Whole Life Insurance As An Investment

Maximizing Wealth: An In-Depth Exploration of Whole Life Insurance as a Smart Investment

In the world of personal finance, the concept of whole life insurance often emerges as a versatile tool that transcends its traditional role as a risk management product. It is a strategy that, when understood and utilized effectively, can be a powerful vehicle for wealth accumulation and long-term financial planning. This article aims to delve deep into the intricacies of whole life insurance, unveiling its potential as an investment and providing a comprehensive guide for those seeking to optimize their financial strategies.

Understanding Whole Life Insurance: More Than Just a Policy

Whole life insurance, a perennial staple in the insurance industry, is characterized by its permanence and the accumulation of cash value over time. Unlike its term life counterpart, which provides coverage for a specified period, whole life insurance offers lifelong protection, ensuring that your loved ones are financially secure regardless of when the unforeseen occurs.

But the true genius of whole life insurance lies in its dual nature. While it serves the fundamental purpose of providing a death benefit, it also functions as a tax-advantaged savings account. The cash value component, which grows on a tax-deferred basis, can be borrowed against or withdrawn, offering policyholders a degree of flexibility that is unique in the insurance landscape.

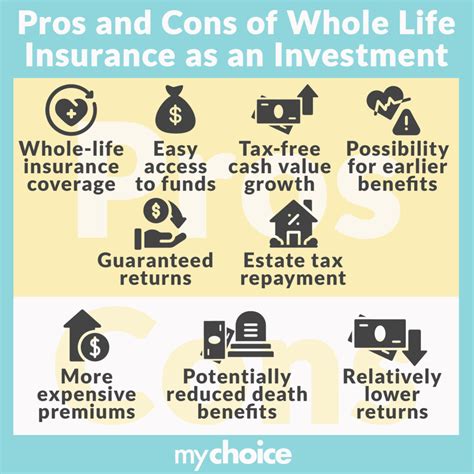

This combination of protection and savings makes whole life insurance an attractive option for individuals seeking to build long-term wealth while simultaneously safeguarding their financial legacy. In the following sections, we will dissect the investment potential of whole life insurance, exploring its benefits, potential pitfalls, and the strategies that can maximize its value.

The Investment Potential: Unlocking Wealth through Whole Life Insurance

Tax Advantages: A Key Driver of Growth

One of the most significant advantages of whole life insurance as an investment is its tax-favored status. The internal growth of the cash value within the policy is not subject to current income tax, a benefit that can substantially enhance the overall return on investment. This tax-deferred growth allows the policy's value to compound over time, creating a substantial nest egg for policyholders.

Moreover, the tax treatment of whole life insurance becomes particularly advantageous when considering the death benefit. Upon the insured's passing, the death benefit is typically paid out tax-free to the beneficiaries, providing a substantial financial boost without the burden of tax implications. This tax-free benefit can be a significant motivator for individuals seeking to leave a substantial legacy for their loved ones.

| Tax Advantage | Description |

|---|---|

| Tax-Deferred Growth | Cash value grows tax-free, enhancing overall returns. |

| Tax-Free Death Benefit | Beneficiaries receive the death benefit without tax implications. |

Cash Value Accumulation: Building Long-Term Wealth

The cash value component of whole life insurance is a powerful tool for wealth accumulation. This cash value grows over time, offering policyholders a substantial sum that can be accessed through policy loans or withdrawals. This accumulated cash value can be a significant source of financial flexibility, providing funds for various purposes such as retirement planning, education funding, or emergency reserves.

Additionally, the cash value within a whole life insurance policy is guaranteed to grow, providing policyholders with a level of certainty that is often lacking in other investment vehicles. This guaranteed growth, combined with the tax advantages, makes whole life insurance an attractive option for conservative investors seeking a stable, long-term wealth-building strategy.

Policy Loans and Withdrawals: Leveraging Your Investment

One of the unique features of whole life insurance is the ability to borrow against or withdraw from the policy's cash value. Policyholders can take out loans against the cash value, with the loan amount and interest rate typically set by the insurance company. These policy loans can be a valuable source of funding for various financial needs, such as purchasing a home, starting a business, or covering unexpected expenses.

It's important to note that policy loans must be repaid with interest, and if left unpaid, they will reduce the policy's death benefit and cash value. However, when used wisely, policy loans can be a flexible tool for accessing funds without incurring tax penalties or impacting credit scores. Withdrawals, on the other hand, reduce the policy's cash value and death benefit but do not need to be repaid.

Maximizing Returns: Strategies for Whole Life Insurance Investors

Paying Premiums Strategically

One of the key strategies for maximizing returns with whole life insurance is understanding how premium payments impact the policy's performance. Whole life insurance policies typically require level premiums, meaning the payment amount remains constant over the policy's lifetime. However, there are strategies that can optimize the value of these premiums.

For instance, some policyholders opt for a higher premium payment in the early years of the policy, which can accelerate the growth of the cash value. This strategy, known as overfunding, can lead to a larger cash value accumulation and potentially shorten the time it takes to break even on the policy.

On the other hand, some individuals may choose to pay the minimum premium, particularly in the early years, to keep costs down. This strategy can be beneficial for those who anticipate increased income or financial flexibility in the future, allowing them to pay larger premiums later on and take advantage of the tax-deferred growth.

Policy Design and Rider Options

The design of your whole life insurance policy, including the selection of riders, can significantly impact its investment value. Riders are optional additions to the base policy that can enhance its benefits or provide additional protections. For instance, a waiver of premium rider can be particularly beneficial, as it waives future premium payments if the insured becomes disabled.

Additionally, the choice of a fixed or variable interest rate can affect the policy's performance. Fixed rates provide a stable, predictable return, while variable rates offer the potential for higher returns but with more volatility. The decision between these options should be made based on an individual's risk tolerance and financial goals.

Regular Policy Reviews and Adjustments

Whole life insurance policies should be regularly reviewed and adjusted to ensure they continue to align with an individual's financial goals and circumstances. Life events such as marriage, the birth of a child, or retirement can significantly impact one's financial needs and priorities. By reviewing and adjusting the policy, individuals can ensure that their whole life insurance remains an effective tool for wealth accumulation and protection.

These adjustments may include increasing the death benefit to provide more financial security for loved ones, adjusting the premium payments to reflect changes in income, or taking advantage of policy loans or withdrawals to meet new financial goals. Regular policy reviews are a crucial aspect of maximizing the investment potential of whole life insurance.

Potential Pitfalls and Considerations

The Cost of Whole Life Insurance

While whole life insurance offers numerous benefits as an investment, it is important to acknowledge its cost. Whole life insurance policies generally have higher premiums compared to term life insurance, which can be a significant financial commitment for policyholders. The cost of whole life insurance is influenced by various factors, including the insured's age, health, and the policy's face amount.

Policyholders should carefully consider their financial situation and goals before committing to a whole life insurance policy. It is essential to ensure that the premiums are affordable and that the policy aligns with one's long-term financial plan. Seeking advice from a financial professional can be invaluable in this regard, as they can provide guidance on whether whole life insurance is the right investment vehicle for an individual's specific circumstances.

Surrender Charges and Policy Lapses

Another potential pitfall of whole life insurance as an investment is the risk of surrender charges and policy lapses. Surrender charges are fees that are imposed if a policyholder decides to cancel or surrender their policy before a certain period, typically within the first few years. These charges can significantly reduce the policy's cash value, negating the benefits of the tax-deferred growth.

Additionally, if a policyholder fails to pay the premiums, the policy can lapse, resulting in the loss of both the death benefit and the cash value. It is crucial for policyholders to understand the financial commitment required to maintain their whole life insurance policy and to plan accordingly to avoid these potential pitfalls.

Flexibility vs. Rigidity

Whole life insurance, while offering a degree of flexibility through policy loans and withdrawals, is not as liquid as other investment vehicles. The cash value within the policy is not readily accessible and may be subject to restrictions or penalties if withdrawn prematurely. This rigidity can be a challenge for individuals who require immediate access to funds or who prefer more liquid investments.

Policyholders should carefully consider their financial needs and the time horizon of their investment goals. If there is a high likelihood of needing funds within a short time frame, whole life insurance may not be the most suitable investment option. It is important to balance the long-term benefits of whole life insurance with the need for flexibility and liquidity in one's financial plan.

Conclusion: Whole Life Insurance - A Strategic Investment

Whole life insurance, when understood and utilized effectively, can be a strategic investment that combines financial protection with wealth accumulation. Its tax advantages, guaranteed cash value growth, and flexible policy loans and withdrawals make it an attractive option for individuals seeking a stable, long-term investment strategy.

However, as with any investment, it is crucial to carefully consider the potential pitfalls and ensure that whole life insurance aligns with one's financial goals and circumstances. By understanding the costs, surrender charges, and the rigidity of the policy, individuals can make informed decisions and maximize the benefits of whole life insurance as an investment.

For those seeking to diversify their investment portfolio and build long-term wealth, whole life insurance offers a unique and valuable opportunity. With its combination of financial protection and tax-advantaged savings, whole life insurance can be a cornerstone of a well-rounded financial plan. By implementing the strategies outlined in this article and seeking professional advice, individuals can unlock the full potential of whole life insurance as a smart investment.

What is the main advantage of whole life insurance as an investment?

+

The primary advantage of whole life insurance as an investment is its tax-favored status. The cash value within the policy grows tax-deferred, and the death benefit is typically paid out tax-free, providing substantial financial benefits without tax implications.

How does the cash value of whole life insurance work?

+

The cash value within a whole life insurance policy grows over time, offering policyholders a substantial sum that can be accessed through policy loans or withdrawals. This accumulated cash value provides financial flexibility and can be used for various purposes, such as retirement planning or emergency reserves.

What are some strategies for maximizing returns with whole life insurance?

+

Maximizing returns with whole life insurance involves strategic premium payments and policy design. Overfunding the policy in the early years can accelerate cash value growth, while adjusting premiums later on can take advantage of tax-deferred growth. Additionally, choosing the right riders and regularly reviewing the policy can enhance its investment value.