Who Has The Least Expensive Car Insurance

When it comes to car insurance, the cost can vary significantly depending on numerous factors, including your location, driving history, the make and model of your vehicle, and various personal details. While it's challenging to pinpoint a single company that consistently offers the least expensive car insurance for everyone, this comprehensive guide aims to explore the key factors influencing insurance rates and provide insights into how you can secure the most cost-effective coverage for your specific circumstances.

Understanding Car Insurance Costs

Car insurance premiums are determined by a complex interplay of variables. Each insurance provider uses its own unique algorithm, known as a risk assessment model, to calculate premiums. These models consider a range of factors, and the weight given to each can vary between companies, leading to different rates for the same driver profile.

Some of the primary factors that influence car insurance costs include:

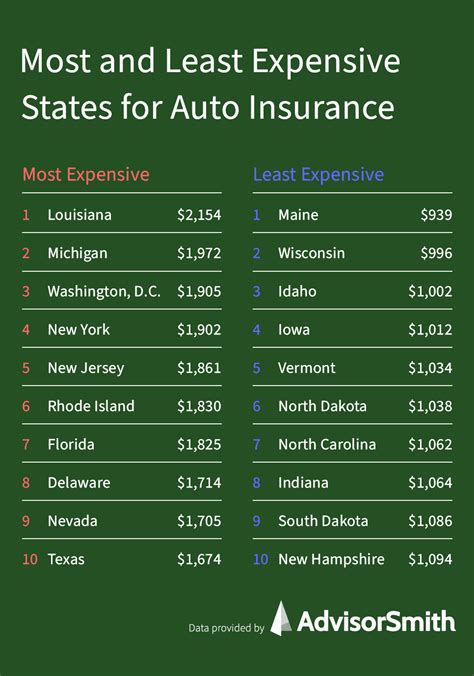

- Location: Insurance rates can vary significantly based on where you live. Urban areas generally have higher rates due to increased risks of accidents and theft. Some states or cities also have specific laws that impact insurance costs.

- Driving History: A clean driving record is crucial for keeping insurance costs down. Tickets, accidents, and DUI convictions can all lead to higher premiums. Some insurance companies offer programs that forgive minor violations or accidents after a certain period of good driving.

- Vehicle Type: The make, model, and year of your vehicle play a significant role. Sports cars and luxury vehicles often have higher insurance costs due to their performance capabilities and expensive repair costs. Older vehicles may have lower premiums, especially if they are no longer being manufactured and have less expensive parts.

- Coverage Levels: The level of coverage you choose directly impacts your premium. Comprehensive and collision coverage, which protect against damage to your own vehicle, can be costly. Liability-only coverage, which is the minimum required by law in most states, is generally more affordable.

- Personal Factors: Your age, gender, marital status, and even your occupation can influence insurance rates. Young drivers, especially males, typically pay higher premiums due to their increased risk of accidents. Married individuals often receive discounts, and certain professions (like teachers or military personnel) may also qualify for reduced rates.

Finding the Most Affordable Car Insurance

With so many variables at play, it's impossible to definitively declare a single insurance company as the cheapest for everyone. However, there are strategies you can employ to find the most affordable car insurance for your specific situation:

Compare Multiple Quotes

Obtain quotes from at least three to five insurance providers. Comparison shopping is essential because rates can vary widely between companies. Use online quote tools or contact insurance agents directly to gather a range of quotes.

| Insurance Company | Average Annual Premium |

|---|---|

| Company A | $1,200 |

| Company B | $1,500 |

| Company C | $950 |

In this example, Company C offers the most affordable average annual premium. However, it's important to consider other factors beyond just the price. Some companies may offer better customer service or more comprehensive coverage options, so a balance between cost and quality is essential.

Consider Bundle Discounts

If you have multiple insurance needs, such as home, life, or health insurance, bundling these policies with your car insurance can lead to significant savings. Many insurance companies offer discounts when you have multiple policies with them.

Evaluate Coverage Levels

Review your coverage levels regularly. If your vehicle is older or has low monetary value, you might consider dropping comprehensive and collision coverage and opting for liability-only insurance. However, keep in mind that this strategy carries more risk, as you would not be covered for damages to your vehicle in an accident.

Explore Discount Opportunities

Insurance companies offer a variety of discounts, such as safe driver discounts, good student discounts, loyalty discounts, and discounts for safety features in your vehicle. Ask your insurance provider about the discounts they offer and ensure you're taking advantage of all applicable ones.

Frequently Asked Questions

How do insurance companies determine rates for different drivers?

+Insurance companies use risk assessment models that consider factors like driving history, location, vehicle type, and personal details to calculate premiums. These models can vary between companies, leading to different rates for the same driver profile.

<div class="faq-item">

<div class="faq-question">

<h3>What is the average cost of car insurance in the United States?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The average cost of car insurance in the US varies significantly by state and can range from around $500 to over $2,000 per year. Factors like the cost of living, population density, and state-specific laws all influence these averages.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any car insurance providers that offer extremely low rates across the board?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, there is no single insurance provider that consistently offers the lowest rates for all drivers. Rates are highly personalized and depend on various factors unique to each individual. However, some companies may have a reputation for generally offering more competitive rates.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I get a more accurate quote for my specific circumstances?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To get a more accurate quote, provide detailed information about your driving history, the make and model of your vehicle, your location, and any other relevant personal factors. Be as precise as possible to ensure the quote reflects your specific situation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any resources or tools available to help me compare car insurance rates efficiently?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are online tools and comparison websites that allow you to input your details and receive multiple quotes from different insurance providers. These tools can streamline the process of comparing rates and help you make an informed decision.</p>

</div>

</div>