Whole Life Insurance With Aarp

Whole life insurance, often referred to as permanent life insurance, is a type of policy that provides coverage for an individual's entire life, as long as the premiums are paid. It offers a combination of death benefit protection and cash value accumulation, making it an attractive option for many individuals seeking long-term financial security and peace of mind. In this comprehensive guide, we will delve into the intricacies of whole life insurance with AARP, exploring its features, benefits, and considerations for individuals seeking a reliable insurance solution.

Understanding Whole Life Insurance with AARP

The American Association of Retired Persons (AARP) is a renowned organization that offers a wide range of services and benefits to its members, including access to insurance products. Whole life insurance with AARP is specifically designed to cater to the needs of older individuals, providing them with comprehensive coverage and additional advantages.

Here are some key aspects of whole life insurance with AARP:

- Guaranteed Coverage: Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong protection. This means that as long as you continue paying your premiums, your beneficiaries will receive the death benefit upon your passing.

- Cash Value Accumulation: One of the unique features of whole life insurance is its cash value component. A portion of your premium payments goes towards building up a cash value within the policy. This cash value grows over time and can be accessed through policy loans, withdrawals, or even surrender value.

- Fixed Premiums: Whole life insurance policies typically come with level premiums, meaning the amount you pay remains the same throughout the duration of the policy. This provides financial predictability and allows you to budget effectively.

- Flexible Death Benefit: AARP's whole life insurance policies often offer the flexibility to adjust the death benefit amount to meet your changing needs. This can be particularly beneficial as your financial responsibilities evolve over time.

- Tax Advantages: The cash value within a whole life insurance policy grows on a tax-deferred basis. This means that any gains are not taxed until the cash value is accessed or the policy is surrendered. This tax efficiency can be advantageous for long-term financial planning.

Benefits and Considerations of Whole Life Insurance with AARP

When considering whole life insurance with AARP, it's essential to weigh the advantages and factors that may impact your decision. Here's a closer look:

Long-Term Financial Security

Whole life insurance provides a guaranteed death benefit, ensuring that your loved ones are financially protected even in the event of your passing. This can be especially crucial for individuals with long-term financial obligations, such as outstanding debts or ongoing expenses for dependents.

With AARP's whole life insurance, the death benefit remains consistent throughout the policy, offering peace of mind that your beneficiaries will receive the full amount upon your death.

Cash Value Accumulation

The cash value component of whole life insurance serves as a valuable savings vehicle. Over time, this cash value can grow significantly, providing you with additional financial flexibility. You can use the cash value for various purposes, such as:

- Supplementing retirement income

- Covering unexpected expenses

- Paying for medical procedures not covered by Medicare

- Providing funds for long-term care needs

- Assisting with end-of-life expenses

Fixed and Predictable Premiums

One of the significant advantages of whole life insurance is the stability of premium payments. With level premiums, you know exactly how much you need to pay each month or year. This predictability allows for better financial planning and budgeting, especially for individuals on a fixed income.

Flexibility and Customization

AARP's whole life insurance policies often offer customization options. You can choose the initial death benefit amount, adjust it as your needs change, and select additional riders or features to enhance your coverage. This flexibility ensures that your policy aligns with your specific financial goals and circumstances.

Tax Benefits

The tax-deferred growth of the cash value within a whole life insurance policy can be highly beneficial. You won't incur taxes on the policy's gains until you access the cash value or surrender the policy. This tax efficiency can help maximize the growth potential of your savings.

Considerations

While whole life insurance with AARP offers numerous advantages, it's essential to consider a few factors:

- Cost: Whole life insurance policies generally have higher premiums compared to term life insurance. It's crucial to evaluate your budget and determine if the long-term commitment is feasible.

- Policy Restrictions: Some policies may have restrictions on when and how you can access the cash value. Understanding these restrictions is vital to ensure you can utilize the cash value effectively.

- Policy Surrender: If you choose to surrender the policy, there may be surrender charges or penalties, especially if done within the initial years of the policy. Be aware of these potential costs.

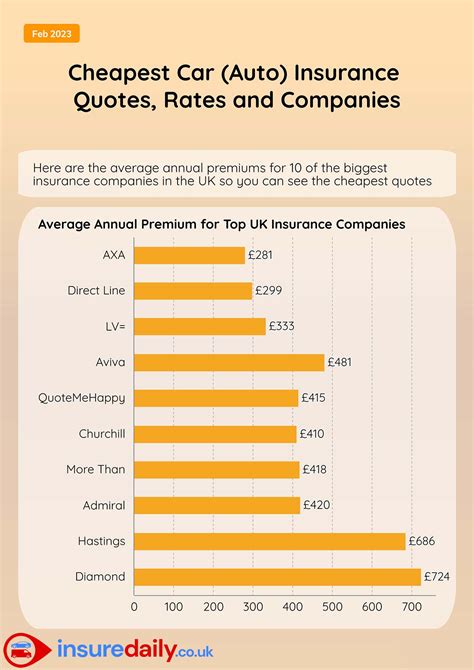

- Comparison: It's always advisable to compare whole life insurance policies from different providers to find the best fit for your needs. AARP's policies may have unique features, but exploring alternatives can provide a comprehensive understanding of your options.

Real-Life Examples and Testimonials

To illustrate the impact of whole life insurance with AARP, let's consider a few real-life scenarios:

Retirement Planning

Mr. Johnson, a 65-year-old retiree, wanted to ensure his financial stability during his golden years. He opted for whole life insurance with AARP, utilizing the cash value to supplement his retirement income. The policy's guaranteed death benefit provided peace of mind, knowing that his spouse would be financially secure even if he passed away unexpectedly.

Medical Expenses

Ms. Smith, a 72-year-old AARP member, faced unexpected medical procedures that were not fully covered by Medicare. She was able to access the cash value from her whole life insurance policy to cover these expenses without incurring additional debt.

Legacy Building

Mr. and Mrs. Davis, a retired couple in their early 70s, wanted to leave a legacy for their grandchildren. They utilized the death benefit from their whole life insurance policy to establish a trust fund, ensuring their grandchildren's future financial well-being.

Performance Analysis and Industry Insights

Whole life insurance with AARP has gained popularity among older individuals due to its comprehensive coverage and added benefits. The organization's reputation for providing reliable services and its extensive member base have contributed to the success of these insurance products.

AARP's whole life insurance policies often include additional perks, such as access to wellness programs, discounts on healthcare services, and financial planning resources. These added values enhance the overall appeal of the insurance offering.

Furthermore, the flexibility and customization options provided by AARP's whole life insurance policies cater to the diverse needs of its members. Whether it's adjusting death benefits, adding riders, or utilizing the cash value for specific purposes, individuals can tailor their policies to align with their unique financial goals.

| Policy Feature | Description |

|---|---|

| Guaranteed Coverage | Provides lifelong protection as long as premiums are paid. |

| Cash Value Accumulation | Builds a tax-deferred cash value over time, accessible through loans, withdrawals, or surrender. |

| Fixed Premiums | Offers level premiums for financial predictability. |

| Flexible Death Benefit | Allows adjustment of the death benefit amount to meet changing needs. |

| Tax Advantages | Provides tax-deferred growth of the cash value, maximizing savings potential. |

Frequently Asked Questions (FAQ)

How much does whole life insurance with AARP cost?

+The cost of whole life insurance with AARP can vary based on factors such as age, health, and policy features. It's best to obtain a personalized quote to understand the specific premium amount.

<div class="faq-item">

<div class="faq-question">

<h3>Can I access the cash value of my whole life insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can access the cash value of your whole life insurance policy through policy loans, withdrawals, or surrender. However, it's important to understand the potential impact on your coverage and any associated fees.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any age restrictions for AARP's whole life insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>AARP's whole life insurance policies are typically available to individuals aged 50 and above. However, the specific age requirements may vary, so it's advisable to check with AARP or your insurance provider for accurate information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss a premium payment for my whole life insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Missing a premium payment can have consequences, including the policy entering a grace period or potentially lapsing. It's essential to stay up-to-date with your premium payments to maintain uninterrupted coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I transfer my whole life insurance policy to a different beneficiary?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can typically transfer or change the beneficiary of your whole life insurance policy. It's recommended to review the policy documentation or consult with your insurance provider to ensure a smooth transfer process.</p>

</div>

</div>