What Is The Cheapest Auto Insurance

Finding the cheapest auto insurance can be a complex task, as the cost of insurance policies varies greatly depending on numerous factors. These factors include the type of vehicle, the driver's age, location, driving record, and the coverage and policy limits desired. While the cheapest option may not always be the best choice, it's essential to understand how to navigate the insurance landscape to find the most cost-effective coverage that suits your needs.

Understanding Auto Insurance Costs

Auto insurance rates are influenced by a multitude of factors, making it challenging to pinpoint a single “cheapest” option. Insurance companies use various criteria to assess risk and determine premiums. Here are some key factors that impact the cost of auto insurance:

- Driver's Profile: Age, gender, driving experience, and driving record are significant factors. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Vehicle Type: The make, model, and age of your vehicle play a role. Sports cars and luxury vehicles often have higher insurance costs due to their expense to repair or replace.

- Location: Where you live or primarily drive can affect your rates. Urban areas with higher traffic and accident rates may result in pricier insurance.

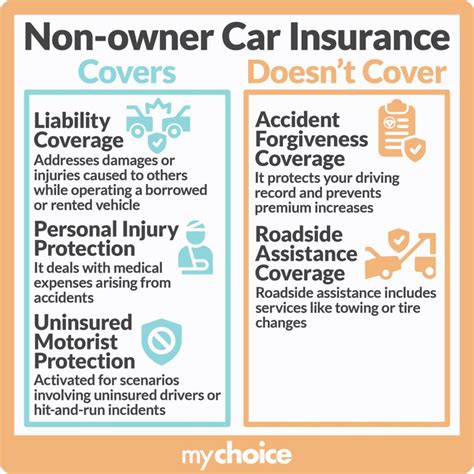

- Coverage Levels: The amount and type of coverage you choose will impact your premium. Comprehensive and collision coverage, for example, can increase costs, while state-mandated minimum coverage may be more affordable.

- Discounts: Insurance companies offer various discounts, such as multi-policy discounts (for bundling auto and home insurance), safe driver discounts, student discounts, and more. These can significantly reduce your overall premium.

Strategies for Finding Affordable Auto Insurance

While the cost of auto insurance can vary significantly, there are strategies you can employ to find more affordable coverage:

Compare Quotes from Multiple Insurers

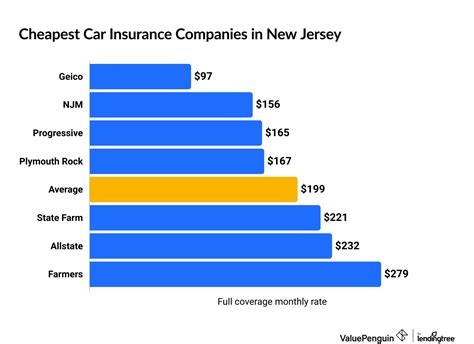

The insurance market is competitive, and prices can differ widely between companies. Obtain quotes from at least three to five insurers to get a good sense of the market rates. Online quote comparison tools can be a convenient way to start.

Understand Your Coverage Needs

Determine the type and level of coverage you require. While it’s tempting to opt for the cheapest option, ensure you have adequate coverage to protect yourself financially in the event of an accident. Consider factors like your vehicle’s value, your financial situation, and your state’s minimum coverage requirements.

Explore Discounts

Inquire about the discounts offered by insurance providers. Common discounts include good student discounts, safe driver discounts, loyalty discounts, and multi-policy discounts. You may also be eligible for discounts if you have certain safety features in your vehicle or if you pay your premium in full rather than in installments.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an option for drivers who don’t log many miles annually. This type of insurance uses telematics devices or smartphone apps to track your driving habits, and premiums are based on your actual driving behavior. This can be a cost-effective option for low-mileage drivers.

Shop Around Regularly

Insurance rates can change over time, and you may find better deals by shopping around annually or whenever your policy renews. Regularly comparing quotes can help you stay on top of any changes in the market and ensure you’re not overpaying.

Example Auto Insurance Costs and Savings

To illustrate the potential savings, consider the following example. A driver in their early 30s with a clean driving record and a mid-range sedan might expect to pay around 1,200 annually for comprehensive coverage. However, by shopping around and taking advantage of discounts, they could potentially reduce their premium to 900 or even lower.

| Coverage Type | Original Cost | Savings with Discounts |

|---|---|---|

| Comprehensive Coverage | $1,200 | $300 (25% savings) |

| Collision Coverage | $800 | $200 (25% savings) |

| Liability Coverage | $600 | $150 (25% savings) |

In this example, the driver achieves significant savings by comparing quotes and utilizing discounts. The savings could be even greater if they were to switch insurers or take advantage of other discounts like multi-policy bundles.

FAQ

How often should I review my auto insurance policy to find the best rates?

+

It’s recommended to review your policy annually or whenever your policy renews. Insurance rates can change, and you may find better deals by regularly comparing quotes.

Are there any insurance providers that consistently offer the lowest rates?

+

Insurance rates can vary widely, and what’s cheapest for one person might not be the best deal for another. It’s essential to compare quotes from multiple insurers to find the most cost-effective option for your specific circumstances.

What factors can I control to lower my auto insurance costs?

+

You can influence your insurance costs by maintaining a clean driving record, shopping around for quotes, understanding your coverage needs, and exploring available discounts. Additionally, considering usage-based insurance or bundling policies can lead to savings.