Whole Life Insurance Vs Term Life

Understanding the differences between whole life insurance and term life insurance is crucial when planning for your financial future and ensuring the well-being of your loved ones. These two types of life insurance policies offer distinct advantages and cater to varying needs. Let's delve into the specifics to help you make an informed decision.

Whole Life Insurance: A Lifetime of Protection and Savings

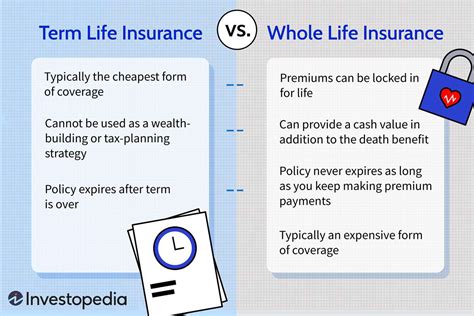

Whole life insurance, also known as permanent life insurance, provides coverage for your entire life, ensuring your beneficiaries receive a payout upon your passing. This type of policy is designed to offer stability and peace of mind, as it guarantees a death benefit regardless of when the insured individual passes away.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance policies remain active throughout your life, as long as premiums are paid.

- Fixed Premiums: Premium amounts are set at the time of purchase and remain constant throughout the policy, providing budget predictability.

- Cash Value Accumulation: One of the unique aspects is the cash value component, which grows on a tax-deferred basis. This cash value can be borrowed against or withdrawn, providing a source of funds for various financial needs.

- Guaranteed Death Benefit: The policy guarantees a payout to your beneficiaries, offering financial security for your loved ones.

- Flexible Investment Options: Some whole life policies offer the opportunity to invest in various funds, allowing policyholders to customize their investment strategy.

Whole life insurance is often recommended for individuals seeking long-term financial protection and those who want to build a legacy for their heirs. The cash value component can be particularly beneficial for retirement planning, as it provides a source of funds that can be accessed tax-free.

Considerations and Advantages

Whole life insurance offers several advantages, including:

- Stability: The policy’s fixed premiums and guaranteed death benefit provide a sense of security and predictability.

- Cash Value: The tax-deferred growth of cash value allows for wealth accumulation over time.

- Flexibility: Policyholders can adjust their coverage and investment strategies to align with their changing financial goals.

- Legacy Building: Whole life insurance can be a powerful tool for leaving a financial legacy to future generations.

However, it's important to consider the potential drawbacks. Whole life insurance policies can be more expensive than term life policies, especially for younger individuals. Additionally, the cash value growth may not keep pace with other investment options, and policyholders may face penalties for withdrawing funds prematurely.

Term Life Insurance: Temporary Protection with Cost-Effectiveness

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is designed to offer affordable protection during specific life stages, such as raising a family or paying off a mortgage.

Key Characteristics of Term Life Insurance

- Limited Coverage Period: Term life policies offer coverage for a defined term, after which the policy expires.

- Affordable Premiums: Premiums are generally lower compared to whole life insurance, making it an attractive option for budget-conscious individuals.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value. The focus is solely on providing a death benefit.

- Renewable and Convertible: Many term life policies allow policyholders to renew their coverage or convert it to a permanent life insurance policy, often without a medical exam.

Term life insurance is an excellent choice for individuals seeking temporary protection during specific life stages. It provides peace of mind without the long-term commitment and higher costs associated with whole life insurance.

Advantages and Considerations

The advantages of term life insurance include:

- Cost-Effectiveness: The lower premiums make term life insurance accessible to a wider range of individuals.

- Flexibility: Policyholders can choose the coverage term that aligns with their specific needs and financial goals.

- Renewal and Conversion Options: The ability to renew or convert the policy provides flexibility and peace of mind.

However, term life insurance has its limitations. As the policy term expires, individuals may face higher premiums when renewing or converting the policy. Additionally, if the insured individual passes away outside the coverage term, the beneficiaries may not receive a payout.

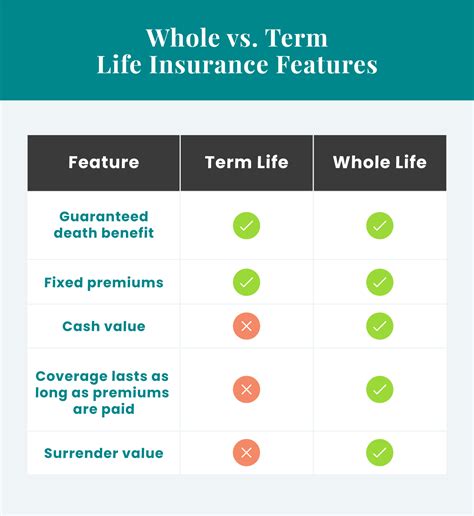

Comparative Analysis: Whole Life vs. Term Life

When deciding between whole life and term life insurance, it’s essential to consider your specific needs and financial situation. Here’s a comparative analysis to help you make an informed choice:

| Aspect | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Duration | Lifetime | Specific term (e.g., 10-30 years) |

| Premiums | Fixed and higher | Lower and variable |

| Cash Value | Yes, tax-deferred growth | No cash value accumulation |

| Guaranteed Death Benefit | Yes | Yes, within the term |

| Investment Opportunities | Some policies offer investment options | None |

| Suitability | Ideal for long-term financial protection and legacy building | Suitable for temporary coverage needs during specific life stages |

Choosing the Right Policy

The decision between whole life and term life insurance depends on your financial goals, budget, and personal circumstances. If you seek long-term protection and want to build wealth through your insurance policy, whole life insurance may be the better choice. On the other hand, if you require temporary coverage during a specific period, term life insurance offers an affordable and flexible solution.

It's crucial to assess your needs and consult with a qualified financial advisor or insurance professional to determine the most suitable option. They can provide personalized advice based on your unique situation.

Future Implications and Recommendations

As you navigate the world of life insurance, it’s essential to keep in mind that your financial needs and circumstances may change over time. Regularly reviewing and updating your insurance policies can ensure they continue to align with your goals. Here are some future implications and recommendations to consider:

- Regular Policy Review: Periodically assess your insurance coverage to ensure it meets your changing needs. Life events such as marriage, childbirth, or career changes may impact your financial situation and require adjustments to your policy.

- Consider a Hybrid Approach: Some individuals opt for a combination of whole life and term life insurance. This hybrid approach allows for both long-term protection and cost-effective coverage during specific life stages. It provides flexibility and can be tailored to your unique circumstances.

- Diversify Your Financial Portfolio: Life insurance is just one aspect of your financial planning. Consider diversifying your investments and savings to build a comprehensive financial strategy. This can include retirement accounts, investment portfolios, and other forms of insurance.

Can I convert my term life insurance policy to whole life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy into a permanent life insurance policy, typically without a medical exam. However, it’s important to review the terms and conditions of your specific policy to understand the conversion process and any potential limitations.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer have life insurance protection. However, some policies offer a renewal option, allowing you to extend the coverage period for an additional term. The renewal may involve a medical exam and potentially higher premiums.

How does the cash value in whole life insurance work?

+The cash value in whole life insurance is a savings component that grows on a tax-deferred basis. It accumulates over time, and policyholders can borrow against it or withdraw funds for various financial needs. The cash value growth rate may vary depending on the policy and market conditions.