Which Is The Best Auto Insurance

Choosing the right auto insurance can be a complex decision, as it involves navigating through a myriad of options and understanding the nuances of coverage to ensure you get the best protection for your vehicle and financial well-being. This comprehensive guide aims to provide an in-depth analysis of the auto insurance landscape, helping you make an informed choice.

Understanding Auto Insurance Coverage

Auto insurance, often referred to as car insurance, is a contract between you and an insurance provider that provides financial protection against various types of losses and liabilities arising from the use of your vehicle. The primary purpose of this coverage is to safeguard you from the financial burden that may result from an accident, theft, or other types of vehicle-related incidents.

Key Components of Auto Insurance

Every auto insurance policy consists of several components, each serving a specific purpose. These include:

- Liability Coverage: This covers the cost of damage or injury you cause to others in an accident. It’s typically split into two categories: Bodily Injury Liability and Property Damage Liability.

- Collision Coverage: This pays for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This covers losses from incidents other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): These cover medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

The exact coverage and limits you choose will depend on your individual needs, the value of your vehicle, and the laws in your state. It's crucial to strike a balance between affordability and adequate coverage to ensure you're protected in a variety of scenarios.

Factors to Consider When Choosing an Auto Insurance Provider

Selecting the best auto insurance provider involves more than just comparing prices. Here are some key factors to keep in mind:

Reputation and Financial Stability

Opt for an insurance company with a solid reputation and a strong financial standing. This ensures that the company will be able to pay out claims even in the event of significant losses across their policyholders. Check reviews and ratings from independent sources to get an unbiased perspective.

Coverage Options and Customization

Different providers offer varying levels of coverage and customization options. Some may specialize in providing comprehensive coverage for specific types of vehicles or drivers, while others may excel in offering customizable policies to meet individual needs. Consider your unique circumstances and choose a provider that can accommodate your requirements.

Pricing and Discounts

While price is an important factor, it shouldn’t be the sole deciding factor. Compare prices from multiple providers to ensure you’re getting a competitive rate. Additionally, look for discounts that you may be eligible for, such as those for safe driving, multiple policies, or specific professions.

Customer Service and Claims Handling

In the event of an accident or claim, you’ll want an insurance provider that offers efficient and responsive customer service. Consider factors like the ease of contacting the company, their response times, and the overall satisfaction of their customers with the claims process.

Digital Tools and Resources

In today’s digital age, many insurance companies offer online or mobile tools to manage your policy, track claims, and access important documents. These tools can greatly enhance your experience and convenience, so consider providers that offer robust digital resources.

Evaluating Top Auto Insurance Providers

Now, let’s delve into a detailed analysis of some of the top auto insurance providers in the market, evaluating them based on the factors outlined above.

State Farm

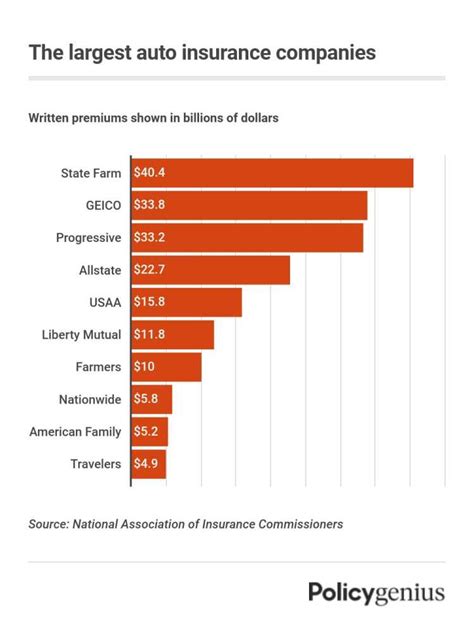

State Farm is one of the largest auto insurance providers in the United States, known for its comprehensive coverage options and strong financial stability. They offer a wide range of discounts, including those for safe driving, multiple policies, and good grades for students.

In terms of customer service, State Farm receives high marks for its responsive claims handling and easy-to-use digital tools. They also provide a range of educational resources to help customers better understand their coverage.

GEICO

GEICO is another leading auto insurance provider, renowned for its competitive pricing and extensive discount offerings. They cater to a wide range of drivers, including those with clean records, high-risk drivers, and those looking for specialized coverage.

GEICO’s digital tools are highly praised for their ease of use and functionality. They also offer a unique “GEICO Mobile” app that allows customers to manage their policies, view ID cards, and report claims directly from their smartphones.

Progressive

Progressive is a well-known provider that offers a variety of coverage options and customizable policies. They’re particularly known for their “Name Your Price” tool, which allows customers to set their desired price range and then customize a policy to fit that budget.

Progressive also offers a wide range of discounts, including those for safe driving, multiple policies, and vehicle safety features. Their claims process is efficient and they provide a dedicated claims specialist to each customer, ensuring personalized attention.

Allstate

Allstate is a comprehensive auto insurance provider that offers a range of coverage options, including specialized policies for classic cars and ride-sharing drivers. They’re known for their innovative tools, such as the “Drivewise” program, which rewards safe driving habits with discounts.

Allstate provides extensive educational resources to help customers understand their coverage and offers a dedicated claims team to assist with the claims process.

USAA

USAA is a provider that exclusively serves active military personnel, veterans, and their families. They’re known for their exceptional customer service and comprehensive coverage options. USAA consistently receives high ratings for customer satisfaction and offers competitive rates.

Their digital tools are highly praised for their functionality and ease of use, allowing policyholders to manage their policies and access important documents with ease.

Comparative Analysis: Which Provider is the Best Fit for You?

The “best” auto insurance provider depends on your unique circumstances and needs. Here’s a breakdown of the key strengths of each provider mentioned above:

| Provider | Key Strengths |

|---|---|

| State Farm | Strong financial stability, comprehensive coverage options, and responsive customer service. |

| GEICO | Competitive pricing, extensive discount offerings, and user-friendly digital tools. |

| Progressive | Customizable policies, the "Name Your Price" tool, and efficient claims handling with dedicated claims specialists. |

| Allstate | Innovative tools like "Drivewise," specialized coverage options, and extensive educational resources. |

| USAA | Exceptional customer service, comprehensive coverage tailored to military personnel and their families, and highly functional digital tools. |

Future Trends in Auto Insurance

The auto insurance industry is evolving, with several emerging trends that are set to shape the future of coverage. Here are some key trends to watch:

Usage-Based Insurance (UBI)

UBI, also known as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD), is a type of auto insurance policy where the cost of coverage is determined by how, when, and where you drive. This is often facilitated by telematics devices installed in the vehicle or through smartphone apps that track driving behavior.

UBI policies offer the potential for significant savings for safe drivers and can help promote safer driving habits. As technology advances, we can expect to see more providers offering UBI policies and refining their approaches to data collection and analysis.

Telematics and Data Analytics

Telematics and data analytics are playing an increasingly important role in the auto insurance industry. By collecting and analyzing driving data, insurance providers can more accurately assess risk and tailor policies to individual driving behaviors.

This technology also enables providers to offer more precise and personalized coverage, potentially reducing costs for safe drivers while ensuring adequate coverage for those with higher risk profiles.

Enhanced Digital Tools and Experiences

Insurance providers are investing heavily in digital transformation, aiming to enhance the customer experience through improved digital tools and resources. This includes mobile apps for policy management, claims reporting, and access to important documents, as well as online platforms for policy customization and quote generation.

As technology advances, we can expect to see even more sophisticated digital tools that further streamline the insurance experience and provide greater convenience for policyholders.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles (AVs) is set to have a significant impact on the auto insurance industry. As AV technology advances and becomes more widespread, insurance providers will need to adapt their coverage models to accommodate the unique risks and benefits associated with these vehicles.

This may include new coverage options, such as policies that cover the vehicle’s autonomous systems or liability coverage for manufacturers. It’s an exciting yet complex area of development, and insurance providers will need to stay agile to keep pace with these technological advancements.

Conclusion

Choosing the best auto insurance involves a careful evaluation of your individual needs, the reputation and financial stability of providers, the coverage and customization options they offer, their pricing and discount structures, and their customer service and claims handling processes. It’s a decision that requires thorough research and consideration.

As the auto insurance landscape continues to evolve, it’s important to stay informed about emerging trends and advancements. Whether it’s the rise of usage-based insurance, the increasing role of telematics and data analytics, the enhancement of digital tools, or the impact of autonomous vehicles, understanding these trends can help you make more informed choices about your auto insurance coverage.

Remember, the “best” auto insurance provider is the one that aligns with your specific needs and provides the coverage and service you require at a competitive price. By staying informed and keeping an eye on industry developments, you can ensure you’re always getting the best value for your insurance dollar.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance varies greatly depending on various factors such as your location, driving record, age, and the type of vehicle you drive. According to recent data, the national average cost of car insurance is around 1,674 per year, or about 140 per month. However, this is just an average, and your actual cost could be significantly higher or lower depending on your individual circumstances.

How can I get cheaper auto insurance rates?

+

There are several strategies you can employ to reduce your auto insurance rates. These include shopping around and comparing quotes from multiple providers, maintaining a clean driving record, taking advantage of discounts (such as those for safe driving, multiple policies, or vehicle safety features), increasing your deductible, and considering usage-based insurance policies that reward safe driving habits.

What factors do auto insurance providers consider when determining rates?

+

Auto insurance providers consider a variety of factors when determining rates, including your age, gender, marital status, driving record, credit score, the type of vehicle you drive, and the location where you primarily drive. They also take into account the level of coverage you choose and any discounts or add-ons you opt for.

What is the difference between liability coverage and collision coverage in auto insurance?

+

Liability coverage in auto insurance protects you financially if you’re found at fault in an accident, covering the cost of damage or injury you cause to others. Collision coverage, on the other hand, pays for the repair or replacement of your own vehicle if it’s damaged in an accident, regardless of fault. While liability coverage is typically required by law, collision coverage is optional but highly recommended to ensure you’re fully protected.

What should I do if I’m involved in an accident and need to file an insurance claim?

+

If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Contact the police to report the accident and obtain a police report. Exchange information with the other driver(s) and take photos of the accident scene and any damage to vehicles. As soon as possible, contact your insurance provider to report the accident and begin the claims process. Follow their instructions and provide any necessary documentation to ensure a smooth and timely resolution.