Who Has The Cheapest Car Insurance In Texas

When it comes to car insurance in Texas, finding the cheapest rates can be a daunting task, as the market is highly competitive with numerous providers offering a wide range of coverage options. The cost of car insurance varies significantly based on several factors, including the driver's age, driving history, location, and the type of vehicle insured. In this comprehensive guide, we will delve into the world of car insurance in Texas, exploring the key factors that influence rates, highlighting the top providers, and providing valuable insights to help Texans secure the most affordable coverage.

Understanding the Cost of Car Insurance in Texas

Texas is known for its diverse population and vast geographic areas, which can greatly impact insurance rates. Several key factors contribute to the cost of car insurance in the Lone Star State. These include:

- Driver's Profile: Age, gender, and driving history play a significant role in determining insurance rates. Young drivers, especially males under the age of 25, often face higher premiums due to their perceived higher risk of accidents. Conversely, mature drivers with a clean driving record and extensive experience can enjoy more affordable rates.

- Location: Where you live in Texas can impact your insurance costs. Urban areas like Houston, Dallas, and Austin tend to have higher rates due to increased traffic, congestion, and the potential for accidents. Rural areas, on the other hand, may offer more affordable rates due to lower population density and reduced traffic.

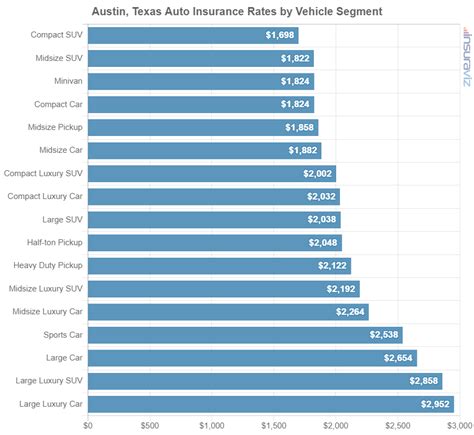

- Vehicle Type and Usage: The make, model, and year of your vehicle can influence insurance rates. High-performance sports cars and luxury vehicles generally come with higher insurance costs due to their value and potential for costly repairs. Additionally, the purpose of your vehicle, such as personal use, business travel, or commuting, can also impact your rates.

- Coverage Options: The type and level of coverage you choose directly affect your insurance premiums. Liability-only coverage, which is the minimum required by law in Texas, is typically more affordable than comprehensive coverage, which includes additional protections like collision, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- Deductibles and Discounts: Opting for higher deductibles can lower your insurance premiums, as you agree to pay more out-of-pocket in the event of a claim. Furthermore, taking advantage of available discounts, such as safe driver discounts, multi-policy discounts, or good student discounts, can significantly reduce your overall insurance costs.

Top Car Insurance Providers in Texas

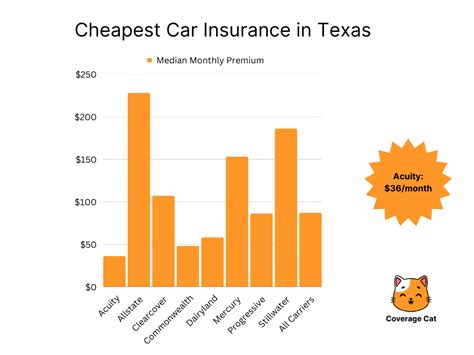

Texas is home to numerous insurance providers, each offering unique coverage options and pricing structures. Here are some of the top providers in the state, along with their average rates and notable features:

| Insurance Provider | Average Annual Premium | Notable Features |

|---|---|---|

| State Farm | $980 | Offers a wide range of coverage options, including comprehensive and collision coverage, as well as specialized programs for classic car enthusiasts and young drivers. Provides a user-friendly online platform for policy management and claims processing. |

| GEICO | $1,020 | Known for its competitive rates and extensive discount options, including good student, military, and emergency deployment discounts. Provides 24/7 customer support and offers digital tools for easy policy management. |

| Progressive | $1,150 | Specializes in customizable coverage options, allowing drivers to tailor their policies to their specific needs. Offers innovative features like Snapshot, which tracks driving behavior to potentially reduce premiums. Provides online tools for easy policy comparisons and adjustments. |

| Allstate | $1,250 | Provides a comprehensive range of coverage options, including liability, collision, and comprehensive coverage, as well as unique offerings like roadside assistance and rental car reimbursement. Offers the "Name Your Price" tool, allowing drivers to set their desired premium and find a suitable coverage plan. |

| USAA | $880 (for military members and their families) | Exclusively serves military members, veterans, and their families, offering highly competitive rates and comprehensive coverage. Provides specialized programs like the Young Driver Program, which helps young drivers develop safe driving habits and potentially reduce premiums. |

It's important to note that these average rates are for illustrative purposes only and may not reflect the actual rates you receive. Insurance premiums can vary significantly based on individual factors and the specific coverage options chosen. To find the cheapest car insurance in Texas, it's essential to compare quotes from multiple providers and tailor your coverage to your unique needs.

Tips for Securing Affordable Car Insurance in Texas

Here are some practical tips to help Texans find the most affordable car insurance:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools can be especially helpful in quickly assessing various options.

- Understand Your Coverage Needs: Assess your unique requirements and choose the coverage options that best fit your needs. Consider the value of your vehicle, your driving habits, and any additional protections you may require.

- Explore Discounts: Take advantage of available discounts, such as safe driver, good student, multi-policy, and loyalty discounts. Many providers offer additional discounts for specific occupations or membership affiliations.

- Maintain a Clean Driving Record: A clean driving history can significantly impact your insurance rates. Avoid traffic violations and at-fault accidents to keep your premiums as low as possible.

- Consider Higher Deductibles: Opting for higher deductibles can lower your insurance premiums. However, ensure you can afford the out-of-pocket expense in the event of a claim.

- Bundle Policies: Combining multiple insurance policies, such as auto and home insurance, can often result in significant discounts and lower overall costs.

- Review and Adjust Your Policy Regularly: Periodically review your insurance policy to ensure it still meets your needs. As your circumstances change, you may be able to adjust your coverage or switch providers to secure more affordable rates.

Future Implications and Industry Insights

The car insurance market in Texas is constantly evolving, and several trends and developments are shaping the industry’s future:

- Telematics and Usage-Based Insurance (UBI): The increasing adoption of telematics and UBI programs allows insurance providers to track driving behavior and offer personalized premiums based on actual driving habits. This technology is expected to become more prevalent, offering drivers the opportunity to lower their insurance costs by demonstrating safe driving practices.

- Digitalization and Online Platforms: The shift towards digital insurance platforms and online policy management is expected to continue. Insurance providers are investing in innovative technologies to enhance customer experiences, streamline claims processes, and offer more convenient and efficient services.

- Autonomous Vehicles and Safety Innovations: The emergence of autonomous vehicles and advanced safety features is likely to impact insurance rates. As these technologies become more widespread, they may lead to reduced accident rates and potentially lower insurance costs.

- Regulatory Changes: The Texas Department of Insurance continuously monitors and regulates the insurance industry to protect consumers. Any changes in regulations or laws can impact insurance rates and coverage options, so it's essential to stay informed and aware of any upcoming changes.

By staying informed about industry trends and taking advantage of the available resources and technologies, Texans can continue to secure affordable and comprehensive car insurance coverage.

Conclusion

Finding the cheapest car insurance in Texas requires a comprehensive understanding of the market, your unique needs, and the available options. By comparing quotes, understanding the factors that influence rates, and taking advantage of discounts and tailored coverage options, Texans can secure affordable insurance while maintaining the necessary level of protection. As the industry continues to evolve, staying informed and adapting to new technologies and trends will be key to making the most of the competitive car insurance market in Texas.

What is the minimum car insurance coverage required in Texas?

+Texas requires drivers to carry at least 30,000 in bodily injury liability coverage per person, 60,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage. This is known as the 30/60/25 rule.

How can I lower my car insurance premiums if I have a poor driving record?

+If you have a poor driving record, you may still be able to lower your premiums by taking defensive driving courses, which can improve your driving skills and potentially reduce your insurance costs. Additionally, maintaining a clean driving record going forward and opting for higher deductibles can also help lower your premiums.

Are there any car insurance providers that specialize in insuring high-risk drivers in Texas?

+Yes, there are insurance providers in Texas that specialize in insuring high-risk drivers. These providers typically offer non-standard insurance policies with higher premiums but can provide coverage to drivers who may have difficulty obtaining insurance elsewhere. It’s important to shop around and compare quotes to find the most affordable option for your specific circumstances.