What Is Whole Life Insurance Vs Term

In the realm of personal finance and insurance, understanding the nuances of different types of life insurance policies is essential. One of the fundamental questions that often arises is the difference between whole life insurance and term life insurance. These two types of policies serve distinct purposes and cater to different financial needs and life stages. Let's delve into a comprehensive analysis of whole life insurance vs. term life insurance, exploring their features, benefits, and implications.

Understanding Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a type of policy that provides coverage for the insured individual's entire life, hence the name "whole life." It is a long-term financial commitment designed to offer lifelong protection and accumulate cash value over time.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance policies remain in force as long as the policyholder pays the premiums, regardless of their age or health status.

- Cash Value Accumulation: One of the unique aspects of whole life insurance is its cash value component. A portion of each premium payment goes towards building cash value, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn during the policyholder's lifetime.

- Guaranteed Premiums: Whole life insurance policies typically have fixed premiums that remain the same throughout the policyholder's life. This predictability allows for long-term financial planning.

- Death Benefit: The death benefit of a whole life policy is guaranteed and remains level throughout the policy term. The beneficiaries receive the full death benefit upon the insured's passing.

| Feature | Description |

|---|---|

| Coverage Duration | Whole life insurance provides lifelong coverage, ensuring protection throughout the policyholder's life. |

| Cash Value | Accumulates cash value that can be utilized for various financial needs, such as emergency funds or supplementing retirement income. |

| Premium Flexibility | While whole life insurance typically has fixed premiums, some policies offer flexible premium payment options. |

Exploring Term Life Insurance

Term life insurance, on the other hand, is a more temporary form of coverage. It provides protection for a specified period, known as the "term," and is often more affordable than whole life insurance.

Key Characteristics of Term Life Insurance

- Fixed Term: Term life insurance policies have a predetermined duration, typically ranging from 10 to 30 years. The policyholder chooses the term length based on their financial needs and goals.

- Lower Premiums: One of the primary advantages of term life insurance is its affordability. Premiums are generally lower compared to whole life insurance, making it accessible to a wider range of individuals.

- Level Premiums: Similar to whole life insurance, term life policies often have level premiums, meaning the premium amount remains constant throughout the term.

- Renewability: Many term life policies offer the option to renew the coverage at the end of the term, although premiums may increase with age.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value. The focus is solely on providing pure protection during the policy term.

| Feature | Description |

|---|---|

| Coverage Period | Term life insurance offers protection for a specific term, after which the coverage expires. |

| Premiums | Term life insurance premiums are generally lower compared to whole life insurance, making it a cost-effective option for many individuals. |

| Death Benefit | The death benefit is paid to the beneficiaries if the insured passes away during the policy term. |

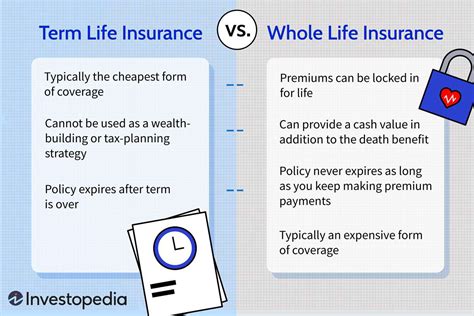

Comparing Whole Life and Term Life Insurance

When comparing whole life and term life insurance, several key factors come into play, including financial goals, budget, and life stage.

Financial Goals and Budget

Whole life insurance is often recommended for individuals seeking long-term financial protection and planning. It can be an excellent choice for those who want to ensure their family's financial security and leave a legacy. The cash value component can provide a financial buffer for various life events and retirement.

On the other hand, term life insurance is ideal for individuals with specific financial goals or temporary needs. For example, a young couple buying their first home may opt for term life insurance to cover their mortgage and ensure their family's financial stability if one or both partners pass away during the term.

Flexibility and Cost

Whole life insurance offers more flexibility in terms of coverage and premium payments. The cash value component allows policyholders to adjust their coverage and access funds if needed. However, the trade-off is the higher cost compared to term life insurance.

Term life insurance, with its lower premiums, is a more affordable option for those with limited budgets. It provides essential protection during critical life stages, such as raising a family or paying off debt.

Renewability and Conversion

Whole life insurance policies do not need to be renewed or converted, as they are designed to provide lifelong coverage. The guaranteed premiums and death benefit remain unchanged.

Term life insurance policies, on the other hand, may offer renewal options, but premiums can increase with age. Some term life policies also allow conversion to permanent life insurance, providing an opportunity to transition to whole life coverage if desired.

Real-World Examples and Scenarios

Let's consider a few real-world scenarios to better understand the application of whole life and term life insurance.

Scenario 1: Young Professional Starting a Family

John, a 30-year-old professional, recently married and is planning to start a family. He wants to ensure that his spouse and future children are financially secure if something happens to him. John opts for a 20-year term life insurance policy with a substantial death benefit. This provides protection during the critical years of raising a family and paying off their mortgage. As his financial situation stabilizes, he can reassess his insurance needs and consider transitioning to whole life insurance for long-term financial planning.

Scenario 2: Established Business Owner

Sarah, a successful business owner in her 40s, has built a thriving company and wants to ensure its continuity. She chooses whole life insurance to provide lifelong protection for her business and family. The cash value component allows her to access funds for business expansion or emergencies, while the guaranteed death benefit ensures her family's financial security if the worst were to happen.

Scenario 3: Retiree Seeking Legacy Planning

Michael, a retiree in his 60s, wants to leave a financial legacy for his grandchildren. He opts for a whole life insurance policy with a smaller death benefit, knowing that the cash value will grow over time. This allows him to provide a significant financial gift to his grandchildren without depleting his retirement savings.

Performance Analysis and Implications

The performance and implications of whole life and term life insurance policies can vary based on individual circumstances and market conditions.

Investment and Cash Value Growth

Whole life insurance policies, with their cash value component, can offer potential investment returns. The insurance company invests a portion of the premiums to grow the cash value. However, the returns may be lower compared to other investment options due to the conservative nature of insurance companies' investment strategies.

Term life insurance, on the other hand, does not provide any investment returns, as the focus is solely on providing pure protection. The premiums are used solely for the policy's coverage, without any accumulation of cash value.

Cost-Benefit Analysis

When considering the cost-benefit analysis, whole life insurance may be more advantageous for individuals with long-term financial goals and a higher risk tolerance. The guaranteed coverage and cash value accumulation can provide significant benefits over time. However, for those with more immediate financial needs and a limited budget, term life insurance offers a cost-effective solution for short-term protection.

Evidence-Based Future Implications

The choice between whole life and term life insurance can have long-lasting implications for an individual's financial well-being. Whole life insurance can provide a solid foundation for retirement planning and legacy building, especially for those who start early. Term life insurance, on the other hand, offers a flexible and affordable option for those with specific, short-term financial goals.

Frequently Asked Questions (FAQ)

Can I cancel my whole life insurance policy and receive a refund?

+Yes, you can typically cancel your whole life insurance policy and receive a refund of your cash value, minus any applicable surrender charges. However, it's important to consider the long-term benefits of maintaining the policy and the potential impact on your financial goals.

Are term life insurance premiums guaranteed to remain level throughout the term?

+In most cases, term life insurance premiums are guaranteed to remain level for the duration of the term. However, it's important to review the policy's terms and conditions, as some policies may have provisions for premium increases under certain circumstances.

Can I convert my term life insurance policy to whole life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing you to transition from term life to whole life insurance. The conversion typically has age and health requirements, so it's advisable to review the policy details and consult with your insurance provider.

In conclusion, understanding the differences between whole life and term life insurance is crucial for making informed financial decisions. Whole life insurance provides lifelong coverage and cash value accumulation, making it an attractive option for long-term financial planning. Term life insurance, with its affordability and flexibility, is ideal for those with specific, temporary financial needs. By considering your financial goals, budget, and life stage, you can choose the type of life insurance that best aligns with your unique circumstances.