Which Car Insurance Is Cheapest

When it comes to finding the cheapest car insurance, it's essential to understand that the cost of insurance can vary significantly depending on numerous factors. While we can provide an in-depth analysis of these factors and offer insights into how to find the most affordable coverage, it's crucial to note that the "cheapest" insurance might not always be the best option for your specific needs. Let's delve into the world of car insurance to help you make an informed decision.

Understanding Car Insurance Costs

Car insurance premiums are influenced by a myriad of factors, and these can differ greatly from one person to another. Here are some key aspects that play a role in determining insurance costs:

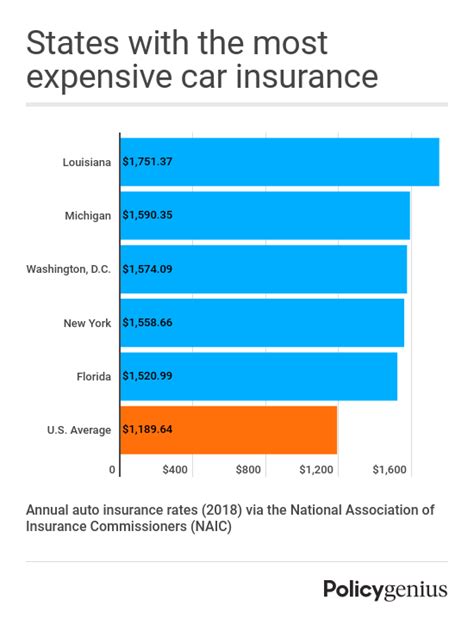

- Location: Insurance rates can vary based on where you live. Urban areas often have higher premiums due to increased traffic and potential for accidents.

- Age and Gender: Younger drivers, especially males, tend to be considered higher-risk, leading to higher insurance costs. As you age, rates generally decrease.

- Driving Record: A clean driving record with no accidents or violations can result in lower insurance premiums. On the other hand, a history of accidents or traffic violations may increase your rates significantly.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Sports cars and luxury vehicles typically have higher insurance premiums due to their value and potential for high-speed accidents.

- Coverage Type and Limits: The type of coverage you choose (e.g., liability-only vs. comprehensive) and the limits you set for each type of coverage will affect your premium. Higher coverage limits generally result in higher premiums.

- Insurance Company: Different insurance providers offer varying rates based on their assessment of risk and the services they provide.

Strategies to Find Affordable Car Insurance

Now that we’ve explored the factors influencing car insurance costs, let’s discuss some strategies to help you find the most affordable coverage without compromising on quality:

Shop Around and Compare Quotes

One of the most effective ways to save on car insurance is to compare quotes from multiple providers. Insurance companies use different methodologies to assess risk, so quotes can vary significantly. Online quote comparison tools can make this process more efficient and convenient.

Understand Your Coverage Needs

Before you start comparing quotes, it’s crucial to understand your specific coverage needs. Consider factors like the value of your vehicle, your driving habits, and any unique circumstances (e.g., frequent long-distance travel). This will help you tailor your coverage to ensure you’re not paying for unnecessary features.

Explore Discounts

Many insurance providers offer a variety of discounts to attract and retain customers. Common discounts include:

- Safe Driver Discounts: Insurers often reward drivers with clean records or those who have completed defensive driving courses.

- Multi-Policy Discounts: If you bundle your car insurance with other policies, such as home or renters insurance, you may be eligible for a discount.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can lead to loyalty discounts.

- Payment Plan Discounts: Some companies offer discounts for paying your premium in full or setting up automatic payments.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premium. However, it’s important to ensure that you can afford the higher out-of-pocket expense in the event of an accident or claim.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly reviewing your coverage and making adjustments as necessary can help ensure you’re not overpaying for unnecessary features. Additionally, it’s a good idea to shop around for new quotes every few years to see if you can find better rates elsewhere.

The Importance of Quality Coverage

While finding the cheapest car insurance is a valid goal, it’s equally important to ensure that your policy provides adequate coverage. Here are some key considerations:

- Liability Coverage: This is a critical aspect of your policy, as it protects you financially if you’re found at fault in an accident. Ensure you have sufficient liability limits to cover potential damages.

- Comprehensive and Collision Coverage: These coverages protect your vehicle from damages not related to accidents, such as theft, vandalism, or natural disasters. If your vehicle is still being financed, comprehensive and collision coverage may be required by your lender.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These coverages provide financial support for medical expenses resulting from an accident, regardless of fault. They can be crucial in ensuring you receive the necessary medical care without incurring significant out-of-pocket expenses.

The Role of Deductibles

When choosing a car insurance policy, understanding the concept of deductibles is essential. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Here’s a closer look at how deductibles work and their impact on your policy:

Understanding Deductibles

Deductibles are a crucial component of your insurance policy. They are typically set at the time you purchase your policy and can vary based on the type of coverage and the level of risk associated with your driving profile.

For example, a high-risk driver might be offered a policy with a higher deductible to offset the increased risk of claims. On the other hand, a low-risk driver might have the option to choose a lower deductible, providing more financial protection in the event of an accident.

Impact on Premium Costs

The choice of deductible can significantly impact your insurance premium. Generally, higher deductibles result in lower premiums, as you’re assuming more financial responsibility in the event of a claim. Conversely, lower deductibles can lead to higher premiums, as the insurance company is taking on more of the financial risk.

It’s important to strike a balance between a deductible that you’re comfortable paying out of pocket and a premium that fits your budget. While a high deductible might save you money on your monthly premium, it could be a significant financial burden if you need to make a claim.

Choosing the Right Deductible

When selecting a deductible, consider your financial situation and the potential risks associated with your driving habits. Ask yourself:

- Can I afford the higher deductible if I need to make a claim?

- Do I drive in areas with a higher risk of accidents or theft?

- Am I comfortable with a higher deductible to save on my monthly premium?

It’s also worth noting that some insurance companies offer flexible deductible options, allowing you to choose a higher deductible for certain types of coverage (e.g., comprehensive) while maintaining a lower deductible for other coverage types (e.g., collision). This can be a great way to customize your policy to your specific needs and budget.

The Future of Car Insurance: Usage-Based Insurance

The car insurance industry is evolving, and one of the most significant trends is the rise of Usage-Based Insurance (UBI) programs. These programs use telematics devices or smartphone apps to track driving behavior and offer insurance premiums based on actual driving habits rather than traditional risk factors.

How UBI Works

UBI programs use real-time data to assess driving behavior, including speed, acceleration, braking, and miles driven. This data is then used to calculate insurance premiums. Drivers who exhibit safe driving behaviors, such as maintaining a steady speed and avoiding sudden stops, may be eligible for lower premiums.

Some UBI programs also offer immediate feedback and rewards for safe driving. For example, an app might notify you when you’ve driven a certain number of miles without any harsh braking incidents, and offer a small discount or reward as an incentive to continue safe driving practices.

Benefits of UBI

UBI programs have the potential to revolutionize the car insurance industry by offering a more personalized and fair pricing model. Here are some key benefits:

- Fairer Pricing: UBI programs can offer more accurate pricing based on an individual’s driving habits, rather than generalizing based on demographic factors.

- Incentivizing Safe Driving: By offering immediate feedback and rewards, UBI programs encourage safer driving behaviors, potentially leading to fewer accidents and lower insurance costs for everyone.

- Reduced Administrative Costs: With real-time data collection, insurance companies can reduce administrative costs associated with traditional risk assessment methods.

The Bottom Line: Finding Affordable, Quality Car Insurance

While finding the cheapest car insurance is a valid goal, it’s important to strike a balance between affordability and quality coverage. By understanding the factors that influence insurance costs, exploring discounts, and tailoring your coverage to your needs, you can find a policy that provides the protection you need without breaking the bank.

Additionally, staying informed about emerging trends like Usage-Based Insurance can help you make more informed decisions about your car insurance and potentially save money in the long run. Remember, the key to affordable car insurance is a combination of smart shopping, understanding your coverage needs, and adopting safe driving habits.

Frequently Asked Questions

How often should I review my car insurance policy and shop for new quotes?

+

It’s recommended to review your car insurance policy and shop for new quotes at least once a year, or whenever your policy renews. This ensures you’re aware of any changes in coverage or premiums and gives you the opportunity to explore better deals.

Can I negotiate car insurance rates with my provider?

+

While car insurance rates are typically set based on standardized formulas, you can still negotiate with your provider. Discuss your driving record, any safety features in your vehicle, or other factors that might qualify you for a lower rate. It’s also worth asking about loyalty discounts if you’ve been with the same provider for a significant period.

What’s the difference between comprehensive and collision coverage?

+

Comprehensive coverage protects your vehicle from non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects, regardless of fault.

Are there any online tools to help me compare car insurance quotes more efficiently?

+

Yes, there are several online comparison tools available that can help you compare car insurance quotes from multiple providers in a matter of minutes. These tools typically ask for basic information about your vehicle, driving history, and desired coverage, and then provide you with a list of quotes to choose from.

What are some common mistakes to avoid when choosing car insurance?

+

Some common mistakes to avoid include solely focusing on the cheapest option without considering coverage quality, neglecting to review your policy annually, and failing to understand the impact of deductibles on your premium. It’s also important to ensure you have sufficient liability coverage to protect your assets in the event of an accident.