Where To Get Travel Insurance

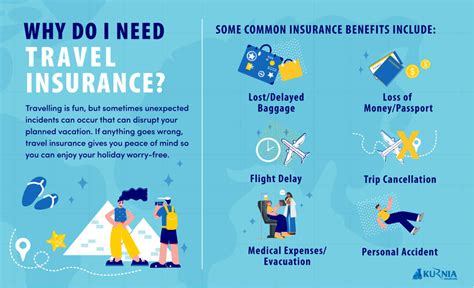

When planning a trip, one of the essential aspects to consider is travel insurance. It provides peace of mind and financial protection in case of unforeseen circumstances during your travels. While many people understand the importance of travel insurance, the question arises: where exactly can you purchase travel insurance coverage? This comprehensive guide aims to explore the various avenues for obtaining travel insurance, providing you with the knowledge to make an informed decision for your next adventure.

Understanding Travel Insurance

Before diving into the options, let’s first establish a clear understanding of travel insurance. Travel insurance is a specialized form of insurance that covers various risks and emergencies associated with traveling. It offers protection for unexpected events such as trip cancellations, medical emergencies, lost luggage, flight delays, and more. The coverage can vary depending on the policy and the provider, so it’s crucial to carefully review the terms and conditions.

Traditional Travel Agents

One of the oldest and most conventional methods of acquiring travel insurance is through a traditional travel agent. These agents, often well-established in the travel industry, have extensive knowledge and experience in arranging trips and providing travel-related services. When you book your trip through a travel agent, they can offer a range of insurance options tailored to your specific needs.

The advantage of obtaining travel insurance through an agent is their ability to provide personalized advice. They can guide you through the different policies, explain the coverage, and help you choose the best option for your trip. Additionally, travel agents often have partnerships with insurance companies, which may result in exclusive deals or additional benefits.

Key Considerations for Travel Agents:

- Research multiple agents to find one with a good reputation and expertise in travel insurance.

- Compare quotes and coverage details to ensure you get the best value for your money.

- Read reviews and seek recommendations to ensure a positive experience.

Online Travel Agencies

In today’s digital age, online travel agencies (OTAs) have become increasingly popular for booking flights, hotels, and vacation packages. These online platforms not only offer convenience but also provide a wide range of travel insurance options.

OTAs often collaborate with various insurance providers to offer comprehensive travel insurance packages. These packages can include coverage for medical emergencies, trip cancellations, baggage loss, and other travel-related incidents. The beauty of using an OTA is the ease of comparing different policies and their prices in one place.

Benefits of Online Travel Agencies:

- Quick and efficient process for comparing and purchasing insurance.

- Often more affordable options due to online pricing and competition.

- User-friendly interfaces make it easy to understand and customize your coverage.

Directly from Insurance Companies

An alternative approach is to purchase travel insurance directly from insurance companies specializing in travel coverage. These companies offer a wide range of policies tailored to different types of travelers and trips.

By dealing directly with the insurance provider, you gain access to their full range of products and services. You can discuss your specific needs and requirements with their representatives and receive expert advice on the most suitable policy for your trip. Additionally, purchasing directly from an insurance company often provides a more personalized experience and dedicated customer support.

Advantages of Dealing Directly:

- Access to specialized travel insurance products and expertise.

- Customizable policies to match your unique travel needs.

- Strong customer support and claims assistance.

Comparison Websites and Aggregators

For those who prefer a more comprehensive and comparative approach, travel insurance comparison websites and aggregators are an excellent resource. These platforms bring together a vast array of insurance providers, allowing you to easily compare policies, prices, and coverage options.

By using a comparison website, you can quickly filter and sort through different insurance plans based on your criteria. This helps you find the most suitable and cost-effective travel insurance for your trip. Additionally, these platforms often provide reviews and ratings from other travelers, offering valuable insights into the quality of the insurance providers.

Key Features of Comparison Websites:

- User-friendly interfaces for easy comparison and selection.

- Real-time quotes and immediate policy purchase options.

- Comprehensive information on coverage, exclusions, and policy details.

Specialized Travel Insurance Providers

Certain trips or travelers may have unique requirements that traditional insurance policies might not cover. In such cases, specialized travel insurance providers come into play.

Specialized providers offer policies tailored to specific needs, such as coverage for adventure sports, medical tourism, or travel for individuals with pre-existing medical conditions. These providers understand the unique risks associated with different types of travel and can provide comprehensive protection accordingly.

Examples of Specialized Insurance:

- Adventure travel insurance for extreme sports and high-risk activities.

- Medical travel insurance for those seeking medical treatment abroad.

- Gap year insurance for long-term travelers or students.

Employer-Provided Travel Insurance

In some fortunate cases, your employer may offer travel insurance as part of your employee benefits package. This is particularly common for businesses that frequently send their employees on business trips or for companies with a large number of international employees.

Employer-provided travel insurance often covers business-related trips and may include additional benefits tailored to the company's needs. It is worth checking with your human resources department or reviewing your employee handbook to explore this option.

Advantages of Employer-Provided Insurance:

- Often included in employee benefits, saving you the cost of purchasing insurance.

- Customized coverage to meet the specific needs of your company and role.

- Seamless integration with your business travel plans.

Government-Sponsored Travel Insurance

Certain countries offer government-sponsored travel insurance programs to their citizens when traveling abroad. These programs are designed to provide emergency medical assistance and repatriation services in case of unexpected health issues or accidents.

While these programs typically focus on medical coverage, they can be a valuable resource for travelers. It is important to research and understand the specific coverage and limitations of these programs before relying on them exclusively.

Examples of Government Programs:

- The Global Health Insurance Card (GHIC) in the United Kingdom, which provides access to state-provided medical treatment when visiting EU countries.

- The Medicare Overseas Program in Australia, offering emergency medical assistance to Australian citizens traveling overseas.

Group Travel Insurance

If you are planning a trip with a large group, such as a family vacation or a group tour, group travel insurance can be a cost-effective and convenient option.

Group travel insurance policies are designed to cover multiple travelers under one policy, often resulting in significant savings. These policies typically offer the same coverage as individual policies but with the added benefit of a discounted rate. Many travel agencies and insurance providers offer group travel insurance options, making it an accessible choice for group trips.

Benefits of Group Travel Insurance:

- Cost savings compared to individual policies.

- Simplifies the insurance process for group leaders or organizers.

- Provides peace of mind for the entire group.

Travel Credit Cards

Some travel credit cards come with built-in travel insurance benefits as an added incentive for cardholders. These benefits can vary widely, so it’s essential to review the terms and conditions of your specific card.

Travel credit cards often provide coverage for trip cancellations, delays, and interruptions, as well as baggage loss or damage. In some cases, they may also offer medical and emergency assistance benefits. However, it's crucial to note that these benefits usually have certain limitations and may not cover all aspects of your travel needs.

Key Considerations for Travel Credit Cards:

- Understand the specific coverage and limitations of your card’s insurance benefits.

- Consider using a travel credit card with higher-tier benefits for more comprehensive coverage.

- Remember that travel credit card insurance is often secondary to your primary travel insurance policy.

Choosing the Right Option for You

The decision of where to purchase travel insurance ultimately depends on your specific needs, preferences, and the nature of your trip. Here are some factors to consider when choosing the right avenue for your travel insurance coverage:

Your Trip Details:

Consider the length of your trip, the destination(s), and the activities you plan to engage in. Different trips may require different levels of coverage, so tailor your insurance choice accordingly.

Your Budget:

Insurance costs can vary widely, so set a budget and compare prices to find the best value for your money. Remember that the cheapest option may not always provide the coverage you need.

Ease of Purchase and Management:

Think about the convenience and simplicity of the purchasing process. Do you prefer a more personalized approach with an agent, or do you value the efficiency of online platforms? Consider what works best for your schedule and preferences.

Specific Coverage Needs:

If you have unique travel requirements or specific concerns, such as pre-existing medical conditions or adventure sports, ensure that your chosen provider offers specialized coverage options.

Customer Service and Claims Process:

Research the reputation and reliability of the insurance provider’s customer service and claims process. You want to ensure that you receive timely assistance and support if you need to make a claim.

Conclusion

Travel insurance is an essential aspect of responsible travel planning, and knowing where to obtain it is the first step towards a stress-free journey. Whether you opt for the personalized advice of a travel agent, the convenience of online platforms, or the specialized coverage of direct insurance providers, the key is to carefully evaluate your options and choose a policy that provides the protection you need. By doing so, you can embark on your travels with confidence, knowing that you are prepared for any unexpected twists and turns along the way.

FAQ

Can I get travel insurance after my trip has started?

+In most cases, travel insurance needs to be purchased before your trip commences. Some policies may offer limited coverage for emergencies that occur after the policy’s effective date, but it is best to purchase insurance well in advance to ensure comprehensive protection.

What happens if I need to make a claim during my trip?

+If you need to make a claim during your trip, you should contact your insurance provider’s emergency assistance number as soon as possible. They will guide you through the claims process and provide instructions on the necessary steps to take.

Are there any exclusions or limitations I should be aware of?

+Yes, it is crucial to carefully review the policy’s terms and conditions to understand any exclusions or limitations. These may include pre-existing medical conditions, high-risk activities, or specific destinations not covered by the policy. Always read the fine print to ensure you are aware of any restrictions.

Can I extend my travel insurance coverage while abroad?

+Some insurance providers offer the option to extend your coverage while you are abroad. However, it is essential to check with your provider in advance, as not all policies allow for extensions. Plan ahead and communicate with your insurer to ensure seamless coverage.