When Do You Buy Travel Insurance

Travel insurance is an essential aspect of any trip, offering peace of mind and financial protection against unforeseen circumstances. While it might seem like a straightforward decision, the timing of purchasing travel insurance can be a bit more nuanced. In this comprehensive guide, we will explore the optimal moments to invest in travel insurance, ensuring you're covered when it matters most.

Understanding the Importance of Travel Insurance

Before delving into the best times to buy, let’s briefly recap why travel insurance is a must-have for every trip.

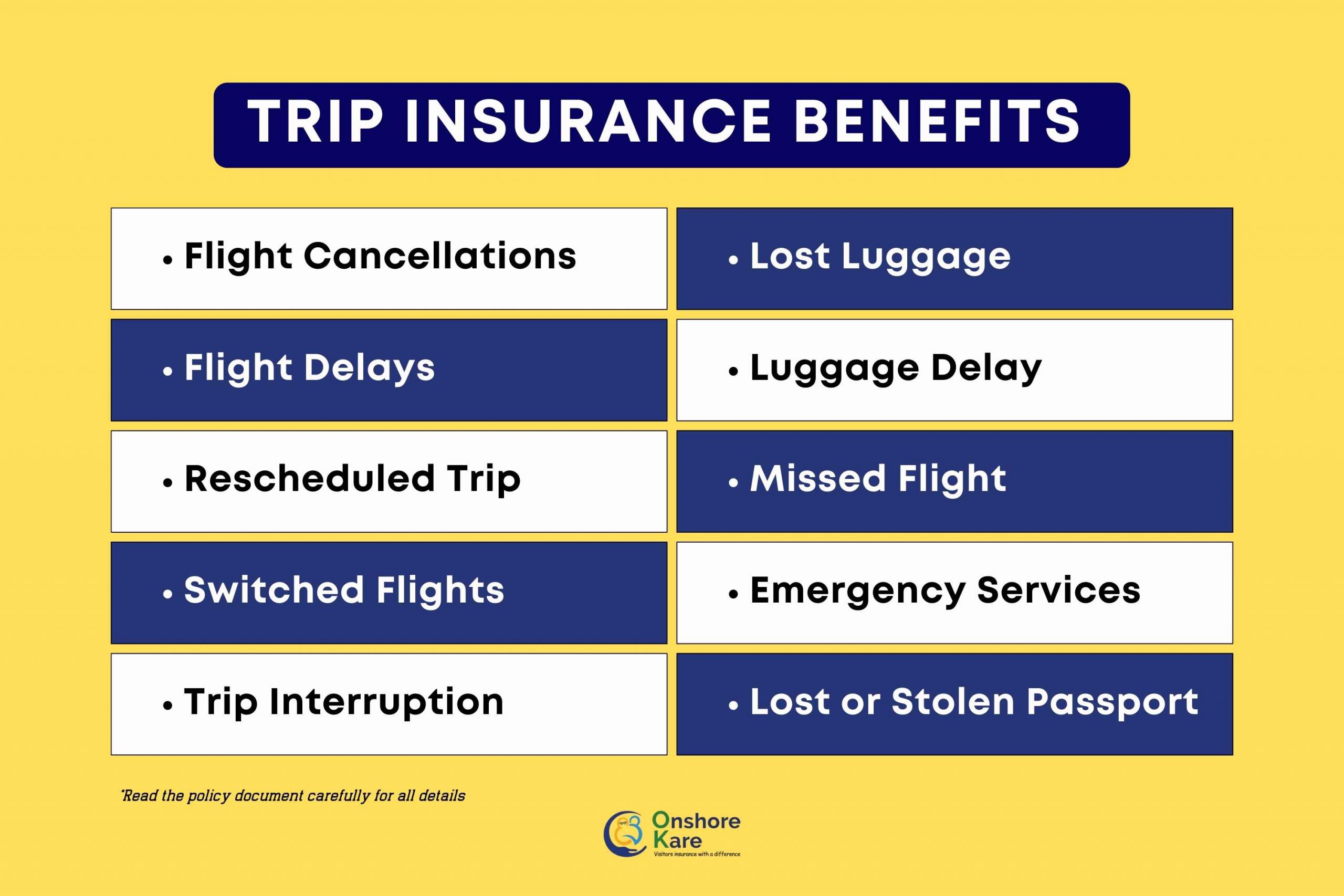

Travel insurance provides a safety net against various travel-related mishaps. It covers a wide range of situations, including medical emergencies, trip cancellations or interruptions, lost luggage, and even personal liability. By purchasing travel insurance, you gain access to medical care, assistance with travel disruptions, and financial reimbursement for covered losses.

The benefits of travel insurance extend beyond peace of mind. In certain countries, it's a legal requirement for visa applications, especially for study or work visas. Additionally, many popular travel destinations now encourage or require visitors to have valid travel insurance to cover potential medical expenses.

The Right Time to Purchase Travel Insurance

The optimal time to buy travel insurance often depends on your specific circumstances and the nature of your trip. Here’s a breakdown of when you should consider purchasing travel insurance:

For Domestic Travel

If you’re planning a trip within your home country, it’s best to purchase travel insurance as soon as you book your travel arrangements. This ensures that you’re covered for any unexpected events that might occur before your departure, such as a family emergency or a sudden illness.

Many domestic travel insurance policies offer trip cancellation coverage, which can be especially useful if you need to cancel your plans due to unforeseen circumstances. Additionally, having insurance in place can provide coverage for medical emergencies or travel inconveniences during your trip.

For International Travel

When it comes to international travel, purchasing travel insurance early is even more crucial. Here’s why:

- Visa Requirements: Many countries require travelers to have valid travel insurance to obtain a visa. Purchasing insurance well in advance ensures you meet these requirements and have the necessary documentation.

- Trip Cancellation and Interruption: International trips often involve more complex planning and higher costs. Travel insurance with trip cancellation and interruption coverage can protect your investment in case you need to cancel or cut your trip short due to unforeseen circumstances, such as a natural disaster or a family emergency.

- Medical Emergencies: International travel can expose you to unfamiliar environments and potential health risks. Travel insurance with comprehensive medical coverage ensures you have access to quality healthcare and covers any medical expenses incurred during your trip.

As a general rule, aim to purchase travel insurance within a few days of booking your international trip. This allows you ample time to review the policy, understand the coverage, and make any necessary adjustments before departure.

Considerations for Last-Minute Trips

In some cases, you might find yourself planning a trip at the last minute. If you’re short on time, here are some quick tips for buying travel insurance:

- Compare multiple policies online to find one that suits your needs and budget.

- Check if the policy has a retroactive coverage option, which covers certain events that occurred before the policy was purchased.

- Review the policy's terms and conditions, especially regarding trip cancellation and interruption coverage, to ensure you're protected for the specific reasons you might need to cancel.

Travel Insurance for Frequent Travelers

If you’re an avid traveler, you might consider investing in an annual travel insurance policy. These policies offer coverage for multiple trips throughout the year, providing convenience and cost savings. Annual policies are ideal for those who travel frequently, especially if their trips are of varying lengths and destinations.

Understanding Travel Insurance Policies

Now that we’ve covered the timing of purchasing travel insurance, let’s take a closer look at some key aspects of travel insurance policies to ensure you make an informed decision.

Policy Coverage and Limitations

When comparing travel insurance policies, pay close attention to the coverage and limitations. Different policies offer varying levels of protection, and it’s essential to choose one that aligns with your specific needs.

Key aspects to consider include:

- Medical Coverage: Ensure the policy provides adequate medical coverage, including emergency medical evacuation and repatriation.

- Trip Cancellation and Interruption: Verify the reasons for which trip cancellation and interruption coverage is provided, and ensure they cover the scenarios most relevant to your trip.

- Luggage and Personal Belongings: Check the policy's coverage for lost, stolen, or damaged luggage and personal items.

- Travel Delays: Understand the coverage for travel delays, including the duration and the reasons for which delays are covered.

- Adventure Activities: If your trip involves adventurous activities like skiing or scuba diving, ensure the policy covers these activities.

Policy Exclusions

Just as important as understanding what’s covered is knowing what’s not covered by your travel insurance policy. Common exclusions include:

- Pre-existing medical conditions: Many policies exclude coverage for medical conditions that existed before the policy was purchased. You might need to declare these conditions and pay an additional premium to be covered.

- High-risk activities: Certain adventure sports and activities, such as skydiving or motorcycling, may not be covered by standard policies. Additional premiums or specific adventure travel insurance might be required.

- Political unrest or natural disasters: Some policies exclude coverage for events related to political unrest, civil disturbances, or natural disasters.

Policy Terms and Conditions

Read the policy’s terms and conditions carefully to understand the fine print. This includes:

- The process for making a claim, including the required documentation and timelines.

- The policy's excess or deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in.

- The policy's duration and any limitations on coverage periods.

- Any additional benefits or services offered by the insurer, such as concierge services or travel assistance.

Travel Insurance and Pre-Existing Conditions

If you have a pre-existing medical condition, it’s crucial to disclose this information when purchasing travel insurance. Failure to do so could result in your claim being denied if a medical emergency arises related to the pre-existing condition.

Many travel insurance providers offer policies specifically designed for travelers with pre-existing conditions. These policies often come with a higher premium but provide the necessary coverage for medical emergencies related to the pre-existing condition.

Future Implications of Travel Insurance

The travel insurance industry is continuously evolving, and its future looks promising. Here are some key trends and developments to watch out for:

- Digitalization: The rise of digital technology has led to more efficient and convenient travel insurance processes. Insurers are investing in online platforms and mobile apps, allowing travelers to purchase policies, file claims, and access policy information easily.

- Personalized Policies: Insurers are developing more tailored policies to meet the unique needs of different traveler profiles. This includes policies for adventure travelers, luxury travelers, or those with specific health concerns.

- Increased Coverage for COVID-19: With the ongoing global health crisis, travel insurance providers are adapting their policies to include coverage for COVID-19-related travel disruptions and medical expenses. This trend is expected to continue, offering travelers more comprehensive protection.

- Enhanced Customer Service: Insurers are placing greater emphasis on customer service and support. This includes 24/7 assistance hotlines, multilingual services, and dedicated travel assistance teams to help travelers navigate any travel-related issues.

Conclusion

Travel insurance is a vital component of any well-planned trip. By understanding when to purchase travel insurance and choosing the right policy, you can ensure a worry-free journey. Remember, the optimal time to buy travel insurance depends on the nature of your trip and your personal circumstances. Whether you’re planning a domestic getaway or an international adventure, taking the time to invest in travel insurance is always a wise decision.

Frequently Asked Questions

Can I purchase travel insurance after I’ve started my trip?

+

While it’s possible to purchase travel insurance during your trip, it’s generally not recommended. Many policies have restrictions on when you can purchase insurance, and some might not provide coverage for pre-existing conditions or events that occurred before the policy was purchased. It’s best to buy travel insurance as soon as you book your trip to ensure comprehensive coverage.

What happens if I need to cancel my trip due to a family emergency?

+

If you have travel insurance with trip cancellation coverage, you might be eligible for reimbursement for your non-refundable trip costs. However, the reasons for cancellation must be covered by your policy, and you’ll typically need to provide documentation supporting your claim. It’s essential to review your policy’s terms and conditions to understand the specific requirements for trip cancellation claims.

Are there any situations where travel insurance is not necessary?

+

Travel insurance is generally recommended for all trips, especially international travel. However, if you’re traveling domestically and have comprehensive health insurance coverage that extends to your travel destination, you might not need travel insurance for medical emergencies. Nevertheless, travel insurance can still provide valuable coverage for trip cancellations, luggage loss, and other travel inconveniences.

How do I choose the right travel insurance policy for my needs?

+

When selecting a travel insurance policy, consider your specific travel plans and the potential risks associated with your trip. Evaluate the coverage limits, exclusions, and any additional benefits offered by the policy. Compare multiple policies to find one that provides adequate coverage at a reasonable cost. Don’t hesitate to reach out to insurance providers or brokers for guidance if needed.

Can I purchase travel insurance for a single trip, or is it only for multiple trips?

+

You can purchase travel insurance for both single trips and multiple trips. Single-trip policies are ideal for one-off journeys, while annual policies or multi-trip policies are suitable for frequent travelers who plan to take multiple trips within a year. The choice depends on your travel frequency and the type of coverage you require.