Where To Buy Renters Insurance

Renters insurance is an essential protection for tenants across the United States, offering coverage for personal belongings and liability. While many property management companies or landlords may not explicitly require it, renters insurance is a wise investment to safeguard against unexpected losses. This comprehensive guide will navigate you through the process of obtaining renters insurance, highlighting the best providers, coverage options, and tips to secure the most suitable policy for your needs.

Understanding Renters Insurance

Renters insurance provides financial protection for tenants in the event of theft, damage, or loss of personal property within a rental unit. It also covers liability for accidents that may occur within the rental property, ensuring you are not personally liable for any injuries or damages caused to others. This coverage is especially crucial as it protects your personal belongings and provides peace of mind, knowing you are insured against unforeseen circumstances.

Coverage Options

Renters insurance policies typically include coverage for personal property, liability, and additional living expenses. Personal property coverage reimburses you for the cost of replacing your belongings in case of theft, fire, or other covered perils. Liability coverage protects you if someone is injured in your rental unit or if your actions result in property damage elsewhere. Additional living expenses cover the cost of temporary accommodation if your rental unit becomes uninhabitable due to a covered incident.

Additionally, some renters insurance policies offer optional endorsements or riders to customize your coverage. These may include coverage for high-value items, such as jewelry or electronics, or additional liability protection. It's essential to review these options and choose the right coverage to match your specific needs.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the cost of replacing belongings after theft, fire, or other covered events. |

| Liability | Protects against legal claims and medical expenses if someone is injured on your rental property. |

| Additional Living Expenses | Covers temporary living costs if your rental becomes uninhabitable due to a covered incident. |

| Optional Endorsements | Customizable coverage for high-value items or additional liability protection. |

Top Renters Insurance Providers

When shopping for renters insurance, it's crucial to compare policies and prices from different providers to find the best coverage at an affordable rate. Here are some of the top renters insurance companies in the United States, along with their key features and offerings:

State Farm

State Farm is a leading provider of renters insurance, offering comprehensive coverage and personalized service. Their policies include personal property, liability, and additional living expenses coverage. State Farm also provides optional endorsements for high-value items and identity restoration services. With a strong focus on customer satisfaction, State Farm is an excellent choice for renters seeking reliable coverage and exceptional service.

Allstate

Allstate offers a wide range of renters insurance options, providing customizable coverage to meet individual needs. Their policies include standard personal property and liability coverage, as well as optional endorsements for high-value items, identity protection, and equipment breakdown. Allstate's online tools and mobile app make it convenient to manage your policy and file claims.

Geico

Geico is known for its competitive pricing and convenient online services. Their renters insurance policies include personal property, liability, and additional living expenses coverage. Geico also offers optional coverage for high-value items and identity theft protection. With a user-friendly website and mobile app, Geico makes it easy to purchase and manage your renters insurance policy.

Progressive

Progressive provides renters insurance through its independent agents, offering personalized coverage and local expertise. Their policies include personal property, liability, and additional living expenses coverage, with optional endorsements for high-value items and personal injury protection. Progressive's agents can help you tailor your policy to your specific needs and provide valuable guidance throughout the process.

Lemonade

Lemonade is a tech-forward insurance company that offers renters insurance with a unique, modern approach. Their policies are designed to be simple and affordable, with coverage for personal property, liability, and additional living expenses. Lemonade's innovative use of artificial intelligence and chatbots streamlines the insurance process, making it quick and efficient. They also offer optional coverage for high-value items and pet injuries.

Tips for Choosing the Right Renters Insurance

When selecting renters insurance, it's essential to consider your specific needs and circumstances. Here are some tips to help you choose the right policy:

- Assess your personal property value: Evaluate the value of your belongings to determine the appropriate level of coverage you need.

- Consider your liability risks: Evaluate the potential risks of accidents or injuries that may occur within your rental unit and choose a policy with adequate liability coverage.

- Compare coverage options: Review the coverage options offered by different providers, including personal property, liability, and additional living expenses, to find the best fit for your needs.

- Research endorsements: Explore the optional endorsements or riders available to customize your coverage, such as high-value item coverage or identity theft protection.

- Check for discounts: Many insurance providers offer discounts for bundling renters insurance with other policies, such as auto insurance. Explore these options to save money on your coverage.

- Read reviews and ratings: Research customer reviews and ratings to gauge the quality of service and satisfaction levels of different insurance providers.

- Work with an agent: Consider working with an insurance agent who can provide personalized advice and guide you through the process of selecting the right renters insurance policy.

How to Buy Renters Insurance

Purchasing renters insurance is a straightforward process, and you have several options to choose from:

Online

Most insurance providers offer online platforms where you can easily compare policies, get quotes, and purchase renters insurance. This convenient method allows you to shop for coverage from the comfort of your home and often provides the quickest way to secure a policy.

Through an Agent

Working with an insurance agent can provide valuable guidance and expertise. Agents can help you understand your coverage options, answer any questions you may have, and assist in selecting the best policy for your needs. They can also help you bundle renters insurance with other policies, such as auto insurance, to save money.

Directly from the Provider

You can also purchase renters insurance directly from the insurance provider, either through their website or by contacting their customer service team. This method may offer more personalized attention and the ability to tailor your policy to your specific needs.

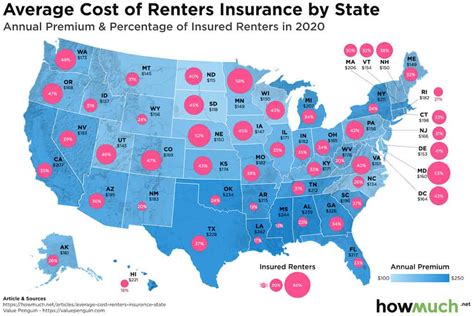

Renters Insurance Costs

The cost of renters insurance varies depending on several factors, including the location of your rental property, the value of your personal belongings, and the level of coverage you choose. On average, renters insurance policies cost between $15 and $30 per month, with some providers offering more affordable rates. It's essential to compare quotes from multiple providers to find the best coverage at the most competitive price.

Factors Affecting Renters Insurance Costs

Several factors influence the cost of renters insurance. Here are some key considerations:

- Location: The cost of renters insurance can vary significantly depending on the state and city where you live. Factors such as crime rates, natural disasters, and local laws can impact insurance rates.

- Coverage Amount: The value of your personal belongings and the level of coverage you choose will directly affect your insurance premium. Higher coverage limits will result in a higher premium.

- Deductible: Renters insurance policies typically have a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premium, but it means you'll pay more out of pocket in the event of a claim.

- Optional Endorsements: Optional endorsements or riders, such as coverage for high-value items or identity theft protection, can increase your insurance premium.

- Discounts: Many insurance providers offer discounts for bundling renters insurance with other policies, such as auto insurance. Additionally, some providers may offer discounts for certain occupations, good student grades, or safety features in your rental unit.

Renters Insurance Claims Process

In the event of a loss or damage to your personal property, it's important to understand the process for filing a renters insurance claim. Here's a step-by-step guide:

Steps to File a Renters Insurance Claim

- Contact Your Insurance Provider: Reach out to your insurance company as soon as possible after the incident to report the claim. Most providers have dedicated claims departments or agents who can guide you through the process.

- Provide Details: Gather and provide all relevant information about the incident, including dates, times, and any potential witnesses. Take photos or videos of the damage or loss to support your claim.

- Complete the Claim Form: Your insurance provider will likely send you a claim form to complete. Ensure you fill it out accurately and provide all the necessary details. Include a list of the damaged or lost items and their estimated value.

- Submit Supporting Documentation: Along with the claim form, you may need to submit additional documentation, such as receipts, appraisals, or police reports, depending on the nature of your claim.

- Wait for Claim Assessment: Your insurance provider will assess your claim based on the information provided. They may contact you for further details or to request additional documentation.

- Receive Claim Decision: Once the claim assessment is complete, your insurance provider will inform you of their decision. If your claim is approved, they will provide details on the payout amount and any necessary steps to receive the compensation.

Renters Insurance Frequently Asked Questions

What is the average cost of renters insurance per month?

+The average cost of renters insurance per month ranges from $15 to $30, depending on various factors such as location, coverage amount, and deductibles. It's important to compare quotes from different providers to find the best coverage at the most affordable price.

Do I need renters insurance if my landlord has insurance?

+While your landlord's insurance may cover the building itself, it does not cover your personal belongings or liability risks. Renters insurance is crucial to protect your possessions and ensure you are not personally liable for injuries or damages caused to others within your rental unit.

What is the difference between actual cash value and replacement cost coverage for personal property?

+Actual cash value coverage reimburses you for the cost of your belongings minus depreciation, while replacement cost coverage provides the full cost of replacing your items without deducting for depreciation. Replacement cost coverage is typically more expensive but offers better protection for your personal property.

Can I add my roommate to my renters insurance policy?

+Yes, many renters insurance policies allow you to add your roommate as an additional insured. This ensures that both you and your roommate are covered for personal property and liability risks. Check with your insurance provider for their specific policy regarding adding roommates.

How long does it take to process a renters insurance claim?

+The time it takes to process a renters insurance claim can vary depending on the complexity of the claim and the insurance provider's processes. Simple claims with clear documentation may be processed within a few days, while more complex claims can take several weeks. It's essential to keep in touch with your insurance provider throughout the process to ensure a timely resolution.

Renters insurance is an essential investment for tenants, providing peace of mind and financial protection in the event of unexpected losses or liability risks. By understanding the coverage options, comparing policies from top providers, and following the tips outlined in this guide, you can confidently choose the right renters insurance policy to meet your needs. Remember to regularly review and update your policy to ensure it aligns with your changing circumstances and continues to provide the coverage you require.