What Is The Average Health Insurance Cost

Health insurance is an essential component of healthcare systems worldwide, providing financial protection and access to medical services for individuals and families. The cost of health insurance varies significantly depending on several factors, including geographic location, age, health status, coverage options, and the chosen insurance plan. Understanding the average health insurance costs and the factors influencing them is crucial for individuals seeking affordable and comprehensive coverage.

Factors Influencing Health Insurance Costs

Several key factors contribute to the variation in health insurance costs. These factors include:

- Geographic Location: Health insurance premiums can vary significantly across different regions. This variation is influenced by factors such as the cost of living, the availability and cost of healthcare services, and the overall healthcare infrastructure in a particular area.

- Age: Age is a critical factor in determining health insurance costs. Typically, younger individuals tend to have lower premiums as they are generally healthier and less likely to require extensive medical care. As individuals age, their health insurance costs tend to increase due to the higher likelihood of developing chronic conditions and requiring specialized treatments.

- Health Status: The health status of an individual significantly impacts their insurance costs. Pre-existing conditions, such as diabetes, heart disease, or chronic illnesses, can lead to higher premiums. Insurance providers consider the risk associated with an individual's health status when calculating premiums.

- Coverage Options: The type of coverage chosen plays a vital role in determining costs. Health insurance plans offer various levels of coverage, including individual, family, and employer-sponsored plans. Each type of coverage comes with its own set of benefits and premium costs. Additionally, the scope of coverage, such as the number of services covered and the level of deductibles and copayments, can influence the overall cost.

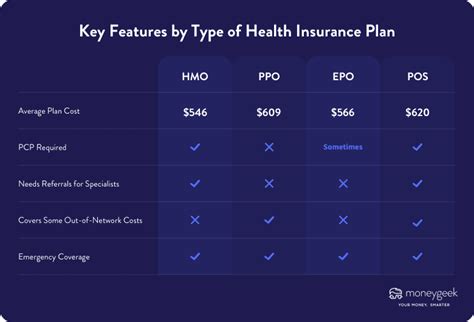

- Plan Type and Network: Different insurance plans have varying structures and networks. Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs) are common plan types. The choice of plan and the network of healthcare providers within it can affect the cost and flexibility of coverage.

Average Health Insurance Costs

Determining the average health insurance cost is challenging due to the aforementioned factors. However, statistical data and industry reports provide insights into the average costs based on specific scenarios and demographics.

Average Individual Health Insurance Costs

For individuals seeking health insurance coverage, the average cost can vary significantly based on their age and geographic location. According to recent studies, the average monthly premium for an individual health insurance plan in the United States ranges from approximately 400 to 600. However, this average can fluctuate based on the specific state and the individual’s age. Younger adults may find premiums closer to the lower end of this range, while older individuals might encounter higher costs.

| Age Group | Average Monthly Premium |

|---|---|

| 18-24 years | $350 - $450 |

| 25-34 years | $400 - $500 |

| 35-44 years | $450 - $550 |

| 45-54 years | $500 - $600 |

| 55-64 years | $550 - $700 |

Average Family Health Insurance Costs

When it comes to family health insurance plans, the costs are generally higher due to the coverage of multiple individuals. The average monthly premium for a family health insurance plan in the United States is estimated to be between 1,200 and 1,500. This range can vary based on the number of family members, their ages, and the chosen plan’s coverage.

| Family Size | Average Monthly Premium |

|---|---|

| 2-member family | $1,000 - $1,200 |

| 3-member family | $1,200 - $1,400 |

| 4-member family | $1,300 - $1,500 |

| 5-member family | $1,400 - $1,600 |

Employer-Sponsored Health Insurance

Many individuals receive health insurance coverage through their employers, which often provides more affordable options. The cost of employer-sponsored health insurance varies based on the employer’s contribution and the plan chosen. On average, employees contribute approximately 100 to 400 per month towards their health insurance premiums, while employers cover the remaining cost.

Analyzing Performance and Future Implications

The average health insurance costs have seen a steady increase over the years, primarily due to rising healthcare expenses and changing insurance market dynamics. Several factors contribute to this trend, including advancements in medical technology, an aging population, and the increasing prevalence of chronic diseases.

From a performance standpoint, the healthcare insurance industry has adapted to these challenges by offering a range of plan options to cater to diverse needs and budgets. The introduction of affordable care plans, such as High Deductible Health Plans (HDHPs) coupled with Health Savings Accounts (HSAs), has provided individuals with more cost-effective alternatives.

Looking ahead, the future of health insurance costs is expected to continue its upward trajectory. However, the industry's focus on value-based care, preventive measures, and technological advancements may help mitigate some of these cost increases. Additionally, policy changes and reforms aimed at improving access and affordability could play a significant role in shaping the landscape of health insurance costs in the coming years.

FAQ

How can I reduce my health insurance costs?

+To reduce health insurance costs, consider comparing plans and opting for a higher deductible plan if you are healthy and can afford the initial out-of-pocket expenses. Additionally, maintaining a healthy lifestyle, utilizing preventive care services, and shopping around for insurance during open enrollment periods can help lower costs.

Are there any government programs to assist with health insurance costs?

+Yes, various government programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), provide assistance for low-income individuals and families. Additionally, the Affordable Care Act (ACA) offers tax credits and subsidies to help make health insurance more affordable for eligible individuals.

Can I get health insurance if I have a pre-existing condition?

+Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, it’s important to carefully review plan details and understand any potential limitations or exclusions related to your specific condition.