What Is Term Insurance Meaning

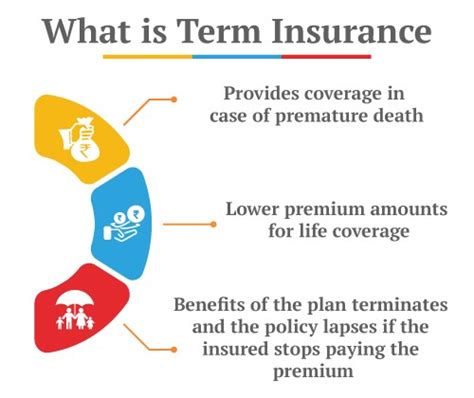

Term insurance is a type of life insurance policy that provides coverage for a specified period, known as the "term." Unlike permanent life insurance, which offers lifelong coverage, term insurance is designed to offer protection for a set number of years, typically ranging from 10 to 30 years. It is a popular choice for individuals seeking affordable and flexible insurance options to protect their loved ones in the event of their untimely demise.

This form of insurance is known for its simplicity and cost-effectiveness. It focuses primarily on providing a death benefit to the policyholder's beneficiaries in the event of their death during the policy term. The death benefit is a lump-sum payment that can be used by the beneficiaries to cover various expenses, including funeral costs, outstanding debts, daily living expenses, and even long-term financial goals like children's education or retirement planning.

Understanding Term Insurance

Term insurance policies are contractual agreements between the policyholder and the insurance company. The policyholder pays a premium, typically on an annual basis, to the insurance company, which in turn promises to pay out a specified sum of money, known as the death benefit, to the beneficiaries upon the policyholder's death during the term of the policy.

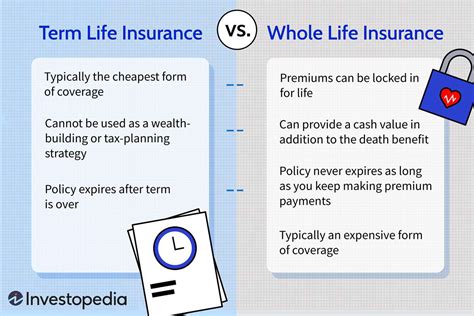

The key characteristic of term insurance is its temporary nature. The policy provides coverage for a specific period, after which it expires. If the policyholder outlives the term, the policy simply ends, and there is no cash value or additional benefits associated with it. However, many term insurance policies offer the option to renew or convert the policy to a permanent life insurance policy, ensuring continued coverage.

Key Features of Term Insurance:

- Affordability: Term insurance is often significantly more affordable than permanent life insurance policies, making it accessible to a wider range of individuals.

- Flexibility: Policyholders can choose the term length based on their specific needs and financial goals. This flexibility allows for tailored coverage.

- Death Benefit: The primary benefit of term insurance is the payment of a lump-sum death benefit to the beneficiaries, which can provide financial security and peace of mind.

- Renewal and Conversion Options: Many policies offer the opportunity to renew the policy for an additional term or convert it to a permanent life insurance policy without requiring additional medical underwriting.

Types of Term Insurance

There are several types of term insurance policies, each designed to cater to different needs and preferences. The most common types include:

Level Term Insurance:

In this type of policy, the death benefit remains constant throughout the term. The premium payments also remain level, providing predictable costs for the policyholder.

Increasing Term Insurance:

As the name suggests, the death benefit in this policy increases over time. This option is beneficial for individuals who anticipate rising financial obligations, such as growing families or increasing mortgage payments.

Decreasing Term Insurance:

Here, the death benefit decreases over the policy term. This type of policy is often used to cover specific financial obligations, such as a mortgage, where the coverage amount decreases as the debt is paid off.

Convertible and Renewable Term Insurance:

These policies offer the flexibility to convert the term insurance into a permanent life insurance policy or renew the term for an additional period. This feature provides an opportunity to extend coverage without the need for additional medical examinations.

The Benefits of Term Insurance

Term insurance policies offer numerous advantages to policyholders. Some of the key benefits include:

- Cost-Effectiveness: Term insurance is generally more affordable than permanent life insurance, making it an attractive option for those on a budget.

- Flexibility and Customization: Policyholders can choose the term length and coverage amount to align with their specific needs and financial goals.

- Death Benefit Protection: The primary purpose of term insurance is to provide financial protection to beneficiaries in the event of the policyholder's untimely death.

- Renewal and Conversion Options: The ability to renew or convert the policy ensures continued coverage and flexibility as life circumstances change.

- No Cash Value Accumulation: Unlike permanent life insurance, term insurance does not build cash value, focusing solely on providing death benefit protection.

Term Insurance Performance Analysis

Term insurance policies have gained popularity due to their straightforward nature and affordability. Here's a performance analysis highlighting some key aspects:

| Aspect | Performance |

|---|---|

| Accessibility | Term insurance is widely accessible, offering coverage to a diverse range of individuals regardless of their financial status. |

| Affordability | Known for its cost-effectiveness, term insurance allows policyholders to secure substantial coverage at a fraction of the cost of permanent life insurance. |

| Flexibility | Policyholders can tailor their coverage by choosing the term length and death benefit amount, ensuring a personalized insurance experience. |

| Renewal and Conversion | The option to renew or convert the policy provides long-term coverage solutions, adapting to changing life circumstances. |

| Beneficiary Support | The death benefit offers financial security to beneficiaries, helping them manage expenses and maintain their standard of living. |

Future Implications and Considerations

As the insurance landscape continues to evolve, term insurance policies are expected to remain a cornerstone of financial protection strategies. Here are some key considerations and future implications:

- Increasing Awareness: With growing financial literacy, more individuals are recognizing the importance of life insurance, leading to a potential rise in term insurance policies.

- Digital Transformation: The insurance industry's digital transformation is likely to enhance the convenience and accessibility of term insurance, making it easier for individuals to compare policies and purchase coverage online.

- Customized Solutions: Insurers may continue to develop more tailored term insurance products to meet the diverse needs of policyholders, offering specialized coverage for specific life stages or financial goals.

- Renewal and Conversion Flexibility: The ability to renew or convert term insurance policies is expected to remain a key advantage, providing policyholders with the flexibility to adapt their coverage as their needs evolve.

Frequently Asked Questions (FAQ)

What is the primary purpose of term insurance?

+The primary purpose of term insurance is to provide financial protection to the policyholder’s beneficiaries in the event of their untimely death during the policy term.

How does term insurance differ from permanent life insurance?

+Term insurance offers coverage for a specified term, typically 10-30 years, and is more affordable. Permanent life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time, making it more expensive.

Can I renew my term insurance policy?

+Yes, many term insurance policies offer the option to renew the policy for an additional term, ensuring continued coverage.

What happens if I outlive the term of my policy?

+If you outlive the term, the policy simply expires. However, some policies provide the option to convert the term insurance into a permanent life insurance policy, ensuring continued coverage.