What Is The Average Cost Of Auto Insurance

The average cost of auto insurance is a complex topic that varies significantly based on numerous factors. It is important to understand these variables to comprehend the broader landscape of automotive insurance costs. While the average cost can provide a general idea, individual circumstances and regional variations play a substantial role in determining insurance premiums.

Factors Influencing Auto Insurance Costs

Numerous factors contribute to the variability of auto insurance costs. These factors include the driver’s age, gender, driving history, location, and the type of vehicle insured. Additionally, coverage options, deductibles, and the insurance company chosen can significantly impact the final cost.

Age and Gender

Age is a significant factor in determining insurance premiums. Younger drivers, particularly those under 25, often face higher insurance costs due to their lack of driving experience and the higher risk associated with this demographic. Gender can also play a role, with some insurance companies charging different rates based on statistical risk assessments.

For instance, Jane, a 22-year-old female driver, might pay higher premiums compared to her older counterparts due to her age and gender. This disparity is often justified by insurance companies citing statistical data that shows younger drivers, especially males, are more prone to accidents.

Driving History and Location

A driver’s history of accidents, tickets, and claims can significantly influence insurance costs. A clean driving record typically leads to lower premiums, while multiple accidents or traffic violations can result in higher rates. Location is another critical factor; urban areas often have higher insurance costs due to increased traffic density and a higher likelihood of accidents.

Consider the case of David, a 35-year-old male driver, who resides in a bustling city. Despite his clean driving record, David might face higher insurance premiums due to the increased risk associated with urban driving conditions.

Vehicle Type and Coverage Options

The type of vehicle being insured and the coverage options chosen can substantially impact insurance costs. Sports cars and luxury vehicles often come with higher insurance costs due to their value and the increased risk associated with their performance capabilities. Additionally, the level of coverage, such as comprehensive and collision coverage, can add to the overall cost.

Imagine Sarah, a 40-year-old female driver, who owns a high-performance sports car. Even with her excellent driving record, Sarah's insurance premiums are likely to be higher due to the nature of her vehicle. Furthermore, opting for additional coverage, such as rental car reimbursement or roadside assistance, can further increase her insurance costs.

| Factor | Impact on Insurance Costs |

|---|---|

| Age | Younger drivers often face higher premiums |

| Gender | Statistical risk assessments can influence rates |

| Driving History | Clean records lead to lower premiums |

| Location | Urban areas often have higher costs due to increased risk |

| Vehicle Type | Sports cars and luxury vehicles typically have higher premiums |

| Coverage Options | Additional coverage can increase overall costs |

Regional Variations and Average Costs

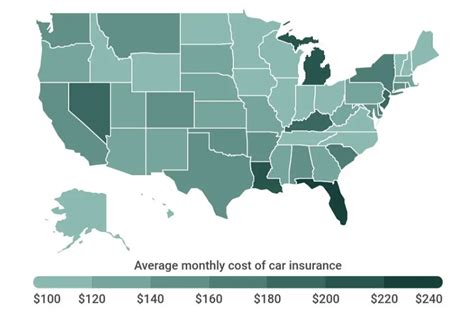

The average cost of auto insurance varies significantly across different regions. This variation is influenced by a combination of factors, including the regional cost of living, the frequency of accidents, and the average cost of vehicle repairs. Urban areas often have higher insurance costs due to increased traffic density and a higher likelihood of accidents, while rural areas might have lower costs due to fewer accidents and lower repair expenses.

Urban vs. Rural Insurance Costs

Urban areas tend to have higher insurance costs due to the increased risk associated with city driving. Factors such as higher traffic volume, the prevalence of theft and vandalism, and the cost of living all contribute to higher insurance premiums. In contrast, rural areas often have lower insurance costs due to fewer accidents, lower repair expenses, and a generally lower cost of living.

For example, in New York City, one of the most densely populated urban areas in the United States, the average annual insurance premium is significantly higher compared to a rural area like Iowa. This disparity is primarily due to the increased risk and cost of living in New York City.

State-by-State Variations

Insurance costs can vary significantly from one state to another. This variation is influenced by a multitude of factors, including state laws, the frequency of accidents, and the average cost of vehicle repairs. States with a higher incidence of accidents and higher repair costs often have higher insurance premiums.

Take the example of California and Texas, two states with vast differences in insurance costs. California, known for its dense population and high cost of living, often has higher insurance premiums compared to Texas, which has a lower population density and a generally lower cost of living.

| State | Average Annual Insurance Premium |

|---|---|

| California | $1,500 - $2,000 |

| Texas | $1,000 - $1,500 |

| New York | $1,200 - $1,800 |

| Iowa | $800 - $1,200 |

Tips for Reducing Auto Insurance Costs

While the average cost of auto insurance is influenced by various factors, there are strategies drivers can employ to potentially reduce their insurance premiums.

Shopping Around and Comparing Quotes

One of the most effective ways to potentially reduce insurance costs is by shopping around and comparing quotes from multiple insurance providers. Different companies have varying rates and policies, so it’s essential to explore options to find the best fit for your needs and budget.

Bundling Policies

Bundling multiple insurance policies, such as auto and home insurance, can often result in significant savings. Many insurance companies offer discounts when customers bundle policies, so it’s worth exploring this option to potentially reduce overall insurance costs.

Maintaining a Clean Driving Record

A clean driving record is crucial for keeping insurance costs down. Avoid accidents, traffic violations, and claims, as these can significantly increase insurance premiums. A clean record demonstrates a lower risk to insurance companies, which can lead to more favorable rates.

Increasing Deductibles

Increasing your deductible can potentially lower your insurance premiums. A higher deductible means you pay more out of pocket before your insurance kicks in, which can result in lower monthly or annual premiums. However, it’s essential to ensure you can afford the higher deductible in the event of a claim.

Taking Advantage of Discounts

Insurance companies often offer a variety of discounts, so it’s worth exploring these options. Common discounts include safe driver discounts, multi-car discounts, good student discounts, and loyalty discounts. Additionally, some companies offer discounts for certain safety features in vehicles, such as anti-lock brakes or air bags.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | For drivers with a clean driving record |

| Multi-Car Discount | For insuring multiple vehicles with the same provider |

| Good Student Discount | For students with good grades |

| Loyalty Discount | For long-term customers |

| Safety Feature Discount | For vehicles equipped with certain safety features |

The Future of Auto Insurance Costs

The landscape of auto insurance is continually evolving, and several factors are expected to influence insurance costs in the future. Technological advancements, such as the increasing use of autonomous vehicles and advanced driver-assistance systems, are likely to impact insurance costs. Additionally, changing demographics and environmental factors will play a role in shaping the future of auto insurance.

Impact of Autonomous Vehicles

The widespread adoption of autonomous vehicles is expected to significantly impact insurance costs. As these vehicles become more prevalent, the number of accidents and claims is likely to decrease, potentially leading to lower insurance premiums. However, the initial introduction of autonomous vehicles might result in higher insurance costs due to the novelty and potential risks associated with this new technology.

Changing Demographics

Changing demographics, such as an aging population and a shift in urban-rural populations, will influence insurance costs. An aging population may lead to a higher incidence of accidents and claims, potentially increasing insurance premiums. Conversely, a shift towards urban living could result in higher insurance costs due to increased traffic density and the associated risks.

Environmental Factors

Environmental factors, such as climate change and extreme weather events, can impact insurance costs. Increased frequency and severity of natural disasters can lead to higher repair costs and potentially higher insurance premiums. Additionally, the transition to electric vehicles and the associated infrastructure changes could impact insurance costs in the future.

| Factor | Potential Impact on Insurance Costs |

|---|---|

| Autonomous Vehicles | May lead to lower premiums in the long term, but higher costs initially |

| Changing Demographics | Aging population and urban shifts could increase insurance costs |

| Environmental Factors | Climate change and extreme weather events could drive up repair costs and premiums |

How often should I review my auto insurance policy?

+

It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures you have the right coverage and are getting the best rates based on your current needs.

Can I get auto insurance without a license or a car?

+

Yes, it is possible to get auto insurance without a license or a car. This is often referred to as “non-owner” or “named driver” insurance and can be useful for people who borrow or rent vehicles frequently.

What is the difference between comprehensive and collision coverage?

+

Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damage to your vehicle resulting from an accident with another vehicle or object.