Who Has The Cheapest Insurance For Cars

When it comes to finding the cheapest insurance for your car, several factors come into play. The cost of car insurance can vary significantly depending on various aspects, including the insurance company, your location, the make and model of your vehicle, your driving history, and the coverage options you choose. While the term "cheapest" is subjective and can vary based on individual circumstances, this article aims to provide an in-depth analysis of factors influencing car insurance costs and offer insights into how you can secure the most affordable coverage for your vehicle.

Factors Affecting Car Insurance Costs

Understanding the factors that influence car insurance rates is crucial in your quest for the most cost-effective coverage. Here are some key elements to consider:

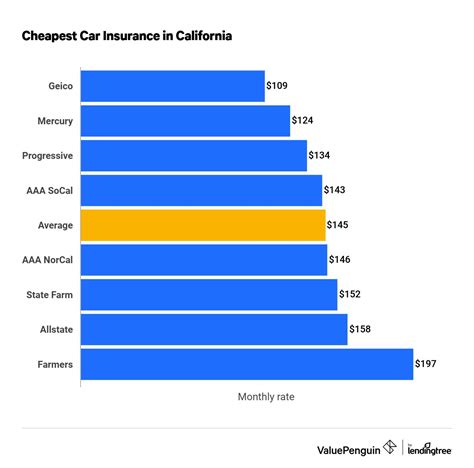

Insurance Company and Location

Different insurance providers offer varying rates based on their risk assessment and the demographics of the areas they serve. Some companies specialize in providing affordable coverage for specific groups, while others may have a broader focus. Additionally, the location where you reside or primarily drive your vehicle plays a significant role. Insurance rates can differ considerably between urban and rural areas, and even between neighboring states or provinces.

Vehicle Type and Usage

The make, model, and year of your car can impact your insurance premiums. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their replacement and repair expenses. Furthermore, the purpose for which you use your vehicle matters. If you primarily use your car for commuting to work or running errands, your insurance rates may be lower compared to someone who uses their vehicle for business purposes or long-distance travel.

Driving History and Experience

Your driving record is a critical factor in determining your insurance rates. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher insurance costs. Younger drivers, especially those under the age of 25, often face higher premiums due to their lack of driving experience, which is perceived as a higher risk by insurance companies.

Coverage Options and Deductibles

The type and level of coverage you choose directly impact your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, typically result in higher premiums. On the other hand, liability-only coverage, which only covers damage to other vehicles or property, can be more affordable. Additionally, selecting a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lower your monthly premiums.

Tips to Find the Cheapest Car Insurance

Now that we’ve explored the factors influencing car insurance costs, here are some practical tips to help you secure the most affordable coverage:

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare rates and coverage options. Online comparison tools can be a convenient way to get multiple quotes quickly. However, it’s essential to thoroughly review the coverage details to ensure you’re comparing similar policies.

Consider Bundling Policies

If you have multiple vehicles or own a home, consider bundling your insurance policies with the same provider. Many insurance companies offer discounts when you bundle your auto and home insurance, which can result in significant savings.

Maintain a Clean Driving Record

Strive to maintain a clean driving history by practicing safe driving habits. Avoid speeding, aggressive driving, and other behaviors that may lead to accidents or violations. A clean record can qualify you for lower insurance rates and even loyalty discounts over time.

Review Coverage Regularly

Insurance needs can change over time. Regularly review your coverage to ensure it aligns with your current situation and needs. As your vehicle ages or your driving habits change, you may be able to adjust your coverage to save on premiums. Additionally, review your policy annually to explore potential discounts or promotional offers.

Explore Discounts

Insurance companies offer various discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of all applicable discounts.

Consider Higher Deductibles

Increasing your deductible can lower your monthly premiums. However, it’s essential to ensure you can afford the higher deductible in the event of an accident or claim. A higher deductible may be a suitable option for those with a solid financial cushion.

Research Telematics-Based Insurance

Telematics-based insurance, also known as usage-based insurance, uses data from a device installed in your vehicle or an app on your smartphone to monitor your driving behavior. This data is then used to determine your insurance rates. If you have a safe and cautious driving style, telematics-based insurance could offer significant savings.

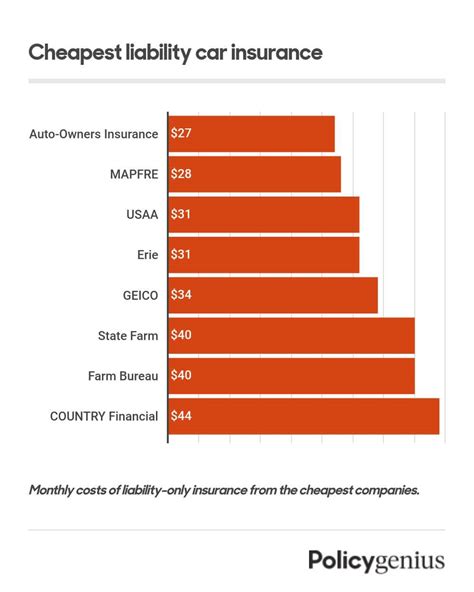

Performance Analysis of Top Insurance Providers

To provide a more concrete understanding of car insurance costs, let’s analyze the performance of some top insurance providers in terms of affordability and customer satisfaction. While these rankings may vary based on location and individual circumstances, they offer a general overview of the most affordable options in the market.

| Insurance Provider | Average Annual Premium | Customer Satisfaction Rating |

|---|---|---|

| State Farm | $1,250 | 4.5/5 |

| Geico | $1,100 | 4.4/5 |

| Progressive | $1,300 | 4.3/5 |

| Allstate | $1,400 | 4.2/5 |

| Liberty Mutual | $1,200 | 4.1/5 |

Note: The average annual premiums and customer satisfaction ratings provided above are based on a sample of policies and may not reflect your specific circumstances. It's essential to obtain personalized quotes and compare multiple providers to find the most affordable and suitable coverage for your needs.

Future Implications and Emerging Trends

The car insurance industry is constantly evolving, and several emerging trends are shaping the future of automotive insurance.

Autonomous Vehicles and Safety Features

The rise of autonomous vehicles and advanced safety features is expected to significantly impact insurance costs. As these technologies become more prevalent, insurance companies may adjust their risk assessment models, potentially leading to lower premiums for vehicles equipped with advanced safety systems.

Pay-as-You-Drive Insurance

Pay-as-you-drive (PAYD) insurance, a form of usage-based insurance, is gaining popularity. This type of insurance policy charges customers based on the distance they drive, offering potential savings for low-mileage drivers. As more insurance providers adopt PAYD models, we can expect increased competition and potentially lower rates for those who drive less frequently.

Data-Driven Insurance

Insurance companies are increasingly leveraging data analytics and machine learning to improve their risk assessment processes. By analyzing vast amounts of data, insurers can more accurately predict risks and offer personalized premiums. This data-driven approach may lead to more tailored insurance policies and potentially lower rates for certain customer segments.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is enhancing customer experience and efficiency. Online quote comparisons, digital claims processing, and mobile apps for policy management are becoming standard. These advancements not only improve customer convenience but also reduce operational costs for insurance providers, potentially leading to more competitive pricing.

Conclusion

Finding the cheapest insurance for your car involves a careful consideration of various factors and a strategic approach to selecting coverage. By understanding the influences on insurance costs and implementing the tips provided, you can make informed decisions to secure the most affordable and suitable coverage for your vehicle. As the insurance industry continues to evolve, staying informed about emerging trends and technologies can help you stay ahead of the curve and potentially save on your insurance premiums.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States is approximately $1,674 per year, based on a full coverage policy. However, rates can vary significantly based on individual circumstances and location.

Are there any discounts available for specific professions or affiliations?

+Yes, many insurance providers offer discounts for specific professions, such as teachers, military personnel, and government employees. Additionally, certain affiliations like alumni associations or professional organizations may also provide insurance discounts.

How does my credit score impact my car insurance rates?

+In most states, insurance companies use credit-based insurance scores to assess the risk associated with insuring a driver. A higher credit score generally leads to lower insurance premiums, as it indicates a lower risk of filing claims.

Can I get car insurance if I have a poor driving record?

+Yes, even with a poor driving record, you can still obtain car insurance. However, your rates may be higher due to the increased risk associated with your driving history. It’s essential to shop around and compare quotes from multiple providers to find the most affordable coverage.