What Is The Best Medicare Supplement Insurance Plan

Medicare Supplement Insurance Plans: A Comprehensive Guide

Medicare Supplement Insurance, also known as Medigap, is an essential aspect of healthcare coverage for many individuals, particularly those approaching or already in their retirement years. These plans are designed to fill the gaps in original Medicare coverage, providing a safety net for unexpected medical expenses. With a multitude of options available, choosing the best Medicare Supplement Insurance plan can be a daunting task. This guide aims to demystify the process and help you make an informed decision.

Understanding Medicare Supplement Insurance Plans

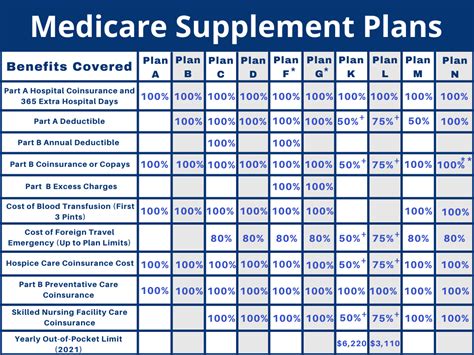

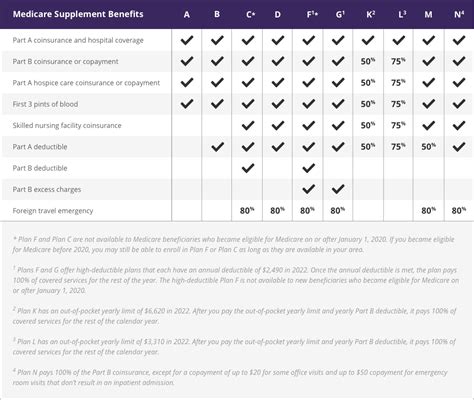

Medicare Supplement Insurance plans are standardized across different insurance companies, meaning that a Plan G from one company will offer the same benefits as a Plan G from another company. The main difference lies in the pricing and customer service, so it's important to shop around and compare options.

These plans are identified by letters A through N, each offering a unique set of benefits. The most popular plans include Plan G, Plan N, and Plan F, which cover a wide range of services, including co-pays, deductibles, and foreign travel emergencies.

It's crucial to note that Medigap plans don't cover everything. They don't include prescription drug coverage, so you'll need to enroll in a separate Medicare Part D plan for that. Additionally, Medigap plans don't cover long-term care, dental care, vision care, or private-duty nursing.

Factors to Consider When Choosing a Plan

Your Health and Medical Needs

The first step in selecting the best Medicare Supplement Insurance plan is to evaluate your current and potential future medical needs. Consider factors such as:

- Do you have any pre-existing medical conditions that require regular treatment or medication?

- Are you likely to need frequent doctor visits or specialized medical procedures in the coming years?

- Do you have any chronic illnesses that may require ongoing care and monitoring?

- Are you at risk for certain health conditions based on your family history or lifestyle factors?

Understanding your health needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Your Budget and Financial Stability

Medicare Supplement Insurance plans come with varying monthly premiums, and these costs can add up over time. It's essential to consider your financial situation and budget when selecting a plan. Here are some factors to keep in mind:

- Can you afford the monthly premium for your desired plan, considering your other financial obligations and retirement income?

- Are there any additional costs associated with the plan, such as deductibles or co-pays, that you can comfortably manage?

- Do you have any savings or investments that could be used to cover unexpected medical expenses?

- Have you explored potential discounts or financial assistance programs offered by insurance providers or government agencies?

It's important to strike a balance between comprehensive coverage and financial stability. Choosing a plan that's too expensive may strain your finances, while opting for a cheaper plan may leave you vulnerable to high out-of-pocket costs.

Insurance Provider Reputation and Service

While the benefits of Medigap plans are standardized, the customer service and overall experience can vary significantly between insurance providers. Consider the following aspects when evaluating providers:

- Research the provider's reputation and financial stability. Look for companies with a strong track record of paying claims promptly and fairly.

- Read reviews and testimonials from current and past customers to gauge their satisfaction levels and the quality of customer service.

- Inquire about the provider's claim process and response times. Efficient claim handling can make a significant difference during medical emergencies.

- Check if the provider offers additional benefits or services, such as wellness programs, that could enhance your overall healthcare experience.

Choosing a reputable insurance provider can provide peace of mind and ensure a seamless experience when you need to utilize your Medicare Supplement Insurance coverage.

The Most Popular Medicare Supplement Insurance Plans

Plan G

Plan G is one of the most popular Medicare Supplement Insurance plans due to its comprehensive coverage. It covers all the gaps in original Medicare, including Part A and Part B deductibles, co-pays, and foreign travel emergencies. Additionally, Plan G covers the Part B excess charge, which is a 20% surcharge that can add up quickly.

Here's a breakdown of the benefits covered by Plan G:

| Benefit | Coverage |

|---|---|

| Part A Deductible | Covered |

| Part B Deductible | Covered |

| Part A Coinsurance | Covered |

| Part B Coinsurance | Covered |

| Blood (first 3 pints) | Covered |

| Foreign Travel Emergency | Covered |

| Part B Excess Charge | Covered |

Plan N

Plan N is another highly sought-after Medigap plan, offering a balance between comprehensive coverage and affordability. It covers many of the same benefits as Plan G, but with a few exceptions. Plan N covers the Part A deductible, Part B coinsurance, and foreign travel emergencies. However, it does not cover the Part B deductible or the Part B excess charge.

The benefits covered by Plan N include:

| Benefit | Coverage |

|---|---|

| Part A Deductible | Covered |

| Part B Deductible | Not Covered |

| Part A Coinsurance | Covered |

| Part B Coinsurance | Covered (except for a $20 copay for some office visits and a $50 copay for emergency room visits) |

| Blood (first 3 pints) | Covered |

| Foreign Travel Emergency | Covered |

| Part B Excess Charge | Not Covered |

Plan F

Plan F is the most comprehensive Medicare Supplement Insurance plan available. It covers all the gaps in original Medicare, providing extensive coverage for various medical expenses. Plan F covers the Part A deductible, Part B deductible, Part A coinsurance, Part B coinsurance, blood, foreign travel emergency, and the Part B excess charge.

The benefits covered by Plan F are as follows:

| Benefit | Coverage |

|---|---|

| Part A Deductible | Covered |

| Part B Deductible | Covered |

| Part A Coinsurance | Covered |

| Part B Coinsurance | Covered |

| Blood (first 3 pints) | Covered |

| Foreign Travel Emergency | Covered |

| Part B Excess Charge | Covered |

Note: Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. However, if you were eligible for Medicare before that date, you may still be able to enroll in Plan F.

Tips for Choosing the Best Plan

Here are some additional tips to guide you in selecting the best Medicare Supplement Insurance plan:

- Compare multiple plans and providers to find the best fit for your needs and budget.

- Consider the stability and financial strength of the insurance provider. A financially stable company is more likely to be able to provide long-term coverage.

- Review the plan's exclusions and limitations to ensure you understand what is not covered.

- Understand the enrollment process and timelines. There may be specific enrollment periods when you can enroll without medical underwriting.

- Don't be afraid to ask questions and seek clarification from insurance agents or customer service representatives.

- Stay informed about changes in Medicare and Medigap plans. Policies and benefits may evolve over time.

FAQs

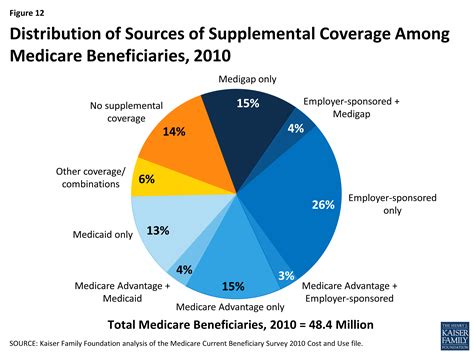

What is the difference between Medicare Advantage and Medicare Supplement Insurance plans?

+Medicare Advantage plans (also known as Medicare Part C) are an alternative to original Medicare. They are offered by private insurance companies and often include additional benefits like prescription drug coverage and vision care. Medicare Supplement Insurance plans, on the other hand, are designed to supplement original Medicare and cover the gaps in its coverage. They do not offer additional benefits beyond what is provided by Medicare Parts A and B.

Are Medicare Supplement Insurance plans regulated by the government?

+Yes, Medicare Supplement Insurance plans are standardized and regulated by the federal government. This means that the benefits offered by a particular plan, such as Plan G or Plan N, are the same regardless of the insurance company providing the plan. However, the prices and customer service may vary between providers.

Can I enroll in a Medicare Supplement Insurance plan at any time?

+Enrollment in Medicare Supplement Insurance plans is typically restricted to specific periods. The best time to enroll is during your Initial Enrollment Period, which begins 6 months before you turn 65 and continues for 6 months after your 65th birthday. Outside of this period, you may need to qualify through a guaranteed issue rights period or wait until the annual Open Enrollment Period.

What happens if I change my mind about my Medicare Supplement Insurance plan?

+If you decide that your chosen Medicare Supplement Insurance plan is not the best fit for your needs, you may be able to switch to a different plan during specific enrollment periods. The annual Open Enrollment Period, which runs from October 15th to December 7th each year, allows you to switch plans without medical underwriting. However, it’s important to note that you may incur a new waiting period if you switch plans outside of this period.