What Is The Best Type Of Life Insurance

Navigating the World of Life Insurance: A Comprehensive Guide to Choosing the Right Coverage

Life insurance is a crucial aspect of financial planning, offering peace of mind and ensuring the well-being of your loved ones in the event of an unforeseen circumstance. With numerous types of life insurance policies available, finding the best fit for your unique needs can be a complex decision. In this in-depth guide, we will explore the various types of life insurance, their features, and the factors to consider when making your choice. By understanding the intricacies of each policy type, you can make an informed decision and secure a solid financial foundation for your family's future.

Understanding the Fundamentals of Life Insurance

At its core, life insurance is a contract between you (the policyholder) and an insurance company. You pay a premium, and in return, the insurance provider agrees to pay a sum of money (the death benefit) to your designated beneficiaries upon your passing. This financial protection can provide immense relief, covering various expenses and ensuring your family's financial stability during a difficult time.

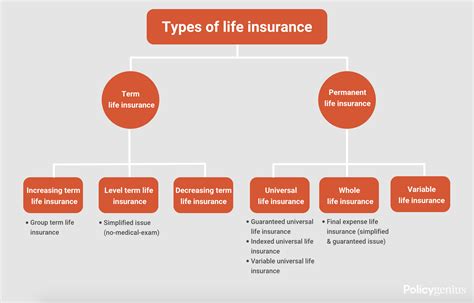

Life insurance policies are categorized into two main types: term life insurance and permanent life insurance. Each type has its own set of advantages and is suited to different life stages and financial goals. Let's delve deeper into these categories to help you make an educated choice.

Term Life Insurance: A Temporary Solution with Long-Term Benefits

Term life insurance is designed to provide coverage for a specified period, known as the term. These policies are often sought by individuals and families who require life insurance coverage for a defined period, such as until their children become independent, their mortgage is paid off, or they reach retirement age. Term life insurance is known for its affordability, making it an attractive option for those on a budget.

Key Features of Term Life Insurance

- Fixed Term: Term life insurance policies are offered for set periods, typically ranging from 10 to 30 years. You can choose a term that aligns with your specific needs and goals.

- Level Premiums: During the policy term, your premium payments remain constant, providing predictable budgeting. This stability is particularly beneficial for those with a fixed income.

- Renewal Options: Most term life insurance policies offer the option to renew at the end of the term. However, be aware that premiums may increase with age, and you may need to undergo a new medical exam.

- Convertibility: Some term life policies allow you to convert your term coverage into a permanent life insurance policy without undergoing a new medical exam. This can be advantageous if your financial situation changes or if you develop health issues.

Real-Life Example: Term Life Insurance in Action

John, a 35-year-old father of two, purchases a 20-year term life insurance policy with a $500,000 death benefit. He pays a monthly premium of $25. With this policy, John ensures that his family will be financially secure if he passes away during the term, covering their mortgage, education costs, and daily expenses. The predictable premium payments make it easy for John to budget and plan for the future.

Permanent Life Insurance: Lifetime Coverage with Added Benefits

Permanent life insurance, as the name suggests, offers lifelong coverage, providing peace of mind that your loved ones will be protected no matter when you pass away. These policies are often more expensive than term life insurance, but they offer additional benefits and a cash value component.

Key Features of Permanent Life Insurance

- Lifetime Coverage: Permanent life insurance policies remain in force for the insured's entire life, as long as premiums are paid. This guarantees a death benefit for your beneficiaries, regardless of when you pass away.

- Cash Value Accumulation: Permanent life insurance policies have a cash value component that grows over time. This cash value can be borrowed against or withdrawn, providing a financial cushion during retirement or for other major life events.

- Flexible Premiums: Unlike term life insurance, permanent life insurance policies often offer flexible premium payment options. You can choose to pay a level premium for life or make larger payments early on to build cash value faster.

- Guaranteed Death Benefit: Permanent life insurance policies guarantee a death benefit, ensuring your beneficiaries receive the full amount, even if you pass away at an advanced age.

Types of Permanent Life Insurance

Within the category of permanent life insurance, there are several sub-types, each with its own unique features and benefits:

- Whole Life Insurance: Whole life insurance offers lifetime coverage with level premiums and a guaranteed cash value. It provides consistent protection and can be a good option for those seeking long-term financial security.

- Universal Life Insurance: Universal life insurance policies offer flexibility in premium payments and death benefit amounts. The cash value can be adjusted to meet your changing needs, making it suitable for those who prefer customization.

- Variable Life Insurance: Variable life insurance policies allow you to invest a portion of your premium in separate accounts, offering the potential for higher returns. However, this also comes with higher risk, as the death benefit and cash value can fluctuate based on market performance.

- Indexed Universal Life Insurance: Indexed universal life insurance combines the features of universal life insurance with the potential for higher returns, tied to a specific stock market index. While it offers growth potential, it also carries investment risk.

Comparing Permanent Life Insurance Policies

| Policy Type | Premiums | Cash Value | Flexibility |

|---|---|---|---|

| Whole Life | Level Premiums | Guaranteed Growth | Limited Flexibility |

| Universal Life | Flexible Premiums | Adjustable Growth | High Flexibility |

| Variable Life | Variable Premiums | Market-Dependent Growth | High Flexibility |

| Indexed Universal Life | Flexible Premiums | Index-Linked Growth | High Flexibility |

Factors to Consider When Choosing Life Insurance

When deciding on the best type of life insurance for your needs, several factors come into play. Here are some key considerations to guide your decision-making process:

- Your Financial Goals: Think about your short-term and long-term financial goals. Do you need coverage for a specific period, or are you seeking lifelong protection? Consider your family's financial needs and the potential impact of your passing on their future.

- Budget and Affordability: Evaluate your financial situation and determine how much you can comfortably allocate towards life insurance premiums. Term life insurance is generally more affordable, making it a good choice for those on a tight budget.

- Health and Lifestyle: Your health and lifestyle can impact the type of life insurance policy you qualify for and the cost of your premiums. If you have a pre-existing health condition or engage in high-risk activities, permanent life insurance may offer more stability in coverage.

- Cash Value Needs: If you're seeking a policy that offers financial growth and the potential for withdrawals or loans, permanent life insurance with a cash value component may be the better option. Term life insurance, on the other hand, focuses solely on providing a death benefit.

- Flexibility and Customization: Consider whether you prefer a straightforward, fixed-term policy or a more flexible option that allows for adjustments as your life circumstances change. Permanent life insurance policies offer more customization but may come with added complexity.

Expert Insights: Navigating the Life Insurance Landscape

The Future of Your Financial Legacy

Life insurance is an essential component of financial planning, providing a safety net for your loved ones and ensuring their financial well-being in the face of uncertainty. By understanding the nuances of term and permanent life insurance policies, you can make an informed decision that aligns with your unique circumstances and goals. Remember, the best type of life insurance is the one that gives you peace of mind and protects the financial future of those you care about.

Frequently Asked Questions

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on various factors, including your income, debts, and financial obligations. A common rule of thumb is to aim for 10-15 times your annual income as the death benefit. However, it’s best to consult with a financial advisor to determine the precise amount needed to cover your specific circumstances.

Can I switch from term life insurance to permanent life insurance later in life?

+

Yes, you can often switch from term life insurance to permanent life insurance. However, the conversion process and the specific terms can vary depending on your policy and insurance provider. It’s advisable to review your policy documents or consult with your insurance agent to understand the conversion options available to you.

What happens if I miss a premium payment for my life insurance policy?

+

Missing a premium payment can have different consequences depending on your policy and the insurance company. In some cases, a grace period of 30 days is allowed, during which the policy remains in force. If you miss the grace period, your policy may lapse, and you’ll need to apply for a new policy, which may involve a new medical exam and potentially higher premiums.

Can I borrow against the cash value of my permanent life insurance policy?

+

Yes, you can typically borrow against the cash value of your permanent life insurance policy. However, it’s important to note that any outstanding loan balance and accrued interest will reduce the death benefit payable to your beneficiaries. Additionally, if you fail to repay the loan, your policy may lapse.

Are there any tax implications associated with life insurance policies?

+

The tax implications of life insurance policies can vary based on the type of policy and how it’s used. In general, the death benefit received by your beneficiaries is typically tax-free. However, if you borrow against the cash value or withdraw funds, those actions may have tax consequences. It’s advisable to consult with a tax professional to understand the specific tax implications of your life insurance policy.