What Is Mortgage Insurance Premium

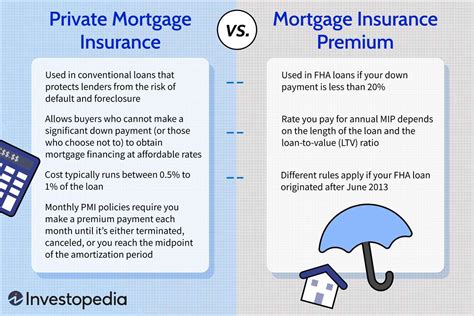

The concept of Mortgage Insurance Premium (MIP) is a crucial aspect of the home buying process, particularly for those utilizing government-insured loans. MIP is designed to protect lenders against losses in the event of a borrower's default, providing a vital safety net for both borrowers and lenders.

In this in-depth exploration, we delve into the intricacies of Mortgage Insurance Premium, shedding light on its various facets, including its purpose, types, and impact on borrowers. Through real-world examples and expert insights, we aim to offer a comprehensive understanding of MIP, empowering readers to make informed decisions when navigating the complex world of mortgage insurance.

Understanding Mortgage Insurance Premium (MIP)

Mortgage Insurance Premium, commonly known as MIP, is a policy mandated by the Federal Housing Administration (FHA) for most FHA loans. This insurance premium is designed to protect lenders from potential losses incurred when borrowers default on their mortgage loans. The FHA, a government agency within the Department of Housing and Urban Development (HUD), insures these loans, making them an attractive option for borrowers with lower credit scores or limited down payment funds.

MIP serves as a safeguard, ensuring that lenders can recover their losses and continue offering mortgage loans to a broader range of borrowers. By requiring MIP, the FHA encourages lenders to extend credit to borrowers who might not otherwise qualify for conventional loans. This policy has played a significant role in increasing homeownership rates, particularly among first-time buyers and those with limited financial resources.

Types of Mortgage Insurance Premium

There are two primary types of MIP: Upfront Mortgage Insurance Premium (UFMIP) and Annual Mortgage Insurance Premium (MIP). Each serves a distinct purpose and is calculated differently.

Upfront Mortgage Insurance Premium (UFMIP)

UFMIP is a one-time premium that is typically financed into the mortgage. It is calculated as a percentage of the base loan amount and is due at closing. For example, consider a borrower seeking an FHA loan for a property valued at $250,000. The UFMIP for this loan would be calculated as follows:

| UFMIP Rate | Base Loan Amount | UFMIP Amount |

|---|---|---|

| 1.75% | $250,000 | $4,375 |

In this scenario, the borrower would need to pay an upfront premium of $4,375, which can be included in the total loan amount.

Annual Mortgage Insurance Premium (MIP)

Annual MIP is an ongoing premium that is paid monthly alongside the mortgage payment. The amount of annual MIP is based on several factors, including the loan term, loan-to-value ratio (LTV), and the initial loan amount. The annual MIP is typically expressed as a percentage of the base loan amount.

For instance, consider a borrower with a 30-year FHA loan and a loan-to-value ratio of 95%. The annual MIP for this loan might be calculated as follows:

| Annual MIP Rate | Base Loan Amount | Annual MIP Amount |

|---|---|---|

| 0.85% | $250,000 | $2,125 per year or $177.08 per month |

In this case, the borrower would need to pay an annual MIP of $2,125 per year, or $177.08 per month, for the duration of the loan.

Impact of Mortgage Insurance Premium on Borrowers

Mortgage Insurance Premium can significantly impact borrowers, both in terms of their upfront costs and ongoing monthly payments. While MIP provides a vital safeguard for lenders, it also presents financial considerations for borrowers.

Upfront Costs

The UFMIP, as a one-time premium, can represent a substantial upfront cost for borrowers. When included in the mortgage, it increases the total loan amount, leading to higher monthly payments and a larger overall financial commitment. For example, if a borrower includes the UFMIP in their $250,000 loan, their monthly payments will be higher than if they had a traditional loan without MIP.

Monthly Payments

The annual MIP, paid monthly, adds to the borrower’s monthly mortgage expenses. This ongoing premium can be a significant financial burden, especially for borrowers with limited income or those already facing high living costs. For instance, the $177.08 monthly MIP payment mentioned earlier can represent a substantial portion of a borrower’s monthly budget.

Removing Mortgage Insurance

One potential relief for borrowers is the possibility of removing MIP once they have reached a certain equity threshold in their property. The specific criteria for canceling MIP vary depending on the loan type and other factors. For example, FHA loans generally require MIP for the life of the loan unless the borrower has a loan term of 15 years or less and has at least 10% equity in the property.

To illustrate, consider a borrower who purchased a home for $250,000 with an FHA loan and a 3.5% down payment. After several years of regular mortgage payments, the borrower's loan balance has decreased, and the property's value has increased, resulting in an LTV of 80% or less. In this scenario, the borrower might be eligible to cancel their annual MIP, reducing their monthly payments and overall financial burden.

Mortgage Insurance Premium and Loan Terms

The terms of a mortgage loan, particularly the loan-to-value ratio and loan term, significantly influence the MIP requirements and amounts. Lenders use these factors to assess the risk associated with a loan and determine the necessary level of insurance coverage.

Loan-to-Value Ratio (LTV)

The LTV is a critical factor in determining MIP. A higher LTV indicates a higher risk for the lender, leading to higher MIP rates. Conversely, a lower LTV may result in lower MIP rates or even the potential for MIP cancellation.

Loan Term

The length of the loan term also impacts MIP. Generally, loans with shorter terms have lower MIP rates. For instance, a 15-year loan typically has lower MIP rates compared to a 30-year loan. This is because shorter-term loans are considered less risky, as they are paid off more quickly, reducing the potential exposure for the lender.

Credit Score and Down Payment

A borrower’s credit score and down payment amount can also influence MIP requirements. Borrowers with higher credit scores and larger down payments may qualify for lower MIP rates, as they are considered less risky borrowers. This is because a higher credit score indicates a better ability to manage debt, while a larger down payment reduces the loan-to-value ratio, which is a key factor in MIP calculations.

Future Implications and Considerations

The future of Mortgage Insurance Premium is subject to ongoing policy changes and market trends. As the housing market evolves, so do the regulations and guidelines surrounding MIP. It’s essential for borrowers to stay informed about these changes, as they can significantly impact the cost and terms of their mortgage loans.

One notable development is the potential for reduced MIP rates or even the elimination of MIP for certain borrowers. This is particularly relevant for borrowers with strong financial profiles, such as those with high credit scores and significant down payments. By offering reduced MIP rates, lenders can make FHA loans more competitive with conventional loans, attracting a wider range of borrowers.

Additionally, the impact of economic conditions and market fluctuations on MIP should not be overlooked. During periods of economic uncertainty or housing market downturns, MIP rates may increase to mitigate potential losses for lenders. Conversely, in stable economic conditions, MIP rates may decrease, making FHA loans more affordable and accessible.

Borrowers should also be aware of the potential for MIP cancellation or reduction as they build equity in their homes. As mentioned earlier, borrowers can often cancel their annual MIP once they reach a certain equity threshold. This provides an incentive for borrowers to make timely mortgage payments and build their home equity, ultimately reducing their financial obligations.

In conclusion, Mortgage Insurance Premium is a vital component of government-insured loans, providing a safety net for lenders and opening doors to homeownership for a broader range of borrowers. By understanding the types, impact, and considerations surrounding MIP, borrowers can make informed decisions and navigate the mortgage process with confidence. As the housing market and regulatory landscape continue to evolve, staying informed about MIP policies and trends will remain essential for borrowers and lenders alike.

How is Mortgage Insurance Premium (MIP) calculated for FHA loans?

+

MIP for FHA loans is calculated based on the loan term, loan-to-value ratio, and the initial loan amount. The specific rates and formulas can vary, but generally, the upfront MIP is a percentage of the base loan amount, while the annual MIP is expressed as a monthly percentage of the base loan amount.

Can Mortgage Insurance Premium (MIP) be waived or reduced for certain borrowers?

+

Yes, MIP can be waived or reduced for certain borrowers who meet specific criteria. For example, borrowers with a 15-year loan term and a loan-to-value ratio of 78% or less may be eligible for MIP cancellation. Additionally, borrowers with high credit scores and substantial down payments may qualify for reduced MIP rates.

What are the consequences of not paying Mortgage Insurance Premium (MIP)?

+

Failing to pay MIP can result in serious consequences, including default on the mortgage loan. MIP is a mandatory requirement for FHA loans, and lenders have the right to initiate foreclosure proceedings if MIP payments are not made. Additionally, late or missed MIP payments can negatively impact the borrower’s credit score and financial stability.