Which Is Better Term Life Insurance Or Whole Life Insurance

When it comes to financial planning and ensuring the well-being of your loved ones, understanding the differences between term life insurance and whole life insurance is crucial. These two types of life insurance policies offer distinct advantages and cater to different needs and life stages. In this comprehensive guide, we will delve into the intricacies of term life insurance and whole life insurance, providing you with the knowledge to make an informed decision.

Understanding Term Life Insurance

Term life insurance is a straightforward and cost-effective solution designed to provide financial protection for a specific period, known as the policy term. This type of insurance is particularly popular among individuals who are seeking coverage for a limited time frame, such as during their working years when financial obligations are at their peak.

Key Features of Term Life Insurance

Term life insurance policies typically offer the following characteristics:

- Coverage Period: Policies are available for various terms, ranging from 10 to 30 years, allowing individuals to choose a duration that aligns with their financial goals and responsibilities.

- Affordability: One of the biggest advantages of term life insurance is its low cost. Premiums are often more affordable compared to whole life insurance, making it an attractive option for those on a budget.

- Flexibility: Policyholders have the flexibility to select the coverage amount that suits their needs. This amount can be adjusted as their circumstances change over time.

- Renewability: Many term life insurance policies offer the option to renew the policy at the end of the term. However, it’s important to note that premiums may increase with age.

| Term Life Insurance Advantages |

|---|

| Cost-effective solution for young adults and families. |

| Provides financial protection during high-obligation periods. |

| Flexible coverage amounts and policy terms. |

Exploring Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a comprehensive financial product designed to provide coverage for the policyholder’s entire life. This type of insurance not only offers a death benefit but also accumulates cash value over time, making it a popular choice for those seeking long-term financial security and estate planning.

Key Features of Whole Life Insurance

Whole life insurance policies typically include the following features:

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for the policyholder’s entire life, ensuring peace of mind and financial protection regardless of age.

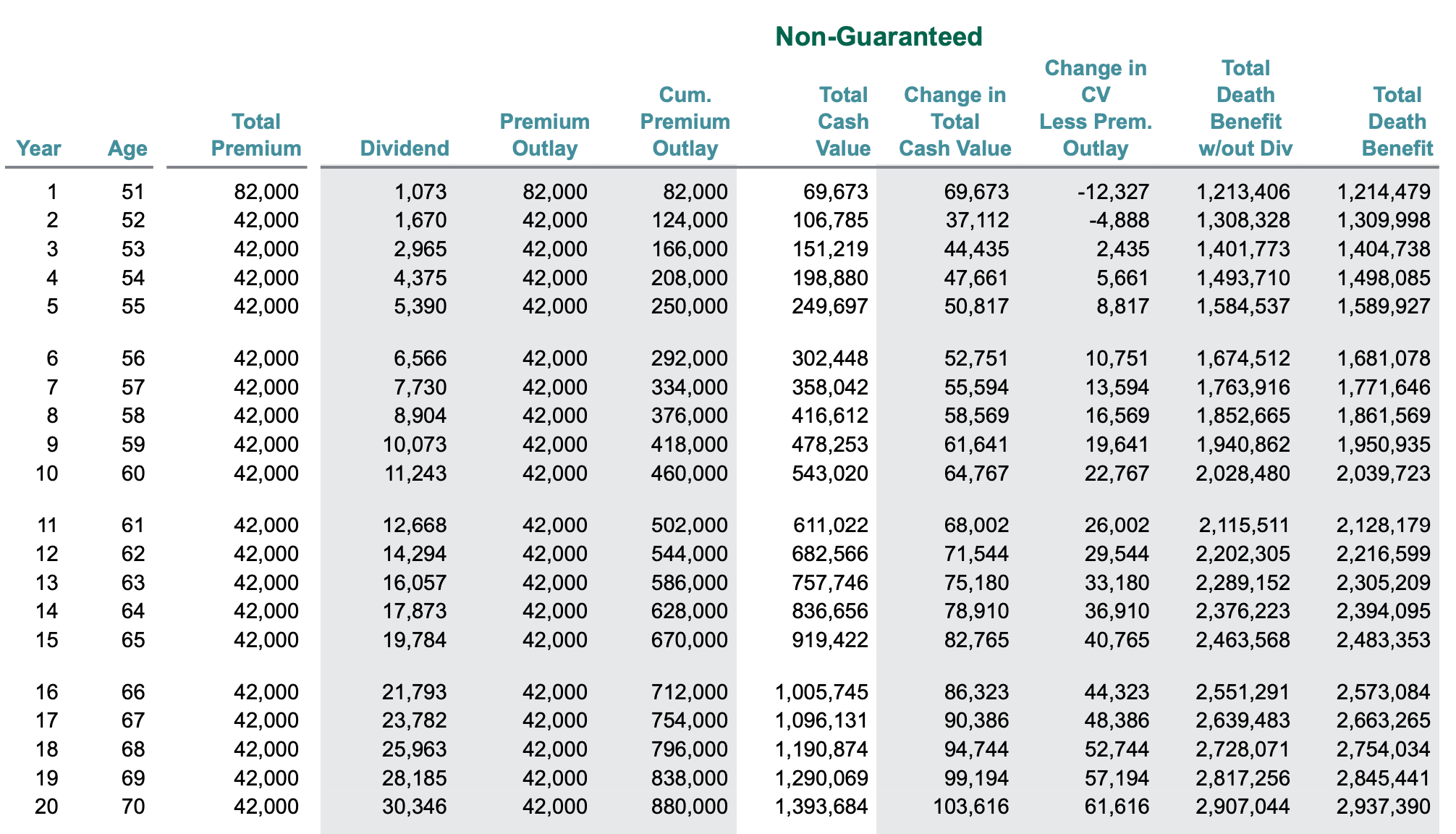

- Cash Value Accumulation: One of the unique aspects of whole life insurance is its cash value component. A portion of the premium goes towards building cash value, which can be borrowed against or withdrawn, offering flexibility for various financial needs.

- Guaranteed Premiums: Unlike term life insurance, whole life insurance offers stable and guaranteed premiums that remain consistent throughout the policy’s duration. This predictability is beneficial for long-term financial planning.

- Estate Planning: The cash value component of whole life insurance can be used to pay estate taxes, ensuring the smooth transfer of assets to heirs without financial burdens.

| Whole Life Insurance Advantages |

|---|

| Provides lifetime coverage and financial protection. |

| Builds cash value over time, offering flexible financial options. |

| Stable and guaranteed premiums for long-term planning. |

| Valuable for estate planning and wealth transfer. |

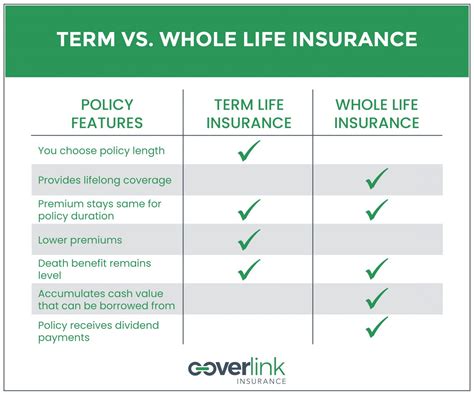

Comparing Term and Whole Life Insurance

The decision between term life insurance and whole life insurance depends on various factors, including your financial goals, life stage, and personal circumstances. Here’s a comparison to help you make an informed choice:

Cost and Coverage

Term life insurance is generally more affordable, making it accessible to a wider range of individuals. It provides coverage for a specific period, typically during high-obligation years, such as when you have a mortgage or young children. On the other hand, whole life insurance offers lifetime coverage and builds cash value, making it a more expensive option but with long-term benefits.

Flexibility and Needs

Term life insurance offers flexibility in terms of coverage amounts and policy terms. It is ideal for those with temporary financial obligations or those who want to secure their family’s future during their working years. Whole life insurance, with its cash value component, provides flexibility for various financial needs, such as borrowing against the policy or using it for estate planning.

Longevity and Peace of Mind

Whole life insurance is designed to provide coverage for the policyholder’s entire life, offering peace of mind and financial security regardless of age. This makes it a suitable choice for individuals who want to ensure their loved ones are protected even in their golden years. Term life insurance, while cost-effective, may require renewal or the purchase of a new policy as the initial term expires.

Investment and Returns

Whole life insurance policies accumulate cash value over time, which can be seen as an investment. This cash value can be used for various purposes, including borrowing against it or withdrawing it. Term life insurance, on the other hand, does not offer this investment component, as its primary focus is on providing pure insurance coverage.

Making the Right Choice

The decision between term life insurance and whole life insurance is a personal one and depends on your unique financial situation and goals. Here are some considerations to help you choose the right option:

- If you are seeking temporary coverage during high-obligation periods, term life insurance is a cost-effective solution.

- For those who want long-term financial security and peace of mind, whole life insurance provides lifetime coverage and the potential for investment through cash value accumulation.

- Consider your financial goals, family needs, and estate planning requirements when deciding between the two.

- Consult with a financial advisor or insurance professional to understand the nuances of each type of insurance and tailor a policy to your specific needs.

Conclusion

In summary, both term life insurance and whole life insurance have their advantages and cater to different life stages and financial goals. Term life insurance offers affordability and flexibility for temporary coverage, while whole life insurance provides lifetime protection and the potential for investment through cash value accumulation. By understanding your needs and consulting with experts, you can make an informed decision that ensures the financial well-being of yourself and your loved ones.

Can I switch from term life insurance to whole life insurance later in life?

+Yes, it is possible to switch from term life insurance to whole life insurance. However, it’s important to consider the age factor. As you get older, the cost of whole life insurance may increase significantly. It’s advisable to explore your options and consult with an insurance professional to find the best solution for your needs.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer have insurance protection. However, some term life policies offer conversion options, allowing you to convert your term policy into a whole life or permanent insurance policy without a medical exam. It’s essential to review your policy’s terms and conditions to understand your options.

Can I use the cash value of my whole life insurance policy for emergencies?

+Yes, the cash value of your whole life insurance policy can be used for various purposes, including emergencies. You can borrow against the cash value or withdraw a portion of it to cover unexpected expenses. However, it’s important to note that borrowing against the policy may impact the death benefit and potential future cash value growth.