What Is The Limit Of Fdic Insurance

The Federal Deposit Insurance Corporation (FDIC) is a U.S. government corporation providing deposit insurance to depositors in the event of a bank failure. FDIC insurance covers both interest-bearing and non-interest-bearing deposit accounts, offering a vital safety net for millions of Americans. While the FDIC has played a crucial role in maintaining stability within the banking system, many wonder about the limits of this insurance and how it might impact their savings.

Understanding FDIC Insurance Coverage

FDIC insurance offers protection for deposit accounts held at FDIC-insured banks and savings associations. The coverage ensures that depositors can retrieve their funds, up to a certain limit, even if the bank fails. This coverage provides a safety net for depositors, encouraging them to keep their money in insured banks and building trust in the financial system.

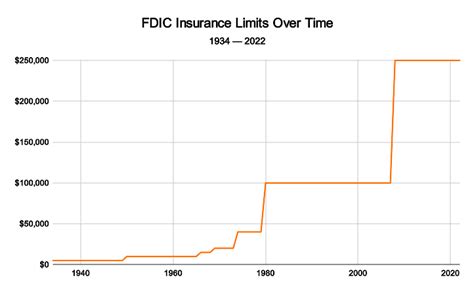

The FDIC's insurance program has evolved over time, adapting to changing economic conditions and the needs of depositors. Originally established in 1933 during the Great Depression, the FDIC initially provided coverage of up to $2,500 per depositor. This limit has been increased several times, reflecting the changing value of money and the need to protect larger deposits.

Current Coverage Limits

As of 2024, the standard insurance coverage limit for FDIC-insured deposit accounts is 250,000 per depositor, per insured bank</strong>. This means that if you have multiple accounts at the same FDIC-insured bank, the total combined balance of those accounts is insured up to 250,000. However, if you have accounts at different FDIC-insured banks, each account is insured separately, allowing you to maximize your coverage.

| FDIC Coverage Categories | Insurance Limit |

|---|---|

| Single Accounts (e.g., checking, savings) | $250,000 |

| Joint Accounts (e.g., owned by two or more people) | $250,000 per co-owner |

| Certain Retirement Accounts (e.g., IRAs) | $250,000 |

| Trust Accounts (e.g., for a minor) | $250,000 per beneficiary |

| Business Accounts (e.g., sole proprietorships) | $250,000 per ownership category |

It's important to note that the $250,000 limit applies to each ownership category and each type of account. For example, if you have a single account and a joint account at the same bank, each account is insured separately up to $250,000.

Maximizing FDIC Coverage

While the FDIC insurance limit of $250,000 provides substantial protection, it’s not uncommon for individuals or families to have savings or investments exceeding this amount. In such cases, it’s essential to understand how to maximize FDIC coverage to ensure the safety of your deposits.

One strategy is to spread your deposits across multiple FDIC-insured banks. By opening accounts at different banks, you can take advantage of the separate insurance coverage provided by each institution. For instance, if you have $500,000 in savings, you could open two single accounts, each insured for $250,000, at two different FDIC-insured banks.

Another approach is to utilize different account ownership categories. As mentioned earlier, joint accounts, retirement accounts, and trust accounts each have their own insurance coverage limits. By carefully structuring your accounts, you can ensure that your deposits are adequately protected within the FDIC insurance framework.

FDIC Insurance and Special Accounts

FDIC insurance applies to a wide range of deposit accounts, but it’s important to understand how it works with specific account types.

Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are time-based savings accounts that offer higher interest rates in exchange for keeping your money deposited for a set period. FDIC insurance covers CDs, but the coverage limit remains at 250,000 per depositor, per insured bank. This means that if you have multiple CDs at the same bank, the combined balance of all your CDs is insured up to 250,000.

Money Market Accounts

Money market accounts offer higher interest rates than traditional savings accounts, making them an attractive option for savers. FDIC insurance also covers money market accounts, with the same $250,000 coverage limit per depositor, per insured bank. However, it’s essential to check with your bank to understand any specific rules or requirements regarding FDIC insurance for money market accounts.

Business Accounts

Business accounts, such as those held by sole proprietorships, partnerships, corporations, and trusts, are also insured by the FDIC. The coverage limit for business accounts is 250,000 per unique ownership category, per insured bank. This means that if you have multiple business accounts at the same bank, each with a different owner or ownership structure, each account is insured separately up to 250,000.

The FDIC’s Role in Bank Failures

The FDIC plays a crucial role in maintaining the stability of the banking system by insuring deposit accounts and managing the resolution of failed banks. When a bank fails, the FDIC steps in to protect depositors’ funds and ensure a smooth transition for customers.

In the event of a bank failure, the FDIC typically takes control of the bank and works to find a new institution to assume its deposits and operations. This process, known as a "purchase and assumption" transaction, ensures that depositors can access their funds as quickly as possible. In most cases, customers of the failed bank will wake up the next business day with their accounts transferred to a new, healthy institution.

The FDIC's prompt action in resolving bank failures helps maintain public confidence in the banking system and minimizes disruption to depositors and the economy.

The FDIC’s Deposit Insurance Fund

The FDIC maintains a Deposit Insurance Fund (DIF) to cover potential losses from failed banks. The DIF is funded by premiums paid by insured banks and any interest earned on the fund’s investments. The fund’s balance is an essential indicator of the FDIC’s ability to handle potential bank failures and maintain the stability of the banking system.

As of [date], the DIF had a balance of approximately $114.9 billion, which is considered a healthy level to cover potential bank failures. The FDIC regularly assesses the fund's balance and adjusts premiums as necessary to maintain its stability.

FDIC Insurance and the Future

The FDIC’s role in insuring deposit accounts has been instrumental in maintaining public confidence in the banking system and protecting depositors’ funds. As the financial landscape continues to evolve, the FDIC’s insurance program will likely adapt to meet new challenges and changing economic conditions.

One area of focus for the FDIC is ensuring that its insurance coverage remains relevant and adequate for the changing nature of banking. With the rise of digital banking and the increasing popularity of online and mobile banking platforms, the FDIC is working to ensure that its insurance program can effectively cover deposits held in these new channels.

Additionally, the FDIC is committed to educating the public about its insurance program and the importance of keeping deposits in FDIC-insured institutions. By promoting financial literacy and understanding of FDIC insurance, the corporation aims to empower depositors to make informed decisions about their savings and investments.

Future Challenges and Opportunities

While the FDIC’s insurance program has proven resilient, there are ongoing challenges and opportunities that the corporation must navigate. One key challenge is keeping pace with the rapid evolution of the financial industry, particularly in the digital realm. As new technologies and platforms emerge, the FDIC must adapt its regulations and processes to ensure effective coverage and protect depositors.

Another area of focus is addressing the changing demographics of depositors. With an aging population and the rise of millennial and Gen Z depositors, the FDIC must tailor its communication and outreach strategies to reach diverse audiences and ensure that all depositors understand the importance of FDIC insurance.

Despite these challenges, the FDIC's insurance program remains a cornerstone of the U.S. financial system, providing a vital safety net for depositors and promoting stability within the banking industry. As the FDIC continues to adapt and innovate, its insurance program will likely remain a critical component of the nation's financial infrastructure.

How often does the FDIC increase its insurance coverage limit?

+The FDIC’s insurance coverage limit has been increased several times since its inception. The last significant increase occurred in 2010, raising the limit from 100,000 to the current 250,000. The FDIC typically adjusts the limit in response to changing economic conditions and the needs of depositors.

Are there any types of accounts not covered by FDIC insurance?

+While FDIC insurance covers a wide range of deposit accounts, there are some exceptions. Accounts held at credit unions, brokerage accounts, and certain investment products are not insured by the FDIC. It’s important to check with your financial institution to understand the specific coverage of your accounts.

Can I transfer my accounts to maximize FDIC coverage?

+Yes, you can transfer your accounts to different FDIC-insured banks to maximize coverage. By spreading your deposits across multiple banks, you can ensure that each account is insured separately up to the 250,000 limit.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How can I verify if my bank is FDIC-insured?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>You can verify if your bank is FDIC-insured by checking for the official FDIC logo on their website or physical branch. You can also visit the FDIC's website and use their "Bank Find" tool to search for your bank and confirm its FDIC-insured status.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What happens if my bank fails, and I have deposits exceeding the FDIC insurance limit?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>If your bank fails and you have deposits exceeding the FDIC insurance limit, the FDIC will prioritize the distribution of insured funds up to 250,000 per depositor, per insured bank. Any remaining funds may be subject to a claim process, and you may recover a portion of your uninsured deposits over time.