Whole Life Insurance Vs Term

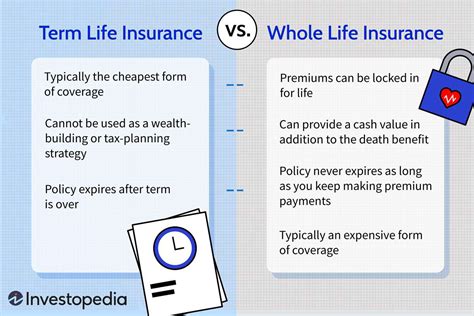

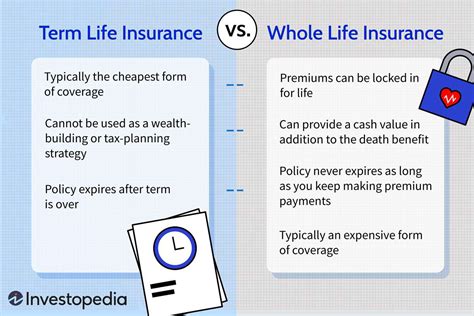

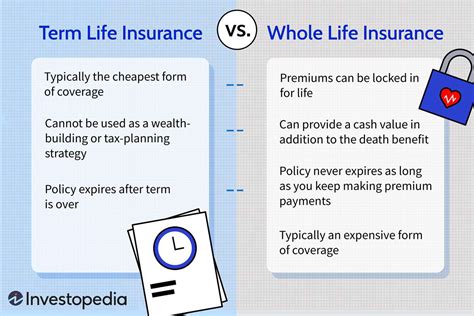

In the world of insurance, understanding the differences between various policies is crucial for making informed decisions about your financial future. Two of the most common types of life insurance policies are whole life insurance and term life insurance. While both provide financial protection to your loved ones in the event of your untimely demise, they differ significantly in terms of coverage, cost, and benefits. In this comprehensive article, we will delve into the intricacies of whole life insurance versus term life insurance, helping you navigate the complex world of insurance with confidence.

Whole Life Insurance: A Comprehensive Overview

Whole life insurance, often referred to as permanent life insurance, is a type of coverage that remains in force throughout your entire life, provided premiums are paid as agreed. It offers a combination of protection and savings, making it an appealing option for those seeking long-term financial security.

Key Features of Whole Life Insurance

- Guaranteed Lifetime Coverage: One of the primary advantages of whole life insurance is its permanence. Once you purchase a policy, it remains active as long as you continue paying the premiums, ensuring your beneficiaries receive the death benefit upon your passing, regardless of when it occurs.

- Cash Value Accumulation: Whole life insurance policies accrue cash value over time. A portion of your premium payments is allocated to a savings component, which earns interest and grows tax-deferred. This cash value can be borrowed against or withdrawn during your lifetime for various purposes, such as funding retirement, paying for education, or covering unexpected expenses.

- Stable Premiums: Whole life insurance policies typically have fixed premiums that remain the same throughout the duration of the policy. This predictability allows for easier financial planning and budgeting, as you know exactly how much you’ll be paying each month or year.

- Dividend Potential: Some whole life insurance policies offer dividends, which are essentially refunds of a portion of the premiums paid. These dividends can be used to reduce future premiums, purchase additional coverage, or add to the policy’s cash value.

Benefits and Considerations

Whole life insurance provides several advantages. The guaranteed coverage ensures your loved ones are financially protected, even if you live a long life. The cash value component can serve as a valuable asset, providing a safety net during retirement or in times of financial need. Additionally, the potential for dividends adds an extra layer of financial benefit.

However, whole life insurance also comes with some drawbacks. The premiums are generally higher compared to term life insurance, especially in the early years. This can make it less affordable for those on a tight budget. Furthermore, the cash value accumulation process is relatively slow, and accessing this value prematurely may result in tax implications or policy lapses.

Term Life Insurance: A Temporary Solution with Long-Term Benefits

Term life insurance, as the name suggests, provides coverage for a specified term or period, typically ranging from 10 to 30 years. It is designed to offer financial protection during periods when your loved ones are most vulnerable, such as when you have young children or significant financial obligations.

Key Characteristics of Term Life Insurance

- Affordable Coverage: One of the primary advantages of term life insurance is its affordability. Premiums are generally much lower compared to whole life insurance, making it an accessible option for individuals and families with limited budgets.

- Flexibility: Term life insurance policies offer flexibility in terms of coverage amounts and term lengths. You can choose a term that aligns with your specific needs, such as covering your children’s education or paying off a mortgage. If your circumstances change, you can adjust your coverage accordingly.

- Renewability: Many term life insurance policies are renewable, allowing you to extend your coverage beyond the initial term. This provides an option to continue protection, even as you age, although premiums may increase with each renewal.

- No Cash Value: Unlike whole life insurance, term life insurance does not accumulate cash value. The policy’s sole purpose is to provide a death benefit to your beneficiaries if you pass away during the term of the policy.

Benefits and Considerations

Term life insurance is an excellent choice for those seeking temporary financial protection at an affordable cost. It is particularly useful for covering specific financial goals or obligations that have a defined timeframe. For example, if you have young children and want to ensure their financial security until they become independent, term life insurance can provide peace of mind.

However, term life insurance does not offer the long-term savings benefits of whole life insurance. Once the term expires, you may find it challenging to secure coverage at a reasonable rate, especially if your health has deteriorated. Additionally, term life insurance does not provide any cash value accumulation, limiting its financial flexibility.

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, it’s essential to consider your unique financial situation, goals, and needs.

| Factor | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Duration | Lifetime | Specified Term (10-30 years) |

| Premiums | Higher, fixed rates | Lower, renewable rates |

| Cash Value | Accumulates over time | None |

| Flexibility | Limited | High flexibility in terms and coverage amounts |

| Benefits | Guaranteed coverage, cash value accumulation, potential dividends | Affordable protection for specific financial goals |

When to Choose Whole Life Insurance

Whole life insurance is an excellent option if you’re seeking long-term financial security and stability. It’s particularly beneficial for:

- Individuals with significant financial obligations that extend beyond a typical term life insurance period.

- Those who want to build a cash value asset for retirement or other financial goals.

- People who prefer the predictability of fixed premiums and guaranteed coverage.

- Families who want to ensure their loved ones are financially protected, regardless of their lifespan.

When to Choose Term Life Insurance

Term life insurance is an ideal choice if you’re looking for temporary financial protection at an affordable cost. It’s suitable for:

- Young families with children who need coverage until they become financially independent.

- Individuals with short-term financial obligations, such as paying off a mortgage or covering education expenses.

- Those who prioritize affordability and flexibility in their insurance coverage.

- People who plan to review their insurance needs regularly and adjust coverage as their circumstances change.

Performance Analysis and Real-World Examples

To better understand the differences between whole life and term life insurance, let’s examine some real-world scenarios and analyze their performance.

Scenario 1: Young Family with Children

John and Sarah, a young couple with two children, are looking to secure financial protection for their family. They decide to compare whole life and term life insurance options.

Whole Life Insurance:

- Coverage: John and Sarah opt for a whole life policy with a 500,000 death benefit. The policy provides lifetime coverage, ensuring their children are protected even if they outlive the parents.</li> <li><strong>Premiums:</strong> The whole life policy has a fixed premium of 500 per month. While it’s higher than term life insurance, they understand the long-term benefits.

- Cash Value: Over time, the policy’s cash value accumulates, providing a financial cushion for their retirement or any unexpected expenses.

Term Life Insurance:

- Coverage: John and Sarah choose a 20-year term life policy with a 500,000 death benefit. This coverage aligns with their goal of protecting their children until they become financially independent.</li> <li><strong>Premiums:</strong> The term life policy has a lower premium of 250 per month, making it more affordable for their budget.

- Renewability: If needed, they can renew the policy at the end of the 20-year term, although premiums may increase.

Scenario 2: Retiree with Financial Goals

Emily, a retiree, is looking to secure financial protection and build an estate for her heirs. She compares whole life and term life insurance options.

Whole Life Insurance:

- Coverage: Emily opts for a whole life policy with a 250,000 death benefit. The policy provides lifetime coverage, ensuring her heirs receive the benefit upon her passing.</li> <li><strong>Premiums:</strong> The whole life policy has a fixed premium of 300 per month. While it’s a significant expense, Emily understands the long-term benefits and stability.

- Cash Value: Over time, the policy’s cash value accumulates, providing a substantial asset for her heirs or to cover any end-of-life expenses.

Term Life Insurance:

- Coverage: Emily considers a 10-year term life policy with a 250,000 death benefit. However, she realizes that term life insurance may not provide the long-term financial protection she seeks.</li> <li><strong>Premiums:</strong> The term life policy has a lower premium of 150 per month, but it’s not a suitable option for her retirement planning.

Evidence-Based Future Implications

The choice between whole life and term life insurance depends on individual circumstances and financial goals. Here are some key implications to consider:

- Long-Term Financial Planning: Whole life insurance is ideal for those with long-term financial goals and a desire for stability. It provides guaranteed coverage and cash value accumulation, making it a solid foundation for retirement planning.

- Short-Term Financial Protection: Term life insurance is an excellent choice for those with specific financial obligations or goals that have a defined timeframe. It offers affordable protection during critical periods.

- Flexibility vs. Predictability: Term life insurance provides flexibility in terms and coverage amounts, making it adaptable to changing circumstances. Whole life insurance, on the other hand, offers predictability with fixed premiums and guaranteed coverage.

- Budget Considerations: Whole life insurance premiums can be higher, especially in the early years, making it less accessible for those on a tight budget. Term life insurance, with its lower premiums, is often a more affordable option.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage ends, and you no longer have financial protection. However, you may have the option to renew the policy or convert it to a permanent life insurance policy, although premiums may increase.

Can I access the cash value of my whole life insurance policy while I’m alive?

+Yes, you can borrow against or withdraw the cash value of your whole life insurance policy during your lifetime. However, withdrawing cash prematurely may have tax implications, and borrowing against the policy reduces the death benefit payable to your beneficiaries.

Are whole life insurance policies subject to market fluctuations?

+Whole life insurance policies are designed to provide guaranteed coverage and cash value accumulation, so they are not directly subject to market fluctuations. However, the interest rates used to calculate cash value growth may be influenced by market conditions.