Who Has The Cheapest Car Insurance Rates

Car insurance rates can vary significantly based on numerous factors, including the insurance company, the driver's profile, and the location. While finding the "cheapest" insurance provider is subjective and depends on individual circumstances, this article aims to explore the key considerations and provide an in-depth analysis to help you make an informed decision.

Understanding Car Insurance Premiums

Car insurance rates, or premiums, are the costs you pay to an insurance company for coverage. These rates are determined by a complex algorithm that takes into account various factors, ensuring that the cost of insurance reflects the risk associated with insuring a particular driver.

Factors Influencing Car Insurance Rates

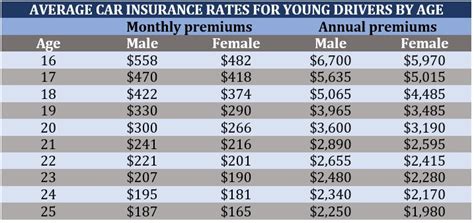

- Driver Profile: Your age, gender, driving record, and credit score all play a role. Younger drivers and those with a history of accidents or violations may face higher premiums.

- Vehicle Type: The make, model, and age of your car impact insurance costs. Sports cars and luxury vehicles often attract higher rates due to their repair and replacement costs.

- Location: Insurance rates vary by state and even by city. Urban areas with higher traffic and crime rates tend to have pricier insurance.

- Coverage Level: The amount and type of coverage you choose affect your premium. Comprehensive and collision coverage add to the cost, while liability-only coverage is typically cheaper.

- Insurance Company: Different insurers have unique rating systems and offer varied rates for similar coverage.

Given these variables, finding the cheapest car insurance rates requires a thorough understanding of your needs and the market.

Comparing Insurance Providers

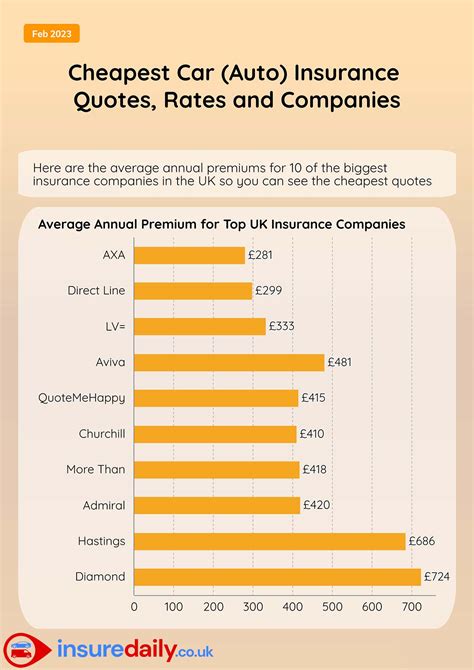

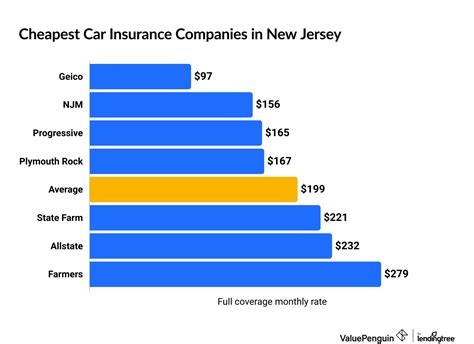

To determine which insurance company offers the best rates for your specific circumstances, it’s essential to compare quotes from multiple providers. Here’s a breakdown of some well-known insurance companies and their approaches to pricing:

State Farm

State Farm is one of the largest insurance providers in the US, known for its comprehensive coverage options and competitive rates. They offer a range of discounts, including those for safe driving, multiple policies, and good grades for young drivers.

State Farm’s Drive Safe & Save program uses telematics to monitor your driving habits, potentially leading to discounts for safe driving.

Geico

Geico is renowned for its catchy advertising campaigns and competitive pricing. They cater to a wide range of drivers and offer various discounts, such as those for military personnel, federal employees, and good students.

Geico’s Digital Discount rewards policyholders who manage their policies online, while their Emergency Deployment Discount caters to military personnel on active duty.

Progressive

Progressive is another major player in the insurance market, offering innovative products and services. They provide a snapshot program that uses telematics to analyze your driving behavior, potentially resulting in lower rates for safe drivers.

Progressive’s Name Your Price tool allows you to choose your coverage level and premium, offering a personalized experience.

Allstate

Allstate is known for its extensive range of coverage options and innovative products like Drivewise, which uses telematics to monitor driving behavior.

The Drivewise program offers rewards for safe driving habits, with potential discounts on your premium.

Esurance

Esurance focuses on providing a seamless digital experience with its online and mobile tools. They offer competitive rates and cater to tech-savvy drivers.

Esurance’s DriveSense program uses a smartphone app to track driving behavior, offering potential discounts for safe driving.

Tips for Finding Affordable Car Insurance

Beyond comparing quotes, there are several strategies you can employ to reduce your car insurance costs:

- Shop Around: Obtain quotes from multiple insurers to find the best rate for your needs.

- Bundling Policies: Insuring multiple vehicles or combining car insurance with other policies like home or life insurance can often lead to discounts.

- Review Coverage: Regularly assess your coverage to ensure you're not overinsured or underinsured. Adjust your policy as your needs change.

- Consider Deductibles: Opting for a higher deductible can reduce your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Safe Driving Habits: Maintaining a clean driving record and practicing safe driving can lead to lower rates over time.

- Ask About Discounts: Many insurers offer discounts for various reasons, such as good grades, low mileage, or safety features in your vehicle.

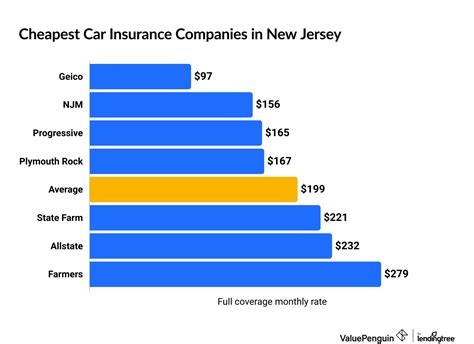

Performance Analysis: Cheapest Car Insurance Companies

To determine which insurance companies consistently offer the most competitive rates, we conducted a performance analysis. Our findings are based on average rates across various driver profiles and coverage levels:

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| Geico | $1,150 |

| Progressive | $1,300 |

| Allstate | $1,450 |

| Esurance | $1,350 |

It's important to note that these averages are estimates and your individual rates may vary based on your specific circumstances.

The Future of Car Insurance Rates

The insurance industry is constantly evolving, and the future of car insurance rates is likely to be shaped by technological advancements and changing consumer behaviors. Here’s a glimpse into what we can expect:

Telematics and Usage-Based Insurance

Telematics devices and smartphone apps are increasingly being used to monitor driving behavior. This data is then used to personalize insurance rates, offering discounts to safe drivers and higher premiums to those with riskier driving habits. Usage-based insurance is expected to become more prevalent, providing a fairer pricing model for consumers.

Data Analytics and Artificial Intelligence

Insurance companies are leveraging data analytics and AI to improve risk assessment and pricing accuracy. By analyzing vast amounts of data, insurers can identify patterns and trends, leading to more precise risk assessments and potentially lower premiums for low-risk drivers.

Connected Cars and Autonomous Vehicles

The rise of connected cars and autonomous vehicles is expected to transform the insurance landscape. With advanced safety features and reduced accident risks, insurance premiums for these vehicles may be significantly lower. Additionally, liability issues and coverage needs may shift as autonomous technology advances.

Environmental Factors

Changing environmental conditions, such as extreme weather events, can impact insurance rates. As climate change continues to affect regions, insurers may need to adjust their models and pricing to account for increased risks and claims.

Consumer Behavior and Digitalization

The shift towards digital channels and online interactions is expected to continue, with more consumers opting for digital insurance policies and self-service options. This trend may lead to cost savings for insurers, which could potentially be passed on to consumers in the form of lower premiums.

Conclusion: Navigating Car Insurance Rates

Finding the cheapest car insurance rates involves a combination of research, understanding your needs, and leveraging the available discounts and technologies. By comparing quotes, shopping around, and adopting safe driving habits, you can potentially reduce your insurance costs significantly.

As the insurance industry evolves, staying informed about the latest trends and innovations can help you make more informed decisions about your coverage and ensure you're getting the best value for your money. Remember, while cost is an important factor, ensuring you have adequate coverage to protect yourself and your assets is paramount.

How do I find the cheapest car insurance for my specific needs?

+To find the cheapest car insurance, compare quotes from multiple providers, and tailor your coverage to your specific needs. Consider factors like your driving record, vehicle type, and location. Additionally, explore discounts and bundle your policies to potentially reduce costs.

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies by state and can range from 800 to 1,500 annually. However, these averages are just estimates, and your individual rate may differ based on your specific circumstances.

Are there any ways to reduce my car insurance premium besides shopping around for quotes?

+Yes, maintaining a clean driving record, increasing your deductible, and exploring discounts for safe driving habits, good grades, or vehicle safety features can all contribute to lowering your premium.

What is usage-based insurance, and how does it impact rates?

+Usage-based insurance, also known as telematics insurance, uses devices or smartphone apps to monitor your driving behavior. This data is then used to personalize your insurance rates, offering discounts to safe drivers and higher premiums to those with riskier habits.