What Is The Best Life Insurance

Choosing the best life insurance is a crucial decision that requires careful consideration of various factors. With numerous options available in the market, it can be overwhelming for individuals and families to navigate the complex world of insurance policies. This comprehensive guide aims to shed light on the key aspects to help you make an informed choice and secure a financially stable future for your loved ones.

Understanding Life Insurance Policies

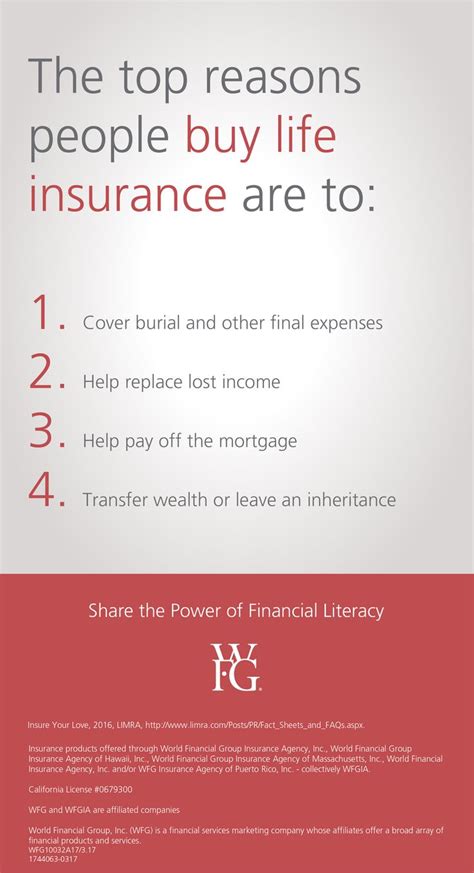

Life insurance is a contract between an individual and an insurance company, wherein the insurer agrees to pay a sum of money to the policyholder's beneficiaries upon the insured's death. The primary purpose of life insurance is to provide financial protection and peace of mind to the policyholder's family or dependents. It acts as a safety net, ensuring that loved ones are taken care of financially in the event of an untimely demise.

There are two main types of life insurance policies: term life insurance and permanent life insurance. Each type has its own set of advantages and is suitable for different life stages and financial goals.

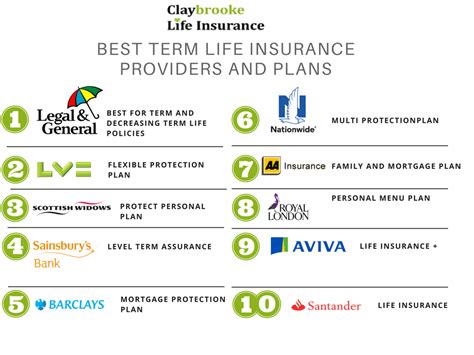

Term Life Insurance

Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It provides a death benefit to the beneficiaries if the policyholder passes away during the term. This type of insurance is often more affordable compared to permanent life insurance, making it an attractive option for individuals seeking temporary coverage to protect their families during their working years.

Key features of term life insurance include:

- Affordability: Term life policies are generally more cost-effective, especially for younger individuals.

- Coverage Flexibility: You can choose the duration of the term based on your needs, such as covering mortgage payments or providing for dependent children until they become independent.

- Renewal Options: Some term policies offer the option to renew at the end of the term, although premiums may increase.

- Convertible Feature: Many term policies allow conversion to permanent life insurance without a medical exam, providing flexibility as your needs change.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the policyholder's entire life, as long as premiums are paid. It offers a death benefit to beneficiaries and also accumulates cash value over time, which can be borrowed against or withdrawn during the policyholder's lifetime.

There are several types of permanent life insurance, including:

- Whole Life Insurance: This policy offers a fixed death benefit and guaranteed cash value growth. Premiums remain level throughout the policy's lifetime.

- Universal Life Insurance: With universal life, you can adjust the death benefit and premium payments to suit your needs. It offers more flexibility than whole life insurance.

- Variable Life Insurance: Variable life policies allow investment of premiums in different accounts, providing the potential for higher returns but also carrying more risk.

- Indexed Universal Life Insurance: Indexed universal life combines the features of universal life with the potential for higher returns linked to a stock market index.

Factors to Consider When Choosing Life Insurance

When deciding on the best life insurance policy, several factors come into play. These factors help tailor the insurance coverage to your specific needs and circumstances.

Your Age and Health

Your age and health status significantly impact the type of policy and the premium you'll pay. Younger individuals often opt for term life insurance, as it is more affordable and provides coverage during their most financially vulnerable years. On the other hand, permanent life insurance may be more suitable for older individuals or those with health concerns, as it offers lifelong coverage and builds cash value.

Financial Goals and Needs

Assessing your financial goals and needs is crucial. Consider the following aspects:

- Debt Coverage: Do you have outstanding debts, such as a mortgage or student loans, that need to be paid off in the event of your demise? Term life insurance can provide coverage for a specific period to cover these debts.

- Income Replacement: If you are the primary income earner in your family, life insurance can ensure your dependents' financial security by replacing your income.

- Education Funding: Planning for your children's or grandchildren's education can be a significant financial goal. Life insurance can help fund their education if you're no longer around.

- Retirement Planning: Permanent life insurance with its cash value accumulation can be a valuable tool for retirement planning, offering tax-advantaged growth.

Policy Features and Benefits

Different life insurance policies offer various features and benefits. Some key considerations include:

- Riders or Endorsements: These are optional additions to your policy that can enhance coverage. For example, a waiver of premium rider waives your premium payments if you become disabled.

- Accelerated Death Benefit: This feature allows you to access a portion of your death benefit if you are diagnosed with a terminal illness.

- Guaranteed Insurability Option: With this option, you can increase your coverage at specific intervals without a medical exam, providing flexibility as your needs change.

- Spouse and Child Coverage: Some policies offer coverage for spouses and children, ensuring comprehensive family protection.

The Role of Insurance Agents and Brokers

Navigating the complex world of life insurance can be daunting, which is why insurance agents and brokers play a crucial role. These professionals can guide you through the process, offering expert advice tailored to your specific needs.

Insurance agents work for specific insurance companies and are trained to sell their products. They can provide in-depth knowledge about the company's policies, features, and benefits. On the other hand, insurance brokers are independent and work with multiple insurance companies. They can offer a broader range of options and help you compare policies from different providers.

When meeting with an insurance agent or broker, it's essential to ask about their experience, qualifications, and any potential conflicts of interest. Ensure they understand your unique circumstances and financial goals to provide the best advice.

Questions to Ask Your Insurance Professional

- What are the key differences between term and permanent life insurance, and which is better suited for my situation?

- How do premiums and coverage amounts change over time for different types of policies?

- Can you explain the potential tax implications of cash value accumulation in permanent life insurance policies?

- What are the common exclusions or limitations in life insurance policies, and how can I ensure I'm adequately covered?

- Are there any riders or endorsements I should consider to enhance my coverage and tailor it to my specific needs?

Performance Analysis and Industry Insights

Understanding the performance and reputation of insurance companies is crucial when choosing a life insurance policy. Several factors contribute to a company's overall performance and stability.

Financial Strength and Ratings

The financial strength of an insurance company is a key indicator of its ability to pay claims. Independent rating agencies, such as A.M. Best, Standard & Poor's, and Moody's, evaluate insurance companies and assign ratings based on their financial health. A higher rating suggests a more stable and reliable company.

When researching insurance companies, look for their financial strength ratings and ensure they meet or exceed industry standards. This ensures that the company will be able to honor its commitments, even in challenging economic times.

Claim Settlement Process

The claim settlement process is a critical aspect of life insurance. A reputable insurance company should have a transparent and efficient claims process. Consider the following factors:

- Claim Approval Rate: Research the company's claim approval rate. A higher approval rate indicates a more reliable and trustworthy insurer.

- Average Time for Claim Settlement: Inquire about the average time it takes for the company to settle claims. A quicker settlement process can provide much-needed financial relief to beneficiaries.

- Customer Satisfaction with Claims: Look for customer reviews and feedback on the company's claims process. Positive experiences indicate a customer-centric approach.

Industry Reputation and Track Record

The reputation and track record of an insurance company are essential indicators of its reliability and trustworthiness. Consider the following aspects:

- Length of Operation: A company with a longer history in the industry often has a more established track record and is likely to be more financially stable.

- Customer Service Reputation: Research the company's reputation for customer service. Positive reviews and a strong customer support system can provide peace of mind.

- Industry Awards and Recognitions: Look for awards or recognitions the company has received for its products, services, or customer satisfaction. These can be indicators of excellence.

Evidence-Based Future Implications

As the world of insurance evolves, it's essential to stay informed about emerging trends and future implications. Here are some key considerations for the future of life insurance:

Digital Transformation

The insurance industry is embracing digital technologies, making it more convenient and efficient for policyholders. Online platforms and mobile apps are being developed to streamline the application process, policy management, and claims filing. This digital transformation is expected to enhance customer experience and make insurance more accessible.

Personalized Insurance

With advancements in data analytics and artificial intelligence, insurance companies are moving towards personalized insurance policies. These policies can be tailored to an individual's unique circumstances, lifestyle, and health status. Personalized insurance offers more flexibility and can provide better coverage options for specific needs.

Wellness and Health Incentives

Some insurance companies are incentivizing policyholders to adopt healthier lifestyles. By offering discounts or rewards for maintaining a healthy lifestyle, these companies aim to reduce the risk of claims and promote overall well-being. This trend is expected to continue, encouraging policyholders to take proactive steps towards their health.

Impact of Economic Changes

Economic fluctuations can impact the insurance industry. During economic downturns, insurance companies may face challenges, which can affect their ability to pay claims. It's essential to choose a financially stable insurer with a proven track record of weathering economic storms.

Additionally, changes in interest rates can affect the performance of permanent life insurance policies with cash value accumulation. Lower interest rates may impact the growth of cash value, while higher rates can provide a boost. Staying informed about economic trends can help you make informed decisions about your policy.

FAQ

Can I change my life insurance policy later if my circumstances change?

+Yes, life insurance policies often offer flexibility. You can typically adjust your coverage, increase or decrease your death benefit, or switch between term and permanent life insurance. However, any changes may require a new medical exam and could impact your premiums.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on your policy. With term life insurance, missing a payment may result in the policy lapsing, meaning it is no longer in force. Permanent life insurance often has a grace period, allowing you to make the payment within a certain timeframe to keep the policy active.

Can I access the cash value in my permanent life insurance policy during my lifetime?

+Yes, the cash value in a permanent life insurance policy can be accessed through policy loans or withdrawals. However, it's important to note that policy loans accumulate interest, which can reduce the death benefit. Withdrawals may also reduce the death benefit and may have tax implications.

Choosing the best life insurance policy is a significant decision that requires careful consideration of your financial goals, needs, and circumstances. By understanding the different types of policies, factors to consider, and industry trends, you can make an informed choice to secure a financially stable future for your loved ones. Remember to seek professional advice and regularly review your policy to ensure it aligns with your changing needs.