What Is Whole Life Insurance Mean

Whole life insurance, often referred to as permanent life insurance, is a type of insurance policy that provides lifelong coverage, offering both financial protection and a savings element. It is designed to remain in force throughout an individual's lifetime, making it a valuable tool for long-term financial planning and asset protection.

In this comprehensive guide, we will delve into the intricacies of whole life insurance, exploring its key features, benefits, and considerations. By understanding how whole life insurance works and its potential advantages, individuals can make informed decisions about their financial future and ensure the well-being of their loved ones.

Understanding Whole Life Insurance

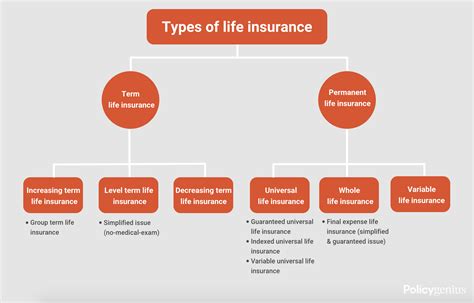

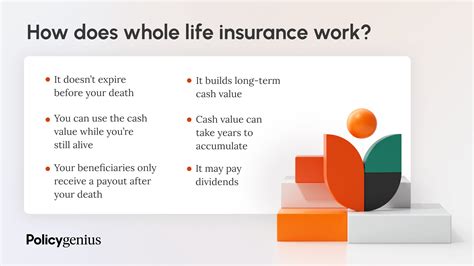

Whole life insurance is a traditional form of life insurance that combines death benefit coverage with a cash value component. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers permanent protection, ensuring that the policy remains active as long as the premiums are paid.

The policy's cash value, also known as the savings element, grows over time and can be accessed by the policyholder through various means. This unique feature sets whole life insurance apart from other types of insurance, providing a potential source of funds for various financial needs and goals.

Key Features and Benefits

Guaranteed Death Benefit

The primary benefit of whole life insurance is the guarantee of a death benefit payout to the beneficiaries upon the insured’s passing. This financial protection provides peace of mind, ensuring that loved ones are financially secure and can cover expenses such as funeral costs, outstanding debts, and daily living expenses.

Cash Value Accumulation

One of the most attractive features of whole life insurance is the cash value accumulation. Over time, a portion of the premiums paid goes towards building up the policy’s cash value. This cash value grows tax-deferred and can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial emergencies.

Fixed Premiums

Whole life insurance policies typically offer fixed premiums, meaning the policyholder pays the same amount each month or year throughout the policy’s duration. This predictability allows individuals to budget effectively and ensures that the cost of insurance remains consistent over time.

Policy Loans and Withdrawals

Policyholders can access the cash value through policy loans or partial withdrawals. Policy loans allow individuals to borrow against the cash value, with the loan being repaid with interest. Withdrawals, on the other hand, involve taking out a portion of the cash value, reducing the policy’s death benefit and cash value accordingly.

Tax Advantages

The cash value within a whole life insurance policy enjoys certain tax advantages. Growth in the cash value is tax-deferred, and if the policy is held for a specific period, the death benefit and any cash value remaining at the time of payout may be tax-free. This makes whole life insurance an attractive option for tax-efficient financial planning.

Flexibility and Customization

Whole life insurance policies can be customized to meet individual needs and goals. Policyholders can choose the amount of coverage, adjust the premium payments, and even add optional riders to enhance the policy’s benefits. This flexibility allows individuals to create a policy that aligns with their unique financial situation and objectives.

How Whole Life Insurance Works

Premium Payments

Policyholders pay regular premiums, typically on a monthly or annual basis. These premiums cover the cost of insurance (COI) and contribute to the policy’s cash value accumulation. The COI is the amount required to maintain the death benefit and administrative costs associated with the policy.

Death Benefit Payout

Upon the insured’s passing, the beneficiaries receive the death benefit payout. The amount of the death benefit is determined when the policy is issued and remains fixed throughout the policy’s term. This guaranteed benefit ensures financial security for loved ones, providing a valuable source of income to cover immediate and long-term expenses.

Cash Value Growth

A portion of the premiums paid is allocated to the policy’s cash value. This cash value grows over time due to interest earnings and any dividends declared by the insurance company. The growth rate and interest earned can vary based on the insurance company’s performance and the policy’s design.

| Policy Feature | Description |

|---|---|

| Guaranteed Death Benefit | A fixed payout to beneficiaries upon the insured's passing. |

| Cash Value Accumulation | A savings element that grows over time, tax-deferred. |

| Fixed Premiums | Consistent premium payments throughout the policy's term. |

| Policy Loans and Withdrawals | Access to cash value through loans or partial withdrawals. |

| Tax Advantages | Tax-deferred growth and potential tax-free death benefit and cash value. |

Considerations and Potential Drawbacks

Cost

Whole life insurance policies tend to have higher premiums compared to term life insurance. The combination of death benefit coverage and cash value accumulation contributes to the higher cost. Policyholders need to carefully consider their budget and financial goals to determine if whole life insurance is the most suitable option.

Limited Investment Potential

While the cash value within a whole life insurance policy grows over time, the growth rate may be lower compared to other investment options. The policy’s conservative investment approach aims to ensure stability and guarantee the death benefit, which may result in slower growth compared to riskier investments.

Policy Loans and Withdrawals

Although policy loans and withdrawals provide flexibility, they should be used judiciously. Taking out loans or making withdrawals reduces the policy’s death benefit and cash value, impacting the long-term financial protection and savings potential of the policy.

Early Surrender Penalties

If a policyholder decides to surrender the policy early, they may incur surrender charges or penalties. These charges are designed to recoup the insurance company’s costs associated with issuing and administering the policy. Understanding the surrender penalties and their impact on the policy’s value is crucial when considering early policy termination.

Suitability

Whole life insurance may not be suitable for everyone. Individuals with specific financial goals or those seeking temporary coverage may find term life insurance or other financial products more aligned with their needs. It is essential to assess personal financial circumstances and goals before committing to a whole life insurance policy.

Real-Life Examples and Success Stories

Retirement Planning

Mr. Johnson, a retired teacher, utilized his whole life insurance policy to supplement his retirement income. With the policy’s cash value, he was able to make partial withdrawals to cover living expenses and maintain a comfortable lifestyle during his golden years. The policy’s guaranteed death benefit provided added peace of mind, ensuring his spouse would be financially secure should the need arise.

Educational Funding

The Smith family used the cash value of their whole life insurance policy to fund their children’s college education. By taking out policy loans, they were able to cover tuition fees and other educational expenses without dipping into their retirement savings or taking on additional debt. The policy’s tax advantages further enhanced the financial benefits of this strategy.

Legacy Building

Ms. Williams, a successful business owner, saw whole life insurance as an opportunity to leave a legacy for her grandchildren. By consistently paying premiums and allowing the policy’s cash value to grow, she was able to provide a substantial death benefit payout. This ensured that her grandchildren would have financial support for their future endeavors, whether it be starting a business or pursuing higher education.

Comparing Whole Life Insurance to Other Options

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a higher death benefit for a lower premium compared to whole life insurance. However, term life insurance does not offer the savings element or the long-term financial protection provided by whole life insurance. Term life insurance is often a suitable choice for individuals seeking temporary coverage or those on a tight budget.

Universal Life Insurance

Universal life insurance, like whole life insurance, offers permanent coverage with a cash value component. However, universal life insurance provides more flexibility in terms of premium payments and death benefit adjustments. Policyholders can choose to pay premiums on a flexible schedule and adjust the death benefit as needed. Universal life insurance may be a preferred option for individuals seeking greater control over their policy and the ability to respond to changing financial circumstances.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows policyholders to invest a portion of the cash value in separate accounts. These separate accounts offer the potential for higher investment returns but also carry more risk compared to traditional whole life insurance. Variable life insurance may appeal to individuals with a higher risk tolerance and a desire to maximize their investment potential.

Expert Insights and Recommendations

Understanding Your Needs

When considering whole life insurance, it is essential to understand your specific financial needs and goals. Assess your current and future financial obligations, such as outstanding debts, mortgage payments, and educational expenses. Determine the level of financial protection required to ensure the well-being of your loved ones and align your goals with the features and benefits of whole life insurance.

Seek Professional Advice

Consulting with a qualified financial advisor or insurance professional is crucial when making decisions about whole life insurance. These experts can provide personalized guidance based on your financial situation, helping you navigate the various policy options and understand the potential advantages and drawbacks. They can also assist in comparing whole life insurance to other financial products to ensure you make an informed choice.

Long-Term Perspective

Whole life insurance is a long-term commitment, and it is essential to adopt a patient and disciplined approach. Understand that the policy’s cash value grows over time and may take several years to reach significant levels. Avoid making impulsive decisions or surrendering the policy prematurely, as this can result in surrender penalties and reduced financial benefits.

Future Implications and Potential Developments

Technological Advancements

The insurance industry is embracing technological advancements, and whole life insurance policies are no exception. Insurers are utilizing digital platforms and mobile applications to enhance policy management and provide policyholders with greater control and accessibility. These technological improvements aim to streamline policy administration and improve the overall policyholder experience.

Changing Market Dynamics

The financial landscape is constantly evolving, and whole life insurance policies must adapt to meet the changing needs and expectations of policyholders. Insurance companies are exploring innovative ways to enhance policy features, such as offering additional riders or introducing more flexible payment options. Staying informed about these developments can help policyholders make the most of their whole life insurance policies.

Policy Customization

As individuals seek greater control over their financial planning, insurance companies are responding by offering more customizable whole life insurance policies. Policyholders can now tailor their policies to align with their unique circumstances and goals. This level of customization allows for a more personalized approach to financial protection and savings, ensuring that whole life insurance remains a relevant and attractive option for the future.

What is the difference between whole life insurance and term life insurance?

+

Whole life insurance provides permanent coverage with a cash value component, while term life insurance offers temporary coverage for a specified period. Whole life insurance offers financial protection and savings, whereas term life insurance is more focused on providing coverage for a limited time, often at a lower cost.

How does the cash value within a whole life insurance policy grow?

+

The cash value within a whole life insurance policy grows through interest earnings and any dividends declared by the insurance company. The growth rate can vary based on the policy’s design and the insurance company’s performance.

Can I access the cash value in my whole life insurance policy?

+

Yes, policyholders can access the cash value through policy loans or partial withdrawals. Policy loans allow individuals to borrow against the cash value, while partial withdrawals involve taking out a portion of the cash value, reducing the policy’s death benefit and cash value accordingly.