What's The Difference Between Whole Life And Term Life Insurance

Understanding the differences between whole life insurance and term life insurance is crucial when it comes to making informed decisions about your financial future and securing the well-being of your loved ones. These two types of life insurance policies offer distinct features and benefits, catering to different needs and financial situations. In this comprehensive guide, we will delve into the intricacies of whole life and term life insurance, exploring their unique characteristics, advantages, and considerations to help you make an educated choice.

The Fundamentals of Whole Life Insurance

Whole life insurance, often referred to as permanent life insurance, is a type of policy designed to provide coverage for the entirety of an individual’s life, hence the name “whole life.” It is a comprehensive insurance product that combines life insurance coverage with a savings or investment component.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance guarantees coverage for the insured’s entire life, provided premiums are paid as agreed. This means the policy remains in force as long as premiums are current, offering peace of mind and long-term financial protection.

- Cash Value Accumulation: One of the defining characteristics of whole life insurance is its cash value accumulation feature. A portion of the premiums paid goes towards building up a cash value within the policy. This cash value grows over time and can be accessed through loans, withdrawals, or surrender of the policy.

- Guaranteed Premiums: Whole life insurance policies typically offer guaranteed premium rates, meaning the premiums remain the same throughout the policy’s duration. This predictability makes it easier to budget and plan for the long term.

- Dividend Potential: Some whole life insurance policies offer the opportunity to receive dividends. These dividends are not guaranteed but can be used to reduce premiums, increase cash value, or be taken as cash payments.

- Flexible Benefits: Whole life insurance policies often allow policyholders to customize their coverage by adding optional riders. These riders can enhance the policy with additional benefits, such as long-term care coverage or waiver of premium in case of disability.

Advantages of Whole Life Insurance

Whole life insurance offers several key advantages that make it an attractive option for certain individuals and families:

- Lifetime Protection: The primary benefit of whole life insurance is the guarantee of coverage for life. This provides a valuable safety net for your loved ones, ensuring they receive the financial support they need regardless of when you pass away.

- Cash Value Growth: The cash value component of whole life insurance can serve as a valuable financial asset. It grows tax-deferred over time and can be utilized for various purposes, such as funding retirement, paying for education, or covering unexpected expenses.

- Stable Premium Rates: The predictability of premium rates is a significant advantage. Policyholders can budget effectively, knowing their premiums will remain constant, which is especially beneficial for long-term financial planning.

- Potential Dividends: Dividend-paying whole life policies offer the opportunity to further enhance the policy’s value. Dividends can be used to reduce premiums, accelerate cash value growth, or provide additional income during retirement.

- Customizable Benefits: The flexibility to add riders allows policyholders to tailor their coverage to their specific needs. This customization ensures the policy aligns with their unique circumstances and goals.

Unveiling Term Life Insurance

Term life insurance, as the name suggests, provides coverage for a specific period or “term.” It is a more straightforward and cost-effective option compared to whole life insurance, making it an attractive choice for many individuals and families.

Key Features of Term Life Insurance

- Fixed Term: Term life insurance policies are designed to offer coverage for a predetermined period, typically ranging from 10 to 30 years. The policyholder selects the term based on their specific needs and financial goals.

- Affordable Premiums: One of the most appealing aspects of term life insurance is its affordability. Premiums for term policies are generally much lower compared to whole life insurance, making it accessible to a wider range of individuals.

- Renewable and Convertible: Many term life insurance policies offer the option to renew or convert the policy. Renewal allows the policyholder to extend the coverage period, while conversion lets them switch to a permanent life insurance policy without undergoing a medical exam.

- Level Premiums: Similar to whole life insurance, term life policies often provide level premiums, meaning the premium amount remains the same throughout the term of the policy.

- Guaranteed Death Benefit: During the policy’s term, the insured’s beneficiaries will receive a tax-free death benefit if the insured passes away. This benefit can provide financial support for various needs, such as mortgage payments, education expenses, or daily living costs.

Advantages of Term Life Insurance

Term life insurance offers several compelling advantages that make it a popular choice for many individuals:

- Cost-Effectiveness: The primary advantage of term life insurance is its affordability. The lower premiums make it an accessible option for individuals and families who require substantial coverage but have budget constraints.

- Flexibility in Coverage: Term life insurance allows policyholders to choose the coverage amount and term that best suits their needs. This flexibility ensures the policy aligns with their current financial situation and goals.

- Renewal and Conversion Options: The ability to renew or convert the policy provides added security. Renewal ensures coverage can be extended as needed, while conversion allows for a seamless transition to permanent life insurance if circumstances change.

- Guaranteed Death Benefit: The tax-free death benefit during the policy’s term provides valuable financial protection for beneficiaries. This benefit can be used to cover immediate expenses, replace lost income, or fund other financial goals.

- Simple and Straightforward: Term life insurance is a straightforward product without the complexities of cash value accumulation or dividend payments. This simplicity makes it easier to understand and manage.

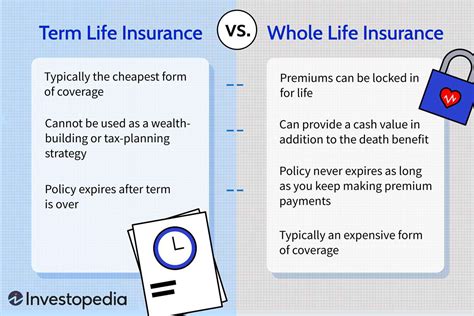

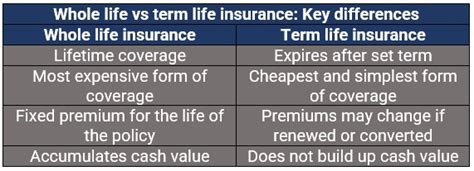

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, it’s essential to consider your specific needs, financial situation, and long-term goals. Here’s a side-by-side comparison to help you evaluate the key differences:

| Aspect | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Period | Lifetime coverage | Fixed term (typically 10-30 years) |

| Premiums | Generally higher | Lower and more affordable |

| Cash Value | Accumulates cash value over time | No cash value accumulation |

| Flexibility | Offers customization through riders | Flexible in coverage amount and term |

| Renewal/Conversion | Not typically renewable or convertible | Renewable and convertible to permanent life insurance |

| Death Benefit | Guaranteed death benefit for life | Guaranteed death benefit during the term |

| Suitability | Suitable for long-term financial planning and wealth accumulation | Ideal for temporary needs or budget-conscious individuals |

Choosing the Right Option for You

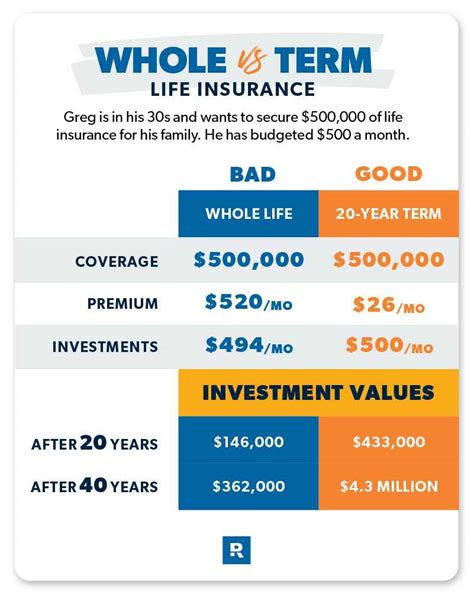

The decision between whole life and term life insurance depends on various factors, including your age, financial goals, and risk tolerance. Here are some considerations to guide your choice:

- Financial Stability: If you have a stable financial situation and are looking for long-term financial protection and wealth accumulation, whole life insurance may be a suitable option.

- Temporary Needs: If you have specific financial needs that are temporary, such as covering mortgage payments or providing for children’s education, term life insurance can offer affordable coverage for a defined period.

- Budget Constraints: Term life insurance is often the preferred choice for individuals on a tight budget. It provides substantial coverage without the higher premiums associated with whole life insurance.

- Wealth Accumulation: Whole life insurance’s cash value accumulation feature makes it an attractive option for those seeking a tax-efficient way to build wealth over time.

- Renewal and Conversion: If you anticipate your financial needs evolving over time, term life insurance’s renewal and conversion options can provide flexibility and adaptability.

FAQs

Can I switch from term life insurance to whole life insurance later on?

+Yes, many term life insurance policies offer a conversion option, allowing you to switch to a permanent life insurance policy, such as whole life, without undergoing a new medical exam. However, it’s important to review the terms and conditions of your specific policy to understand the conversion process and any potential limitations.

Are there any tax implications with whole life insurance’s cash value accumulation?

+Whole life insurance’s cash value accumulation grows tax-deferred, meaning it is not taxed as long as the policy remains in force. However, if you take out a loan against the cash value or surrender the policy, the accumulated cash value may be subject to taxation. It’s advisable to consult a tax professional for specific advice.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer have life insurance protection. However, you may have the option to renew the policy or convert it to a permanent life insurance policy, depending on the terms of your specific policy and your health status at the time of renewal or conversion.

Can I customize my whole life insurance policy with additional benefits?

+Yes, whole life insurance policies often offer the flexibility to add optional riders, which allow you to customize your coverage. Common riders include waiver of premium in case of disability, long-term care coverage, or accelerated death benefit in case of a terminal illness. These riders can enhance your policy’s benefits and provide additional peace of mind.

In conclusion, both whole life and term life insurance policies have their unique advantages and considerations. Whole life insurance offers lifetime coverage, cash value accumulation, and customization options, making it suitable for long-term financial planning and wealth accumulation. On the other hand, term life insurance provides affordable coverage for a defined period, making it ideal for temporary needs or budget-conscious individuals. Understanding your financial goals, risk tolerance, and budget will help you make an informed decision between these two types of life insurance policies.