Which Is Better Term Or Whole Life Insurance

Understanding Term and Whole Life Insurance: A Comprehensive Comparison

Choosing the right life insurance policy is a crucial decision that can have long-lasting financial implications. Two popular options that often come into consideration are term life insurance and whole life insurance. While both serve the fundamental purpose of providing financial protection, they differ significantly in their coverage, cost, and overall value proposition. This comprehensive guide will delve into the nuances of each type, helping you make an informed choice tailored to your specific needs and circumstances.

Life insurance is an essential component of financial planning, offering peace of mind and security to policyholders and their beneficiaries. It serves as a safety net, ensuring that loved ones are financially protected in the event of an untimely demise. The market offers a wide range of life insurance policies, each designed to cater to different needs and budgets. Among these, term life insurance and whole life insurance stand out as two of the most widely adopted options.

Term life insurance, as the name suggests, provides coverage for a specified term or period, typically ranging from 10 to 30 years. It is designed to offer affordable protection during key life stages, such as raising a family or paying off a mortgage. On the other hand, whole life insurance, also known as permanent life insurance, provides coverage for the policyholder's entire life, offering a death benefit and the potential for cash value accumulation.

Term Life Insurance: A Detailed Overview

Term life insurance is a straightforward and cost-effective solution for individuals seeking temporary financial protection. Here's a closer look at its key features and benefits:

Affordability and Flexibility

One of the most appealing aspects of term life insurance is its affordability. Premiums for term policies are generally much lower compared to whole life insurance, making it an attractive option for those on a budget. Additionally, term insurance offers flexibility in terms of coverage duration. Policyholders can choose a term that aligns with their specific needs, such as covering children’s education expenses or paying off a mortgage.

Simplicity and Ease of Understanding

Term life insurance policies are straightforward and easy to comprehend. The policyholder pays a fixed premium for a specified period, and in return, the beneficiary receives a guaranteed death benefit if the insured passes away during the term. There are no complex investment components or cash value accumulation, making it a simple and transparent product.

Tailored Coverage Options

Term life insurance allows policyholders to customize their coverage based on their evolving needs. For instance, if you require a larger death benefit during certain life stages, you can opt for a higher coverage amount during those years. This flexibility ensures that your insurance coverage remains aligned with your financial responsibilities.

| Term Life Insurance Benefits |

|---|

| Affordable premiums |

| Flexibility in coverage duration |

| Simple and easy to understand |

| Tailored coverage options |

Considerations for Term Life Insurance

While term life insurance offers numerous advantages, it’s essential to consider its limitations. As the name suggests, term policies have a finite coverage period. Once the term expires, the policyholder may need to renew the policy or opt for a new one, potentially facing higher premiums due to aging. Additionally, term life insurance does not provide any cash value or investment opportunities, which may be a drawback for those seeking long-term financial growth.

Whole Life Insurance: An In-Depth Analysis

Whole life insurance, also known as permanent life insurance, is a comprehensive and long-term financial protection solution. Unlike term insurance, whole life insurance provides coverage for the policyholder's entire life, offering a death benefit and the potential for cash value accumulation. Here's a detailed look at its features and benefits:

Guaranteed Protection for Life

One of the primary advantages of whole life insurance is its lifelong coverage. Once you purchase a whole life policy, you can rest assured that your beneficiaries will receive the death benefit whenever you pass away, regardless of your age or health condition at that time.

Cash Value Accumulation

Whole life insurance policies have a cash value component, which accumulates over time. This cash value acts as a savings account, growing tax-deferred until the policyholder decides to use it. Policyholders can borrow against this cash value or use it to pay premiums, providing financial flexibility and the potential for long-term wealth accumulation.

Consistent and Predictable Premiums

Whole life insurance policies offer consistent and predictable premiums. The premium amount remains the same throughout the policy’s lifetime, providing stability and peace of mind. This feature is particularly beneficial for those who prefer a fixed financial commitment and want to avoid the potential premium increases associated with term insurance as they age.

| Whole Life Insurance Benefits |

|---|

| Lifelong coverage |

| Cash value accumulation |

| Consistent and predictable premiums |

| Potential for tax-advantaged growth |

Considerations for Whole Life Insurance

While whole life insurance offers numerous benefits, it’s important to consider its potential drawbacks. Whole life insurance policies tend to have higher premiums compared to term insurance, which may not be feasible for everyone. Additionally, the cash value component may grow slowly, especially in the early years of the policy, and may not keep pace with other investment options.

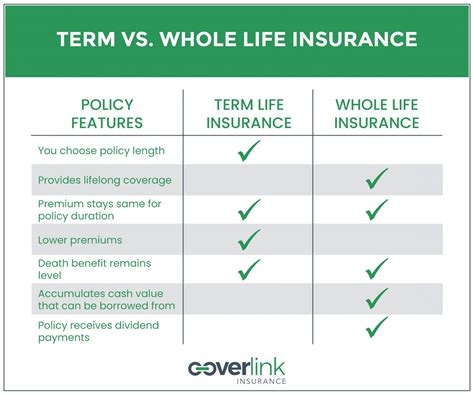

Comparative Analysis: Term vs. Whole Life Insurance

Now that we've explored the key features of term and whole life insurance, let's compare them side by side to help you make an informed decision:

Cost and Affordability

Term life insurance is generally more affordable than whole life insurance, making it an attractive option for those on a budget. The premiums for term insurance are lower, especially for younger individuals, as the coverage is temporary. On the other hand, whole life insurance requires higher premiums due to its lifelong coverage and cash value accumulation.

Coverage Duration

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This makes it ideal for individuals seeking temporary protection during specific life stages. In contrast, whole life insurance offers lifelong coverage, ensuring that your beneficiaries are protected regardless of your age or health condition.

Cash Value Accumulation

Whole life insurance policies have a cash value component that accumulates over time. This cash value can be used for various financial needs, such as borrowing against it or paying premiums. Term life insurance, on the other hand, does not offer any cash value accumulation, focusing solely on providing a death benefit.

Flexibility and Customization

Term life insurance offers flexibility in terms of coverage duration and amounts. Policyholders can choose the term and coverage amount that best suit their needs, allowing for customization as their circumstances change. Whole life insurance, while offering lifelong coverage, may not provide the same level of flexibility in terms of coverage amounts.

Investment Opportunities

Whole life insurance policies provide an opportunity for long-term investment and wealth accumulation through their cash value component. Policyholders can potentially benefit from tax-advantaged growth, making it an attractive option for those seeking both protection and investment potential. Term life insurance, on the other hand, does not offer any investment opportunities, focusing solely on providing a death benefit.

Choosing the Right Option: Term or Whole Life Insurance

The decision between term and whole life insurance depends on your individual circumstances, financial goals, and risk appetite. Here are some key factors to consider when making your choice:

Financial Situation and Goals

If you’re on a tight budget or have specific financial goals, term life insurance may be a more suitable option. Its affordability and flexibility make it an attractive choice for those seeking temporary protection. On the other hand, if you have a higher disposable income and are looking for long-term financial protection and investment potential, whole life insurance could be the better choice.

Coverage Needs

Consider your current and future coverage needs. If you require temporary protection during specific life stages, such as covering children’s education or paying off a mortgage, term life insurance is a viable option. However, if you’re looking for lifelong protection and want to ensure that your beneficiaries are financially secure regardless of your age or health condition, whole life insurance is the more appropriate choice.

Risk Appetite

Your risk appetite is another crucial factor to consider. Term life insurance provides straightforward protection without any investment components, making it a low-risk option. On the other hand, whole life insurance involves a higher level of risk due to its cash value accumulation and potential investment returns. If you’re comfortable with some risk and want the potential for long-term growth, whole life insurance may be a suitable choice.

Expert Insights and Recommendations

As an industry expert, I often recommend term life insurance for individuals seeking temporary protection during specific life stages. Its affordability and flexibility make it an excellent choice for those on a budget. However, for those with higher financial means and a long-term perspective, whole life insurance can provide comprehensive protection and the potential for wealth accumulation.

It's essential to note that both term and whole life insurance have their unique advantages and disadvantages. The key is to assess your specific needs, financial goals, and risk tolerance to make an informed decision. Consulting with a qualified financial advisor or insurance professional can also provide valuable insights and guidance tailored to your circumstances.

Conclusion: Making an Informed Decision

Choosing between term and whole life insurance is a significant financial decision that requires careful consideration. By understanding the key differences, advantages, and limitations of each type, you can make an informed choice that provides the best protection for you and your loved ones. Remember, your financial goals, coverage needs, and risk appetite are unique, so tailor your decision accordingly.

Whether you opt for term life insurance's affordability and flexibility or whole life insurance's lifelong coverage and potential for wealth accumulation, ensuring you have adequate life insurance coverage is a responsible step towards securing your family's financial future. Take the time to review your options, seek expert advice, and make a decision that aligns with your long-term financial goals.

Can term life insurance be renewed after the term expires?

+Yes, many term life insurance policies offer the option to renew the coverage at the end of the term. However, the premiums may increase significantly due to aging, and the coverage may be subject to certain limitations.

Is whole life insurance suitable for retirement planning?

+Whole life insurance can be a part of retirement planning, especially for those seeking a stable and predictable source of income. The cash value accumulation can be used to supplement retirement funds or pay for retirement expenses.

Can I convert my term life insurance to whole life insurance?

+In some cases, you may have the option to convert your term life insurance policy to a whole life insurance policy. This conversion typically occurs within a specified period, such as during the first few years of the term, and may be subject to certain conditions and additional costs.