What Is Life Insurance And How Does It Work

Life insurance is a vital financial tool that provides protection and peace of mind to individuals and their loved ones. In today's fast-paced and uncertain world, having adequate life insurance coverage is more important than ever. It serves as a safety net, ensuring that your family's financial well-being is secured even in the face of unforeseen events. In this comprehensive guide, we will delve into the intricacies of life insurance, exploring its workings, benefits, and the various types available to help you make informed decisions about your financial future.

Understanding the Basics of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder agrees to pay a premium, which is a regular payment, in exchange for the insurance company’s promise to provide a specified sum of money (known as the death benefit) to the policyholder’s beneficiaries upon their death. This financial protection ensures that the beneficiaries can maintain their standard of living and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

The primary purpose of life insurance is to provide financial security and stability for those left behind. It acts as a safety net, ensuring that the policyholder's family or chosen beneficiaries can continue their lives without the added burden of financial worries. Life insurance can also serve other purposes, such as providing funds for business continuation, estate planning, or even funding charitable causes.

How Life Insurance Works: A Step-by-Step Process

- Policy Application: The journey towards life insurance coverage begins with an application. The policyholder provides personal and health-related information, and in some cases, may undergo a medical examination. This step helps the insurance company assess the risk associated with insuring the individual.

- Risk Assessment and Underwriting: The insurance company’s underwriting team evaluates the application and assesses the risk level. They consider factors such as age, health status, family medical history, and lifestyle choices. Based on this assessment, the company determines the policy terms, including the premium amount and any exclusions or limitations.

- Policy Selection and Premium Payment: Once the application is approved, the policyholder selects the type of life insurance policy that best suits their needs and financial situation. Common types include term life insurance, whole life insurance, and universal life insurance. The policyholder then begins making premium payments as per the agreed-upon schedule.

- Coverage Period: The life insurance policy remains active as long as the policyholder continues to pay the premiums. The coverage period can vary depending on the type of policy chosen. Term life insurance policies offer coverage for a specific period, while permanent life insurance policies, such as whole life or universal life, provide coverage for the policyholder’s entire life.

- Beneficiary Designation: Policyholders nominate beneficiaries who will receive the death benefit upon their passing. Beneficiaries can be family members, partners, children, or even charities. It is crucial to review and update beneficiary designations regularly, especially after significant life events like marriage, divorce, or the birth of a child.

- Claim Process: In the unfortunate event of the policyholder’s death, the beneficiaries must initiate the claim process. They need to provide proof of the policyholder’s death, such as a death certificate, and complete the necessary paperwork. The insurance company then verifies the claim and processes the death benefit payment, typically within a specified timeframe.

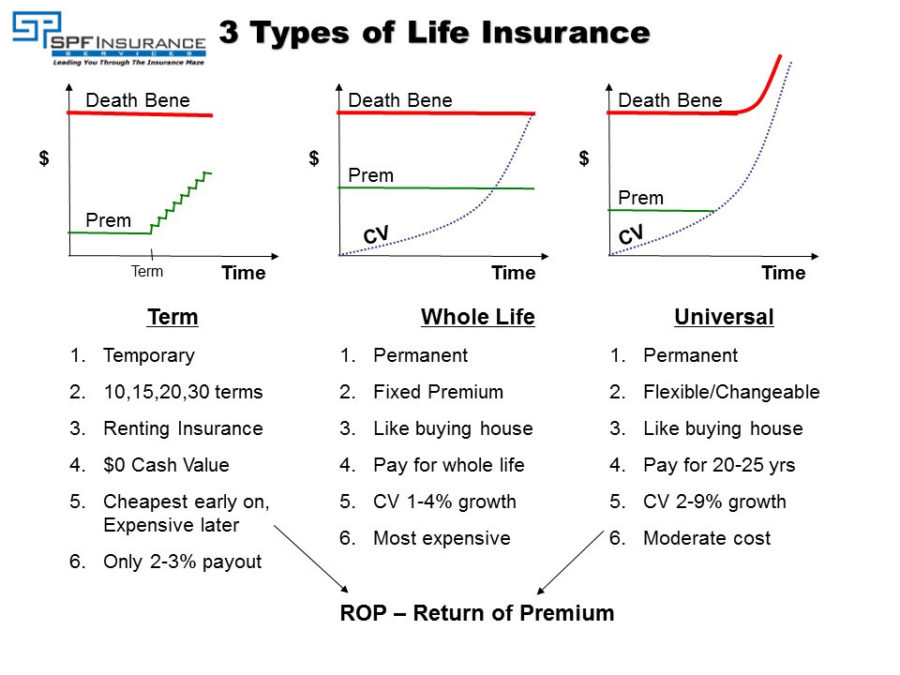

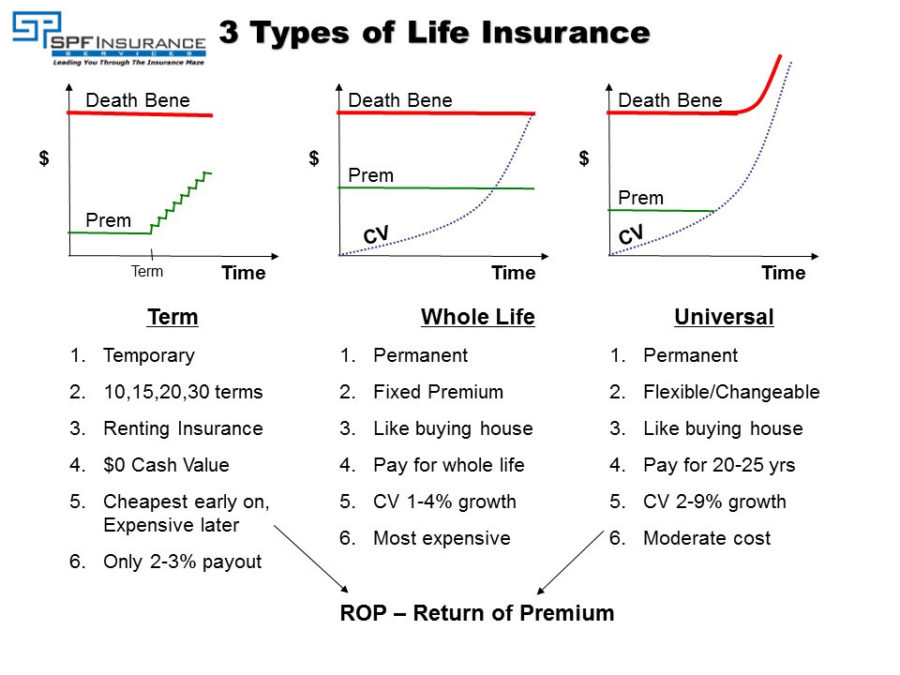

Types of Life Insurance: Exploring Your Options

Life insurance policies come in various forms, each designed to cater to different needs and financial situations. Understanding the different types can help you choose the most suitable option for your circumstances.

Term Life Insurance

Term life insurance provides coverage for a specified period, known as the term. It offers a cost-effective solution for individuals seeking temporary protection, such as covering financial obligations during their working years. The death benefit is paid out only if the policyholder dies within the term of the policy. Common term lengths include 10, 20, or 30 years.

| Pros | Cons |

|---|---|

| Affordable premiums | Coverage expires at the end of the term |

| Flexible coverage options | May not cover long-term financial needs |

| No cash value accumulation | Renewal may result in higher premiums |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire life. It offers a fixed death benefit and builds cash value over time. The policy accumulates cash value, which can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is a long-term investment and typically has higher premiums compared to term life insurance.

| Pros | Cons |

|---|---|

| Lifetime coverage | Higher premiums compared to term life |

| Cash value accumulation | May be less flexible than other options |

| Guaranteed death benefit | Limited investment options |

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that allows policyholders to adjust their premium payments and death benefit amounts within certain limits. It offers a combination of coverage and cash value accumulation. Policyholders can choose to pay a fixed premium or adjust their payments based on their financial circumstances. The cash value can be used for various purposes, such as supplementing retirement income or covering policy expenses.

| Pros | Cons |

|---|---|

| Flexible premium payments | May have higher fees compared to other policies |

| Adjustable death benefit | Performance of cash value may be affected by market conditions |

| Potential for higher cash value accumulation | Slower cash value growth compared to whole life |

The Benefits of Life Insurance: Financial Security and Peace of Mind

Life insurance offers a multitude of benefits that extend beyond financial protection. Here are some key advantages that make life insurance an essential component of a comprehensive financial plan:

- Financial Security for Loved Ones: Life insurance ensures that your family or chosen beneficiaries have the financial means to maintain their standard of living and cover essential expenses after your passing. It provides a safety net, alleviating financial worries during an already challenging time.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This helps prevent financial strain on your loved ones and allows them to focus on healing and moving forward.

- Education Funding: With life insurance, you can set aside funds specifically for your children's or grandchildren's education. This ensures that they have the financial support needed to pursue their academic goals without added financial burden.

- Business Continuity: For business owners, life insurance can be a crucial tool to ensure the continuity of their business in the event of their untimely death. It provides funds to cover business expenses, pay off debts, or transfer ownership to a designated successor.

- Estate Planning: Life insurance can be an integral part of your estate planning strategy. It can help cover estate taxes, probate fees, and other expenses associated with settling an estate, ensuring that your assets are distributed according to your wishes.

- Charitable Giving: Life insurance policies can be structured to include charitable beneficiaries. This allows you to support causes that are close to your heart while providing financial security for your loved ones.

Factors to Consider When Choosing Life Insurance

When selecting a life insurance policy, it’s essential to consider various factors to ensure you choose the most appropriate coverage for your needs. Here are some key considerations:

Your Financial Goals

Assess your financial goals and determine how much coverage you require. Consider your income, outstanding debts, future expenses, and the financial needs of your loved ones. Calculate the amount of coverage needed to provide adequate financial support for your beneficiaries.

Your Age and Health

Life insurance premiums are influenced by your age and health status. Younger individuals generally enjoy lower premiums, while those with pre-existing health conditions may face higher costs. It’s essential to disclose all relevant health information accurately during the application process to avoid complications later on.

Type of Policy

As mentioned earlier, there are different types of life insurance policies available. Evaluate your needs and financial situation to determine whether term life, whole life, or universal life insurance is the best fit for you. Consider factors such as coverage duration, cash value accumulation, and flexibility.

Premium Affordability

Life insurance premiums can vary significantly depending on the policy type, coverage amount, and your personal circumstances. Ensure that the premium payments align with your budget and financial capabilities. Remember, consistent premium payments are crucial to maintaining your life insurance coverage.

Rider Options

Riders are additional benefits or coverage options that can be added to your life insurance policy. Common riders include waiver of premium, accelerated death benefit, and long-term care coverage. Evaluate your specific needs and consider adding riders that provide extra protection or flexibility.

Life Insurance and Tax Benefits

Life insurance policies offer certain tax advantages that can further enhance their value. Here are some key tax benefits associated with life insurance:

- Tax-Free Death Benefit: The death benefit received by your beneficiaries is typically exempt from income tax, providing a significant financial advantage. This ensures that the full amount of the benefit is available to cover expenses and support your loved ones.

- Tax-Deferred Cash Value Growth: In permanent life insurance policies, the cash value component grows on a tax-deferred basis. This means that any earnings or interest accrued within the policy are not subject to immediate taxation. The tax-deferred growth can lead to substantial savings over time.

- Tax-Free Policy Loans: Policyholders can borrow against the cash value of their permanent life insurance policy without incurring immediate tax consequences. These policy loans can be a valuable source of funds for various financial needs, such as funding a child's education or covering emergency expenses.

Conclusion: Empowering Your Financial Future

Life insurance is a powerful tool that empowers individuals to protect their loved ones and secure their financial future. By understanding the basics, exploring the different types of policies, and considering the numerous benefits, you can make informed decisions about your life insurance coverage. Remember, life insurance provides peace of mind, financial security, and the ability to leave a lasting legacy for your family and the causes you care about.

As you navigate the world of life insurance, don't hesitate to seek guidance from insurance professionals or financial advisors. They can provide personalized advice and help you tailor your life insurance plan to your unique circumstances. With the right coverage in place, you can face the future with confidence, knowing that your loved ones are protected and your financial goals are within reach.

Can I change my life insurance policy after purchasing it?

+Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, adjusting premium payments, or adding riders. However, policy changes may be subject to additional underwriting and may result in higher premiums. It’s important to review your policy regularly and consult with your insurance provider to ensure it aligns with your evolving needs.

What happens if I miss a premium payment?

+Missing a premium payment can have consequences for your life insurance policy. Some policies may have a grace period, allowing you to make the payment within a certain timeframe without incurring penalties. If you consistently miss payments, your policy may lapse, and you may need to reapply for coverage, potentially at a higher cost.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy periodically, especially after significant life events such as marriage, divorce, the birth of a child, or changes in your financial situation. Regular reviews ensure that your coverage remains adequate and aligned with your current needs. Consulting with a financial advisor or insurance professional can provide valuable guidance during these reviews.