What Is The Average Cost Of Car Insurance

When it comes to car insurance, the average cost is a question that many vehicle owners ponder. While the average cost of car insurance is a helpful benchmark, it's important to note that insurance rates can vary significantly based on numerous factors. Understanding these factors and how they impact insurance costs is crucial for making informed decisions and potentially saving money on your auto insurance policy.

Understanding the Factors Influencing Car Insurance Costs

The average cost of car insurance is influenced by a multitude of variables, including your personal information, driving history, and the type of vehicle you own. Here’s a breakdown of some key factors that impact insurance rates:

Demographic Factors

Your age, gender, and location play a significant role in determining insurance rates. Statistically, younger drivers, especially males, tend to be involved in more accidents, leading to higher insurance premiums. Similarly, urban areas often have higher rates due to increased traffic congestion and theft risks.

Driving Record

Your driving history is a critical factor in insurance pricing. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations may result in significantly higher insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. High-performance cars, luxury vehicles, and SUVs often carry higher insurance costs due to their increased repair expenses and higher likelihood of theft. Additionally, using your vehicle for business purposes or commuting long distances can increase your insurance premiums.

Coverage Options

The coverage options you choose for your car insurance policy can significantly affect your overall costs. Comprehensive and collision coverage, which provide protection for damages to your vehicle, typically come with higher premiums. Conversely, liability-only coverage, which only covers damages to other vehicles or property, is generally more affordable.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters. |

| Collision | Covers damages to your vehicle resulting from a collision with another vehicle or object. |

| Liability | Covers damages to other vehicles or property in an accident for which you are at fault. |

Discounts and Bundling

Insurance providers often offer discounts to incentivize safe driving and loyalty. Common discounts include those for safe driving records, multiple vehicles insured with the same company, and bundling car insurance with other policies like homeowners or renters insurance. Taking advantage of these discounts can help reduce your overall insurance costs.

Analyzing Average Car Insurance Costs

The average cost of car insurance varies significantly based on geographic location and personal factors. According to recent studies, the average annual cost of car insurance in the United States is approximately 1,674</strong>. However, this average can range from <strong>1,000 to $2,000 or more depending on various factors.

Regional Variations

Car insurance rates can vary significantly from one state to another. For example, the average annual premium in Maine is 686</strong>, while in <strong>Michigan</strong>, it can be as high as <strong>3,000. These variations are influenced by factors such as state regulations, traffic density, and the frequency of accidents.

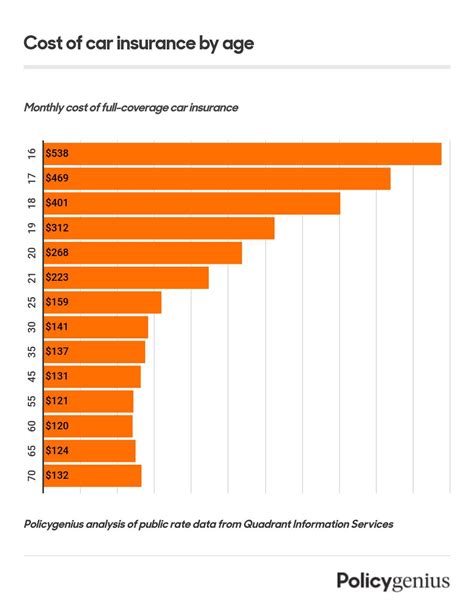

Age and Gender Disparities

Insurance rates often vary based on age and gender. Young drivers, especially males, tend to pay significantly higher premiums due to their higher accident risk. For instance, a 20-year-old male might pay an average of 2,500</strong> annually, while a <strong>35-year-old female</strong> with a similar driving record might pay around <strong>1,500.

Vehicle Make and Model Impact

The make and model of your vehicle can also influence insurance costs. High-performance cars and luxury vehicles are often more expensive to insure due to their higher repair costs and theft risks. For example, insuring a Ferrari could cost upwards of 5,000</strong> annually, while a <strong>Toyota Corolla</strong> might be insured for around <strong>1,200 per year.

Strategies to Reduce Car Insurance Costs

While the average cost of car insurance can provide a general benchmark, it’s important to remember that insurance rates are highly personalized. Here are some strategies to potentially reduce your car insurance costs:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your specific circumstances.

- Improve Your Driving Record: Maintain a clean driving record by avoiding accidents and traffic violations. This can lead to significant savings over time.

- Adjust Your Coverage: Review your coverage options and consider adjusting them based on your needs and budget. For example, you might opt for higher deductibles to reduce your premiums.

- Take Advantage of Discounts: Ask your insurance provider about available discounts and ensure you're taking advantage of any applicable ones, such as safe driver discounts or bundling discounts.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

Future Trends in Car Insurance Costs

The car insurance industry is evolving, and future trends may impact the average cost of insurance. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles could lead to a decrease in accidents, potentially reducing insurance costs over time. Additionally, the growing popularity of usage-based insurance and telematics could provide more personalized pricing based on individual driving habits.

Conclusion

Understanding the average cost of car insurance is a good starting point, but it’s essential to delve deeper into the various factors that influence insurance rates. By analyzing these factors and adopting strategies to reduce costs, you can make more informed decisions and potentially save money on your car insurance. Remember, personalized insurance policies tailored to your specific circumstances are often the most cost-effective.

What is the most affordable car insurance option?

+The most affordable car insurance option typically involves a combination of factors, including choosing liability-only coverage, increasing your deductible, and taking advantage of available discounts. Additionally, shopping around and comparing quotes from multiple insurers can help you find the most cost-effective policy for your needs.

How do I know if I’m paying too much for car insurance?

+Comparing your current insurance rates to industry averages and rates offered by other providers can help you assess if you’re paying too much. Additionally, reviewing your coverage options and understanding the factors that influence your premiums can provide insights into potential areas for cost savings.

Can I negotiate my car insurance rates?

+While car insurance rates are largely based on objective factors, you can negotiate with your insurance provider to potentially secure a better rate. This might involve discussing your driving record, claiming history, and any available discounts. It’s important to approach negotiations with a clear understanding of your value as a customer and the competitive landscape.