When Can You Enroll In Health Insurance

Health insurance is a vital aspect of modern life, providing financial protection and access to essential healthcare services. Understanding the enrollment periods and processes is crucial to ensure you and your loved ones are covered when needed. In this comprehensive guide, we will delve into the world of health insurance enrollment, exploring the key timelines, options, and strategies to navigate the healthcare marketplace effectively.

Understanding Open Enrollment Periods

The cornerstone of health insurance enrollment is the Open Enrollment Period (OEP), a designated timeframe when individuals can freely select and enroll in health insurance plans without requiring a qualifying life event. This period typically occurs annually and is a critical opportunity to review and update your coverage.

The exact dates of the OEP vary depending on your location and the specific healthcare system. In the United States, for instance, the Affordable Care Act (ACA) mandates an annual Open Enrollment Period, which usually spans a few months toward the end of the year. For example, the OEP for the 2023 coverage year ran from November 1, 2022, to January 15, 2023.

During the Open Enrollment Period, you can explore various health insurance plans, compare benefits and costs, and choose the one that best suits your needs. This period ensures a level playing field, as insurance companies cannot discriminate based on pre-existing conditions or health status.

| Year | Open Enrollment Period |

|---|---|

| 2023 | November 1, 2022 - January 15, 2023 |

| 2024 | Expected: November 1, 2023 - January 15, 2024 |

Special Enrollment Periods (SEPs)

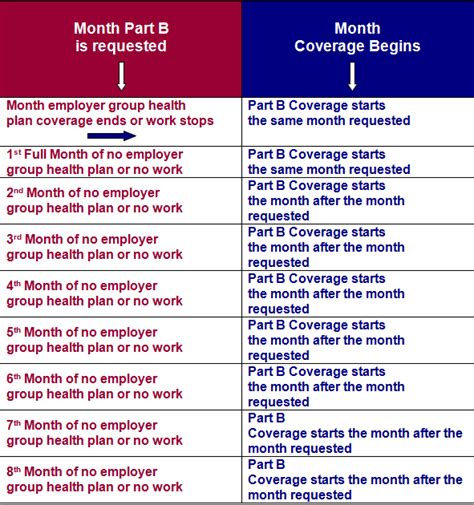

While the Open Enrollment Period is the primary opportunity to enroll in health insurance, Special Enrollment Periods (SEPs) offer a second chance for those who miss the OEP or experience specific life events.

SEPs are triggered by qualifying life events, such as marriage, divorce, birth or adoption of a child, loss of other health coverage, or changes in income. During a SEP, you can enroll outside the standard OEP, ensuring you have continuous coverage. The exact timeline for SEPs varies, and you must act promptly upon experiencing a qualifying event to take advantage of this opportunity.

Navigating Health Insurance Options

With a myriad of health insurance plans available, choosing the right coverage can be daunting. Here’s a breakdown of key factors to consider when navigating your options:

Plan Types

- Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but require you to choose a primary care physician and obtain referrals for specialist visits.

- Preferred Provider Organizations (PPOs): PPOs provide more flexibility, allowing you to visit doctors and hospitals without referrals, but they often come with higher premiums.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but limit your network to specific providers, offering a balance between cost and flexibility.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs, offering cost-effective coverage with some out-of-network benefits.

Network Coverage

Health insurance plans are typically categorized based on their network coverage, which determines the providers you can access and the costs associated with their services. Understanding the network structure is crucial:

- In-Network: Visiting in-network providers means lower out-of-pocket costs, as these providers have negotiated rates with your insurance company.

- Out-of-Network: Out-of-network providers may charge higher fees, and you might need to pay more out of pocket. However, some plans offer out-of-network benefits, providing partial coverage.

Premiums and Deductibles

When comparing health insurance plans, consider the premiums (the amount you pay monthly for coverage) and deductibles (the amount you must pay out of pocket before your insurance kicks in). Lower premiums often come with higher deductibles, so strike a balance based on your budget and anticipated healthcare needs.

Benefits and Coverage

Each health insurance plan offers a unique set of benefits and coverage options. Review the plan’s summary of benefits to understand what’s included, such as:

- Prescription drug coverage

- Mental health and substance abuse treatment

- Maternity and newborn care

- Preventive care services

- Specialist visits and procedures

Strategies for Successful Enrollment

To ensure a smooth and successful health insurance enrollment process, consider the following strategies:

Research and Compare Plans

Take the time to research and compare various health insurance plans. Utilize online tools and resources provided by healthcare marketplaces or insurance brokers to understand the differences in coverage, costs, and benefits.

Understand Your Healthcare Needs

Assess your current and anticipated healthcare needs. Consider factors like chronic conditions, prescription medications, and the likelihood of specialist visits. Choose a plan that aligns with your unique requirements to avoid unexpected out-of-pocket expenses.

Consider Cost-Sharing Options

Health insurance plans often offer cost-sharing options, such as health savings accounts (HSAs) or flexible spending accounts (FSAs). These accounts allow you to set aside pre-tax dollars to cover qualified medical expenses, providing tax benefits and financial flexibility.

Seek Professional Guidance

If you’re unsure about the best health insurance plan for your situation, consider consulting a professional. Insurance brokers or financial advisors specializing in healthcare can provide personalized recommendations based on your needs and budget.

FAQs

Can I enroll in health insurance outside the Open Enrollment Period if I don’t have a qualifying life event?

+Generally, you need a qualifying life event to enroll outside the OEP. However, some states or countries may offer additional enrollment opportunities or have different rules. It’s best to check with your local healthcare authority or insurance provider for specific guidelines.

What happens if I miss the Open Enrollment Period and don’t have a qualifying life event for a SEP?

+If you miss the OEP and don’t have a qualifying event for a SEP, you may face a gap in coverage. In such cases, you might consider short-term health insurance plans or explore other temporary coverage options until the next OEP.

Are there any exceptions to the Open Enrollment Period rules?

+Yes, certain exceptions exist, such as for those who qualify for Medicaid or the Children’s Health Insurance Program (CHIP). These programs often have year-round enrollment, so check your eligibility and explore these options if applicable.

How do I know if a health insurance plan is right for me?

+Evaluating a health insurance plan involves considering factors like your healthcare needs, budget, and the plan’s coverage and cost-sharing arrangements. It’s essential to read the plan’s summary of benefits and understand the network coverage and out-of-pocket costs. If in doubt, consult a professional for guidance.