. Term life insurance, however, does not offer this feature.

- Cost and Premiums: Term life insurance is generally more affordable in the short term, making it accessible to a wider range of individuals. Whole life insurance, with its fixed premiums, may be more expensive initially but offers lifetime coverage.

Conclusion

Understanding the differences between whole life and term life insurance empowers you to make informed decisions about your financial future and the protection of your loved ones. Both policies have their advantages, and the choice ultimately depends on your specific needs, goals, and budget.

Frequently Asked Questions

Can I switch from term life to whole life insurance later in life?

+

Yes, many term life insurance policies offer a conversion option, allowing you to switch to a whole life or permanent policy without having to undergo a new medical exam. However, it’s important to review the terms and conditions of your specific policy and consult with your insurance provider to understand the conversion process.

Are there any tax benefits associated with whole life insurance?

+

Whole life insurance policies often come with tax advantages. The cash value within the policy grows on a tax-deferred basis, and withdrawals or loans against the cash value may have tax benefits. However, it’s crucial to consult a tax professional to understand the specific tax implications in your situation.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage expires, and you will no longer have insurance protection. It’s essential to review your financial needs and consider your options for extended coverage, such as renewing the policy or converting it to a permanent life insurance plan.

Can I cancel my whole life insurance policy if my financial situation changes?

+

Yes, you have the option to cancel your whole life insurance policy at any time. However, it’s important to consider the potential financial implications, as canceling the policy may result in the loss of accumulated cash value and the surrender of any benefits associated with the policy.